The digital economy and cryptocurrencies are undergoing a period of transformation and some confrontation with financial and government institutions despite the acceptance by the majority of the numerous benefits of cryptocurrencies. This dual situation is associated primarily with the desire to regulate financial flows and counteract illegal activities, just like the desire of some states to replenish the budget through taxes.

- Private companies are looking towards digital assets

- BTC (Bitcoin) Analysis

- Bitcoin is up more than 26%

- Expert opinions on the Bitcoin price in 2022

- Stripe and El Salvador support Bitcoin

- The first Bitcoin ETF and the possibility of asset correction

- Ethereum (ETH)

- Maintaining the level of $3000 and the road to $5000 per Ether

- XRP (Ripple)

- Long way - $2 for Ripple

- Since 2022, the price of Ripple has risen by 150%

- XLM (Stellar)

- Issuing assets on the Stellar blockchain

- When to buy XLM?

- Other Altcoins

Private companies are looking towards digital assets

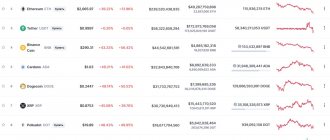

The cryptocurrency market is experiencing an increase in volumes, numerous private companies and investors are looking towards digital assets, multiple ETFs are applying for registration, and micro-credit companies are being founded to invest in cryptocurrencies.

MicroStrategy's investment in the main cryptocurrency amounts to more than $15 million (with an average price of ~$57,000 per Bitcoin).

The Open Interest Rate for Bitcoin futures is also growing on the largest US exchange – CME. This is due to the upward trend and the expectation of its continuation and speculation of traders who opened short positions.

This article provides price analysis and forecast for cryptocurrencies for 2022. The most promising cryptocurrencies BTC(Bitcoin), ETH(Ethereum), XRP(Ripple), and XLM(Stellar) are considered.

#Forecasts about the cryptocurrency market

Forecasts of opinion leaders and analysts about the price of Bitcoin, industry development and other events in the digital economy.

President of El Salvador: Bitcoin price will reach $100,000 in 2022

President of El Salvador Nayib Bukele expressed confidence that in 2022 the price of the first cryptocurrency will rise to $100,000.

Alex Kondratyuk 7294 01/02/2022

Integration with metaverses on the way to the concentration camp and other forecasts for cryptocurrencies for 2022

ForkLog spoke with experts about the main trends in the cryptocurrency market that are worth following in 2022.

Lena Jess 10998 01/02/2022

Opinion: to continue the Bitcoin rally, new market growth drivers are needed

Regulatory clarity and an influx of institutional capital are needed for the cryptocurrency market to continue to grow, and 2022 “promises to be an interesting year for the industry.”

Alex Kondratyuk 3374 12/21/2021

Anthony Scaramucci: Bitcoin will trade at $500,000

Bitcoin will “easily” reach a price of $500,000. This forecast was given by SkyBridge Capital founder Anthony Scaramucci on CNBC, citing the limited issue of the first cryptocurrency and the potential number of wealthy investors in it.

Roman Petrov 13240 11/15/2021

Experts estimate the timing and probability of Bitcoin reaching $100,000

ForkLog asked experts to predict the further dynamics of the price development of the first cryptocurrency and indicate the factors on which it will depend.

Lena Jess 23765 10/22/2021

Standard Chartered: Ethereum will be several times higher than Bitcoin in terms of price growth

Standard Chartered analysts were positive about the future prospects of Bitcoin and Ethereum. The latter, according to their estimates, could rise to $35,000.

Alex Kondratyuk 7715 09/07/2021

The expert named the upper limit for the current growth of Bitcoin

Until the Bitcoin network is updated, expected in November 2022, rapid growth in digital gold should not be expected, says Yuri Mazur, head of data analysis at CEX.IO Broker.

Lena Jess 43520 09/03/2021

The expert justified the likelihood of Bitcoin falling to $25,000

A fall in the price of Bitcoin downwards from a protracted consolidation looks like the most likely scenario, said EXANTE lead strategist Janis Kivkulis.

Lena Jess 9012 07/19/2021

The trader allowed the price of Bitcoin to collapse to $23,600

Nikita Semov, a practicing trader and founder of the Crypto Mentors project, talks about the current situation on the market.

