Greetings to enthusiastic readers.

Today we will talk about MSCI Russia. I'll tell you what the index is and who publishes it, why it's important to track it, and what strategies you can use to make money on it. I will provide current data on the composition and structure of the instrument, and also show a calculation methodology with which each investor will be able to roughly analyze future changes in MSCI Russia.

I will also explain when large-scale rebalancing occurs and where you need to look in order to react as quickly as possible to changing situations. This information will be extremely useful for anyone who trades in the stock market, be it long-term investors or active traders.

What is an index?

The MSCI Russia Index is a reflection of the general dynamics of a number of securities of Russian issuers that best fit the parameters established by the index provider.

Hurry up to take advantage of the doubling of the tax deduction until December 31, 2022.

The shares in it may be distributed unevenly, and the initial values are conventionally taken as 100%.

Cost and dynamics for all time

The MSCI Russia index, after appearing on the stock market, turned out to be very attractive for investors. He showed growth and gained popularity. The indicator recorded a historical maximum at 1649 points. The peak occurred in May 2008.

The global economic crisis of 2008 spoiled everything. Everyone remembers its depth and destructive power of impact. This could not but affect the MSCI Russia quotes. Immediately after its historic peak, the index collapsed at an unprecedented rate.

This was such a deep drawdown that the result was a historical low of 321 points in January 2009. It turns out that over the six months this asset lost 80.5%.

After the crisis, the index managed to recover from the shock and began to grow again. By April 2011, it reached the level of 1136 points, which is very good in this situation. However, a long decline followed, which lasted until 2016. Only in the spring of that year the index was able to return to a slight increase, which continues to this day.

ERUS quotes provided by TradingView

Which companies are included in the index?

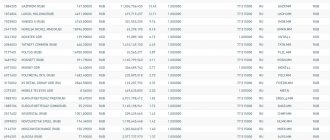

Here is the current composition of the list of companies included in MSCI Russia as of June 2022. Data taken from the provider’s official website: www.msci.com

| MSCI code | Issuer's name | Ticker | Weight, % |

| 1896804 | Sberbank of Russia | SBER | 19,32 |

| 1884205 | Gazprom | GAZP | 17,7 |

| 1874804 | Lukoil | LKOH | 15,27 |

| 3241302 | Novatek (GDR) | NVTK | 8,47 |

| 2056003 | Tatneft | TATN | 8,29 |

| 2491705 | MMC Norilsk Nickel | GMKN | 6,3 |

| 3481902 | Rosneft | ROSN | 3,53 |

| 6071002 | Magnet | MGNT | 2,4 |

| 1885703 | Surgutneftegaz (private) | SNGS_p | 2,03 |

| 2375301 | MTS (ADR) | MBT.N | 1,9 |

| 3170002 | X5 RETAIL GROUP (GDR) | FIVEDR | 1,8 |

| 6994201 | Alrosa | ALRS | 1,65 |

| 2517402 | Severstal | CHMF | 1,59 |

| 3099803 | NLMK | NLMK | 1,49 |

| 1885706 | Surgutneftegaz (common) | SNGS | 1,3 |

| 6971602 | Polymetal | POLY | 1,11 |

| 6187102 | Inter RAO | IRAO | 1,08 |

| 7177401 | Pole gold | PLZL | 1,05 |

| 3692203 | VTB | VTBR | 0,91 |

| 7143701 | Moscow Exchange | MOEX | 0,86 |

| 3692701 | MMK | MAGN | 0,73 |

| 6971101 | Phosagro | PHOR | 0,68 |

| 2788702 | TRANSNEFT PREF (RUB) | TRNF_p | 0,54 |

Index history

Currently, MSCI Russia indicators are calculated by the Morgan Stanley financial group. But 1968 can be considered the starting point for world benchmarks for different stock markets.

The first calculations of non-standard indices were carried out by the company Capital International; it published instruments under the names: Canada, Germany, French, Italy, Great Brittan, which corresponded to the calculation based on the dynamics of shares of large companies in these countries.

liked this idea and wanted to buy the rights to publish these instruments, but they were refused. Then the financial group decided to make its own analogue, which gained quite a lot of popularity among investors and analysts.

And then, in 1986, the two providers continued negotiations on a franchise for calculating indices, and Morgan Stanley managed to obtain the rights to all areas.

Later, in 2007, the rating agency MSCI, Inc. was spun off. from the general financial group and this structure independently carried out the placement of shares on the stock exchange.

