Bitcoin Cash (BCC) emerged as a result of a hard fork as an “alternative to Bitcoin.” So, on August 1, 2022, the Bitcoin blockchain split into two chains and a new digital asset appeared - Bitcoin Cash (sometimes - Bcash), which has a common history with Bitcoin, but is traded under a different ticker - BCH (less often - BCC).

After the hard fork, many exchanges and wallets gave holders of “digital gold” an excellent opportunity - to receive a certain amount of Bitcoin Cash tokens, which should correspond to the balance of Bitcoin in a 1:1 ratio. For example, if a user has 1 BTC in his wallet, then he receives 1 BCH after the hard fork.

Immediately after its appearance on the exchanges, the new cryptocurrency found itself in third place in terms of capitalization, leaving behind such market “veterans” as Litecoin and Ripple. However, shortly after exchanges made Bitcoin Cash deposits and withdrawals available, the “alternative to Bitcoin” began to plummet in price. So, if on August 2 the price of BCH reached 0.485 BTC (approximately $1,300) on the Bittrex exchange, then two days later its weighted average price slightly exceeded $250.

On November 15, 2022, another hard fork took place, dividing Bitcoin Cash into Bitcoin ABC and Bitcoin SV, read more about this in our material - “How did the war between Bitcoin SV and Bitcoin ABC end? Results of the Bitcoin Cash hard fork.”

Where can you buy Bitcoin Cash?

For a safe and convenient purchase of Bitcoin Cash, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds in rubles, hryvnia, dollars and euros.

The most reliable platform with the highest cash turnover; for several years now, the largest cryptocurrency exchange in the world has been Binance. The Binance platform is the most popular crypto exchange in the CIS, as it has maximum trading volumes and supports transfers in rubles from Visa/MasterCard bank cards and payment systems QIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy Bitcoin on a crypto exchange for rubles?

| # | Cryptocurrency exchange | Official site | Site assessment |

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Huobi | https://huobi.com | 7.5 |

| 3 | Exmo | https://exmo.me | 6.9 |

| 4 | Yobit | https://yobit.net | 6.3 |

| 5 | OKEx | https://okex.com | 6.1 |

The criteria by which the rating is given in our rating of crypto exchanges:

- Reliability of operation

- stable access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the period of operation on the market and daily trading volume. - Commissions – the amount of commission for trading operations within the platform and withdrawal of assets.

- Reviews and support – we analyze user reviews and the quality of technical support.

- Interface convenience – we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Features of the platform are the presence of additional features - futures, options, staking, etc.

- The final score is the average number of points for all indicators, determines the place in the ranking.

Dynamics of Bitcoin Cash (Bitcoin Cash) exchange rate to the ruble in the last hours today

16:00

| 15:50 | 15:40 | 15:27 | 15:17 | 15:07 | 14:58 | 14:46 | 14:36 | 14:25 | |

| 39 792.68 | 39 766.37 | 39 830.78 | 39 762.38 | 39 783.71 | 39 701.11 | 39 588.63 | 39 659.76 | 39 700.46 | 39 572.36 |

Why did the Bitcoin and Bitcoin Cash split happen?

Around mid-July, the developers agreed on the need to update the Bitcoin protocol using SegWit2x (Segregated Witness) technology. This is exactly the solution proposed by the Bitcoin Core development team; it was supported by the largest mining pools from China. The new technology made it possible to remove a certain part of the information from the block, including transaction signatures, while simultaneously increasing the throughput of the entire chain.

Most miners agreed to the protocol update, which promised to improve the performance of the entire network. But some of the large companies involved in mining supported the separation. Most of the supporters of this position are from China; we can say that Chinese miners were the reason for the appearance of the Bitcoin fork (by the way, not everyone agrees that this is exactly a fork). But, in general, this is true. So, on August 1, the Bitcoin Cash cryptocurrency was born with a block size of 8 MB.

The split occurred at block number 478558. Accordingly, both versions of Bitcoin have common old transactions, but all new transactions are different. The block size of the new currency is 8 MB. Interestingly, the Chinese were also the first to conduct transactions with this cryptocurrency.

