The cryptocurrency market is actively developing, governments are trying to regulate new mechanisms in the global economy. Yes, in some countries certain tokens have been legalized, but cryptocurrencies have not yet received widespread use.

It cannot be said that Russia is ahead of the rest in matters of regulating the cryptocurrency market, but the deputies did not sit with their hands folded. From January 1, 2022, the Law “On Digital Financial Assets” in the Russian Federation received official legal status. Vladimir Putin approved the federal law, having signed it earlier.

Therefore, today we’ll talk about what awaits the Russian cryptocurrency market, tokens, exchanges and exchangers. Sit back, it will be interesting.

Regulatory issues

According to Moscow Digital School experts, there are still gaps in the legislative field that prevent the regulation of cryptocurrency processes in the legal field.

The law on digital financial assets practically does not use terminology that is generally accepted and popular in the crypto community, and proposes its own. On the one hand, this is easier for lawyers, law enforcement agencies, tax authorities and courts, but the barrier to entry for token holders is extremely high.

The law also does not stipulate individual cryptocurrencies and their varieties; there is not even the concept of “mining”. Even bonuses from retail chains and electronic certificates fall under the formulated definitions and concepts.

Domestic cryptocurrency holders were waiting for unification, the introduction of a single conceptual apparatus and a transparent legal framework for regulating digital assets. However, the adopted law is more aimed at digitalizing Russian assets and issuing electronic variations of shares of domestic companies. Their main drawback is difficulties with international certification and entry into the world market.

We think the general trends are clear to you. Now let’s talk about the individual components of the cryptocurrency market in more detail.

Binance as a crypto exchange

Binance.com is already an exchange that specializes in Crypto-to-Crypto transactions, where you can buy more than 1000 cryptocurrencies; it is a whole ecosystem of controlled social projects. The smart policy of Changpeng Zhao (the founder of the exchange) is such that in order to eliminate dependence on the regulated authorities of different states, they had to expand - opening branches in different countries.

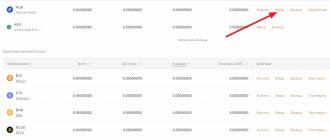

Today on Binance, among the trading pairs available for trading:

- Bitcoin (BTC) / USD

- Ethereum (ETH) / USD

- Ripple (XRP) / USD

- Litecoin (LTC) / USD

- and many others

Update - Binance has opened a division specializing in fiat currency transactions

Since its launch in July 2022, the exchange has experienced explosive growth and is now positioned as the 4th largest cryptocurrency exchange in terms of daily trading volume.

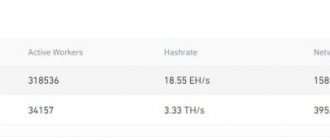

Place of the exchange among competitors in terms of capitalization

This explosive growth was due to many reasons, one of which was its ability to process up to 1.4 million transactions per second, meaning you can trade with peace of mind no matter how busy the site is. Additionally, Binance offers competitive market rates for its trading fees: 0.1% on each side of the trade or 0.075% if you trade your Binance Tokens (BNB) (more on this later).

Get a 10% discount on trading fees on Binance using the code “ CRYPTOSLIVA ” or by registering using this link

Binance also encourages its users to store their cryptocurrencies on the Binance exchange, giving them the opportunity to receive regular airdrops. This is a great advantage for those who want to regularly trade their coins while still receiving a financial reward (GAS) for holding them.

They pride themselves on being an exchange for everyone (no wonder when their slogan is “Exchange the World”), claiming to provide a user-friendly and intuitive mobile and web platform interface for beginners, and a one-click complex UI for experienced traders.

Bottom line. What is the Binance exchange:

- Binance - An exchange that is capable of processing up to 1.4 million transactions per second.

- It offers incredibly low trading fees of 0.1% or 0.075 % when using your BNB tokens.

- Has a user interface for all trading needs and offers a client for web and mobile applications.

- Some cryptocurrencies earn GAS

Registration on the Binance website

Registration on the exchange

Registration on the official Binance website

Registration on Binance is not a complicated process, so in order to create an account on the exchange, just 3 steps are enough:

- Checking the official website www.binance.com

- Entering email and password

- Confirmation of data in a letter by E-mail

Next, you can expect to set up two-factor authentication.

