- BitPapa

- BitZlato

- LocalCoinSwap

- CryptoLocator

- LocalBitcoins

- LocalCryptos

BitPapa - P2P cryptocurrency exchange

At the moment, you can find many cryptocurrency exchangers on the network, with different conditions and commissions for the operation. But the oldest and most proven form of exchange is the P2P formula (peer to peer or person to person). Such exchanges involve interaction between real people, where the platform acts only as a guarantor of the integrity of transactions. Using such platforms, you can exchange cryptocurrency directly without the participation of intermediaries.

A buyer and seller in a P2P network publish a trade ad to complete a transaction within a specific price range at a specific location. There is direct interaction between the buyer and the seller. Thus, if a seller wants to buy Bitcoin at a specified location, then locally the P2P exchange will connect with the person who wants to sell Bitcoin. This method allows both parties to complete the transaction at the right time and place at an agreed price with a payment mode that is easy for both parties.

This scheme is called peer-to-peer and embodies the idea of decentralization, exactly the one that the creator of Bitcoin spoke about.

Trade only with verified users

The simplest but most important advice. Before making a transaction with a user, it is worth studying his profile. The reliability of the seller can be indicated by a high rating, the presence of verification and a large number of successful transactions.

The most common type of scam is when an attacker posts their own sales ad or responds to an existing one. He will not transfer funds and will try to persuade you in various ways to confirm the success of the transaction on the service. Therefore, if a user has only recently joined the service and does not have verification, then transactions with him should be carried out with caution.

It is better to trade with a trader who has good statistics

When searching for an ad in the Bitzlato P2P exchanger, it is possible to enable a filter for verified users. Then offers will be displayed only from those people who have confirmed their identity with documents. Creating an ad works the same way. In the settings, you can specify an option in which only verified users will be able to respond to the ad.

Best P2P (Peer-to-peer) cryptocurrency exchanges

Let's look at the most popular peer-to-peer crypto exchanges today and their main features:

BitPapa is a P2P cryptocurrency exchanger. Here you can exchange rubles, dollars or euros for Bitcoin or Ethereum. Transactions between sellers and buyers take place in a few clicks. Fiat currencies available: RUB, USD, EUR.

The platform is registered in Belize and does not require account verification. To register, just confirm your email and phone number. There are no input or trading fees. When withdrawing, a fee is charged: 0.5% of the transferred amount.

The service meets all basic user requirements:

- Safe. Transaction details are available only to the seller and buyer. The service does not disclose information to third parties.

- Comfortable. The service supports rubles, dollars and euros. Buying and selling cryptocurrency is carried out in 3 clicks.

- Understandable. To exchange rubles for cryptocurrency, you don’t need any special knowledge - just register.

- Profitable. Buying and selling cryptocurrency without commissions.

We personally tested the platform, made a purchase of cryptocurrency, transferred it to an external wallet and can recommend it for making p2p transactions.

BitPapa - P2P exchange

LocalCoinSwap is a secure, simple and fast peer-to-peer (P2P) trading platform that allows any trader to trade without unnecessary verification processes or wait time. Supports about 30 cryptocurrencies and many fiat payment methods.

LocalCoinSwap offers huge benefits to its users, allowing them to trade all popular cryptocurrencies and digital assets. The exchange also implements escrow and multi-sig as a guarantee of secure transactions.

LocalCoinSwap also gives users ownership of the exchange itself through tokenization in the ICO using the Cryptoshare system. In addition, regular airdrops of new coins are carried out for currency holders. The exchange provides an impressive selection of currencies (including more than 20 fiat) and supports almost all types of payment, for example:

- Bank transfer.

- Network transactions.

- Cash exchange.

- Fiat deposit.

- International wire.

- PayPal.

- Cash by mail.

- Exchange of assets such as gold.

You can start trading immediately after registration, without account verification. For each completed transaction, the ad creator pays 1% of the amount. Withdrawal fees are limited to those that are optimal for the current load level of the blockchain. Residents of all countries of the world can use the services of the decentralized platform.

LocalCoinSwap - P2P exchange

BitZlato was created on the basis of a telegram bot that has been working since 2016. The goal of the launch is to create a multifunctional platform that will include not only an exchanger, but also a mining pool, merchant service, encrypted wallets, and an exchange.

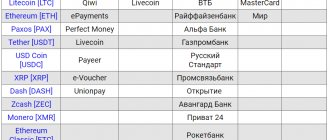

BitZlato supports more than 70+ methods of depositing and withdrawing funds - Yandex.Money, Qiwi, Tinkoff and Sberbank cards, and many others, popular among Russian traders.

