In addition, you can install the AO_ZOTIK and WPR_VSMARK indicators for FREE

This minimal set of tools will already make it possible to understand the logic of the movements of the DASH crypt, and you can learn the nuances of working with data and other analysis tools when studying at the MasterForex-V Academy.

In which countries does the law prohibit the use of DASH coins?

The main task of financial regulators, who control the process of circulation of funds and other market instruments at the international level or in individual states, is to ensure stability. Financial authorities are trying to create an atmosphere of complete security in the territory under their control in order to reduce the number of hypothetical troubles that residents of a particular state may encounter.

Quite rightly, many regulators perceive digital means of payment, including DASH, as a source of risk and a tool whose use can cause imbalance in the financial system. To reduce the impact of the potential threat, the governments of a number of countries have introduced partial or complete bans on the use of virtual money.

The position of the regulators who made this decision can be easily understood. At the state level, officials cannot exercise control over the issue of virtual money. Also, the concerns of governments that have introduced bans are related to the lack of a real equivalent value for digital payment instruments. Taking into account these specific characteristics of cryptographic money, restrictive mechanisms have been put in place by regulators in the following countries:

- only in certain situations business and ordinary citizens of Russia, India, Iceland, Libya, Indonesia and Bangladesh have the right to use cryptocurrencies as means of payment when carrying out various types of transactions.

Officials from these countries believe that the currently available monetary units are sufficient for the population and business, so there is no point in changing legislation to provide participants in financial relations with access to new instruments. All of these countries have their own fiat money - official means of payment, the issuer of which is the state. In addition, regulatory documents allow citizens and entrepreneurs to use currencies of other states (dollars, euros, etc.) when making international payments;

- Vietnamese financial authorities provide the opportunity to use digital money in settlements and other transactions only for ordinary citizens. Business representatives (banks, hedge funds, trust management[/anchor], insurance companies, ETFs, investment funds and other organizations) are prohibited from using virtual means of payment or exchanging them for money from any country in the world.

It is noteworthy that for several years the position of the Chinese leadership was similar. In August 2022, the situation in China changed somewhat. According to Bloomberg, an important statement during a financial forum held in the city of Yichun was made by Mu Changchun, who heads the payments department at the Chinese Central Bank. The official announced that the regulator will soon begin issuing its own cryptocurrency.

The banker did not provide specific information about the launch time of the project in his speech. However, it is known that the release of a new virtual currency in Beijing is considered as a way to take control of this market segment and at the same time an opportunity to strengthen the position of the yuan on the global stage. Control of the circulation of digital money will be carried out using a mechanism that is used to track the movement of foreign money in China in order to avoid sharp fluctuations in the exchange rate in the long term;

- are gradually changing their sharply negative attitude towards digital currencies governments of Muslim countries. At the initial stage, regulators in Morocco, Nepal, Iran and Algeria stated that cryptographic means of payment, which have no real equivalent, could not be used in Muslim countries, since their speculative nature contradicted religious canons.

According to the Mehr News agency, at the end of July 2022, the Iranian authorities made a decision that could prove fatal for the circulation of cryptocurrencies in Muslim countries. Tehran decided to include mining in the list of types of production activities. After the relevant legislative innovations come into force, every resident of Iran or entrepreneur from this country has the right to establish the process of mining digital money. Before this, the future miner should obtain a license from the Ministry of Industry, Mines and Trade.

The encouraging news coming from China and Iran is actively commented on by representatives of the expert community. There is cautious optimism in the assessments of relevant experts. According to analysts, official Tehran in the foreseeable future may allow the population and business to switch to the widespread use of digital money. With a high degree of probability, such a decision will be made by the financial authorities of China.

At the same time, many observers call for attention to the specifics of the situation created in the summer of 2022. The governments of Iran and China are waging a rather tense battle with the United States. Perhaps it is Washington’s onslaught that is forcing Tehran and Beijing to make adjustments to previously made decisions regarding cryptocurrencies. However, it is possible that after some time, officials from other countries who perceive virtual means of payment negatively will also lift the bans.