Two-factor authorization on Binance is an additional measure of your security, essentially logging into the exchange website using two or more factors. For example, confirmation via Google Authy and then via email.

Recently, there has been a wave of phishing attacks, when the site the user needs is replaced with a fake version. The official Binance website is no exception; it is worth checking every time you connect. In your browser's address bar, check the Binance.com domain name and HTTPS encryption protocol

How to translate the Binance website into Russian

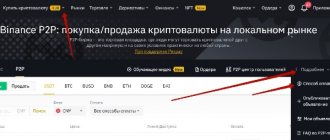

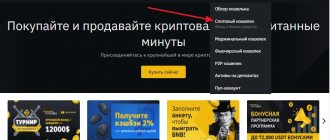

Most of our readers asked us a reasonable question about the linguistic affiliation of the Binance exchange. Although it is not in Russian, there is a function to switch to the language of any country.

Binance official website in Russian

Based on the screenshot above, the instructions for translating Binance into Russian are quite simple:

- Go to the right corner of the page

- Click on the globe

- Select Russian language for Binance

Cryptocurrency

The law that came into force only added contradictions instead of resolving them. For example, cryptocurrency is recognized as a means of payment and can be used as an investment instrument.

However, Article 14 of the adopted law states that legal entities and individuals cannot accept cryptocurrencies as payment for the goods or services offered.

Experts also argue that legislators have failed to develop the correct terminology. Specifically, a “cryptocurrency” is a token without an obligated party. However, all electronic money, certificates, accounts and other digital elements fit into this category.

Judicial protection of rights to cryptocurrency assets applies only to citizens who have properly declared tokens and paid income taxes on them. This is a rather strange decision that smacks of illegality. Why does paying or not paying taxes on a cryptocurrency asset affect ownership and the ability to protect your rights in court?

Binance Listing Calendar

Finding the exact listing date of a coin or token is extremely difficult. Usually the data is kept strictly confidential. The first news about the addition of a new crypto to trading is published 24 hours in advance in the official resources of the exchange and the project developers. On Binance, new crypto listings are published in the “Announcements” section:

You can also learn about listing on Binance 2022 from thematic telegrams of channels, forums and groups on social networks. Below I have collected several proven resources regarding this topic.

- CoinMarketCal – always up-to-date data on crypto listings and other industry news

- Coindar - an overview of all events in the world of cryptocurrencies, including a calendar for the inclusion of new tokens and coins in exchanges, not only Binance

- Cryptonews.website – calendar of events in the cryptocurrency industry and blockchain technology

- Coinmarketcap – listing information for Binance and other exchanges

- Binance.com/ru/support/announcement/c-48 – new Binance crypto listings

Mining

So far, the law “On CFA” does not contain a regulatory framework dedicated to mining. Not long ago, the Ministry of Finance sent out packages of bills to relevant departments, which contain references to the mining of cryptocurrencies and the writing of software products for mining.

However, the same paragraph establishes a ban on making a profit for the manipulations with digital assets described above.

Lawyers warn that miners will have to find workarounds or somehow legalize coin mining in order to avoid administrative or criminal liability.

What happened to the Binance exchange and when will trading begin?

Despite promises, Binance did not go online this morning. More than a day ago, technical work began on the exchange, which was supposed to lead only to a “temporary decrease in productivity,” but ultimately stopped the operation of the exchange and dragged on indefinitely. Yesterday, Binance CEO Changpeng Zhao tweeted that there were unexpected difficulties when copying data, and the database needs to be resynchronized, which will take several hours.

At 6.00 Moscow time, Zhao once again commented on the situation, saying that the developers are trying three synchronization methods that differ in speed: 1-2 hours, 5 hours and 9 hours, respectively. At this point, it is clear that the shortcuts did not work. According to the latest information, “final data validation” is now taking place; trading is expected to resume at 13.00 Moscow time. Within an hour before the exchange goes online, users will be able to cancel orders. Additionally, the team announced that as a token of gratitude for the “continued support,” the exchange will reduce fees to 0.03% per transaction until February 24th.

