Prerequisites for the creation of Bitcoin Cash

The main disadvantage of Bitcoin is its small block size, it is equal to 1 Mb. At the initial stage of Bitcoin development, this did not affect the speed of the network. But with the growing popularity of the crypt, due to the small block size, transactions began to take a long time to be confirmed, and the commission began to increase. Bitcoin was seen as an analogue of conventional payment systems and this situation became a serious problem.

Let's take a closer look to understand the scale of the problem. Let's start with the composition of the Bitcoin block:

- 4 byte – allocated for magic no. 0xD9B4BEF9;

- 4 byte – blocksize, how much is left until the end of the block;

- 80 byte – block header;

- 1-9 bytes – transaction counter;

- the rest of the volume is allocated for the transactions themselves. They are packed into a block, then miners confirm them and the block is added to the blockchain.

Problems begin when the block volume approaches the boundary value. Transactions begin to compete with each other to get into the block, and as a result, the commission increases. Commission is the reward of miners, so transactions with the maximum commission are included in the block first.

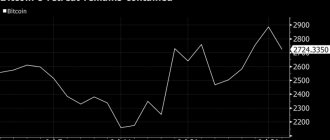

Pay attention to the commission in 2022 and at the beginning of 2022. It was the block size that caused it to increase by an order of magnitude.

Among the ways to solve the problem were:

- SegWit – moving part of the information outside the blockchain. In particular, signature information can be removed from the transaction. In theory, this was supposed to reduce competition between transaction senders and stop the growth of commissions as the load on the network increased;

- Remove the size limit of 1 block = 1 Mb. As a result, more transactions will be placed in one block, miners will earn more, but the commission for the average crypto user will decrease.

The voting showed that the majority is in favor of the hybrid option. That is, part of the data will be behind the blockchain, but at the same time the block size limitation will be removed. 95% of miners voted for this option. This solution was called SegWit2x, and it was supposed to be implemented on 08/01/2017.

The situation was radically changed by Amaury Secheta and his supporters. The developers announced that SegWit2x was being cancelled, and instead the Bitcoin blockchain was split on August 1st. In VSN, the block increased 8 times – up to 8 Mb. Block number 478559 was already formed in 2 different blockchains.

This was good news for Bitcoin holders. They all received a similar number of tokens of the new cryptocurrency in their Bitcoin wallets. Considering the exchange rate, quite a lot of money was obtained literally out of thin air.

Subsequently, forks also occurred; the division of the blockchain is shown schematically in the figure above.

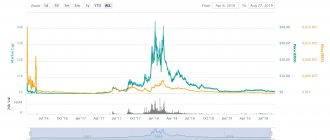

BCH exchange rate history

The prospects for the growth of a hard fork begin with studying its advantages and the history of the exchange rate. The first has already been described above. Now we will talk about its price, which often surprised network users.

It all started with a price of about $200. What is noteworthy is that even at this price, the cryptocurrency immediately entered the top capitalization according to Coinmarketcap. The very next day the rate doubled. Then there was relative stability, but after three weeks the cost rose sharply to a thousand dollars and immediately fell to 700.

After this, a long, smooth drain was observed. After reaching $317, there was a reversal. Then the first serious rise to $1,600 occurred. Then many people actively bought Bitcoin Cash.

After another recession there was a huge increase. This coincided with the peak value of all cryptocurrencies in mid-December 2022. The highest market value was $4,091, however, that day closed at $3,526.

Gray Friday on December 22 and its consequences also had an impact on this cryptocurrency. As a result, the rate returned to about $1,000. At the beginning of May there was an increase to one and a half thousand, and at the time of writing (05/26/2018) the cost was $1,032.

What conclusion can be drawn based on the history of its course? Firstly, the successful implementation of the hard fork idea attracted many users who actively invested in it. Secondly, it also greatly depends on the Bitcoin exchange rate, and therefore the general situation on the cryptocurrency market. Third, BCH tends to make big moves despite the cryptocurrency's high value.