Guest materials 8135 07/13/2021

Survey: Wall Street expects Bitcoin below $30,000 by end of year

44% of participants in a CNBC survey of institutional investment managers believe that Bitcoin will close 2022 with a price below $30,000.

Roman Petrov 7307 07/03/2021

Max Kaiser predicted Bitcoin's rise to $220,000

TV presenter and founder of Heisenberg Capital Max Kaiser expects the price of Bitcoin to rise by 500% to reach $220,000 in the second half of 2022.

Artem Galunov 7652 05/31/2021

The expert named the reasons for Bitcoin's growth to a new high

The main reason for the growth of the Bitcoin rate to $63,000 was the growing demand from institutional investors, says Yuri Mazur, head of the data analysis department at CEX.IO Broker.

Lena Jess 17418 04/13/2021

Opinion: Ethereum price can reach $10,000 by the end of the year

In 2022, Ethereum may surpass Bitcoin in profitability, and the price of the coin may rise to $10,000. This forecast was given by the famous crypto trader and host of The Wolf Of All Streets podcast Scott Melker.

Roman Petrov 26103 04/11/2021

Kraken Report: Bitcoin Could Hit $90,000, Ethereum Could Hit $15,000

Kraken exchange analysts allowed Bitcoin to rise to $90,000, and Ethereum to $15,000.

Alex Kondratyuk 21665 04/10/2021

Experts assessed the prospects for the altcoin season

The short-term correction has ended in the cryptocurrency market and is now set for growth again. ForkLog found out from experts whether it is possible to talk about the onset of the altseason, which assets look the most promising and how they will affect the price of Bitcoin.

Lena Jess 36551 04/09/2021

Experts pointed to the uncertainty of the future of XRP, despite the growth of the asset

On April 6, the price of the XRP token exceeded the $1 mark. ForkLog learned from experts how long the current growth of the token will be and what local maximums it can reach in the near future.

Lena Jess 19255 04/06/2021

JPMorgan adjusted forecast for Bitcoin price to $130,000

JPMorgan bank specialists called the long-term target for the price of the first cryptocurrency $130,000, lowering the bar due to the fall in gold prices.

Roman Petrov 18903 04/02/2021

Guggenheim Partners confirmed forecast for Bitcoin growth to $400,000

Guggenheim Partners Investment Director Scott Minerd confirmed his forecast for Bitcoin to reach $400,000. He also expressed concerns about the short-term prospects of the cryptocurrency market.

ForkLog 12649 01/15/2021

Pantera Capital CEO: Bitcoin will reach $115,000 in eight months

The price of Bitcoin will rise to $115,000 by August 2022, Dan Morehead, CEO of cryptocurrency hedge fund Pantera Capital, confirmed his forecast. Blockworks reports.

ForkLog 11476 01/14/2021

Bakkt analysts predicted growth of the cryptocurrency market to $3 trillion

The cryptocurrency market could grow to $3 trillion by 2025. This forecast was given by analysts of the Bakkt platform in a presentation for investors.

Alex Kondratyuk 4547 01/12/2021

JPMorgan predicted Bitcoin at $146,000

Investment bank JPMorgan has named a theoretical long-term target for the price of Bitcoin at $146,000. Experts believe that the image of an alternative to gold will make the first cryptocurrency even more popular.

ForkLog 12195 01/05/2021

Total regulation and correction of Bitcoin: experts gave forecasts for 2022

ForkLog talked to experts about what awaits the cryptocurrency market in 2022.

Lena Jess 40567 01/02/2021

Experts call Bitcoin correction “healthy” and necessary before rising to $86,000

Bitcoin needs a correction after breaking through key resistance levels. The market is still far from “euphoria,” which could push the price of the cryptocurrency to $86,000 next year. These findings are contained in a report from Stack Funds.

Alex Kondratyuk 24635 11/28/2020

PlanB: Bitcoin will undoubtedly reach $100,000–$288,000 by December 2022

Popular blogger PlanB confirmed that he remains true to his forecast that the price of the first cryptocurrency will rise to $100,000–$288,000 by December 2022. He found further evidence in favor of a reduction in coin supply, which is consistent with the Stock-to-Flow (S2F) model on which his expectations are based.

Roman Petrov 27586 11/10/2020

Winklevoss brothers: $500,000 for one Bitcoin is only a matter of time

The founders of the Gemini cryptocurrency exchange, the Winklevoss brothers, confirmed their previous forecast, saying that sooner or later Bitcoin will cost $500,000.

