Cryptocurrencies have burst into the life of modern people and have firmly established themselves in the sphere of financial relations. Not surprising, because what could be more convenient than anonymous transactions that take place in a few seconds, with penny commissions or without them at all. And most importantly, cryptocurrency transactions do not depend in any way on the citizenship, location and place of residence of the participants. This is very convenient both for freelancers and specialists who work with crypto projects, and for any type of financial relationship. Moreover, such transactions are not subject to any tax in Russia yet. Thus, more and more people are joining the trend and becoming owners of digital assets.

But among the majority of those who receive payment in cryptocurrencies, there are few enthusiasts who are ready to leave their money in the form of coins in a crypto wallet or exchange account. After all, in addition to all the advantages listed above, cryptocurrencies still have one big drawback - an unstable exchange rate in relation to fiat currencies. Yes, if you receive $1,000 worth of coins today, you can wake up with $10,000 dollars tomorrow. But there is also a flip side to the coin, when an asset significantly loses value. Unfortunately, this is what is happening most often lately.

Of course, a reasonable solution would be to exchange cryptocurrency for fiat in order to immediately be able to pay for any purchases and manage your money, avoiding the risk of losing funds. In this article we will look at the options available to residents of Russia and beyond for withdrawing cryptocurrency, as well as the legal side of the issue.

Is it necessary to withdraw cryptocurrencies into rubles in 2022?

The received BTC, ETH and other altcoins go to your crypto wallet. You can store them until better times, hoping that in the near future the rate will skyrocket even more and you will be able to sell it profitably. Now it is already possible to buy goods and order services using crypto, but this is not yet very common, and the rate is not always satisfactory.

Therefore, many people prefer to withdraw cryptocurrencies to a card, turning them into familiar money that can be used everywhere. Whether this is the right decision or whether it is still worth waiting, no one, including us, can say with a 100% guarantee. Therefore, you yourself must decide for yourself what is more profitable - to get finance here and now, or to take a risk and hope for additional profit in the future.

Legal regulation and taxation

When withdrawing assets from a crypto exchange or other source to a card, you need to understand that all transactions, especially large ones, are controlled. Accordingly, questions may arise from the tax service or law enforcement agencies regarding the origin of funds.

In the Russian Federation, cryptocurrency is partially regulated by the Law “On Digital Financial Assets”. According to it, cryptocurrency is equated to property, and the income generated by it is subject to standard personal income tax. Moreover, if there is no evidence of expenses for the purchase of coins, then tax will have to be paid on the entire sale amount. Otherwise, only from the difference between expenses and income.

In the Republic of Belarus , according to Decree No. 8 “On the Development of the Digital Economy,” until January 1, 2023, taxes will not be levied on any activity related to cryptocurrencies and tokens. This applies to both individuals and legal entities (residents of the Hi-Tech Park legal regime).

In Ukraine, the law “On Virtual Assets” was introduced to regulate crypto-assets. In essence, it is similar to the Russian law and establishes similar rules and restrictions. The purpose of the bill is to bring cryptocurrency “to the bright side” - it is estimated that currently about a billion hryvnia are spent in shadow transactions with digital coins per day. The law will officially come into force when the corresponding amendments to the Tax Code are introduced.

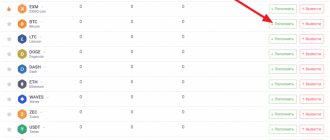

Cryptocurrency exchanges with withdrawal

This method is especially relevant for traders who already store their savings within the trading platform. Although no one prohibits moving your monthly mining income to a crypto exchange and using it as storage.

In most cases, cryptocurrency exchanges with withdrawals in rubles require account verification, which may require:

- Email;

- phone number;

- scans of documents.

To trust such data to third parties, it is important to choose a reliable crypto exchange that guarantees the security of personal information. We can highlight several of these:

- Binance;

- Currency

- EXMO.

All of them have been working in this field for a long time and are 100% safe.

How to cash out bitcoins and avoid being subject to tax audit

Cashing out bitcoins itself is not punishable by law. Question: where does a particular person get the funds to buy cryptocurrency? If he cannot prove his income, then the likelihood of criminal proceedings is high.

You can safely buy and sell virtual money in an amount not exceeding 600 thousand rubles per month. Many payment systems have such a limit on transactions in their electronic wallets. If a citizen has several wallets registered in one service, they are interconnected, and the transaction amounts exceed the monthly limit, then the service has the right to temporarily block access to the site, as well as send the data for investigation to the tax office.

The Federal Tax Service does not independently verify user accounts; it does not have full access. Tax officials can only request reporting for a specific person.

Banks and payment systems monitor all transactions and, if fraud or large turnover of funds is suspected, they report the incident to the Federal Tax Service. If a person’s official income allows him to operate with large sums, then no questions will be raised against him.