The MSCI Russia direction is included in the so-called group of markets with developing economies (MSCI Emerging markets).

MSCI and its history

The MSCI index owes its appearance to the American company of the same name, Morgan Stanley Capital International (MSCI), an international agency that calculates the index of the same name and conducts in-depth market research. In addition to analytical research in the investment field, the company calculates and publishes its own indices, formed by analogy with the most famous Dow Jones or S&P 500.

However, the founder of MSCI was the Capital Group (USA). The index, which appeared in 1969, and the rights to it were sold in 1987 to Morgan Stanley. The purpose of the deal was the desire to draw attention to foreign markets and their opportunities, which for the company itself meant expanding international activity.

To prevent information leakage, the index was calculated in Geneva by Capital Group employees. Morgan Stanly took on the responsibility of introducing the index into the investment space. The merger between Morgan Stanly and Capital Group culminated in the formation of the joint venture MSCI Inc. in 1998.

The MSCI family currently covers 160 thousand indices used by market participants around the world. Based on the indicator, informed investment decisions are made with the formation of private and collective portfolios. Professional investors who base their actions on changes in the MSCI index include ETFs and hedge funds.

Types of index

In addition to the main MSCI Russia Standard index, there is another instrument called Russia 10/40. It is built on the basis of the basic Russia Standard, but with some additional conditions that allow it to comply with European investment management standards for funds.

Here's the thing: funds in the EU are prohibited from investing more than 10% of their total capital in the shares of one company, provided that, collectively, such securities do not occupy a share exceeding 40% of the fund's total assets. In other cases, the level of diversification should limit the issuer's weight in the fund's portfolio to 5%.

In this regard, MSCI Russia 10/40 reduces the shares of individual stocks, distributing their weights in proportions to 4.5 and 9%.

Cost and dynamics for all time

MSCI Russia reflects quotes of the largest Russian issuers, so its dynamics are very similar to the chart of our RTS index.

If you smooth out some volatility, you can see that since 2010, quotes have remained at the same levels. But you need to understand that the graph reflects the cost in dollars.

Let's sum it up

- Understanding how an index works allows an investor to improve stock selection in a portfolio.

- The development of the stock market in Russia, the entry of new issuers, and increased liquidity will allow the expansion of MSCI Russia. This will increase the flow of foreign investment and lead to higher valuations in our market.

- The nearest rebalancing promises the entry of TCS Group and, possibly, Mail.ru.

- The companies RUSAL, PIK, Rostelecom, AFK Sistema, Petropavlovsk, RusHydro and Rosseti have good prospects for inclusion in the index.

0

Author of the publication

offline 1 year

Index calculation method

The provider does not disclose specific conditions and calculation formulas for inclusion of issuers in MSCI Russia. However, there are some guidelines that can be used.

I would like to note right away that MSCI Russia can take into account both company shares and depositary receipts. The main criterion is that they can be freely purchased by foreign investors.

Other inclusion conditions include:

- The free float valuation should be above $1.5 billion.

- The share of free float is not less than 15% of capitalization.

- Market capitalization of at least $3 billion.

Let's talk about FIF and ATVR indicators

FIF, or foreign inclusion factor, is an assessment of free circulation. The way the FIF is assessed affects the weightings of companies in the index, as well as the possibility of inclusion in the index. Free float estimates from the Moscow Exchange and MSCI are usually different, but not significantly. New shares below 15% must meet the criterion: free float capitalization must be 1.8 times the minimum level of the standard segment index.

Annualized Traded Value Ratio is the ratio of stock turnover to market free float in annual terms. This coefficient can also be converted to an annual format from values of 3, 6, 9 months. The conditions for a stock to be included in the index are as follows:

- Liquidity must be equal to at least 15% of ATVR for 3 months and for a year

- Trading frequency is 80% of the time per year.

Pros and cons of the index

Among the advantages of MSCI Russia are:

- Diversification across the largest and most liquid stories on the Russian market.

- Effective accounting of issuers' shares.

- Dynamic rebalancing.

- An excellent indicator of the state of the Russian stock market.

- The main benchmark used by the world's largest funds.

I will name the disadvantages:

- There is no specific calculation formula, which makes forecasting difficult.

- Does not take into account any individual characteristics of companies from a fundamental point of view.

How and where to make money on the index

The most obvious way is to purchase structured products based on the MSCI Russia index.