ForkLog 15595 10/24/2020

Researcher: Bitcoin will not fall below $11,000 with 90% probability

Cane Island Alternative Advisors manager Timothy Peterson is convinced that the price of Bitcoin with a 90% probability will not fall below $11,000.

Alex Kondratyuk 12675 10/12/2020

The Winklevoss brothers predicted Bitcoin at $500,000

The founders of Winklevoss Capital and the Gemini bitcoin exchange, Tyler and Cameron Winklevoss, believe that the price of Bitcoin can exceed the $500 thousand mark. They believe that Bitcoin is superior to gold, oil and the US dollar as a store of value and is the only long-term hedge against inflation.

ForkLog 19336 08/28/2020

Kraken predicted Bitcoin will grow by 200% in the coming months

Analysts at the Kraken cryptocurrency exchange expect the price of Bitcoin to rise by 50-200% in the coming months. This is stated in the company's latest report.

ForkLog 7096 08/13/2020

Max Kaiser predicted Bitcoin's rise to $28,000

Well-known Bitcoin enthusiast and TV presenter Max Kaiser expects the price of the first cryptocurrency to soon rise to $28,000.

Roman Petrov 14351 08/02/2020

John McAfee was reminded of his promise to eat his penis

Twitter users reminded John McAfee of his promise, made exactly three years ago, to eat his penis on television if the price of Bitcoin did not reach $500,000. The entrepreneur responded in his own style.

Roman Petrov 28523 07/18/2020

Weiss Ratings predicted Bitcoin's growth to $70,000 in 2021

Analysts at research company Weiss Crypto Ratings predicted a Bitcoin rally to $70,000 by the middle of next year. This is indicated by the Stock-to-Flow (S2F) model.

Alex Kondratyuk 5863 07/10/2020

Opinion: Bitcoin will reach $397,000 by 2030

Over the next ten years, an increase in the price of Bitcoin to $397,000 looks quite realistic, according to the authors of the Crypto Research Report.

ForkLog 5776 06/29/2020

Willy Woo: Bitcoin rally was disrupted due to COVID-19, but a new breakthrough is ahead

Well-known analyst Willy Wu called the COVID-19 pandemic a “white swan” for Bitcoin, disrupting preparations for a new rally of the first cryptocurrency.

ForkLog 3964 06/29/2020

Bloomberg analyst: Bitcoin is ripe for a breakout to $13,000

Bloomberg Intelligence chief commodities strategist Mike McGlone expects the price of the first cryptocurrency to soon surge towards the resistance level at $13,000.

Roman Petrov 7934 06/26/2020

More materials

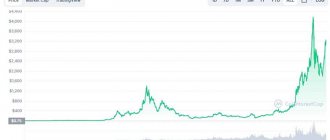

Bitcoin is up more than 26%

By mid-October 2022, Bitcoin was up more than 26%, despite falling about 7% in the previous month. September is historically a month of correction, which has been repeated for several years now.

Staying away from the first major support level in the $42,000 - $43,000 zone, which was broken early in October, Bitcoin rose to a one-week high and traded at $56,450 on Sunday, October 10th. The subsequent decline was associated with investors who bought the cryptocurrency at a higher rate from August to September, who wanted to lock in profits, Glassnode believes.

Despite a pullback to levels below $55,000 per Bitcoin, trading closed above the second major resistance level.

Bitcoin managed to gain a foothold above the support level at $54,900. The rise in price was not preceded by consolidation, which some expected around $49,500. The uptrend continued after testing the exponential moving average (50 EMA) on the four-hour chart. Resistance around the 0.236 Fibonacci retracement level ($56,454), which acted as the immediate target of upside momentum, was broken by the bulls. After this, the asset managed to set a new local maximum at $58.548. The last time Bitcoin traded at this level was in May 2022. Since October 17, Bitcoin has been trying to gain a foothold in the area of the previously established local maximum – $62,000-$63,000. Trading activity decreases when prices rise, which increases the likelihood of a rollback. A couple more attempts to exit upward from the trading channel are expected and then it will roll back to the support level at $61,450, after consolidating above which the bulls will again go on an active offensive, contributing to the movement to the area of $63,500 and above.

Polygon

Bennett recalled that last week the Polygon token broke through a powerful resistance level, which was located around $2.7. Also according to the analyst, the altcoin tested this level as a strong support. In the near future, Polygon may rise in price to $4.5 (an increase of 60% from current levels), the trader predicted.