Technical principles of the Dash blockchain

The cryptocurrency architecture includes miners and masternodes. The former carry out calculations, and the latter confirm operations. The operating principle is called PrivateSend. The blockchain does not contain information about the recipients and senders of funds, so high confidentiality is maintained. Transfers online are grouped by amount. Transactions with approximately equal amounts are included in one group; after the masternode, transactions are mixed to ensure anonymity. The number of stirrings is set manually - from two to eight.

Mixing trades is the task of the masternode (PC). To solve the problems, the computer owner must pay a 1000 Dash deposit and submit an application. The requirements are in place to prevent a takeover of the network and control of 51 percent of the masternodes. Looking at the price chart and the high price of Dash, many are refusing the role. A number of participants incur expenses in order to make a profit in the future. 45 percent of the crypto network’s income goes to pay for the operation of masternodes.

An additional feature of Dash is the introduction of changes to the network after voting by participants. Each member of the community has the right to make a proposal, and the rest must say their “yes” or “no”. Once a majority is received, the project comes into force. For each proposal to change the network, you must pay five coins.

Which countries' legislation allows the use of the DASH cryptocurrency?

The governments of a number of other states consider the use of restrictions and prohibitions to be ineffective. Therefore, officials prefer to create effective regulatory mechanisms some time after a new promising instrument appears on the market. As a rule, such decisions are made by the financial authorities of countries with developed economies and popular offshore jurisdictions. Liberal-minded regulators introduce bans only in exceptional cases when a particular instrument is truly dangerous.

By developing clear rules and effective procedures, financial authorities can reduce risk. As a result, the population and business have the opportunity to use a wider range of instruments when performing payment and other transactions, increasing the amount of profit received. Accordingly, the volume of tax contributions going to the budget of each state increases, which is hardly possible if restrictions are introduced.

It is obvious that regulation brings much more benefits to the state, citizens and business than restrictions or complete bans. The use of digital money for settlement transactions and other purposes is considered acceptable by the governments and regulators of the following countries: USA (SEC and CFTC), Germany (BaFin), Israel (ISA), Estonia (EFSA), Hong Kong Special Administrative Region of China (SFC), Switzerland ( FINMA), Belize (IFSC), Malta (FSC Mauritius), Spain (CNMV), Singapore (MAS), Australia (ASIC), New Zealand (FSCL), Mauritius (FSC), Canada (IIROC), Botswana (Botswana IFSC) , South Africa (FSB) and a number of other states whose leadership has a positive attitude towards expanding the list of market instruments.

In all of these countries, legislative norms have been approved that transform the seemingly complex sphere of cryptocurrency turnover into an understandable and regulated space. Among other things, companies wishing to be active in the cryptocurrency market must obtain a license. The document is issued by the relevant division of the regulator or a separate authorized government agency. License holders, if ambiguous situations arise during their work, can count on government support.

For readers who want to learn more about the peculiarities of digital money circulation in different countries of the world, analysts at the Masterforex-V wiki have prepared a review publication. The material, which is entirely dedicated to cryptocurrencies, examines, among other things, experts’ views on scenarios for the further development of this segment of the global market.

Specifics and prospects of the DASH coin

The DASH cryptocurrency is a fork of Bitcoin . The popularity of the altcoin is lower than that of Bitcoin, but in terms of stability, DASH is not inferior to the main player in the market of virtual means of payment. As a result, users are given the opportunity to receive greater benefits when carrying out a number of transactions with altcoins.

Experts call DASH an anonymous coin in the full sense of the word, which has a unique two-level system. The high degree of security of information about users and transactions makes the coin a fairly popular everyday means of payment, and also ensures that DASH remains on the list of leaders in capitalization. The impressive growth potential of the project is indicated by the progressive network development system, data security and a unique mechanism for distributing rewards between participants.

The DASH coin was originally created as an alternative to Bitcoin . The coin developers sought to improve the BTC and solve the problems of the world's first cryptocurrency. There is no central issuer in the decentralized DASH network, so all participants are equal. Another advantage of the coin is that to mine Dash it is not necessary to use such powerful equipment as is used for mining Bitcoin.

