So what is hedging?

The word “hedging” means “insurance”. Currency risk hedging

are actions aimed at reducing the risk associated with exchange rate volatility. When a person decides to hedge, he essentially insures himself against possible losses.

However, one definition is not enough to understand the full meaning of the word “hedging”. Therefore, further we will consider this topic in more detail, we will talk about the tools, types, methods, strategies for hedging transactions on Forex, and also give examples.

Risk hedging: futures, forwards, options, swaps

Instruments for hedging currency risks or, as they are also called, derivative financial instruments (futures, forwards, options, swaps) help to hedge risks for those companies that enter into contracts in foreign currencies. Our company is one of them, since it is a participant in foreign economic activity. In order to eliminate the volatility of exchange rates in financial statements and receive predicted profits, we have entered the stock exchange more than once when concluding derivatives agreements with the bank. To optimize costs, we began to work directly with Moscow Exchange OJSC*.

| * The Moscow Exchange Group operates the only multifunctional exchange platform in Russia. The Group includes a central depository and a clearing center, which allows the Moscow Exchange to provide clients with a full cycle of trading and post-trading services. One of the founders of the exchange is the Central Bank of Russia. Areas of work: foreign exchange market and precious metals market; stock market and derivatives market. |

When playing on the stock exchange, it is important to know:

- How to account for currency risk hedging instruments in financial statements

- How to independently buy and sell currency on the exchange

- How transactions with derivative funds will affect taxation and accounting

- How should you interact with the exchange yourself?

- How to reduce costs using a broker

- How to improve your hedging methodology

Hedging instruments

The main hedging instruments are considered to be so-called financial derivatives, futures exchange contracts - options and futures.

- An option allows you to lock in the right to buy or sell a selected asset in the future at a predetermined price.

- Futures allow you to record an obligation to buy or sell a selected asset in the future at a predetermined price.

By the way, the hedging instruments we mentioned can be used both separately and together in various combinations and cases. There can be quite a lot of such combinations.

Example of hedging currency risks

Our company is a “daughter” of a foreign parent company, which through us supplies goods for euros to Russian counterparties. It is important for us to stipulate in contracts with counterparties the terms of payment in euros at the Central Bank exchange rate on the day of payment. Like our counterparties, we want to receive a fixed price in rubles. Thus, each party has a desire to see a clear and predictable financial result:

- the foreign parent company must receive the financial result in euros;

- we must get a financial result, both in rubles and euros;

- for a Russian counterparty, the financial result must be expressed in rubles.

Let's see how to implement this scheme using exchange tools:

- The foreign parent company enters into a contract with us in euros;

- We enter into an agreement with a Russian counterparty (price offer in rubles) and receive an advance payment of 20%;

- We contact the Moscow Exchange, credit 10% as collateral and fix the current rate, using the possibility of making transactions in the partial deposit mode;

- After receiving the remaining payment of 80% from the Russian counterparty, we credit 90% of the remaining amount to settle the transaction, cover insurance costs and receive euros at the fixing rate.

As a result, all participants in the transaction receive a predictable profit, which does not depend on currency fluctuations. I will consider how you can enter the stock exchange through a bank and on your own, thus hedging currency risks. Currency risk hedging is considered highly effective if its actual results are in the range of 80-125%.

An example of hedging funds in the foreign exchange market

The importing company waits for n-amount of time for the delivery of a consignment of goods from the United States for a certain amount in dollars. There are euros in the company account. To complete a transaction, the company needs to convert them into dollars at its bank. By opening a deal on a trading account, the company decides to hedge risks from a sudden rise in the dollar exchange rate. When using a leverage of 1:1000, you need to invest approximately 1% of the amount that needs to be insured. If the dollar begins to rise, then the company suffers losses due to high exchange rate fluctuations, but the resulting profit from the concluded transaction allows one to compensate for this loss.

Consequently, the value of the currency is fixed, and the amount of profit and loss will always be at zero. As a result, the company relieves itself of the stress that may be caused by unwanted exchange rate fluctuations and at the same time retains funds for other transactions.

Trading currency through a bank

Several years ago, only banks had access to the foreign exchange market. We collaborated with them according to the following scheme:

- We submitted an application to the bank for the purchase and sale of currency;

- A trader at a bank assessed exchange rates on the open market;

- The bank offered us a rate with its own hidden margin (some banks additionally withheld a commission for the conversion operation).

Next, it was necessary to take into account instruments for hedging currency risks in the financial statements. Since this is an important point, I’ll tell you about it in more detail. The Civil Code of the Russian Federation does not contain the concepts of industrial financial instruments, and the procedure for concluding such transactions is not defined. Accounting for instruments for hedging currency risks in International Financial Reporting is regulated by the standards IAS 39, IFRS 9, hedge accounting - IAS 39. The main rule is that derivatives must be revalued at fair value.

RAS rules do not define a special accounting scheme for hedging transactions. At the same time, the list of transactions not subject to VAT also includes transactions for the sale of derivatives instruments, including forwards, futures contracts and options. That is, it is advisable to reflect requirements/obligations on off-balance sheet accounts at the time of concluding such transactions. When disclosing information about derivatives in RAS reporting, the company’s accounting policy should establish for accounting purposes the procedure for determining the fair value of financial instruments of futures transactions (FISS).

