Who will benefit from the resource?

More than a billion people use the company's services.

The information offered may be of interest in the following areas:

- Finance. There are more than twenty international banks and thousands of investor funds.

- Jurisprudence. These are schools, academies and associations.

- Accounting.

- Taxation.

- Scientific research.

The company offers numerous products to its subscribers. If we take the most popular ones, they will be: “Reuters 3000 Xtra”, “Reuters Dealing” and news feed.

Information and analytical terminal EIKON

The EIKON information and analytical terminal from Refinitiv (with integrated specialized add-ons) allows you to effectively solve the tasks associated with regular monitoring of the Russian and international financial and commodity markets, and also allows you to conduct a comprehensive analysis with the creation of data samples of various sizes and types across a wide set of criteria.

Eikon provides access to data, news and analytics across all asset classes, market sectors and countries, allowing you to discover new opportunities and make important decisions every day.

You can get acquainted with the basic functionality of the EIKON information and analytical terminal in the auditorium. 1077, according to the laboratory work schedule.

Main sections of the EIKON information and analytical terminal

QUOTES Eikon gives you access to quotes on over 1,500 currency pairs from 2,000 sources; equity market coverage exceeds 99% of global market capitalization; 1800 sources of quotes for the debt market and structured products.

NEWS Get the latest news and analysis from Reuters to help you make smart, informed decisions. More than 2,600 full-time journalists in 200 bureaus produce more than 1 million breaking news stories a year. Our columnists comment in detail on the events of the day and analyze market news.

FORECASTS With unprecedented breadth of coverage, the I/B/E/S database sets the standard for financial forecasting, providing detailed analyst estimates, consensus forecasts and aggregate data for 22,000 companies in 87 countries. You can also evaluate the historical performance of analyst recommendations using StarMine SmartEstimates analytical models.

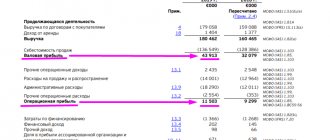

FINANCIAL REPORTING Eikon provides the most complete data on the financial results of companies with the ability to drill down and directly access sources. Company Views collects first-party data in 120 countries, covering 99% of global market capitalization - companies listed on 167 stock markets in 123 countries, 54,500 active and 22,500 inactive companies.

GRAPHICAL ANALYSIS A wide selection of graphical analysis tools allows you to quickly and effectively visualize data for decision making. Charts easily integrate with the search engine and other key terminal functions, quickly providing access to analytical tools.

Reference materials

Information about Refinitiv (ex. Thomson Reuters)

Refinitiv is one of the world's largest providers of data and infrastructure solutions for financial markets. Works with 40,000 institutions in more than 150 countries. Refinitiv provides data and insights, trading platforms, market data infrastructure solutions and open technology platforms that support and connect the global financial markets community. The company's technologies enable progress in areas such as trading, investment, private capital and corporate risk management, the fight against financial crime, regulation and market data management.

What do sections give?

The most popular section is the “Reuters Dealing” section. This is where many users enter into various deals and negotiate. The popularity of the platform lies in the fact that all actions there are carried out in real time. In addition, complete confidentiality is maintained, but at the same time access to leader quotes is provided.

Any difficulties?

Need teacher help?

We are always happy to help you!

master's theses

It is also gaining popularity in the CIS countries, although it has long been used in more than a hundred countries around the world, where users can use terminals in four thousand banks.

Terminals

Each has a news feed that highlights events happening in the world's major financial companies. You can also watch news on economics and politics. These are the main topics of interest to most users of the system.

Reuters 3000 Xtra terminals provide financial analysis. You can view past and current prices on global exchanges and over-the-counter markets. It is proposed to build charts and financial models on the basis.

Thomson Reuters stock exchange terminals will analyze conversations on social networks

Now the Thomson Reuters Eikon terminal, designed for traders, brokers and analysts, allows you to analyze the sentiment of the flow of messages on Twitter and StockTwits, a specialized social network used by traders and investors.

To the general public, Thomson Reuters is most likely better known as the news agency of the same name. However, news is only part of what she does. The agency was founded in the mid-nineteenth century to transmit stock exchange quotations. News was added later and was initially aimed at the same audience. A lot has changed over one and a half hundred years, but serving specialists working in the field of finance and stock trading still remains one of the main activities of Thomson Reuters.

The Eikon terminal, developed by Thomson Reuters, is a software product that actually represents a workstation for a trader or stock analyst. It allows you to quickly access news reports, financial analytics, stock prices, a variety of charts and other similar information.

Eikon interface.

Although a competing product that Bloomberg is working on introduced support for Twitter last year, it is noticeably behind Thomson Reuters's in terms of capabilities. Unlike the Bloomberg terminal, Eikon visualizes the flow of messages in the form of graphs of changes in the number of positive and negative messages on a topic of interest to the user. There is no need to re-read hundreds of tweets: one glance is enough to get an idea of what is happening.

It is widely believed that analyzing the sentiment of the text of messages published on Twitter helps predict how market events will develop in the near future. Computerra talked about this in the article “The Hidden Wealth of Twitter”:

A couple of years ago, specialists from the Technical University of Munich published a paper entitled “Tweets and Transactions: Information Content of Exchange Microblogs.” She described the results of a six-month experiment, during which 250 thousand posts published on stock exchange blogs were analyzed per day. Using sentiment analysis tools, the researchers categorized tweets into pessimistic and optimistic tweets and then calculated an “average sentiment.” It turned out that fluctuations in the Standard & Poor's 500 index, which reflects the capitalization of the five hundred largest American companies, repeat changes in sentiment on Twitter that were recorded the day before.