You can use foreign instruments:

- ERUS;

- db x-trackers MSCI Russia Capped UCITS 1C;

- KIM KINDEX MSCI Russia Synth;

- iShares MSCI Russia Adr/Gdr UCITS.

Such an ETF is not yet available on the Russian market. However, Finex provides the opportunity to buy the RTS index through the “FinEx Russian RTS Equity UCITS ETF” instrument. This is practically an analogue of MSCI Russia.

But you can use other tactics. By analyzing the market dynamics of Russian stocks, you can try to predict which issuers will increase or decrease their weight on the MSCI Russia rebalancing, and based on this data, build a speculative trading strategy.

Warning

Expert opinion

Vladimir Silchenko

Private investor, stock market expert and author of the Capitalist blog

Ask a Question

You should only trade on real markets and through licensed brokers. Almost all binary options firms are fraudulent structures that play against their clients using various schemes for taking money. There is no need to trust your funds to just anyone in the hope of getting rich quick. This always leads to disastrous consequences!

Best brokers

Here you can see a list of reliable brokers with optimal conditions.

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

MSCI Russia Index: instructions for use

My article in INCOME about MSCI Russia.

Yandex, TCS Group, Mail.ru... who will be the next to join or leave the MSCI Russia index?

This article is devoted to the MSCI Russia index, which is calculated by the international analytical company MSCI Inc. MSCI Russia is a stock index of the Russian market, part of the MSCI Emerging Markets group of emerging market indices. The index includes securities of 23 Russian issuers. The weight of each issuer's shares in the index depends on the company's capitalization and the share of its shares in free float. The composition and structure of the index is reviewed quarterly.

Passive investing (through the purchase of index funds or independently building portfolios according to certain benchmarks) is taking up a larger and larger share of the stock market around the world every year, and Russia is no exception. Indeed, for many market participants, obtaining even the average market result over a long period is an unattainable goal, and by buying an index you solve this problem easily and cheaply (relative to active management).

Initially, index investing didn't have much impact on the market. But as usually happens, any process that gains popularity begins to have an impact on reality. The inclusion of a stock or increase in its weight in the index leads to an influx of investment in the company's securities, which inevitably pushes the company's quotes up as many investors use indices to determine the composition of their investment portfolios. Inclusion in the MSCI index guarantees higher liquidity for company shares. The retirement or reduction of a stock's share in the index provokes the opposite process. That is why it would be a good idea for a reasonable investor to study how certain securities are included in indices, how shares in indices are determined, and other issues.

We can mention an investment strategy based on the forecast for the inclusion of a stock in an index. It consists of purchasing a candidate for inclusion in the index or shares whose share may increase (in the event of an expected increase in the level of the FIF coefficient (foreign inclusion factor, in relation to Russia - this is actually a free float estimate)) several months before rebalancing. Yandex is a prime example of such a strategy!

Supernova explosion: Yandex NV

During the latest rebalancing of the MSCI Russia index (announced on August 12, 2022, came into force on August 31, 2022), a long-awaited historical event occurred - the inclusion of Yandex NV (YNDX) class A shares in the index. Yandex is the largest Russian company in the information technology industry.

The large free float of shares (according to the Moscow Exchange 97%, and MSCI - 95%) and the level of capitalization allowed the company to receive a 10% weight in the MSCI Russia index. In addition, Yandex shares entered the top 4 of the MSCI Russia 10/40 index with a weight of 9.44%, while removing Norilsk Nickel from the “list of heavyweights”, the weight of which decreased to 4.72% from 8.09%. True, after the cancellation of the deal with TKS, there is a risk that Yandex shares will fall out of the top 4 of the MSCI Russia index, and will give way back to Norilsk Nickel shares.

MSCI Russia 10/40 is a “child” index of MSCI Russia Standard. The distribution of weights in the MSCI Russia 10/40 index is important from the point of view of the assets of funds investing in Russia, since many of them are required to follow the UCITS III directives (restrictions for investment funds), which, in particular, prohibit the allocation of more than 10% assets in shares of one company. The MSCI 10/40 has four heavyweights with a weighting of 8-10%, followed by eight stocks of 4-5%.

The inclusion of Yandex shares in the MSCI Russia index can be compared with the historical increase in the weight of Gazprom (from 5.85% to 29.15%, now 13.6%) in the summer of 2006, then MSCI removed Gazprom ADRs with an insignificant FIF level from its indices and added Gazprom shares listed on the RTS.