On December 27, Polygon updated its all-time high above $2.9. In 24 hours, the price of the altcoin increased by more than 7%, and its capitalization increased to $19.7 billion, according to CoinGecko. At 10:10 Moscow time, the cryptocurrency is trading at $2.8.

Polygon is an Ethereum-compatible second-level sidechain that operates using the PoS (Proof-of-Stake) algorithm. It has faster speeds and lower fees than the Ethereum main network.

Expert opinions on the Bitcoin price in 2022

Most opinions regarding the BTC price in 2022 are positive. This is not surprising; the asset has good consolidation indicators, and over the past weeks it has shown stable growth. Many respected figures in the global market, such as James Patrick Gorman, Lawrence Fink, as well as other analysts and market players, recognize the value of Bitcoin and other cryptocurrencies as assets and means of payment. Also, a large number of so-called “whales”, for example, hodlers, continue to purchase Bitcoin. About 150,000 BTC were purchased at the end of September and beginning of October alone.

Stripe and El Salvador support Bitcoin

The prospects for Bitcoin are also hinted at by its recognition as a full-fledged means of payment in El Salvador, where Bitcoin ATMs were even installed in September. In addition, Twitter has launched functionality for transferring tips within the platform to Bitcoin.

Good news was the announcement of the payment system Stripe about integrating Bitcoin into its service, although three years earlier the company’s management decided to abandon cryptocurrencies.

Stripe experimented with introducing cryptocurrency into its service back in 2014. However, having refused to use Bitcoin and other cryptocurrencies in his service, Stripe President John Collison expressed his confidence in the effectiveness of cryptocurrencies as a means of payment.

One of America's largest banks, Bankcorp Inc., has announced plans to launch custodial services for fund managers. The combination of such conditions encourages payment companies to use cryptocurrencies in their services, because this allows you to reach more users. This trend will only intensify in the near future.

The first Bitcoin ETF and the possibility of asset correction

A slight correction is expected in the first half of 2022 for BTC. The possibility of such a correction is due to the desire of traders to take profits and the SEC's approval of the first Bitcoin ETF, as was the case in 2022, when the release of Bitcoin futures on the CME exchange was announced. The main support levels in the event of an asset collapse are 55200, 51000, 49500 and 47300. If these levels do not hold, then we will face a decline to $42200, $31500–$31200. Next, we can consider the levels of September 2022.

Especially for you, we have prepared a table of predicted BTC levels and its profitability:

Maintaining the level of $3000 and the road to $5000 per Ether

The fall below $3,000 again opens up the prospect that the intermediate, broader $2,700-$3,300 range will be tested at the lower end. Looking at the dynamics of the chart at the moment, it seems that this will not require too much effort. However, as we know, there is significant bullish interest in preventing this from happening.

There is a cyclical retest of the resistance level at $4100-4500, which may be broken and soon we will see ETH at $4900, as Tom Lee from Fundstrat says. His assumption is based on the increasing volumes of the DeFi industry, which functions thanks to Ethereum.

Many analysts predicted that ETH would rise after major upgrades accompanied by coin burns (updates called Berlin and London). Since these updates reduce the growth rate of the supply of Ethereum tokens, provided that demand increases, their price will increase. These assumptions can be considered justified, looking at the weekly chart of the asset in the ETH/USD and ETH/USDT pairs, despite the retest of the support levels of the $2900-2700 zone.

XRP (Ripple)

Launched in 2012, the project called Ripple (formerly XRP Ledger) has weathered many storms in the crypto market. It is worth noting that the project is open source and is based on distributed registry technology.

What makes XRP different is its distributed ledger and consensus process. The XRP currency does not use the PoW algorithm (i.e. does not require mining), consensus, in turn, does not require multiple confirmations for the immutability of transactions. These advantages make it faster and more efficient than some other cryptocurrencies.

Ripple executives say the project embodies a legacy and values based on economic justice and opportunity for all through research, education and philanthropy.

Long way - $2 for Ripple

From the point of view of technical analysis, the historical path of the XRP cryptocurrency seems quite interesting. XRP initially entered the cryptocurrency market at a modest $0.0058 per coin and remained in this zone for several months. Later, news came out that the Ripple network had merged with Tokyo-Mitsubishi Bank in 2022, which strengthened the position of the asset.