The platform has several advantages:

- Support for Russian language and ruble. Bitzlato is one of the few exchanges where the ruble is supported, the exchange works for a Russian-speaking audience, so the technical support, interface and knowledge of the staff correspond to the clients, the only negative is that the user agreement is posted in English, despite the obvious preponderance of the Russian-speaking audience.

- Low commissions. Maker commission 0.05%, taker 0.15%, withdrawal commission: Bitcoin 0.0002, Bitcoin Cash 0.0002, Litecoin 0.005, DASH 0.001, Dogecoin 1.0, Ethereum 0.001.

The BitZlato exchange does not require mandatory verification, but confirming your identity will be useful for those users who trade through a p2p exchanger: the level of trust among other sellers and buyers in verified accounts is higher, and their transaction announcements are displayed in “Safe Mode”.

Telegram bots Bitzlato:

- BTC_CHANGE_BOT – Bot for buying Bitcoin cryptocurrency (BTC).

- ETH_CHANGE_BOT – Bot for buying Ethereum (ETH) cryptocurrency.

- BCH_CHANGE_BOT – Bot for buying Bitcoin Cash (BCH) cryptocurrency.

- LTC_CHANGE_BOT – Bot for buying Litecoin (LTC) cryptocurrency.

- DASH_CHANGE_BOT – Bot for buying Dash cryptocurrency (DASH).

- DOGE_CHANGE_BOT – Bot for buying Dogecoin (DOGE) cryptocurrency.

- TETHER_CHANGE_BOT – Bot for buying Tether (USDT) cryptocurrency.

The Bitzlato project continues to develop. In the future, the team plans to enter markets in Africa, South America and China, and will also launch a lending service. If you have heard anything about DeFi, MakerDAO and decentralized finance, then you probably know that this is a new promising direction. Issuing loans and credits secured in cryptocurrency is the future. And Bitzlato wants to be part of it.

BitZlato - P2P exchange

CryptoLocator - The platform is used to exchange ETH and BTC cryptocurrencies for fiat funds. Guarantees the honesty of the exchange, thanks to the escrow system - holding user funds until both the buyer and the seller fulfill the terms of the transaction. In addition, the site provides the opportunity to quickly exchange cryptocurrency for USDT in order to save savings from fluctuations in the cryptocurrency market.

The site has been operating since 2022 and is actively developing. Applications for mobile devices and new functionality are appearing. Cryptolocator has all the necessary European licenses giving the right to carry out this type of activity. User security is ensured through an encrypted connection and two-factor authentication.

Advantages:

- The two most popular currencies on one platform are ETH and BTC.

- Low commission - 0.75% for makers.

- No transaction commission for takers.

- Cryptolocator Bot is a unique Telegram bot.

- User support is provided 24/7, including in Russian.

The platform offers more than 100 exchange methods and a wide range of payments. Cryptolocator users set their own trading conditions among themselves in accordance with the general market rules.

CryptoLocator - P2P exchange

LocalCryptos is a P2P platform formerly known as LocalEthereum. Allows peer-to-peer trading of cryptocurrencies such as ETH and BTC. There are also plans to add EOS, LTC and DASH in the near future. The site supports a large number of payment methods - many large banks, electronic payment systems, cash, gift cards, etc.

The security of transactions is ensured by the principle of escrow (escrow), when cryptocurrency is blocked on the user’s account until payment. Thus, the chance of losing your funds is minimal, despite the fact that trading is carried out with living people. And this chance can be completely reduced to zero by choosing counterparties with good ratings and statistics.

LocalCryptos does not require any verification to work, just confirm your email address. The service’s commissions are quite low - 0.25% from the creator of the ad, 0.75% from the user who responded to it. There are no commissions for depositing or withdrawing funds, with the exception of network commissions.

LocalCryptos - P2P exchange

LocalBitcoins - The exchange began operating in 2012, making it one of the first P2P exchangers. It provides all the features you can expect from P2P trading, such as worldwide offers and several different payment methods. To ensure the security of each transaction, the exchange provides payment escrow services (escrow), which ensures that both parties fulfill their obligations.

The LocalBitcoins exchange specializes only in buying and selling bitcoins. Other cryptocurrencies cannot be purchased here. But more than 200 payment methods and fiat currencies are supported.