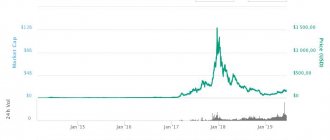

Over the history of its existence, digital money Dash has changed its name several times. The main developer of the project, Evan Duffield, launched sales in January 2014, then anyone could purchase coins called XCoin. At the initial stage, the team of authors made a mistake in the code, which was successfully exploited by the miners. In the first hour, a total of about 500 thousand coins were mined. Quite quickly, the developers fixed the problem, but decided to change the name of the coin so that in the future the coins would not cause associations with the unpleasant episode that happened during launch.

At the end of February 2014, the creators of the coin replaced the initial name XCoin with Darkcoin. However, rebranding did not allow the situation to radically change for the better. Many traders refused to invest money in the project because the name evoked associations with the Darknet. The project received its current name Dash, which brought success to the coin, in March 2015, after which its capitalization began to grow.

The main task of cryptocurrency developers is to create the most anonymous network possible. The key advantages of Dash include the positive characteristics inherent to the Bitcoin blockchain (decentralization, anonymity, general availability and lack of inflation). At the same time, the DASH coin has a number of specific characteristics that distinguish this coin from other digital monetary units:

- high speed of block formation in the chain (the process takes only 2.5 minutes);

- transfer encryption system PrivateSend. The mechanism involves distributing the entire transfer amount into several equal parts and mixing them with the assets of other network users. At the next stage, the funds are collected back into a single group, after which they are transferred to the recipient. The system allows you to encrypt all transactions using Dash as securely as possible;

- simple mining process. In terms of the speed of mining network blocks, DASH leaves all other cryptocurrencies far behind. Miners have the opportunity to mine more coins, while the amount of energy consumed by the equipment is reduced;

- approximately half of the income received from mining is distributed among the owners of masternodes (special services that participate in ensuring the full functioning of the Dash ecosystem);

- transactions using DASH coins are carried out almost instantly, security remains at a high level, unattainable for many other digital currencies.

Special attention should be paid to the key project managers. The team included people well known in the cryptocurrency environment. They participate quite actively in promoting the product, but do not distance themselves from ordinary users. When making important decisions, the opinion of the audience must be taken into account. Anyone can submit their own idea for consideration; to do this, you need to pay 5 Dash coins. During the subsequent voting, other network users have the opportunity to support the initiative. Thus, at one time the block size in the network was increased.