Despite the fact that Changpeng Zhao has repeatedly stated that the exchange is offline solely due to technical work and denied a hacker attack, some users still think that it is a hack. In particular, John McAfee demanded comments from the exchange, saying that “not a single company admitted to a hacker attack until it was forced.” McAfee tweeted last night that he's "not trying to cause FUD," but he's been receiving dozens of messages about the exchange being hacked. Attached to the post is a screenshot in which, under the Binance logo, the exchange itself allegedly admits that it was attacked. And although some supported McAfee, many accused the crypto expert of unsubstantiated information and dubious evidence: “a picture sent by some “yellow” group - so you prove the facts?”, “never heard of Photoshop? grow up,” “you’re the security expert here.”

McAfee insisted that he was "just asking a question" and as a security expert knows that "if an attack does occur and attempts to recover funds are not made immediately, then the chances of recovering them are slim to none within 24 hours." However, the Binance CEO, who responded to many of the tweets, said that the programmer was still “spreading FUD” and assured: “We will prove you wrong.” In response to the accusations, Binance posted a tweet with intact Bitcoin and Ethereum addresses:

Fortunately, blockchain provides a public ledger that can prove FUD wrong. If you want to verify this for yourself, here are the addresses of our wallets: 1NDyJtNTjmwk5xPNhjgAMu4HDHigtobu1s, 0x3f5ce5fbfe3e9af3971dd833d26ba9b5c936f0be. There you will see that we were definitely not hacked.

Changpeng Zhao also tweeted that he “just transferred 30,000 Bitcoin from a cold wallet to a hot wallet” to “kill FUD.” And he once again emphasized that user funds were not affected: “Hot wallets make up a tiny percentage, but you need to be sure that your coins are safe.”

Despite the suspicions and still present FUD, many users appreciated the behavior of Binance, which reports progress information every two hours or more often:

I like how Binance is holding up during this outage. The team is more communicative than any other exchange I've used and the FUD is completely undeserved.

Some people joke that the exchange has turned everyone into “hodlers”:

Turned all Binance users into hodlers for 12 hours.

However, Binance has already been pushed into third place in terms of daily trading volume: ahead of Upbit and OKEx.

Source

Exchanges and exchangers

The Law “On Digital Financial Assets” introduces a new concept into the legal field – digital financial asset exchange operator. Essentially, we are talking about cryptocurrency exchanges. However, only their function is defined: to exchange one digital asset for another.

The law also contains provisions according to which digital asset exchange operators can be organized in Russia. However, already existing cryptocurrency exchanges, like Binance, still remain unregulated.

The Central Bank also reserves the opportunity to establish additional requirements for such operators. In particular, there is already a requirement to store information about all transactions of citizens for 5 years.

Requirements are also being made for the reliability of such platforms. They should not have any debt obligations, unexpunged or outstanding convictions, or no administrative or criminal liability.

It is important to know!

As for taxation, the Federal Tax Service has not determined any special tax conditions for holders of digital tokens. They will have to pay the standard 13% on profits, which is defined as the difference between the cost of buying and selling digital assets.

Why is Binance not working? What kind of glitch happened on January 13th?

In most of Russia today, January 13, 2022, Binance is not working. Failures were recorded in the following regions of the country:

| Chechen Republic (Grozny) | Khanty-Mansiysk Autonomous Okrug - Ugra (Khanty-Mansiysk) |

| Sakhalin region (Yuzhno-Sakhalinsk) | Republic of Sakha - Yakutia (Yakutsk) |

| Magadan region (Magadan) | Republic of Tyva (Kyzyl) |

| Sverdlovsk region (Ekaterinburg) | Altai Republic (Gorno-Altaisk) |

| Tula region (Tula) | Kaliningrad region (Kaliningrad) |

| Jewish Autonomous Region (Birobidzhan) | Lipetsk region (Lipetsk) |

| Oryol region (Oryol) | Stavropol Territory (Stavropol) |

| Novosibirsk region (Novosibirsk) | Ivanovo region (Ivanovo) |

| Voronezh region (Voronezh) | Altai Territory (Barnaul) |

| Kamchatka Territory (Petropavlovsk-Kamchatsky) | Krasnoyarsk region (Krasnoyarsk) |