The platform allows clients to arrange a personal meeting to conduct a transaction. During their time together, they must complete the transaction completely. Of course, this option is only possible if the location of the traders matches. The name of the site itself suggests that this feature is considered the most important one (“local” Bitcoins). This is a reliable means of increasing security.

The ad creator pays LocalBitcoins a commission of 1% of the transaction amount. There are also limits on posting ads - a beginner can create no more than five applications. There are two ways to set the price: fixed or floating.

Recently, the exchange has introduced a KYC policy. That is, users must provide documents and confirm their identity. This policy is mainly aimed at sellers and large buyers. Those purchasing currency worth less than €1,000 per year are allowed to provide minimal information.

LocalBitcoins - P2P exchange

Paxful - A popular P2P exchange that can also be used as a wallet for Bitcoin, Ethereum and USDT. The Paxful exchange offers trading for a wide variety of countries, and also provides escrow and many different payment methods.

The exchange was founded in 2015 in the USA. Ambitious developers Arthur Shabak and Ray Youssef decided to create a peer-to-peer marketplace that would allow sellers and buyers to communicate directly. Paxful acts as an intermediary (broker), providing a platform for interaction.

First of all, Paxful attracts with its simplicity and convenience. You can pay for Bitcoins using fiat money using bank cards, PayPal, Skrill, MoneyGram and even gift certificates such as iTunes or Amazon. No cryptocurrency exchange in the world has such capabilities.

Paxful - These are new opportunities! On the platform you can:

- Buy Bitcoin online. Buy Bitcoin on Paxful in real time. Trade with other users online via internal chat.

- Sell Bitcoin. Sell bitcoins at your own rate and receive payment in any of the many ways.

- Make trades using a secure custody account. Your Bitcoins remain in a secure storage account until the transaction is successfully completed.

- Earn a reputation. Thanks to the feedback system, you can trade with the most reliable and experienced users.

- Get a free wallet. Get a free Bitcoin wallet powered by BitGo, the leading provider of secure cryptocurrency wallets.

- Get extra income. The Paxful affiliate program will help you organize a stable income.

So that a beginner can quickly get used to it and find a reliable seller, a special training program is provided. In addition, there is a special “Find the best offer” button, which greatly simplifies and speeds up trading.

It is noteworthy that on PaxFul, sellers have the opportunity to create their own payment methods, so the total number of them is constantly growing. Become a seller on Paxful and help millions of people around the world achieve financial freedom. Provide users with the opportunity to buy Bitcoin without intermediaries, and the service will happily share its resources and tips with you to help you succeed.

PaxFul - P2P exchange

Hodl Hodl is a peer-to-peer P2P crypto exchange that gives traders the opportunity to trade directly with each other.

Hodl Hodl went live in February 2022, making it a fairly new P2P exchange. It tries to separate itself from its competitors with additional features. For example, it provides support for the Bitcoin Lightning Network and also offers a prediction market similar to other alternatives. However, Hodl Hodl is a P2P exchange at its core, and it works the same as LocalBitcoins and Paxful in most cases.

Hodl Hodl aims to provide KYC-free exchanges. However, the site provides user verification as an additional feature. Hodl Hodl is not very active - it only has a few hundred listings worldwide. This is probably due to the short period of work.

Main advantages:

- Security - P2SH contracts with multi-signature.

- Low commission - 0.6% per transaction.

- TESTNET - An opportunity to learn trading without risk with real assets.

- Segwit - Support for native Bech32 SegWit addresses.

A large number of fiat currencies are supported, for which you can buy or sell Bitcoin or other cryptocurrency. New registered users are given certain limits on the number of offers (proposals), this is necessary in order to combat spam.

Since Hodl Hodl does not hold funds, the exchange is not subject to complex procedures. As a result, all transactions occur directly between user wallets.

Hodl Hodl - P2P exchange

Bisq is a P2P cryptocurrency exchange that connects sellers and buyers through a single blockchain network. Bisq allows users to exchange BTC and other coins for national currencies without sharing any identifying information. It is an open source desktop application created and maintained by developers around the world.

Like other P2P exchanges, Bisq allows individual users to create or find trade offers. However, Bisq is significantly more decentralized than its competitors. First, Bisq is a community-developed app and not a company-run website. This means that Bisq is more resistant to external pressure than other P2P exchanges. As a result, Bisq does not rely on KYC or identity verification, and likely never will.