Average prices table

- by month

- by days

- on years

| Month | Price, USD |

| January 2022 | 139.735 |

| December 2021 | 136.715 |

| November 2021 | 197.695 |

| October 2021 | 187.595 |

| September 2021 | 198.45 |

| August 2021 | 200.12 |

| July 2021 | 138.14999999999998 |

| June 2021 | 164.05 |

| May 2021 | 312.845 |

| April 2021 | 282.84250000000003 |

| March 2021 | 217.945 |

| February 2021 | 223.8125 |

| January 2021 | 104.31 |

| date | Price, USD |

| 13.01.2022 | 142.07999999999998 |

| 12.01.2022 | 141.64499999999998 |

| 11.01.2022 | 148.55 |

| 10.01.2022 | 147.52499999999998 |

| 09.01.2022 | 148.54000000000002 |

| 08.01.2022 | 139.735 |

| 07.01.2022 | 125.19 |

| 06.01.2022 | 121.635 |

| 05.01.2022 | 127.035 |

| 04.01.2022 | 136.67000000000002 |

| 03.01.2022 | 139.49 |

| 02.01.2022 | 140.24 |

| 01.01.2022 | 136.51 |

| 31.12.2021 | 136.715 |

| 30.12.2021 | 132.675 |

| 29.12.2021 | 134.12 |

| 28.12.2021 | 143.03 |

| 27.12.2021 | 151.58499999999998 |

| 26.12.2021 | 150.62 |

| 25.12.2021 | 150.07999999999998 |

| 24.12.2021 | 150.7 |

| 23.12.2021 | 139.57999999999998 |

| 22.12.2021 | 136.935 |

| 21.12.2021 | 130.25 |

| 20.12.2021 | 127.91 |

| 19.12.2021 | 130.96 |

| 18.12.2021 | 130.885 |

| 17.12.2021 | 128.35 |

| 16.12.2021 | 131.285 |

| 15.12.2021 | 130.565 |

| 14.12.2021 | 129.525 |

| 13.12.2021 | 131.78 |

| 12.12.2021 | 140.18 |

| 11.12.2021 | 136.315 |

| 10.12.2021 | 136.565 |

| 09.12.2021 | 143.66 |

| 08.12.2021 | 142.20499999999998 |

| 07.12.2021 | 140.235 |

| 06.12.2021 | 131.135 |

| 05.12.2021 | 136.065 |

| 04.12.2021 | 141.305 |

| 03.12.2021 | 170.71499999999997 |

| 02.12.2021 | 175.305 |

| 01.12.2021 | 181.235 |

| 30.11.2021 | 180.64499999999998 |

| 29.11.2021 | 180.32 |

| 28.11.2021 | 173.57 |

| 27.11.2021 | 185.42000000000002 |

| 26.11.2021 | 197.875 |

| 25.11.2021 | 208.95499999999998 |

| 24.11.2021 | 194.72500000000002 |

| 23.11.2021 | 192.79 |

| 22.11.2021 | 199.29000000000002 |

| 21.11.2021 | 197.85000000000002 |

| 20.11.2021 | 197.54 |

| 19.11.2021 | 182.065 |

| 18.11.2021 | 180.76 |

| 17.11.2021 | 192.90499999999997 |

| 16.11.2021 | 207.635 |

| 15.11.2021 | 232.195 |

| 14.11.2021 | 226.18 |

| 13.11.2021 | 224.54500000000002 |

| 12.11.2021 | 224.35500000000002 |

| 11.11.2021 | 224.26999999999998 |

| 10.11.2021 | 228.36 |

| 09.11.2021 | 225.07999999999998 |

| 08.11.2021 | 203.37 |

| 07.11.2021 | 191.945 |

| 06.11.2021 | 191.72 |

| 05.11.2021 | 195.94 |

| 04.11.2021 | 199.22000000000003 |

| 03.11.2021 | 199.26999999999998 |

| 02.11.2021 | 195.31 |

| 01.11.2021 | 189.255 |

| 31.10.2021 | 191.58 |

| 30.10.2021 | 184.62 |

| 29.10.2021 | 185.415 |

| 28.10.2021 | 179.79500000000002 |

| 27.10.2021 | 187.13 |

| 26.10.2021 | 202.015 |

| 25.10.2021 | 208.385 |

| 24.10.2021 | 204.99 |

| 23.10.2021 | 196.845 |

| 22.10.2021 | 197.925 |

| 21.10.2021 | 200.685 |

| 20.10.2021 | 197.655 |

| 19.10.2021 | 190.625 |

| 18.10.2021 | 186.145 |

| 17.10.2021 | 189.945 |

| 16.10.2021 | 192.465 |

| 15.10.2021 | 195.48000000000002 |

| 14.10.2021 | 184.695 |

| 13.10.2021 | 178.575 |

| 12.10.2021 | 175.29 |

| 11.10.2021 | 186.695 |

| 10.10.2021 | 187.595 |

| 09.10.2021 | 192.61 |

| 08.10.2021 | 192.005 |

| 07.10.2021 | 186.41 |

| 06.10.2021 | 190.975 |

| 05.10.2021 | 181.785 |

| 04.10.2021 | 178.065 |

| 03.10.2021 | 178.32 |

| 02.10.2021 | 176.97 |

| 01.10.2021 | 179.57999999999998 |

| 30.09.2021 | 164.01 |

| 29.09.2021 | 153.575 |

| 28.09.2021 | 149.57 |

| 27.09.2021 | 156.18 |

| 26.09.2021 | 162.265 |

| 25.09.2021 | 167.3 |

| 24.09.2021 | 170.17000000000002 |

| 23.09.2021 | 182.65 |

| 22.09.2021 | 170.775 |

| 21.09.2021 | 165.995 |

| 20.09.2021 | 180.595 |

| 19.09.2021 | 194.64999999999998 |

| 18.09.2021 | 202.72 |

| 17.09.2021 | 201.60500000000002 |

| 16.09.2021 | 211.57999999999998 |

| 15.09.2021 | 208.675 |

| 14.09.2021 | 204.95999999999998 |

| 13.09.2021 | 197.77 |

| 12.09.2021 | 200.385 |

| 11.09.2021 | 196.855 |

| 10.09.2021 | 197.01999999999998 |

| 09.09.2021 | 202.82999999999998 |

| 08.09.2021 | 199.13 |

| 07.09.2021 | 221.805 |

| 06.09.2021 | 262.515 |