| Nenets Autonomous Okrug (Naryan-Mar) | Krasnodar region (Krasnodar) |

| Chukotka Autonomous Okrug (Anadyr) | Vologda region (Vologda) |

| Kemerovo region (Kemerovo) | Kabardino-Balkarian Republic (Nalchik) |

| Tomsk region (Tomsk) | Udmurt Republic (Izhevsk) |

| St. Petersburg (St. Petersburg) | Republic of Crimea (Simferopol) |

| Kaluga region (Kaluga) | Perm region (Perm) |

| Karachay-Cherkess Republic (Cherkessk) | Komi Republic (Syktyvkar) |

| Ulyanovsk region (Ulyanovsk) | Kurgan region (Kurgan) |

| Republic of Bashkortostan (Ufa) | Belgorod region (Belgorod) |

| Nizhny Novgorod region (Nizhny Novgorod) | Saratov region (Saratov) |

| Republic of Mordovia (Saransk) | Kirov region (Kirov) |

| Samara region (Samara) | Republic of Karelia (Petrozavodsk) |

| Republic of Buryatia (Ulan-Ude) | Tyumen region (Tyumen) |

| Republic of Tatarstan (Kazan) | Vladimir region (Vladimir) |

| Moscow region (Moscow) | Murmansk region (Murmansk) |

| Republic of Khakassia (Abakan) | Republic of Dagestan (Makhachkala) |

We recommend: CIAN

Prospects for regulation of the cryptocurrency market and what awaits Binance

Experts say that in this version, the law “On DFA” does not allow legal entities and individuals to work without restrictions with digital assets. However, receiving a salary in crypto is not prohibited, as is the use of exchangers.

As for cryptocurrency exchanges like Binance, such platforms still remain outside the legal framework, since the current law does not have a conceptual apparatus and norms to regulate the interaction between a citizen and a cryptocurrency exchange.

Therefore, nothing will change dramatically for Binance investors yet. However, with the law entering into force, the Government receives tools to bring citizens to administrative or criminal liability for unlawful actions. In order to avoid the negative consequences of using cryptocurrency, holders and investors will need to develop a new scheme for interaction with exchanges, exchangers and wallets.

It cannot be said that the law “On CFA” is absolutely useless, but it did not clarify the mechanism of legal relations for the ordinary Russian and the regulatory authorities. Cryptocurrency is still outside the regulated field. Therefore, the Federal Tax Service only received the opportunity to monitor the investment activities of citizens and cryptocurrency holders with the ability to apply administrative and criminal articles to punish them.

Comments for the site

Cackl e

Exchange

Binance crypto exchange

We are not going to say that everything is a scam, it will collapse tomorrow and urgently save your money. No, it seems to us, this is more of a planned attack by regulators with the goal of taking control of all crypto exchanges. If you force the leading platform to cooperate, then the rest won’t even make a peep.

Another large and relatively young cryptocurrency exchange, FTX, bought back its shares from Binance under the pretext of business necessity. And the Gemini platform generally stated that in the future they will become the market leader. That is, colleagues in the industry are in no particular hurry to support Binance; on the contrary, they will try to profit from it.

Now about the exchange itself, they began cheerfully, and made a statement about how they intended to resolve the issue. There are three main points there. The first is an increase in compliance staff by 500%, likely to prevent illegal money from entering the site. Next comes the implementation of hardware solutions that are recommended by the international anti-money laundering organization. And the third key point is action within the legislative framework of specific countries. Why then these countries declare the absence of a work permit is unclear; perhaps the exchange has now decided to address this issue.

Due to so-called unforeseen circumstances, the acceptance of payments in euros through the SEPA payment network was stopped. It is noteworthy that this was the decision of the exchange itself; for some unknown reason they decided to close this financial channel.

The next solution is to completely abandon trading of tokenized shares. Clients were given 90 days to sell assets. As representatives of the exchange explained, no one forced them to do this, they just decided to develop their business in a different direction. Although if you delve into recent history, back in early May the German financial regulator issued a warning to Binance for tokenized shares. Interestingly, other exchanges, with the same partners, continue to trade tokenized shares and no one has any questions for them.

Then we come across an extremely interesting statement from the head of Binance, Changpeng Zhao, that he is looking for a successor and is ready to cede the post of CEO to someone who can solve problems with regulators. It’s a noble cause, but why just step up and leave the post of general, you can simply give such a superman the position of some kind of deputy director. If you build a conspiracy theory, the idea that comes to mind is that maybe Changpeng Zhao is looking for a way to retire, supposedly he has nothing to do with it in case of even bigger problems. He also talked about plans to hold an IPO of the American division of Binance.

Such legalization can remove many questions regarding regulation. But it still needs to be passed, and so far, apart from words, we have not heard of any actions in this direction.