“A group of miners who did not like the option using SegWit2x decided to increase the cryptocurrency block size from 1 MB to 8 MB,” commented Charles Morris, a representative of the investment company NextBlock Global.

How to use the calculator

The approximate income from bitcoin cash mining is based on calculations using automatic variable values (for example, the complexity of the network at present, these values are always relevant, because they are updated in the calculator in real time), and those values that you specify (cost and power of your equipment). In order to make the calculation, you just need to fill in the missing fields and click on the “Calculate” button.

- about the author

- Recent publications

Sergey Orekhanov

Trader and financial analyst since 2011. Has a portfolio with hundreds of cryptocurrencies. Knows everything about mining, dating back to the days of CPU mining. Every day he follows all the new products and trends in the cryptocurrency sphere and actively shares them with his readers.

Sergey Orekhanov recently published (see all)

- 7 Best NFT Trading Platforms for Buying and Selling NFT Tokens – 2021 – 05/21/2021

- What are NFT tokens? A Beginner's Guide to Non-fungible tokens - 05/21/2021

- Blockchain startups for the development of the Internet of Things (IoT) - 01/16/2019

Consequences of separation

No, with the exception of the “redistribution of spheres” of influence and changes in some principles of infrastructure operation, nothing of the kind has happened in the world of cryptocurrency. In principle, division was expected for a long time, and preparations were made for it. Here the words “who did not hide, I am not to blame” are fully true. It’s not for nothing that before the split, Bitcoin network users were asked not to accept or send payments on July 31 and August 1. No one knew exactly what could happen - perhaps, when sending a certain amount of money, it simply would not reach the addressee, or it would reach, but then disappear straight from the wallet.

Before the split, the Bitcoin rate reached $2,900, although it then dropped slightly. The volatility of the cryptocurrency turned out to be very high; the exchange rate of both units remains not very stable to this day. The same Bitcoin Cash initially cost $300, then its rate rose to $700 and fell again, although not to its original position, but to about $500.

As of August 2, Bitcoin Cash rose to third place among cryptocurrencies. Bitcoin (the original) is still on the first one, Ethereum is on the second one.

“The Bitcoin price rose before the split on expectations of additional profits for cryptocurrency holders,” says one market participant. “This has happened before on other blockchains. This is a normal market phenomenon where you expect more money.”

Just before the Bitcoin split, some exchanges, mindful of the problem described above, stopped performing operations with cryptocurrency, including freezing the acceptance and issuance of deposits, but quickly resumed all operations (literally the next day after the split). As mentioned above, some Chinese exchanges immediately began conducting transactions with the new cryptocurrency.

Cash is supported by companies such as OKCoin, Huobi, BTCCPool, Bitmain, F2Pool, BTC.Top, ViaBTC, BiXin, BW, 1Hash, Canoe, BATPool, Bitkan and others. On the other hand, there are no less those who decided not to work with Bitcoin Cash until the situation stabilizes. These include the Coinbase exchange, a fairly large player in the cryptocurrency market.

“In anticipation of the split on August 1st, we are saying that we will only support one version. We have no intention of working with a Bitcoin fork,” said the head of Coinbase.

It is worth noting that after the Bitcoin split, all owners of the classic cryptocurrency also became owners of Bitcoin Cash. And since there were 16.48 million bitcoins in circulation, the amount of new cryptocurrency became similar. According to Cathie Wood, a representative of ARK Investment Management, new and old cryptocurrencies will have their purpose in the world of blockchain, and no one will be left behind.

By the way, after the division, a new software client was introduced, which was called Bitcoin ABC. Some nodes will be updated and use it, while others will remain “their own”. Each node will decide what to do, whether to update or not, independently.