To avoid falling under the watchful eyes of banks and tax officials, you should not exceed the maximum transaction limit per month. This applies to those categories of citizens whose income is significantly lower than the cash amounts.

Electronic payment system for withdrawing cryptocurrencies

EPS offer to quickly exchange Bitcoin and its altcoins for real money, and with a fairly moderate commission. In most cases, they work very simply - what to sell, in what currency to receive, where to send, and that’s it. We recommend the following electronic payment systems for withdrawing cryptocurrency in 2021:

- Advanced Cash;

- Payeer;

- Capitalist.

Using AdvCash as an example, the procedure is as follows. Selects the currencies to be sold and received, after which the system will issue the address of the crypto wallet. You make a transfer to it and wait to receive real money on your card. Usually, the withdrawal of crypto to fiat occurs quite quickly, from 1 minute, but there are times when you have to wait 24 hours.

Commissions in blockchain networks for transfers

When sending cryptocurrency from one address to another, in some wallets and services you can choose a commission that is paid to the miners.

This is a very important point. Since the commission is part of the miners’ earnings, their priority when processing payments will always be those with the highest commission. Choosing the lowest commission may result in the transaction never being confirmed. It is best to choose the recommended fee or increase it to speed up the payment.

Services for tracking the average commission and the optimal cryptocurrency for withdrawal:

- https://bitcoinfees.earn.com/

- https://privacypros.io/tools/bitcoin-fee-estimator/

- https://ycharts.com/indicators/bitcoin_average_transaction_fee

- https://bitcoiner.live/

- https://etherscan.io/gastracker

- https://bitinfocharts.com/comparison/ethereum-transactionfees.html#3y

- https://txstreet.com/v/eth-btc

Example. Transaction setup and approximate confirmation time in Wasabi wallet:

Commissions in Wasabi wallet

P2P exchanges for withdrawing money from cryptocurrency

Unlike conventional crypto exchanges, exchanges here are carried out directly between users, without the participation of intermediaries. Users set their own prices for Bitcoin and altcoins, and you decide whether to accept or refuse. This choice allows you to sometimes withdraw crypto to the card at a very attractive rate. Security is ensured by arbitration, which will look into the matter if problems arise. The crypt and money of both exchange participants are transferred to the exchange’s own storage, and only after confirmation from both sides of agreement with the transaction are sent to the owners. To withdraw bitcoins in this way, we give the following recommendations:

- Binance p2p;

- LocalBitcoins;

- Cryptolocator.

Exchange security issues

In connection with the contradictory legislation of the Russian Federation, which restricts a number of transactions with cryptocurrencies, the question arises: is it safe to withdraw Bitcoin into rubles in 2022? From a legal point of view, this is not prohibited. The new rules, which came into effect in January, mainly affect companies. Thus, organizations do not have the right to accept payment in cryptocurrency, as well as advertise this type of payment.

As for ordinary users, little has changed for them. It is still necessary to pay a 13% tax on profits, even if they are received from cryptocurrency trading. Legalization of such income does not have any significant features and involves filing a tax return with the Federal Tax Service.

It should also be mentioned that banks often block accounts that receive suspicious transactions. There is no exact algorithm of actions on how to avoid blocking, but you can give some tips:

- Take screenshots of exchanges and wallets to confirm receipt of funds if necessary.

- Use only Russian ruble cards, which also belong to you personally.

- Pay taxes. The danger of blocking still remains, but the account will be unblocked much faster after that.

- Don't be afraid to make the situation public. There have already been cases when, after an indignant post on a blog or social networks, banks quickly removed the block from the account.

You can completely refuse to use banks, for example, withdraw funds through exchanges to electronic payment systems or in cash.

Withdrawing money from Bitcoin through an exchanger

In this case, the second participant in the transaction is not a person, but a system. There is no need to wait for someone to confirm receipt of the sent BTC or ETH, since the site immediately processes the information and sends fiat instantly. Sometimes there are situations where you have to wait 20 minutes or more for a transaction to be confirmed, but this is an exception to the rule. We recommend these exchangers for withdrawing crypto in 2022:

- 60sec;

- Baksman;

- NiceChange.

In person or on p2p platforms

One of the simplest and most in keeping with the spirit of decentralization methods is to find a suitable offer on social networks, instant messengers or forums. The advantage is that there are no extra commissions. The disadvantage is that there is a high probability of encountering scammers.

I exchange tokens for dollars, the exchange rate is favorable, and I give it straight away. Source: freepik.com/diana-grytsku

A safer alternative is peer-to-peer, or p2p, platforms. These are specialized message boards with a rating system, and often user identification. Some cryptocurrency exchanges also offer the service.