Those who bet on the inclusion of Yandex securities in MSCI Russia made great money in 2022. Even the coronavirus did not stop the growth of shares. By the way, Yandex’s P/E 2020 valuation is now around 100!

Of course, mere inclusion in the index cannot be the only reason for the growth of shares, but in this case it does not matter what comes first - the chicken or the egg, growth in anticipation of inclusion in the index or growth, and then inclusion. In any case, the “index tailwind” plays on the investor’s side, not against it.

Index composition

Let's look at the current composition of the MSCI Russia index

When calculating the MSCI Russia index, quotes from the Moscow Exchange are used for almost all stocks, with the exception of GDR - Phosagro, Magnit and NOVATEK (LSE) and ADR MTS (NYSE). I note that Magnit’s GDRs in London are traded at a noticeable premium (+17%) to prices on the Moscow Exchange.

It can be assumed that in the future, the MSCI index committee will move to calculations based only on stock trading on its home market. The use of foreign quotes for settlements developed historically, when trading volumes in London and New York were significantly higher than in Moscow - the proportion was 80/20, now it has become the opposite - 20/80.

Market underdevelopment

The small number of issuers in the index and the huge concentration are immediately striking - only 23 and the first 6 shares account for 2/3 of the entire capitalization of the index.

The Russian stock market can be described as underdeveloped, even relative to other developing countries. For example, MSCI Taiwan has 87 tickers, MSCI India has 86, and even MSCI Thailand has 43.

Russia

India

Taiwan

Thailand

In some developed markets, the number of shares in the index may seem simply fantastic to us: MSCI Japan – 320, MSCI USA – 619, MSCI Germany – 63, MSCI United Kingdom and MSCI Canada 86 shares each.

Sectoral poverty

In addition to the small number of securities in the Russian index, we note low sectoral diversification. For comparison, I will give the sectoral structures of the MSCI indices: Russia, Brazil, Canada and Australia.

Russia

Brazil

Canada

Australia

There is a noticeable difference with developed countries - Canada and Australia, and even with developing Brazil. The “commodity” bias (Energy and Materials) prevails in the Russian index even among relatively “commodity” countries. Somehow, Canada, Australia and Brazil, unlike Russia, managed to overcome the commodity curse and diversify their economies.

The structure of the stock index is an excellent indicator of the development of both the country’s financial sector and the economy as a whole. Russia is a small market consisting of commodity monsters, and therefore it is subject to cyclicality.

How is the composition of the index determined?

To understand the algorithm for selecting stocks for the index, you should refer to the methodology - MSCI Global Investable Market Indexes Methodology , this file is updated monthly. In this document you will find all the answers.

The criteria for selecting stocks for the index are quite simple.

MSCI Russia is part of the MSCI Emerging Markets group of emerging market indices, and accordingly, a Russian stock, in addition to listing on the Moscow Exchange, must meet the following basic requirements to be included in the index:

1. Total market capitalization – at least 1.4 billion US dollars ;

2. Free float capitalization – at least 700 million US dollars ;

3. Liquidity of securities - ATVR (Annualized Traded Value Ratio, annual free float turnover ratio) above 15%.

The question immediately arises regarding the quantitative composition of MSCI Russia, why are there only 23 shares?

The answer lies in one more condition for the formation of MSCI country indexes: the index must cover 85% of the free float capitalization.

The MSCI index committee algorithm works as follows: firstly, the total capitalization and free float capitalization of all companies represented on the market are determined, and secondly, starting from the top of the list by the size of the total capitalization, a list of shares is determined that will be included in the index so that they the total share of the free float capitalization was equal to 85% of the free float capitalization of the entire market.

It turns out that the underdevelopment of our market - a small number of issuers and the presence of market monsters - leads to such a small number of securities in the index. The capitalization of free float MSCI Russia (as of October 22, 2022) is equal to 14.5 trillion rubles. ($189 billion), and the free float capitalization of the entire market is about 16.8-17.2 trillion rubles. ($219-225 billion), thereby the index covers about 85% of the market.

Essentially, the level of free float capitalization accepted by analysts, required to be included in the MSCI Russia index - $1.3-1.5 billion, is a consequence of the condition of covering 85% of the market, and in the future, may fall to the minimum value ($ 700 million) indicated in methodology. With positive development of the Russian market, the number of securities in the index will increase as new issuers appear (companies from foreign sites, new IPOs, privatization of state-owned companies).