From the end of December 2022 to March 2022, XRP grew steadily, but then the main players such as BTC (Bitcoin), ETH (Ethereum) and LTC (Litecoin) and other cryptocurrencies that took a strong place in the market dropped it to less than half a cent per one coin. The decline continued until 2022, even levels such as 14 cents per coin were met. An important, and perhaps even the main role in this decline was played by the claims of the US Securities and Exchange Commission and the trial, which greatly shook the confidence of investors.

If we look at the price movement of XRP during this period, the currency was trading at a market value of $0.25, with a market capitalization of $9,206,907,569 in January 2022. Ripple later showed slight momentum. The XRP price has reached its resistance levels above $0.25.

DASH

DASH

To analyze DASH, we started as usual with the latest news and the media write only about the DOGE DASH project, a type of game for making money, which starts on December 15th. But it was released on the Binance Smart Chain network and has nothing to do with the DASH cryptocurrency, which you asked about. But on the Twitter itself of the real DASH, we saw activity, which is very good, but we did not find any important events due to which it would be worth waiting for the growth of the coin.

You often ask for this coin and we really hope that your interest is caused by the fact that you bought it at the bottom somewhere at the end of 2022 and throughout 2022 and even 2022 and are definitely not expecting a miracle, because you entered at the peaks of the previous cycle .

DASH Chart

Look, today DASH is 1,000% lower than its all-time high and at the local peak this year the price was still 250% lower than in December 2022.

DASH Chart

We understand that many will not like this, but there are many altcoins on the market now, for which we very much doubt that the highs of the previous cycle will be rewritten, and DASH is one of them. Because it hasn't become a store of value like Bitcoin, and it hasn't become a payment network. At the peak of 2022, the number of transactions on the network per day hovered around 30,000, but is now around 11,000.

DASH Transaction Chart

Also on the bad side, the coin reacted poorly to the recovery of the crypto market, which began in August. The latest correction in Bitcoin actually nullified all growth and we are in a downward trend.

Chart DASH chart

Some positive outlook on DASH, in our understanding, is possible if the price goes above the downward trend, approximately $230. But we don’t yet see how to achieve such growth, only together with the market following Bitcoin. And we must warn you that if Bitcoin now chooses a bearish scenario, then DASH will fall below $100.

Since 2022, the price of Ripple has risen by 150%

Since the beginning of March 2022, the price of Ripple has increased by almost 150% of its starting price - to around $0.7. However, the asset did not maintain the level and began a sharp decline. By the end of December 2022, its price fell to $0.17.

However, since June 2022, XRP has recovered in value and is now trading between $1.2 and $0.9 per coin, demonstrating stability in terms of price, market capitalization and market sentiment.

Ripple has received support from some major investment firms.

A number of cryptocurrency firms also want to cooperate with Ripple. This shows us that many are positive about XRP's prospects. According to recent forecasts and price movements, XRP could gain significant momentum by the end of the year.

Now the zone 1.07-1.01 $ serves as confident support. There is an increase in sales with a retest of the lower border of this support zone. The last major purchases were about a week ago, which indicates that the support level is confidently maintained. RSI is at the level of 51-52, which indicates the possibility of entering a transaction if the asset fixes above the level of $1.59-1.61. Further, when the bullish trend strengthens, we will storm the strong resistance level in the $1.96 zone.

USA hits cryptocurrency: what's happening to Bitcoin

If October 2022 was held in the cryptocurrency market under the motto “buy on expectations,” then November, at least its first half, passed under the continuation of the October motto – “sell on facts.” Anton Bykov, senior analyst at Esperio, provided details in a conversation with .

In October, Bitcoin grew by almost 40%, from 43.8 to 62.4 thousand dollars, and since the beginning of November, the main cryptocurrency not only has not grown, but as of November 18, it is losing 5%, trading below 60 thousand dollars per month. coin, putting moderate pressure on the capitalization of the entire cryptocurrency market. Since November 1, 2021, it has decreased by only 0.7% - from $2.644 trillion to $2.624 trillion.

November was not very lucky in terms of significant events for the cryptocurrency market. Investors were eagerly awaiting the launch of the first-ever Bitcoin futures ETF on the New York Stock Exchange (NYSE). The start took place on October 19, and since then we have seen a slow slide in the quotes of the main cryptocurrency with periodic surges.