Let's look at transactions using Binance P2P as an example:

- Log in using your login to the official website - binance.com.

- In the “Buy Cryptocurrency” section, select “P2P trading”.

- In the new window, specify the required settings, confirming that you need to sell BTC in exchange for crediting payment in rubles to your Sberbank card.

In a new window, the system will remind you: it is not recommended to transfer cryptocurrency before receiving payment. Follow this recommendation.

- Study data about users who are ready to carry out a transaction - the number and percentage of successful transactions, the average time to complete a transaction and other information. In the “Available” column, look at how much BTC the buyer needs. Then you can click “Sell BTC”.

Important: in order to continue the operation, you must enable authentication and go through the KYC verification procedure, which the system will remind you of at this stage.

- Next, specify how many BTC you want to sell to the user. Pay attention to the payment period - it is set by the buyer, and it ranges from 15 minutes to 6 hours. The payment method - Sberbank card - will be set by default.

If the card has not yet been linked to your profile, you will be prompted to do so. The procedure is standard and does not differ from binding to any other service. We'll tell you how to do this below.

Click “Sell BTC” again.

- Now you should wait until the user transfers payment to your card. If successful, confirm the transaction and the bitcoins will be credited to the buyer.

Important: it is recommended not to rely on SMS, but to verify that funds have been credited by logging into your Sberbank Online account.

How to link a card to the Binance exchange?

- Click the profile icon and select “Security” from the drop-down menu.

- In the new window, go to the “Payment” section - “Add payment method” - select the desired bank from the list (Sberbank).

- In the new window, enter the card number, then confirm the attachment via SMS notification.

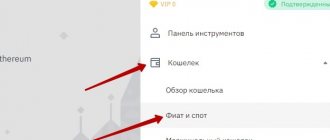

Wallets for withdrawing cryptocurrency

Some storage facilities allow you to exchange crypto for real money. The positive side of direct withdrawal from a Bitcoin wallet is the speed of the operation - it usually happens instantly. On the other hand, sometimes they offer a not very favorable rate or high commissions.

We can recommend them:

- Trustee Wallet;

- Blockchain.com;

- Matbea.

Cryptopay

A cryptocurrency platform founded in 2013. It is a crypto wallet and a cryptocurrency service within which users can make transactions with each other.

Inside the Cryptopay Wallet you can store Bitcoin, Ethereum, Litecoin and Ripple. You do not pay additional fees to send and receive coins. Money can be transferred directly between your Cryptopay wallet and your bank account (SEPA) in Euros or GBP.

Cryptopay also offers the issuance of Visa plastic cards, with which you can make purchases in stores and withdraw cash from ATMs. The virtual card is issued free of charge.

Withdrawal of cryptocurrency into fiat in a cryptomat

There are not many of them on the territory of the Russian Federation, but there are several in large cities. They work similarly to ATMs, where you just need to indicate the exchange amount and crypto wallet address, and all you have to do is wait for the cash to be dispensed. A fast and convenient, although not very profitable, way to withdraw cryptocurrency to fiat in 2022.

Mercuryo

A multi-currency crypto wallet with which you can buy, sell and store cryptocurrency. Mercuryo supports Bitcoin, Ethereum, USDT and other cryptocurrencies (about 8 coins in total).

You can purchase cryptocurrency using a bank card. The purchase widget supports 7 fiat currencies - RUB, UAH, USD, EUR, GBP, etc. All transactions are protected, and cryptocurrency is stored in secure offline wallets. The service adheres to the KYC/AML policy, so users are forced to undergo identity verification, which takes about 15 minutes.

To cash out cryptocurrency and use it for purchases in stores, you can order a plastic Visa card. It is a prepaid card with a base in BTC (the card balance is the balance of the Bitcoin wallet). Commission on purchases is 0%. There are no card issuance, currency conversion or transaction processing fees.

How to get a favorable rate

The easiest way is to monitor course news from trusted experts. If you don't trust other crypto experts, you can learn to analyze charts yourself using Metatrader 4 - this tool allows traders to analyze trading operations and exchange rates. The most important thing is to constantly monitor changes in the exchange rate and not make hasty decisions. If the rate has fallen, wait for it to fall steadily (the same rule applies to an increase in the rate).

Results

Knowing how to profitably withdraw Bitcoin, you can cash out the cryptocurrency at any time and convert it into a form acceptable to you. When choosing, pay key attention to the security of the transaction, and only then look at the rate. Ignoring this rule often leads to financial losses due to the actions of scammers.

As for earning Bitcoin, it is not difficult to do. It is enough to buy a contract on a cloud service and receive stable accruals to your cryptocurrency wallet. This method eliminates expenses for the purchase of equipment and commissions, as well as risks associated with exchange rate fluctuations and other force majeure events in the cryptocurrency market.