Features of the Bitcoin Cash cryptocurrency

Since this is a fork of Bitcoin, the main technical characteristics of VSN are the same as Bitcoin:

- the maximum issue is limited to 21 million coins . At the time of division of the blockchain, the number of Bitcoin Cash coins was automatically equal to the number of already mined BTC tokens;

- The method of rewarding miners is the same as in Bitcoin;

- the PoW consensus algorithm is used , that is, the efficiency of mining is directly related to the power of the equipment.

Other Features

- Complexity . Among the differences, in addition to the block size, we note the rapidly changing difficulty. If in Bitcoin it was revised every 2016 mined blocks, then in BSN - every 6. This allows the network to quickly adapt to the activity of miners.

- The lack of a single development center is another feature of Bitcoin Cash. Several teams are working on the code.

- Low commission. BCH users immediately saw the benefit of the block size increase. The commission has decreased and on average does not reach a cent. Even during the peak load on the network, the transaction fee did not exceed $0.82, but these values were reached at the same time; most of the time in January 2018, the fee remained at $0.40 per transaction.

- Block size. As for the block size (one of the main advantages of the new crypt), it almost never reaches 8 Mb. The fact is that 8 Mb is its maximum size, but nothing bad happens if the block is not completely filled. It is also confirmed by miners and added to the blockchain.

As you can see, occasionally the block size exceeds 4 Mb, so 8 Mb should be enough for the future, when the popularity of the crypt in general and Bitcoin Cash in particular grows.

Occasionally there are “complete” blocks. Thus, in December 2022, the ViaBTC pool processed a block of 8 Mb in size. Note that, unlike Bitcoin, there are no big problems with incomplete transactions in BCH. When a new block is added to the BCH blockchain, the mempool is cleared, and uncompleted transactions are confirmed all at once.

Bitcoin Cash rate forecast for each day in the table

| date | Day | Min | Well | Max |

| 14.01 | heels | 387 | 395 | 403 |

| 17.01 | Mon | 396 | 404 | 412 |

| 18.01 | WTO | 383 | 391 | 399 |

| 19.01 | Wednesday | 382 | 390 | 398 |

| 20.01 | even | 368 | 375 | 383 |

| 21.01 | heels | 360 | 367 | 374 |

| 24.01 | Mon | 358 | 365 | 372 |

| 25.01 | WTO | 336 | 343 | 350 |

| 26.01 | Wednesday | 335 | 342 | 349 |

| 27.01 | even | 324 | 331 | 338 |

| 28.01 | heels | 323 | 330 | 337 |

| 31.01 | Mon | 332 | 339 | 346 |

| 01.02 | WTO | 333 | 340 | 347 |

| 02.02 | Wednesday | 335 | 342 | 349 |

| 03.02 | even | 326 | 333 | 340 |

| 04.02 | heels | 312 | 318 | 324 |

| 07.02 | Mon | 320 | 327 | 334 |

| 08.02 | WTO | 319 | 326 | 333 |

| 09.02 | Wednesday | 318 | 324 | 330 |

| 10.02 | even | 318 | 324 | 330 |

| 11.02 | heels | 330 | 337 | 344 |

| 14.02 | Mon | 333 | 340 | 347 |

| 15.02 | WTO | 338 | 345 | 352 |

| 16.02 | Wednesday | 333 | 340 | 347 |

What is the Bitcoin Cash forecast for March?

The forecast for the Bitcoin Cash rate for March is in the range of 235-300, at the end of March 240 dollars. Monthly change -20.0%.

What Bitcoin Cash price is predicted until the end of 2022?

Bitcoin Cash price forecast for 2022 : the rate will trade in the range of 167-352. Forecast for the exchange rate at the end of December 2022 : 236 dollars.

What will the Bitcoin Cash price be in 2023?

Bitcoin Cash exchange rate forecast for 2023 : rate at the end of December 2023 - 360 . And throughout the year the rate will fluctuate in the range of 236-498.

The cost of the BCH token and its development

Immediately after the Bitcoin Cash fork, you could get 0.5 BTC for the BCH coin. But the crypto began to be leaked en masse and, as a result, the rate very quickly fell to 0.08 BTC per 1 token. Ahead was the rise of the entire crypto market and at that moment the cost of 1 BCH token exceeded $4,000.

Then the demand for crypto began to fall. BCH did not come to life even in the summer of 2022, when Bitcoin, after a protracted decline, broke through resistance at $10,000 per coin. BCH, as before, cannot gain a foothold above the level of 0.1 BTC per 1 BCH.