| 05.09.2021 | 267.36 |

| 04.09.2021 | 250.75 |

| 03.09.2021 | 244.67000000000002 |

| 02.09.2021 | 241.025 |

| 01.09.2021 | 235.16500000000002 |

| 31.08.2021 | 220.805 |

| 30.08.2021 | 222.975 |

| 29.08.2021 | 233.54500000000002 |

| 28.08.2021 | 238.75 |

| 27.08.2021 | 240.21499999999997 |

| 26.08.2021 | 241.97 |

| 25.08.2021 | 256.065 |

| 24.08.2021 | 259.945 |

| 23.08.2021 | 274.62 |

| 22.08.2021 | 246.075 |

| 21.08.2021 | 236.595 |

| 20.08.2021 | 237.60500000000002 |

| 19.08.2021 | 216.2 |

| 18.08.2021 | 200.12 |

| 17.08.2021 | 193.75 |

| Data is provided for the dates on which the auction took place. Therefore, there is no data for weekends and holidays. | |

| The table is too large to display on the screen. | |

| Year | Price, USD |

| 2022 | 139.735 |

| 2021 | 190.975 |

| 2020 | 76.3125 |

| 2019 | 88.32 |

| 2018 | 246.0 |

| 2017 | 173.735 |

| 2016 | 7.9975 |

| 2015 | 2.6 |

| 2014 | 2.175 |

What online resources can you buy DASH coins from?

Despite the fact that the project developers have made the mining procedure unprecedentedly profitable, not all users prefer this method of receiving coins. Some fans of the DASH cryptocurrency use transfers to purchase or visit specialized virtual platforms. Owners of digital coins who belong to the last of these groups most often make purchases on the following types of sites:

- virtual payment exchanges. Those interested have the opportunity to choose from a huge variety of similar trading platforms. Over time, experienced users independently determine the advantages and disadvantages of each individual exchange. Daily turnover indicators allow us to compile a list of exchanges that occupy leading positions in the trust rating of Internet users:

Binance

- DigiFinex

- OKEx

- Huobi Global

- CoinBene

- DOBI Exchange

- OEX

Immediately before making a purchase, users visit exchanger monitoring services. On the website www.bestchange.ru, you can easily find data on the current DASH rate on various exchange platforms. In addition, the monitoring service will tell you which resource you can buy coins on using Visa/MasterCard, QIWI, Yandex.Money, WMZ, Skrill USD and other popular methods as payment.

Dash cryptocurrency storage options

On the cryptocurrency website at the link dash.org/ru/wallets/, users are offered several types of wallets. Each has individual pros and cons (must be taken into account by the user). After choosing, you need to download the software and install it on your PC. Regardless of the type of storage, it is important to make a backup copy. If you lose access to the storage, it will not be possible to restore it.

The money in the wallet is stored in the Dash cryptocurrency. In the future, they can be converted into rubles, dollars or another monetary unit through exchange platforms and exchangers. Users have four types of storage at their disposal:

- PC Wallets. They are installed on a computer, have a high level of security and good functionality. Representatives of desktop storage: Dash Core, Dash Electrum, Guarda, Jaxx and others.

- Mobile wallets. Unlike software wallets, they are installed on smartphones with Android or iOS operating systems. Dash Wallet, Edge Wallet, Jaxx, Ethos and others are suitable for the first version of the OS. The following programs are used for iOS: Dash Core iOS, Jaxx, Evercoin and Ethos.

- Hardware storage devices are devices specifically designed to store cryptocurrency and protect against hackers. Money is stored cold (without connection to the Internet). Representatives of hardware wallets: Ledger, Keep Key, Guarda, Trezor.

- A paper vault is a wallet that represents a sheet of keys. Coins are stored without a connection to the Internet, therefore they are reliably protected from hackers.

Dash Core

Dash Core is one of the premier cryptocurrency wallets. This is a full wallet requiring a 9.54 GB blockchain download (as of January 17, 2022). To use the program, you need to download the software to your PC, install it and wait for synchronization. Before installation, you need to determine the sufficient amount of free space on your hard drive.

The wallet installation algorithm is standard:

- Saving the installation file on your PC.

- Choosing a storage location.

- Follow the prompts and launch the vault.

After launch, the program asks for a place to store the blockchain chain. Synchronization takes up to two to three days depending on the type of PC and Internet speed.

After installation, you need to set and write down a password, the loss of which will restrict access to the wallet. Next, the encryption process starts, and at the final stage a backup copy of the wallet is made (useful during recovery). Sending and receiving Dash occurs through the corresponding sections of the client.

Jaxx

The Jaxx wallet is available in desktop and mobile versions. Keys to enter the device are created on the PC and controlled by the user. Developers or other users do not have access to the owner's money.

When conducting a transaction, you will have to trust the service that is responsible for information about the transfer of money (sending or receiving).

Exodus

Exodus Wallet is a program for storing various digital coins. Features: built-in ShapeShift option, key encryption and transfer information, online asset price control. Any changes in the exchange rate change the indicators in the wallet. The wallet guarantees complete control over your money, but you will have to trust the server that informs you about system payments. During use, a direct connection to the Dash P2P network is provided.

Ledger Nano S hardware wallet

Of the available hardware storage devices, the most popular is the Ledger Nano S, which is used to accumulate Bitcoin, Ethereum and other digital money. The peculiarity is the storage of digital money without connecting to the Internet. The wallet is connected to the PC only to receive or transfer coins. For convenience, there is a display and several buttons necessary to control the device.

Paper storage

For long-term storage of cryptocurrency, the Dash Core wallet is used. Suitable for creation is paper.dash.org or the generator walletgenerator.net/?currency=Dash. The code is available through the resource github.com/dashpay/paper.dash.org/releases/latest. Algorithm for creating a paper wallet:

- Go to paper.dash.org.

- Move the mouse until it reaches 100 percent.

- Obtaining a private and public key.

- Printing a document on paper.

For additional security, the BIP38 Encrypt function is used. After selection, a password is indicated and the Hide Art checkbox is checked. If you click on the generate button, a new wallet is created with a key encrypted with a password. To further use the wallet, you will need a BIP38 key. If necessary, the private and public keys are transferred to a hot wallet. After spending all the funds, you can destroy the storage.

Where can I trade the DASH USD pair?

As a more stable alternative to Bitcoin, DASH coins have become quite popular over time. The undeniable advantages of this digital currency allow experts to talk about the upcoming strengthening of the altcoin’s market position. Given the significant potential of DASH, many experienced and novice investors and traders are considering options for using this instrument to increase the level of profitability of their work.

Currently, visitors to several types of Internet sites can use the specified cryptocurrency pair to carry out trading and investment operations. This means that market players are given the opportunity to make a profit by correctly determining the nature of the trend at a particular moment and the likelihood of it changing in the short or long term. The following sites have the functions necessary to make a profit:

- cryptocurrency exchanges . The list of the most popular such Internet resources is given in the previous section of the publication. Fans of exchange trading eventually determine for themselves a trading platform with the most favorable conditions;

- Forex brokers . During the period of growing popularity of cryptocurrencies, clients of brokerage companies just began to use new tools in their work. For experienced market players, the operating conditions remained unchanged.

Gradually, more and more fans of digital payment methods are paying attention to the additional opportunities that cooperation with brokers provides. Market makers provide their clients with complete liquidity, something that cryptocurrency exchanges cannot do. When interacting with brokers, a transaction can be closed at any convenient time. Special offers from brokerage companies (]PAMM[/anchor] accounts, leverage and other services also contribute to the growth of profitability.

Ways to increase profitability when trading the DASH USD pair

Every trader who has some experience in using market mechanisms is well aware that specific parameters should be taken into account only when developing a trading plan with individual instruments. In other cases (when working with stock indices, cryptocurrencies, currency pairs, commodity futures, etc.), to obtain an impressive income, it is enough to follow a number of simple rules.

The primary task is to prepare a money management strategy. Then you should develop an effective trading plan. A component of success is also a balanced choice of a brokerage company, on the quality of whose services much depends. At the strategy preparation stage, professionals and beginners take into account objective analytics data. An effective trading plan should include diverse tools in order to bring profit to the author of the strategy through movement within the framework instead of passively observing fluctuations in the flat phase.

Strict adherence to these three rules will allow even a trader with minimal experience to create an effective strategy, the implementation of which will bring impressive returns. For several years, these rules have been confirmed by the experience of practicing market players. Statistics data from Rebate - autocopy service pro-rebate.com. show that as a result, traders can achieve profitability levels of 300 to 700 percent. Under no circumstances can such a profit be achieved by investing in stocks, ETFs, or any other available instrument, which is often practiced by novice traders.

Brokers who have created acceptable conditions for trading DASH USD

A description of the DASH cryptocurrency and ways to make a profit using this tool will be incomplete without considering the issue of choosing a brokerage company. Each trader has his own set of criteria that are taken into account when making a decision. In the vast majority of cases, traders pay attention to the number of available instruments; for many of them, regulation and innovative activities of the company are important; individual market players take into account bonus programs or other indicators.

In fact, when choosing a broker for further cooperation, there are almost no parameters that can be called insignificant. Both traders and brokers understand this. More often than not, even the most demanding market players highly appreciate the quality of services and recommend to their colleagues cooperation with leading brokers. Leaders make every effort to create optimal trading conditions for their clients.

Market players who have previously chosen to collaborate with industry leaders can use a variety of tools when developing a strategy, which contributes to increased profitability. Having achieved impressive results, traders share their impressions on the pages of specialized information resources and in thematic groups on social networks. Masterforex-V Academy experts analyze information received from clients of different companies.

Based on reviews and independent research data, ratings of Forex brokers are regularly compiled. As part of the study, all companies are assessed according to a number of criteria; the list includes several dozen indicators. Quite expectedly, the companies about which practicing investors and traders write the most positive reviews then end up in high ranking positions.

Typically, leading companies differ from other brokers not only by the presence of various awards and positive customer reviews. Leading companies are doing everything possible to gain a foothold in leading positions - introducing innovative developments and improving the quality of services. In August 2022, the list of major league brokers includes the following companies: NordFx , Swissquote Bank SA, Saxo Bank, FXPro, Finam, FIBO Group, FOREX.com, OANDA, Alpari, Interactive Brokers, FXCM, Dukascopy and FortFS.

It is noteworthy that many brokers with impressive experience in the market found themselves in the second league of the rating. These companies can confidently be called worthy of attention and trust, although some unpleasant moments in their work cause dissatisfaction among traders.

It is customer reviews that are most often the key arguments when including companies in the list of second league brokers. The current list of companies, among other projects, includes the following brokers: Forex Club, ActivTrades, TeleTrade, XM.com, Xtreamforex, Larson&Holz, FreshForex, GKFX, ForexTime, eToro, Nefteprombank RoboForex, HY Capital Markets, FinmaxFX, TurboForex, Forex Optimum Group Limited, FXOpen , Alfa Forex (Alfa Bank), Admiral Markets, EXNESS (Exness), IG Markets, Forex4you, LiteForex, BKS Forex, Renesource Capital, MaxiMarkets, World Forex, PROFIT Group, HotForex, Grand Capital and a number of other companies.

The material was prepared by the Masterforex-V wiki and our Masterforex-V school and professional training courses.

Mining Dash

The cryptocurrency is based on a blockchain containing information about all transactions since the appearance of the first Dash coin. Blockchain technology is protected using a special mechanism - PoW. The mining process involves using equipment to solve mathematical problems. When a new number is found, a block is formed, and miners receive income (as of January 17, 2022, the reward is 3.35 Dash).

Previously, CPUs and GPUs were used for mining. The former have long lost their relevance, but farms on video cards are still used, but after the advent of ASIC miners, their use has less effect. To get the greatest profit, you need to buy an ASIC running on the X11 algorithm. The following options are available today:

- Bitmain AntMiner D5 (119 GH/s). Price: $1,180.

- Innosilicon A5 (32 GC/s). Price: $990.

- iBelink DM56G (56 GH/s). Cost: $1800.

- Spondoolies SPx36 (540 GC/s). Price: $7,000.

To mine cryptocurrency, you will need to connect to a pool: Zpool, ViaBTC, IpoMiner, NiceHash and others. Detailed information on the setup and features of Dash mining is discussed on the page dash.org/ru/mining/.