One of the key features of Bisq is the ability to perform fiat transactions without any integration with banks or national currency systems. This is possible thanks to the Bisq trading protocol, which facilitates fiat payments outside the platform, for example through regular P2P payments SEPA in Europe or Zelle in the US.

Bisq has few users and offers despite being active since 2014. But it trades many cryptocurrencies, giving it an edge over its Bitcoin-only competitors.

To be a truly anonymous peer-to-peer network, the platform uses Tor and does not hold fiat or crypto on its servers. Every aspect of this exchange, from order placement to matching or fulfillment, is decentralized. It currently supports 126 cryptocurrencies (including BTC) and is available on Windows, Mac and Linux platforms.

Bisq - P2P exchange

P2PB2B is a Cryptocurrency exchange from Estonia that was launched in 2022. The platform offers users a wide selection of trading instruments.

The exchange provides the opportunity to conduct IEO (Initial Exchange Offering, an improved variation of ICO). Features support for a large number of digital assets, including many new tokens. The platform’s website has a special section through which users can submit applications for listing new tokens.

Main advantages:

- High performance. The main distinguishing feature of P2PB2B is its support for processing speeds of up to 10,000 transactions every second and 1,000,000 TCP connections.

- Multilingual support 24/7. We speak your language: English, Chinese, Japanese, Russian, Indonesian, Spanish, German, Korean.

- Optimized interface. A website is a single-page application that provides a fast user experience by dynamically updating content. In this way, high operating speed is achieved.

- Multicurrency. The exchange supports more than 200 cryptocurrencies and fiat currencies, including BTC, ETH, USD and others.

- Maximum security. More than 95% of all currencies are stored in cold wallets. We also use a WAF (Web Application Firewall), a web application firewall that detects and blocks hacker attacks.

To increase user security, Google's two-factor authentication service has been integrated. If you lose access to your smartphone, you can restore your account only by providing KYC data, login and information about recent transactions with assets. The KYC (verification) system is also one of the security factors. On the one hand, this eliminates anonymity, but at the same time eliminates the risk of account theft.

The commission fees of this cryptocurrency exchange cannot be called very low - 0.2% of each transaction, regardless of the status of the trader (maker or taker). According to this criterion, the exchange is significantly inferior to many competitors.

P2PB2B – Cryptocurrency exchange

Ask for a comment

When selling cryptocurrencies, in the terms of the transaction it is better to ask the buyer to leave a comment on the payment. This will help during proceedings in the event of a controversial situation.

When exchanging, you can encounter two types of problems. Firstly, the sender can contact the bank's support service and ask to cancel the transfer because they have the wrong number. If the text on the site and in the comment are the same, then it was not an error. Secondly, the sender's money may be obtained through criminal means. The comment will be displayed on the receipt and will help prove that the seller is not involved in a criminal scheme, but simply exchanged cryptocurrency in a P2P exchanger.

The sender writes a comment so that the recipient, banking services and regulators can understand the purpose of the payment

For example, when creating an ad in Bitzlato, the user specifies additional information in the “Trade conditions” section. There he writes the following text: “Please write a comment on the payment with the text “Transfer @your_username for BTC.” Otherwise, the payment will not be confirmed." This way, the seller will be sure that there will be a comment on his receipt that will help explain the source of funds if necessary. If there is no comment, the seller has the right not to confirm the transaction.

Why choose Bitzlato?

- Buy and sell cryptocurrency without commission using existing advertisements.

- P2P exchange in Telegram bot . Bitzlato first gained popularity as a Telegram bot for cryptocurrency exchanges, and its Telegram-integrated services remain relevant and in demand to this day. It provides a convenient way to buy and sell cryptocurrency without any hassle.

- Trade cryptocurrencies using the Bitzlato web platform. The Bitzlato web platform is simple and easy to use for beginners. However, it also supports advanced trading tools for experienced traders.

- Safe and reliable service . Bitzlato operates a secure cryptocurrency exchange service that has been operating since 2016 and has not yet experienced a security breach.

- Rating for sellers. After the exchange, buyers evaluate sellers. Bitzlato displays information about the seller: the number and volume of transactions, defeats in disputes, trust rating. Accordingly, you have the opportunity to choose a seller based on rating.

- Verification is not mandatory for trading. On Bitzlato you can buy and sell cryptocurrency without verification. But by passing verification, you will increase the trust of the service and other users in you.

- Instant transactions. Average transaction time is less than 6 minutes .

- The ability to send cryptocurrency within the service without commission using checks.

- The service support team works 24/7 and will always help you with any issue.

Monitor the amount of payments

It is not recommended to make transfers over 600,000 rubles in one payment. Russia has an Anti-Money Laundering Law (115-FZ), which imposes restrictions on large transfers. According to it, banks are required to notify regulators of suspicious transactions and may temporarily freeze the account.

The limit of 600 thousand rubles does not mean that payments for a smaller amount are not checked. If the funds for the purchase of cryptocurrency were obtained from illegal activities, then banks can still freeze them. In this case, there is no point in even accepting the amount in parts. To avoid any questions from regulators, you need to not only not exceed this limit, but also follow advice #1 - trade only with verified users.

Recommended material

The true story of how the founder of Maff exchanged bitcoins and was questioned by an investigator. The article describes in detail what to do in such a situation and how to prevent it.

Settings for trading P2P binance

Since using a p2p exchange involves conducting monetary transactions, the first step is to set up payment methods.

This can be done through the main P2P Trading page by selecting the “Details” tab and then “Payment Methods”.

P2P on Binance supports more than 100 payment methods, which include e-wallets, using banks, and more. The most popular and frequently used options are located at the top of the complete list called “Recommended.”

Check username and cardholder

It is recommended to always pay attention to the correspondence between the user name and the name of the person from whose card the funds were credited. If the names are different, then it is worth checking the sender’s full name in the service’s internal chat.

When selling cryptocurrency, it is important to carefully check the crediting of funds and not get confused. For example, a buyer will pay with someone else’s card or another person will transfer the same amount. If you mistakenly confirm the success of a transaction, then it will be impossible to appeal it later.

It takes just seconds to check the information from the transfer with the information from the exchanger

How to exchange cryptocurrency

To make a transaction as a seller, you need to register on the exchange and top up your balance, for example, in VTS. Next, you can independently place an advertisement for the sale, indicating the exchange rate, the number of coins and the desired payment methods, or respond to one of the offers from buyers.

Before initiating a transaction with a specific user, carefully review the information provided about him. Basically, P2P exchanges allow you to see the rating, the number of transactions concluded, and reviews.

After the transaction begins, its amount is frozen in the seller’s account. Once the buyer transfers money for the purchase, he will receive a return payment with cryptocurrency. If for any reason the transaction was not completed, the frozen funds will be returned to the seller's account.

Check currency

When checking the receipt of funds, you should pay attention not only to the amount, but also to the currency in which it is transferred. Sometimes scammers make transfers in the agreed amount, but in a different currency.

For example, instead of Russian rubles, Kazakhstani tenge (₸) may come. 1 tenge costs approximately 17 kopecks, so the seller will receive less money. In this case, you need to demand compliance with the agreed conditions and not confirm the success of the transaction.

The sender expects the recipient to not notice the difference

For example, a fraudster buys cryptocurrency and confirms in the service that he made the transfer. The seller notices that the payment was made in a different currency than agreed upon. If the user receives a different currency from the card than was agreed upon, he can open a dispute. In this case, Bitzlato support will appoint an arbitrator - an employee who will quickly resolve this issue.

Referral program

Each user has an additional opportunity to earn money on Bitzlato using the Referral Program. It has no limit on invitations, starts working immediately and has no expiration date. A referral is considered invited by you if he registered in the service using your referral link.

You receive 8% of the service commission if your referral was the creator of the ad. 32% if your referral made a deal on an already created ad.

Do not go beyond the exchange office

If the user has already found a suitable ad and is ready to make a transaction, then he should do this from start to finish on the service itself. Otherwise, there is no guarantee that both parties will honestly fulfill their obligations.

The scammer may offer to discuss the terms of the transaction in Telegram in order to avoid paying a commission. The p2p exchanger will not be responsible for the security of such a transfer. The scammer will receive your funds and stop contacting you. Therefore, if someone asks to conduct a transaction outside the service, you should be wary, and it is better to immediately inform the support service.

The seller outside the platform promises that he will fulfill all the conditions, but he cannot give any guarantees

For example, a scammer writes to the seller on social media. networks and invites him to change the terms of the deal. The seller refuses to communicate because the Bitzlato platform has a built-in chat, which in the event of a dispute, an arbitrator appointed by the exchanger can connect to.

Advantages and disadvantages of P2P exchanges

Online exchanges have been the main tools for working with cryptocurrency throughout the existence of Bitcoin. However, these projects are managed by companies. This means that they have employees, they have control over all operations, the team also acts as arbitrators in case of disputes, and commissions are charged for all of this.