Tinkoff Bank, Lit. No. 2673

Tinkoff Black (with secure card delivery) up to 7.00% on balance, Cashback

Tinkoff Bank, Lit. No. 2673

Apply for a card

Bankiros.ru

The strongest of them occurred on November 8-10, when markets were awaiting very important statistics on inflation in the United States, on which investors' understanding of the speed of the Fed's winding down of the $105 billion per month bond purchase program depended.

Crypto investors were hoping for a moderate increase in inflation in October, which, on the one hand, would support “crypto” as an anti-inflationary tool, and on the other, would not push the American financial regulator to take more stringent actions, because cryptocurrencies, like other risky assets, are extremely vulnerable to rising interest rates rates.

Hopes were not justified, inflation in the United States jumped from 5.4% per annum immediately to 6.2%, the highest level in 31 years, which, in the understanding of investors, left no alternative for the Fed other than to accelerate the winding down of incentives from $15 billion per month to higher value.

On the November horizon, no other major events for cryptocurrencies were expected to “warm up” the market. Naturally, the participants, cryptocurrency traders, who a few days before the publication of these statistics, on November 10, bribed Bitcoin, hoping for its anti-inflationary rise, were forced to close positions. Bitcoin on November 10, during the release of statistics for the United States, set a historical high, rising to 69 thousand dollars and began to fall.

Raiffeisenbank, Lit. No. 3292

Debit card “Cashback” up to 4.00% on balance, Cashback

Raiffeisenbank, Lit. No. 3292

Apply for a card

Bankiros.ru

Later, there was other bad news for cryptocurrencies, such as promises from the Chinese authorities to increase electricity tariffs for enterprises that violate the bans and participate in cryptocurrency mining. Or the law passed in the United States on November 16, according to which all cryptocurrency brokers and operators will be required to report transactions worth more than $10 thousand to the US Internal Revenue Service, which has called into question the anonymity of crypto investors.

But still, the main thing in the current decline in cryptocurrency rates was the inflationary blow to the gut, which brought down the growth rate and demonstrated the weakness of the cryptocurrency market in the context of a tougher Fed policy. In other circumstances, with an absolutely clear information background, which will be typical for the cryptocurrency market in the coming weeks, one could talk about high chances of Bitcoin recovery and even its growth to new historical highs of 70.0 -75.0 thousand dollars per coin by the first days of December 2022.

Renaissance Credit Bank, Lit. No. 3354

Debit card "Main" up to 7.00% on balance, Cashback

Renaissance Credit Bank, Lit. No. 3354

Apply for a card

Issuing assets on the Stellar blockchain

The Stellar blockchain allows anyone to issue new assets on the network and exchange them for other assets. Assets on Stellar are issued and purchased by “anchors”, which are trusted entities. Anchors allow real assets to be exchanged for Stellar using a distributed exchange that maintains an order book. Stellar supports the issuance of any type of asset, including stocks, digital currencies, and more.

Having reached a minimum in September 2022 at $0.2601 per coin, the asset changed its trend on the weekly chart and is now represented by three candles with good volumes, but shadows on top.

Comparing exponential moving averages, XLM coin is trading below the 100 day EMA and 200 day EMA, critical EMAs, indicating a continued bearish trend. However, with the current price movement, the coin has returned to the level of the 50 day EMA line.

MATIC

Should I invest in MATIC

Second place went to Polygon, aka MATIC, and it’s clear why so many people asked about it, because it is one of the few altcoins that shows strength in the current market no worse than Ethereum.

Let's start with an interesting pattern: the previous high for MATIC was set on May 18, when Bitcoin was looking for its bottom after a panic sell-off.

MATIC chart

Today we have a similar situation with Bitcoin and what MATIC is doing is that it is again near the maximum and is preparing to update it. Also why we named this coin the same as Ethereum because we look at the weekly chart and we see.

MATIC chart

We have an upward trend that has persisted since February of this year, at the close of the weekly candle we can update the high very soon, the RSI has not yet reached the overbought zone, and the MACD is again on the bullish side.

Thus, we must take our words back and say that Polygon is not like Ethereum, it really looks even stronger and if we pass the last resistance in the form of updating the maximum price, then there will be no restrictions higher, and the coin will begin its movement to the TOP -10 cryptocurrencies.