A similar study was published in 2010 by scientists from the universities of Manchester and Indiana, but they did not select exchange-related messages, but sifted through all tweets in a row. In addition, during the semantic analysis, they were not so much interested in the positive or negative sentiment of the tweet, but rather the feelings that it conveys. This approach turned out to be no less effective. The researchers were able to identify factors in the messages they analyzed that correctly predicted where the Dow Jones index would head a few days later in 87.6% of cases.

According to Thomson Reuters CTO Philip Britton, there is growing interest in behavioral finance, a discipline that studies the influence of social, cognitive and emotional factors on economic decisions. However, the use of it in practice was hampered by the volume of information that surpassed human capabilities, which traders would have to analyze. Automatic text sentiment analysis solves this problem at least partially.

Main products of the Reuters news agency

The main areas of its activities, which are expressed in the production of several types of products, allow you to get an idea of the work of the Reuters agency.

The entire range of Reuters services can be divided into information products used by the media and financial platforms.

Media products include such types of information delivery as news feeds with socio-political materials, photo and video reviews.

Other traders believe in the dominant and guiding force of the New York Stock Exchanges on Wall Street, which deliver their price values around the world.

Still other traders rely on the potential of the London Stock Exchange, which provides second-by-second quotes for traders on global investment platforms.

At one time, these centers with the largest exchanges and other trading platforms had influence in certain territories in delivering the cross-rate of financial assets.

Trading terminals for corporations (Bloomberg and Reuters)

What are trading terminals and why do companies need them? Why are Bloomberg and Thomson Reuters the most common financial transaction technology tools for corporations? How do trading terminals “insure” against risks associated with concluding financial transactions?

Why do we need trading platforms?

It is likely that many financiers and economists do not have in-depth knowledge of the world of trading and the procedures for making transactions in the market. However, for example, the responsibilities of corporate financiers and treasurers of large companies often include the conclusion of financial transactions. Such transactions are used, for example, as a tool in the process of hedging financial risks.

But despite the fact that modern IT infrastructure and products from companies such as Bloomberg and Reuters make it possible to effectively optimize this process (saving time and minimizing the likelihood of errors or abuse of authority), it is still quite common in many corporations, for example, to enter into forward contracts for the purchase/sale of currency or placing a deposit is carried out only by calls. This, firstly, is extremely inconvenient and time-consuming, and, secondly, it does not make it possible to simultaneously receive and compare partners’ offers. In addition, due to the lack of specialized technical tools, it is impossible to effectively record and store data both for internal and external control, and for subsequent financial accounting and analysis.

In this article we will try to expand your knowledge about such effective technical tools for concluding financial transactions for corporations as trading terminals .

Let us immediately note that the undoubted leaders among exchange instruments used by traders on the side of large players, such as banks, institutional investors and, of course, corporations, are special terminals from Bloomberg and Thomson Reuters (despite their “expensiveness” and the outright complexity of the interface) .

Recently, there have been attempts by companies such as Goldman Sachs (with its Symphony ) to oust these two titans from the stock exchange Olympus, but the functionality they offer is significantly inferior in variety and convenience to the above-mentioned recognized leaders.

Despite the fact that, for example, the same Bloomberg terminal is often criticized for its “outdated” and inconvenient interface, many traders actually consider it prestigious to master such an “old-school” terminal. This probably gives a feeling of belonging to some closed club of “professionals”.

In addition, Bloomberg owes its popularity to its built-in chat program for traders, where it is convenient not only to discuss the terms of transactions with counterparties, but also simply market news.

Reuters

The current name of the Thomson Reuters corporation appeared in 2007, when the media holding Thomson (Canada) entered into a deal to purchase the Reuters agency.

In more than a century and a half history, this was only the second reorganization involving a change of ownership (the first took place in 1941). Although, in fact, Reuters has always been listed as the official news agency of Great Britain.

A transition to a single owner is unlikely, and Reuters' organizational structure consists of numerous shareholders.

Nowadays, most people on the planet associate Reuters with an information and news agency, but initially Paul Reiter’s organization was created and operated to transmit stock quotes.

In Reuters, the news appeared much later and was intended for the same users from the stock exchange and financial sectors of the economy.

During the agency's existence, the volume of media transmissions has increased thousands of times. However, the priorities in transmitting information from exchange platforms around the world have still been preserved.

A significant expansion of the company occurred in 1984, when Reuters went public by listing its shares on the London Stock Exchange.

Entering the stock exchange allowed us to immediately attract about 56 million pounds sterling, which served as investments in our own development.

Considering that around this same time the company was the first to use computer technology for its own business, the dynamics of development of Reuters at the end of the last century exceeded all expectations.

In general, the company's innovation policy was of paramount importance to Reuters, which was manifested in its primacy in the use of radio, telegraph and the Internet for business.

All this led to an increase in the popularity of the agency and improved communication links throughout the world. Reuters shares are now included in the FTSE 100 index's calculated summary index at .