Seeing the many shortcomings of such a system, some community members decided to transform the market by creating a new way of exchange - decentralized peer-to-peer systems run by software rather than people.

Advantages:

- The main advantage of such a system is the absence of a link on which all operations are tied. In other words, during regular transfers, when the exchange service comes under attack, all operations that it carried out are frozen. With P2P this is impossible, because this “weak link” simply does not exist.

- Another advantage is independence from the state and other structures that seek to control the circulation of cryptocurrencies and can put pressure on exchangers. In the case of P2P, if this can be done, it will be done only locally, without damaging the exchange system as a whole.

- Anonymity. In view of the fact that the governments of many countries began to suspect that money could be “laundered” using cryptocurrencies, they introduced laws obliging exchangers to collect data about users. When using P2P, no one collects any data, meaning all users can remain anonymous.

- Security of transfers. Due to the fact that funds do not pass through any foreign currency accounts, but are transferred directly from user to user, they cannot be stolen “on the road.”

- Low commissions. Since most of the process is completed by the parties involved in the transaction, the exchange platform will not charge high trading fees.

- Global market. Exchanges can provide services both globally and locally.

- There are no withdrawal or deposit restrictions. This gives the user the ability to add or withdraw funds as needed.

- Using fiat currencies for purchases. Fiat assets can be used to purchase cryptocurrency.

The disadvantages of P2P are associated with the lack of popularity of this system. The number of trading pairs, as well as users, is incomparably smaller than on conventional centralized platforms. Professional traders are not interested in P2P exchanges; they are used mainly for one-time exchanges.

Since the trading method on P2P exchanges does not fully protect users, there is a risk of possible fraud. BTC transactions are final and cannot be reversed, while fiat transfers, on the other hand, are often reversed. Because of this, there is a risk that the buyer will send their fiat payment, receive the Bitcoins, and then simply ask their bank for a refund, leaving the seller empty-handed.

However, to solve this problem, P2P services have public arbitrators who resolve such disputes, as well as payment deposit services. That is, user funds are held until both the buyer and seller fulfill the terms of the transaction.

It's better to lose your rating than money

This is the most universal advice. Do not confirm the success of the transaction under any pretext if you are not sure that the funds have been received. If the situation turns out to be suspicious, you should contact the support service of the P2P exchanger. It is better to lose your rating on the service than your own money.

There are a lot of ways to deceive - scammers on p2p exchangers can pose as support employees, send messages in banking applications, or try to find out account information. In any of these cases, they will not succeed if they are vigilant.

For example, the scammer introduced himself as a support employee. The seller knows that Bitzlato support never writes first. He decides not to continue the dialogue, but instead contacts the service support himself, opens a dispute and waits for the appointed arbitrator to sort out the situation.

What are P2P exchangers

Unlike online exchanges, where you buy bitcoins from a specific office, or crypto exchanges, where thousands of traders place orders simultaneously, in peer-to-peer services the transaction is concluded between two specific participants. The platform acts primarily as an information resource that allows sellers and buyers to find each other by posting their advertisement for a purchase or sale, so p2p services are a kind of crypto-Avito.

How is p2p different from MFOs and banks?

An online platform (for example, “City of Money”) brings together investors and borrowers. The second role is usually played by small businesses and individual entrepreneurs. Who for some reason cannot or do not want to take out a loan from a bank. But they will willingly take it from a private person.

The 2p2 lending service itself necessarily evaluates the borrower’s reliability. In this way, 2p2 exchanges are not much different from banks and microfinance organizations. However, not a single crowdlending site gives out YOUR money! The investor and the borrower sign the agreement directly with each other.

Oddly enough, the share of overdue payments on p2p sites is lower than in banks and microfinance organizations. According to the City of Money service, over five years the non-repayment rate was only 4.5% (for more than 25,000 borrowers).

The service deals with delays in two ways: it involves the company’s lawyers or turns to a collection agency for help.

Another difference between investments in p2p and investments in banks and microfinance organizations: here investors’ funds are not insured! The procedure for obtaining a loan stipulates that you give a loan to someone without any guarantees or coverage. Let me remind you that deposits in the bank in the amount of up to 1.4 million rubles are insured by the DIA. And investments in microfinance organizations can, if desired, be insured with separate insurance companies.