FIF

FIF stands for foreign inclusion factor, in relation to Russian companies - free float assessment.

The question of determining FIF is very important, in fact, based on its value, the share in the index and the fact of being included in the index are ultimately determined. Comparing the free float estimates of the Moscow Exchange and MSCI (the table at the beginning of this article), you can see that they are often very close.

For new securities with FIF below 15%, there is a restriction: free float capitalization must be 1.8 times the threshold value for the standard index for the segment.

ATVR

ATVR (Annualized Traded Value Ratio) is the share turnover ratio relative to free float for 12 months or annualized data for 3, 6, 9 months.

Inclusion of a security in the index requires a minimum level of liquidity of 15% of the 3-month ATVR and a trading frequency of 80% of the time for the last 4 consecutive quarters, as well as 15% of the 12-month ATVR. Details of the ATVR calculation can be found in the methodology.

Index rebalancing and challengers

The next rebalancing of MSCI Russia will take place on December 1, 2020; information will appear on November 10, 2022.

Dates for upcoming rebalancings are until September 2022.

What to expect in the next rebalancing?

The most significant changes in the index that may occur in the near future include: the inclusion TCS Group Holding and Mail.ru Group in the MSCI Russia index , an increase in the weight of Polymetal due to a revision of the FIF level, as well as the possible exclusion of shares MMK from the index.

However, these four events have different probabilities of occurring in the November rebalancing. Let's start with the most likely event - the inclusion of TCS Group Holding's GDRs.

TCS Group Holding GDRs began trading on October 28, 2022 and meet all formal liquidity and capitalization requirements.

A significant part of the share capital of TCS Group is in free circulation: 53.1% of the holding is traded on the stock exchange. 40.4% belongs to Oleg Tinkov’s family trust, another 6.5% belongs to TCS top managers.

If MSCI assigns a FIF of 0.55 to the company's shares (rounding 53.1% to 55%), then they will enter the index with a weight of about 1.34%, which implies a mandatory inflow from index funds of ~11-13 billion rubles.

And as a result, the most likely rebalancing of the MSCI Russia index in November 2022 will look like this:

This is the baseline forecast.

The main donors for TCS Group securities will again be heavyweights: Sberbank, Gazprom and LUKoil. Most likely, MMK shares can remain in the index this time too, but more on that below.

The second contender, even with even greater weight, is GDR Mail.ru Group. However, a certain stopper for the MSCI index committee in including Mail.ru securities may be the short trading period on the Moscow Exchange; local listing occurred only on July 2, 2020.

MSCI usually doesn't like to rush, so Mail.ru Group GDRs are likely to be included in the MSCI Russia index in 2022.

If, after all, the index committee decides to include Mail.ru in November and estimates its FIF at 0.55, then the weight in the index at current quotes could be about 1.79%, which implies a mandatory inflow from index funds of ~18 billion rub.

Polymetal

On September 18, 2022, the East Alexander Nesis Group placed 19 million shares or 4% of capital through accelerated book building (ABB). This was Polymetal's fifth share placement in 2022 and the second in September amid favorable gold price conditions. In July, Otkritie Bank sold over 3% of Polymetal, after which it sold another 3.4% of shares in September. In May the shares were placed by an unknown seller, and in June by the Czech PPF.

In its latest presentation, Polymetal already announces a free float level of 75%

A revision of Polymetal's FIF level could lead to an increase in its share in the MSCI Russia index from 2.93% to 4.18%, which implies a mandatory inflow from index funds of ~RUB 10 billion.

However, neither the Moscow Exchange nor MSCI are in a hurry to revise the free float for Polymetal; now it is 50%. Knowing how slow MSCI can be, this change is likely to be expected only in 2022.

You can make an alternative forecast . If we add to the most probable event – the inclusion of TKS in the index – the less probable ones – the inclusion of Mail.ru and an increase in the share of Polymetal, then the rebalancing of the MSCI Russia index in November 2022 will look like this:

And now we come to the last issue related to the possible disposal of MMK shares. In both forecasts, both the base and the alternative, MMK remains part of the index, but remains questionable.

The fate of MMK is influenced by both the valuation of its shares and the quotes of other index and non-index securities. As mentioned above, the index should cover 85%, but there is room for a gap of plus/minus 5%.