As for the development of Bitcoin Cash, from the very beginning this cryptocurrency was called at least a controversial project, some even called it a troll cryptocurrency. At first, some exchanges refused to add BCH, but then they did it anyway.

Despite the fact that VSN has existed for more than 2 years, the attitude towards it is still wary. Until now, it is not perceived as a competitor to Bitcoin, although it is among the TOP in terms of capitalization.

The fork of Bitcoin Cash also contributed to this attitude towards crypto; it took place on November 15, 2018 as a result of a conflict of opinions regarding the development of crypto in the future. Let us remember that then Craig Wright proposed to revise the block size and make the maximum volume equal to 128 Mb, Roger Ver did not accept this opinion.

As a result, on November 15, we received another fork and 2 consensus algorithms – BCHABC and BCHSV. This was accompanied by the manipulative growth of Bitcoin Cash, which did not add attractiveness to the crypt in the eyes of long-term investors.

Bitcoin Cash price forecast for 2022, 2023 and 2024

| Month | Min-Max | Closing | Total,% | |

| 2022 | ||||

| Jan | 323-448 | 339 | -22.1% | |

| Feb | 294-352 | 300 | -31.0% | |

| Mar | 235-300 | 240 | -44.8% | |

| Apr | 226-240 | 231 | -46.9% | |

| May | 231-279 | 274 | -37.0% | |

| Jun | 215-274 | 219 | -49.7% | |

| Jul | 219-261 | 256 | -41.1% | |

| Aug | 256-270 | 265 | -39.1% | |

| Sep | 208-265 | 212 | -51.3% | |

| Oct | 167-212 | 170 | -60.9% | |

| But I | 170-208 | 204 | -53.1% | |

| Dec | 204-241 | 236 | -45.7% | |

| 2023 | ||||

| Jan | 236-288 | 282 | -35.2% | |

| Feb | 282-329 | 323 | -25.7% | |

| Mar | 323-360 | 353 | -18.9% | |

| Apr | 353-430 | 422 | -3.0% | |

| May | 422-498 | 488 | +12.2% | |

| Jun | 392-488 | 400 | -8.0% | |

| Jul | 362-400 | 369 | -15.2% | |

| Aug | 369-452 | 443 | +1.8% | |

| Sep | 404-443 | 412 | -5.3% | |

| Oct | 385-412 | 393 | -9.7% | |

| But I | 393-459 | 450 | +3.4% | |

| Dec | 353-450 | 360 | -17.2% | |

| 2024 | ||||

| Jan | 288-360 | 294 | -32.4% | |

The forecast is updated daily.

Apple stock forecast 2022, 2023.

Dollar exchange rate forecast for January, February and March 2022.

Advantages and disadvantages of Bitcoin Cash

Let's start with the advantages :

- The block size has been increased - the problem of commission growth when the network load increases has been eliminated, transactions are confirmed faster. In 2018, the block size was increased again, now to 32 Mb, so the problem of slow transactions was solved;

- developers protected Bitcoin Cash from erasure and replay attacks;

- transaction security has been increased.

The disadvantages include:

- linking the speed of data extraction to the complexity of the network. That is, if few blocks are mined over a certain period of time, then the difficulty drops. Recalculation occurs every 6 blocks. As a result, miners could take advantage of this - mine the crypt when the difficulty was falling and leave when it grew;

- unprofitable mining. The rates of MTC and BCH vary too much.

We also note that BCH is not growing despite the general revival of the crypto market. Large long-term investors are still wary of it.

Where to store

Storing BCH

There is a huge variety of wallets that support BCH. They can be desktop, paper, mobile or hardware.

The most common hardware wallets among users are Ledger and Trezor. These are very popular wallets designed to provide maximum security for storing Bitcoins. They are designed as flash drives that allow connection to a PC. Their only drawback is the price.

A good alternative would be the official Bitcoin wallet. Moreover, you can store both regular bitcoins and its fork on this wallet. One of the disadvantages is that it is often attacked by hackers.

Mobile wallets for iOS and Android

A complete list of wallets that support BCH can be found here.