Of course, sites are trying to at least somehow protect investors from the risk of non-return. For example, the City of Money service offers lenders a guarantee product for 6% of the loan amount. If the borrower defaults, the platform will return the full amount of the debt to the investor. True, the guarantee only applies to loans up to 500,000 rubles.

And the last difference between investing in P2P is the amount of investment. The minimum investment in MFOs is 1.5 million rubles. A bank deposit can be opened for almost any amount (even 1000 rubles).

Theoretically, you can also invest 1000 rubles in “pitupi”. But only large amounts (from 100,000 rubles) can effectively diversify investments.

Rules for safe trading in p2p binance

The first thing an exchange cares about in relation to its traders is security. Therefore, when wondering how to make money on p2p binance, first of all you need to be careful and follow several rules:

- do not enter into transactions outside the platform;

- communicate with counterparties via the exchange chat;

- Having received the payment, make sure that the buyer’s data and the counterparty’s data match;

- do not transfer assets before actually receiving funds, do not succumb to pressure from the buyer insisting on speeding up the transaction, do not accept sent checks as confirmation of the transaction, be guided only by changes in the balance of your own account;

- Be sure to enable two-factor authentication 2FA.

If any user raises doubts, it is better to terminate the transaction with him. Finding a trusted trader is not difficult; it is much more difficult to return funds from scammers.

-loans

Specific conditions and methods for processing, receiving and repaying p2p loans are established by the platform.

For example, on the Fundico service you can “ask” for a loan of an amount from 100,000 to 2,000,000 rubles for a period of 1 to 12 months at an interest rate of 19.5% per annum. No property collateral is required. But for a legal entity, a guarantee from the business owner is required.

Each site uses its own borrower rating system. For example, the Loanberry service divides borrowers into four categories: A, B, C and D. To receive a D rating, it is enough to have a good credit history. In this case, the maximum loan size will be 150,000 rubles, and the interest rate will vary from 25% to 40% per annum.

Rating A allows you to get up to 500,000 rubles on Loanberry at 12 – 14.9% per annum. But in addition to a good credit history, the A-borrower must have confirmed income and a history of loans on the site.

Requirements for borrowers

Again, each P2P platform has its own requirements for borrowers. For example, the “City of Money” service first “breaks through” the company and its founders using open sources (enforcement proceedings databases, arbitrations, credit history bureaus and others). Then it analyzes the previous experience of the company's owners. After that, site employees study receipts and payments on current accounts to assess the solvency of the project.

Basic requirements for the borrower: the business has been operating for at least six months, annual revenue is not less than 1.5 million rubles, there are no current overdue loans.

Any platform will require you to provide key information about yourself, the loan and the business (loan term, purpose of the loan, age and profession of the borrower).

To conduct a more in-depth financial analysis, you will need financial and management reporting, data on the business, guarantors and collateral. Service specialists analyze the documents provided, and sometimes go to the place of business to evaluate it.

Interest and terms

Interest rates on p2p loans vary from 12 to 40% per annum. The price of borrowed funds depends on the borrower’s rating, the amount and term of the loan, as well as the availability of collateral (collateral, surety).

Important point! P2P loans are classified as short-term loan products. Most often, borrowed funds can be issued for a period from one month to one year. Sometimes sites “extend” the loan term to 2-3 years (for borrowers with a high rating). And it’s very rare to find “long” lending options (up to 5 years) on the market.

Most P2P services charge a commission both to the investor and a slightly larger commission to the borrower.

Borrower's responsibility

Each P2P platform has its own ways of collecting overdue payments from the debtor. After 30 days of delay, the Longbury service transfers the debt to collectors. The Penenza project collects debt through the courts (and the site already has positive judicial practice).

Documents for obtaining a p2p loan

To get a P2P loan, you will need a minimum package of documents. Most often, an individual is required only to have a passport and an individual entrepreneur certificate.

Everything else (credit history, real estate ownership) is checked by service employees using databases. Of course, more documents will be required from a legal entity. Including balance sheets and financial reports.

What can I get a p2p loan for?

On P2P lending platforms, borrowed funds can be obtained for the purchase, repair or renewal of equipment, real estate or vehicles. P2P loans are also issued to buy out shares in a business or replenish working capital. The Loanberry service even offers to apply for a loan to refinance other loans.

Getting a loan is much easier if the borrower agrees to provide liquid collateral. For example, purchasing real estate using the p2p lending system is possible provided that this or another real estate object is provided as collateral.