Dynamics of Bitcoin Cash (Bitcoin Cash) exchange rate to the ruble for this minute

16:05

16:02 16:01 16:00 15:57 15:56 15:55 15:52 15:51 15:50 39 746.33 39 721.47 39 725 39 792.68 39 861.19 39 862.73 39 861.85 39 777.06 39 765.57 39 766.37Prospects for Bitcoin Cash

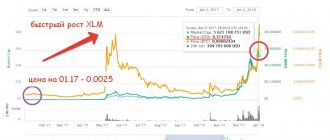

Cryptocurrency experts believe that in the future, the original Bitcoin will develop faster than the fork. This will mean that Big Brother will be a more attractive option for investors than Bitcoin Cash for a long time. But if a sufficient number of miners and exchanges pay attention to the new cryptocurrency, then its development will also be rapid. Miners, before all other participants in the cryptocurrency market, will determine the future of the new Bitcoin.

In addition, those who trade virtual coins also make their contribution to the development of the new cryptocurrency. Thus, some users of the Bitcoin network are buying Bitcoin Cash en masse, in the hope of an increase in the exchange rate and the opportunity to earn money, and good ones at that.

The number of market participants who support Bitcoin Cash is growing. So, if immediately after the division the new cryptocurrency was supported by 3% of miners, now there are already about 10% or even more.

However, at the moment, not tens or hundreds, but only a few large pools are engaged in mining the new cryptocoin. There are three of them in total. Two are ViaBTC, plus the ViaBTC company. But the third one is still unknown. At the same time, the third pool accounts for more than 77% of the total network hashrate.

Dynamics of Bitcoin Cash (Bitcoin Cash) exchange rate to the ruble hourly rate for March 29, 2021

16:05

| 15:45 | 15:22 | 15:03 | 14:41 | 14:20 | 13:55 | 13:31 | 13:10 | 12:47 | |

| 39 746.33 | 39 813.88 | 39 800.14 | 39 614.14 | 39 629.13 | 39 600.88 | 39 447.79 | 39 554.91 | 39 491.06 | 39 506.28 |

Wallets and exchanges

Instructions for creating a wallet for Bitcoin Cash - three options for storing this cryptocurrency are considered.

Many exchanges have stated that they will give their clients the opportunity to obtain BCC. You just need to keep your bitcoins in your account. That's all. It's that simple

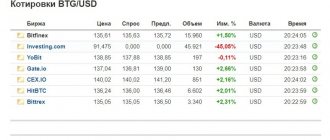

Here is a list of all exchanges:

As you can see, many major exchanges are on this list. For example, Bitfinex and Kraken are respected and time-tested platforms. However, for some reason the list is not complete. It lacks Bittrex, which in its blog announced that it WILL support BCC and all its users will receive coins. I hold on Bittrex myself, so I will receive there.

Wallets supporting Bitcoin Cash:

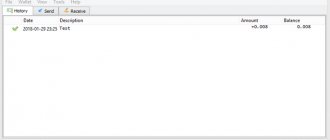

If you have hardware wallets such as Trezor or Ledger, then you will receive your BCCs. Also, any wallets whose private keys belong to you will give you the right to receive your BCC in full without problems. What do we have to do? Almost nothing.

Keep your bitcoins in your wallet and after August 1, using your private key or seed (a 12-word phrase) you will be able to log into a client that supports BCC (see the list above in the picture). Before this, I advise you to transfer your bitcoins to a new wallet and, with an empty balance, go to a client that supports BCC. Simple precautions.

Mining Bitcoin Cash

If you are a miner, you have probably already wondered how you can mine BCC? And how profitable is this activity at the moment? The good news is that the first block was already mined a few days ago by a mining rig called ViaBTC, which means that Bitcoin Cash is not a myth and can in fact be mined. The bad news is that it took quite a long time to mine the first block. According to CNBC, Bitcoin Cash required the same amount of computing power as Bitcoin and the fact that it took so long to find a block made people nervous.

Today, mining Bitcoin Cash cannot be a profitable activity, since BCC costs less than Bitcoin, but requires the same computing power as Bitcoin to find a block. People who are currently mining BCC believe that the new altcoin will be able to replace Bitcoin in the future. At this point, mining BCC can be compared to investing in the shares of a new company that may prosper in the future, or may be forgotten by everyone.