The Polygon ecosystem continues to develop, so they allocated a grant of $500,000 to provide liquidity in the new DEX exchange. The altcoin is of interest to large players; yesterday two large wallets bought tokens worth over $2 million at once.

Well, some news from the project itself, they are holding new conferences, attracting developers and building their own ZKVerse.

As for the price here and now, if Bitcoin starts to recover, we will expect an increase according to Polygon to $3:

Polygon Forecast

And the negative scenario, if Bitcoin decides to start a “crypto winter”, then we’ll see if Polygon will maintain the upward trend, if so, perhaps we will still have an interesting altseason in this coin. Otherwise, you will have to return to the coin and make a forecast based on the situation at that time.

Subscribe to the CoinPost channel to quickly receive the latest cryptocurrency news

When to buy XLM?

The RSI indicator is at 53, which indicates a slight strengthening of buyers. From a technical point of view, XLM has shown a significant drop in its value and the trend cannot be clearly defined at the moment. There are opportunities for cryptocurrency growth, since the formation on the chart is very similar to the double bottom pattern. As soon as a price breakout ($0.43) is noticed in the neck zone of this pattern, certain entry points into trades can be considered. Longer-term targets for XLM will be the $1.20 and $1.53 zones, respectively.

Other Altcoins

After the SafePal project announced an airdrop, together with DreamQuestNFT, the cost of SFP increased by 130% (to the dollar). The integration of Visor Finance with the Futureswap platform caused VISR to grow by 35% (to the dollar). The listing of the Opulous project on the MEXC exchange led to an increase in the price of OPUL by 20% (to the dollar).

The total capitalization of the cryptocurrency market increased by 4.85%, Bitcoin dominance increased by 0.6%.

Analytics company Coin Metrics, in one of its reviews of non-fungible tokens (NFTs), stated that today they make up ~16% of total daily activity on the Ethereum network, although at the beginning of the year they were only ~1%.

*The information in this article does not constitute financial advice, a recommendation, or an inducement to purchase any asset.

The expert explained which cryptocurrencies can bring super profits

MOSCOW, May 29 — PRIME. This week it became known that a number of crypto investors received record income: their amounts amounted to approximately 3000-7000%. This was due to the fact that several altcoins simultaneously showed explosive growth in quotes. At the same time, Bitcoin is still unable to recover from the enormous collapse that occurred this spring. Life spoke with reference to its experts about which altcoins can bring big profits to their owners, which ones are not worth buying, and how to identify dummy coins.

Analysts told how to buy cryptocurrency cheaply in parts

Let us recall that just recently the crypto community was rocked by the news that a user of the Poloniex crypto exchange sold his Kishu Inu coins for 60 times more than the market price. From this he instantly earned 15 thousand dollars. Thus, the profit was 6000%. Earlier, Ethereum increased in price by 30% in a day. Similar fluctuations plagued a number of other cryptocurrencies. Economists say that it is precisely because of this situation that interest in altcoins began to grow, but they warn that there are more and more risks in the crypto market, although the potential for making super profits is also great.

CRYPTOCURRENCIES THAT ARE DANGEROUS TO BUY NOW

The most popular resources among cryptocurrency market traders, CoinGecko and CoinMarketCap, provide data on 7535 and 10081 assets. Only an extremely small part of them are destined to survive. The vast majority of these coins do not have serious funding, a team of professional developers, or a community of users. There is also no need to talk about the implementation of the main stages of the roadmap to create a product that is in demand by the market and the tokenomics around it.

The head of the investment department of the ICB Fund, Aaron Chomsky, is confident that “only those projects that meet the above criteria will survive. And those investors who did not conduct proper analysis before purchasing an asset may face a complete loss of money. From the point of view of the financial market there will be nothing new in this. The composition of stock indices is constantly changing, companies go bankrupt and become targets for takeovers due to changes in the balance of competitive forces and the structure of the economy itself. The same can be expected in the cryptocurrency market, which reflects its distant digital future.”

He believes that today it is safer to rely on leaders - those projects that have great ambitions and who actually strive to bring them to life. The analyst does not recommend chasing tokens that are actively discussed on social networks. The most striking example is Dogecoin and its clones.

“Even despite the hopes of Elon Musk, who expresses his love for this coin on Twitter and says that in the future Dogecoin will become the “people’s coin” for payments, in reality there are not very many prerequisites for this, and the price of the coin may reflect a much larger bubble than all previously known similar episodes in history. “Nationwide love” and the popularity of this or that meme are transitory things. Over a longer period, economic laws will lead to a collapse in the price of this token if in the future it continues to represent an asset created as a joke without real useful functions,” Chomsky explained.

The CEO of the cryptocurrency p2p platform Chatex, Michael Ross-Johnson, in turn, believes that it is now quite dangerous to buy all the “top” cryptocurrencies that are on everyone’s lips. In his opinion, the market is clearly overheated. This means that the volatility of such assets will be very high, making it extremely difficult to predict the exchange rate. “Moreover, recent events in the market (when Elon Musk causes Bitcoin to sharply decline or rise by publishing certain news) have shown how much one person can control the market by creating a news background,” added Michael Ross-Johnson.

The expert explained why the practical value of Ethereum is higher than Bitcoin

CRYPTOCURRENCIES THAT CAN BRING SUPER PROFIT

According to Chomsky, Bitcoin will not disappear in the future due to its limited issue (21 million coins). It is already perceived as a digital analogue of gold in the context of unprecedented incentives from the world's leading central banks, undermining confidence in traditional currencies. Current quotes on financial markets reflect unprecedented optimism. This raises fears of a deep correction, and Bitcoin is perceived as an asset in which it will be possible to calmly survive it.

“Recovery to records after a decline can also be expected in Ethereum, which can become the “fabric” of the future digital economy built on the blockchain. At the end of this year - in the first half of next year, it will undergo a transition from the current Proof-of-work consensus algorithm to Proof-of-stake, which, together with the deployment of second-level solutions, will increase the Network throughput to values 3.5 times higher than the current ones payment system capabilities. Ethereum has developed a strong ecosystem of applications, developers, and community. In the context of the current exorbitantly high fees of Ethereum, many so-called Ethereum killers are trying to challenge its leading position - Cardano, Avalanche, Solana and others,” says Chomsky.

The analyst predicts that high interest and demand awaits Polkadot and Cosmos, aimed at interaction between blockchains. In his opinion, coins that build a decentralized Internet have good prospects. These are Internet Computer and Filecoin. There is a future for individual tokens that play a certain important role in a particular segment. Among them are Polygon, Chainlink, Uniswap.

CEO and CEO of the vvCube consulting group Vadim Tkachenko says that “the cryptocurrency market is a high-risk market, and we need to understand this. Any investment here must imply that both upswings of this currency and a complete collapse can occur. As recent events have shown, the value of a particular type of cryptocurrency can depend on news, one word from a popular person, or just a joke. Therefore, here you need to first of all understand why a digital coin is needed. This is not the best asset for investment. And for urgent settlements on the Internet with the seller (maximum one or two days), it can be a completely working tool. Of course, the most successful are Bitcoin and Ethereum. Others, such as Litecoin or Monero, require careful consideration before investing in them.”

Experts also pay attention to one very important point. On January 1, a law came into force that prohibits paying for goods and services with cryptocurrency in Russia. There are many restrictions in other countries as well. Accordingly, the free circulation of altcoins as a means of payment is questionable in many countries. There may also be difficulties here.

“In the near future, it is definitely not the most promoted and popular currencies that are in high demand (like Dogecoin) that have room for growth. While Elon Musk is playing with “dogs” on Twitter, infrastructure projects of new blockchains like Polkadot, Atom, Free TON are developing their projects and communities, which means that we will soon see the growth of these coins. It’s also worth taking a closer look at DeFi projects, but you need to study each one and not get involved in the hype that grows on tweets,” Ross-Johnson believes.

Elon Musk revealed the secret of his interest in Dogecoin

HOW TO DISTINGUISH A PROMISING ALTCOIN FROM A Dummy COIN?

According to Chomsky, it is important to avoid assets outside the top 30, not to rush into a purchase before conducting a comprehensive analysis, read relevant resources, improve your educational level, and follow project news on social networks. It is better to focus on long-term investments, not resort to leverage, and be psychologically prepared for increased volatility.

For example, from a historical high in April, Bitcoin fell in price by half within seven weeks, and other assets - even more. Moreover, this does not at all exclude their return to the levels they left during this year.

— There is no need to chase little-known tokens that allow you to make so-called X’s - to increase the volume of initial investments several times over. There is a high probability of becoming a participant in a “pump and dump” scheme. This is a sharp acceleration of quotes followed by their collapse,” Chomsky explained.