By the way, a potential investor does not see information on the site that allows him to identify the identity or place of business of the borrower. Investors have access to only general information about the business (type of business, its “age”, performance indicators, purpose of the loan, desired amount, term and rate, proposed collateral).

Most often, the approved loan amount is transferred by bank transfer to the borrower’s account. Much less often, other options are available as a method of issuing money (QIWI, WebMoney).

Is it possible to trade via p2p binance in the app?

The Binance mobile app has the same functionality as the main web version. In it you can both trade through a p2p platform and withdraw money from Binance, create advertisements, edit them, track offers, cryptocurrency rates and much more.

You can get to the P2P trading section through the menu located at the bottom of the screen.

There is no need to register again, you just need to log in by entering your username and password - your personal account is single.

Cryptocurrency trading is a very popular and profitable, but quite risky way to make money. Therefore, when making transactions, you should be careful, careful and be able to calculate all the risks in advance.

Major players in the Russian P2P lending market

The Russian p2p lending market is constantly changing. More recently, the Vdolg.ru service was considered one of the leaders. However, in fact, the site has not been fully operational since April 2016.

At the beginning of 2018, the following large sites operate in Russia:

- "City of Money"

- "Alpha Stream"

- Loanberry

- Fundico

- SimplyFi

I would like to draw your attention to one more project: SOFIN – an international fiat platform for P2P lending on the blockchain. Now the world of cryptocurrencies has its own credit project.

The main feature of the project: all actions on the site (replenishment of the borrower’s account by the lender, payment of commission to the service, generation of all documents) are saved on the platform in the form of a Blockchain transaction and are visible in the borrower’s personal account. For active participation, both participants in the transaction receive bonuses and rewards in internal electronic money (SOFIN tokens). In the future, these tokens can be transferred to other cryptocurrencies.

By the way, experts estimate the potential of the direct loan market in Russia at 4.3 billion rubles!

Binance p2p commissions

The Binance exchange takes a certain commission percentage when carrying out a P2P transaction. This is the amount that is deducted when converting fiat currency (traditional) to crypto. For the Taker user, the commission is 0%, since it is charged only to the Maker trader. Its size depends on the trading pair.

On average it is 0.1%, but there are exceptions. For example, when transferring euros to cryptocurrency, the commission is 0%, and for some types of fiat (for example, dollars) it is increased and amounts to 0.35%.

Why is P2P popular with businesses?

Due to the recent financial crisis, banks are gradually losing their positions in the business lending market. Firstly, banks are not always able to provide flexible conditions to entrepreneurs. Secondly, the cost of banking services is only growing every year. Well, and most importantly, banks fundamentally do not issue loans to businesses at the initial stage of development.

On such platforms, the investor himself chooses the company to finance. The borrower is scored according to EBRD standards for small businesses in developing economies. To get a p2p loan, a businessman sometimes doesn’t even need to provide collateral - it’s enough to find a reliable guarantor.

Easy to connect - easy to use

To use the solution, you should start by submitting an application for connection on the PayOnline website. At the time of registration, each site is assigned a personal manager who helps in all matters related to the preparation of documents, provides an API library and accompanies the resource through all steps, right up to making the first payment.

This allows you to connect easily and quickly - no longer than 15–20 days.

If you want to integrate card-to-card money transfers into the application, you can use two methods: integration of the payment form through the built-in browser and integration directly into the application.

In the first case, the user fills out the payment form and the 3-DS code entry form in the built-in browser (since the browser is built-in, the user does not have to leave the application to pay). In the second case, the payment form is integrated directly into the application, but you still have to enter the 3-DS code in the built-in browser.

As for the payment form interface, you can always order an individual design, so that the form in the built-in browser will fully comply with the application design concept.

It doesn’t matter what platform your website or mobile application is on and who you are - a legal entity, individual entrepreneur or individual. In any case, you can easily connect PayOnline, and your users will have the opportunity to quickly and safely make P2P transfers through the service or mobile application.

How to transfer money from p2p to spot wallet

To trade on a regular exchange, you need funds on your account balance. They can be transferred from a p2p wallet to a binance spot account.

The easiest way to withdraw tokens from a p2p account to binance is to do this when purchasing them by clicking on the appropriate button. If this was not done in time, the sequence of actions is as follows:

- Select the “P2P trading” tab on the main page.

- In the list of assets that opens, select the token that you want to transfer and click “Transfer”.

- In the upper right corner, select the “Spot Wallet” tab.

- Enter the transfer amount and click “Transfer”.