I note that in accordance with Article 326 of the Tax Code of the Russian Federation, claims/obligations for FISS, both traded and not traded on the organized market, are not subject to current revaluation in connection with the change:

- market price;

- market quotation;

- exchange rate;

- interest rate values;

- stock indices;

- other indicators of the underlying asset.

The above article does not apply to risk hedging transactions (also see “Procedure for taxation of hedging transactions”).

Hedging - what is it: in simple words

In simple terms, hedging is an attempt to find balance. A transaction that may turn out to be unprofitable is covered by a transaction that, under the same conditions, will be profitable. That is, hedging is aimed at establishing equilibrium for a certain market instrument for a given period of time.

In skillful hands, hedging turns into a unique financial instrument that allows you to reduce risks in trading to a minimum, while gradually increasing profits. However, inexperienced traders need to hedge transactions very carefully, carefully, since incorrect actions can lead to losses.

Procedure for taxation of hedging transactions

Clause 5 of Article 301 of the Tax Code of the Russian Federation states that hedging operations are operations (a set of operations) with financial instruments of futures transactions (including different types), carried out in order to reduce (compensate) adverse consequences for the taxpayer (in whole or in part) , due to:

- occurrence of loss;

- lack of profit;

- decrease in revenue;

- reduction in the market value of property, including property rights (claims);

- an increase in the taxpayer's liabilities due to changes in the price, interest rate, exchange rate, including the exchange rate of foreign currency to the currency of the Russian Federation, or other indicator (set of indicators) of the hedged item(s).

In paragraph 5 of Art. 304 of the Tax Code of the Russian Federation provides that when carrying out hedging transactions, taking into account the requirements of clause 5 of Art. 301 of the Tax Code of the Russian Federation, expenses are taken into account when determining the tax base, when calculating it in accordance with the provisions of Art. 274 of the Tax Code of the Russian Federation takes into account income and expenses that are associated with the hedged item.

Independent entry to the stock exchange

Now, after changes have been made to the legislation, in addition to banks, brokers who are professional participants in the securities market can also trade on the stock exchange (also see “Rules of trading on the stock exchange”).

Hedging strategy

A hedging strategy is a set of specific hedging instruments and methods of their application in order to reduce financial risks.

It’s worth noting right away that if you want to get an effective, profitable strategy, you need to create it “for yourself,” taking into account your willingness to take risks, the amount of time you are willing to devote to trading, and other factors. There is simply no universal profitable system in nature: the same instrument in some hands can be very effective, while in others it will be useless.

Exchange trading rules

Rule 1. Transactions in foreign currency between residents are prohibited (Clause 22 of Part 1 of Article 9 No. 173-FZ of December 10, 2003 “On Currency Regulation and Currency Control”) The exception is transactions between “commission agents (agents, attorneys) and principals (principals, principals).” Commission agents must provide services related to the conclusion and execution of contracts, the obligations under which are subject to fulfillment based on the results of clearing (Federal Law “On Clearing and Clearing Activities”). As a result, commission agents must return money (other property) to the principals.

Rule 2. If contracts for the purchase and sale of foreign currency at organized trading are concluded with a central counterparty, which is an authorized bank, other (non-credit) legal entities may be allowed to participate in these organized trading (clause 3 of Article 16 No. 325-FZ dated 11/21/2011 “On organized auctions”).

Rule 3. The purchase and sale of foreign currency in the Russian Federation is carried out only through authorized banks (Clause 1.Article 11 No. 173-FZ of December 10, 2003 “On Currency Regulation and Currency Control”). The “National Clearing Center” is an authorized bank and central counterparty with which transactions are concluded, as well as a clearing organization that carries out clearing (7-FZ “On Clearing and Clearing Activities”).

Consequently, we can buy and sell currency independently, without a bank, using the services of a broker. The scheme is like this:

- We enter into an agreement with a broker (he must have a license), give instructions for a transaction with funds, transfer rubles to a special brokerage account;

- The broker records our application in the trading system of Moscow Exchange OJSC;

- The register and settlement of the transaction are transferred to the National Clearing Center, where rubles are reserved for the purchase of currency;

- The purchased currency is withdrawn from the trading system to a special currency brokerage account and then transferred to our account;

- Along with the money, we receive a broker's report (based on the exchange report).

How to reflect purchase and sale transactions in accounting and taxation

Since regular currency purchase and sale transactions are carried out in cooperation with a broker, this will not affect taxation. There is no need to notify the competent authorities about opening a brokerage account. In accounting, during conversion operations on the foreign exchange market, exchange rate differences will arise when compared with the rate of the Central Bank. Currency transactions are controlled by authorized banks (currency control agents), so you will need to submit to them:

- agreement with a broker;

- broker's report;

- certificate of currency transactions.

It is more profitable to cooperate with a broker than to trade on the stock exchange through a bank (also see “Additional opportunities of the foreign exchange market”). Let me give you a few reasons:

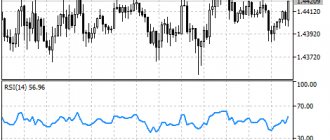

- The broker offers access to the trading program, that is, we see the movement of exchange rates in real time;

- Transactions are concluded at the market rate and through trading terminals from any point where there is Internet access;

- The gap between the purchase rate and the sale rate is the smallest; the exchange commission for purchase and sale is 0.0015% of the transaction amount;

- Broker commission on average is 0.015% of turnover per day.

There will be additional costs, for example, for withdrawal of rubles and foreign currency, subscription fee for the trading terminal, etc. But these are small amounts. They must be clarified with a specific broker.