The value of the free float capitalization of the entire market, which is obtained from MSCI, is unknown to us. According to our calculations, this value is $220-225 billion.

You need to sum it up in descending order of market capitalization, starting with the largest company. Companies continue to be counted until the total free float market capitalization reaches 85% of the free float capitalization of the entire market.

However, judging by the data from the methodology based on the example of Hungary, the limit can reach 90%.

You can see what we get for MMK under two scenarios for different levels of free float capitalization of the entire market ($220-225 billion).

The coverage does not reach 90%, which means that MMK will most likely remain. MMK is saved by the buffer zone. In addition, if we rank shares by the size of their total capitalization, this is stated in the methodology itself, then MMK is not at all last by this criterion (shares of Phosagro, the Moscow Exchange and preferred shares of Surgutneftegaz have a lower total capitalization).

However, the final decision will be up to the MSCI !

The exclusion of MMK from the index may lead to an outflow from index funds in the amount of ~4-5 billion rubles.

Who else might be included in the index in the future?

Applicants for inclusion in the MSCI Russia index in 2021-2023. You can name 7 more companies - RUSAL, PIK, Rostelecom, AFK Sistema, Petropavlovsk, RusHydro and Rosseti (+FSK UES and IDGC).

Almost all companies already meet the minimum requirements for the MSCI Emerging Markets indices, but cannot get into MSCI Russia due to the narrowness of the Russian market.

The development of our market, as well as the arrival of new issuers, will make it easier for new shares to be included in the index. Under current conditions, in order for them to be included in the index, they still need to grow by 30-50%.

conclusions

- A general understanding of index evolution can allow you to improve your stock selection approach (for example, you can increase the proportion of index-performing stocks in your portfolios).

- The development of the Russian stock market, the emergence of new stocks and increased liquidity in the medium term will lead to an expansion of the MSCI Russia index, which in turn will lead to an increase in foreign investment and will contribute to a better market valuation.

- The next rebalancing may lead to inclusion of TCS Group in the index and, less likely, Mail.ru. MMK shares, despite the high risks of exclusion, may remain.

- Possible consideration of the growth of the FIF indicator (foreign inclusion factor, in relation to Russia - this is actually an estimate of free float) for Polymetal could lead to an increase in its share in the index in the coming year.

- Promising from the point of view of inclusion in the index in 2021-2023: RUSAL, PIK, Rostelecom, AFK Sistema, Petropavlovsk, RusHydro and Rosseti (+FGC UES and IDGC).

Happy investment!

https://vk.com/shadrininvest

Interesting facts about the index

Many large foreign funds operating billions of dollars literally copy the MSCI Russia portfolio.

Therefore, astute investors always monitor possible changes in the index, because a change in the weight of the issuer can lead to a large inflow or outflow of capital from the trading instrument.

What affects the price

Since the MSCI Russia index is a reflection of our stock market, its value may be influenced by:

- General economic geopolitical factors (including possible sanctions).

- Change of composition and percentage of shares in the index.

- Indicators of individual companies that occupy a large weight in MSCI Russia.

- The balance of power among trends in Russia and the world.

- Other indices from the MSCI emerging markets family.

Forecast, analytics and prospects

Geopolitical factors that are difficult to predict can play a large role in determining the future dynamics of the MSCI Russia index.

If we look from the point of view of economic trends, the reduction in rates on the Russian market over the next few years will have a positive impact on the price of shares of issuers included in MSCI Russia.

Similar indexes

In addition to Russia, the emerging markets segment includes MSCI instruments calculated for other countries and regions.

| "Americas" | "Europe, Middle East & Africa" | "Asia" |

| Argentina | Egypt | India |

| Brazil | Greece | China |

| Chile | Hungary | Indonesia |

| Colombia | Poland | Korea |

| Mexico | Qatar | Malaysia |

| Peru | Saudi Arabia | Pakistan |

| South Africa | Philippines | |

| Türkiye | Taiwan | |

| United emirates | Thailand |

MSCI Emerging market - what is it?

MSCI Emerging markets (abbreviated as “EM”) is an index reflecting the global index of emerging markets (24 countries in total). The largest representatives are: Brazil, India, China, South Africa, Russia, Korea.

Based on the calculated value, you can understand the movements of investment money.

The Emerging market collectively includes companies with a total capitalization of 85% of the global stock market in developing countries.

Emerging market quotes are as follows: