Sberbank Investments

Today's investment sphere in Russia is significantly different from what it was before. If, for example, 10-20 years ago, ordinary citizens almost did not trade exchange-traded assets due to the complicated procedure for opening a brokerage account and the need to deal with complex software, now these obstacles have been eliminated.

Most brokers are trying to expand the circle of their clients by simplifying access to investment instruments. One of those who do this best is Sberbank Investments. The secret to the success of this service is that it offers citizens the opportunity to open a brokerage account online, trade through a convenient mobile application with a friendly interface, and high-quality support with investment ideas and analytics.

In this article we will look in detail at the process of registering with Sberbank Investments, depositing and withdrawing funds, tariffs for using the service and, of course, the nuances of earning money with its help.

- What is Sberbank Investments

- Registration with Sberbank Investments

- How Sberbank Investments works

- Tariffs Sberbank Investments

- Depositing and withdrawing funds from Sberbank Investments

- Reviews about Sberbank Investments

About the broker "Sberbank Investor"

When choosing a company, it is recommended to focus on rating indicators.

The company is a division of the most reliable and largest Russian bank. The broker developed gradually, improved its services, and worked on software products. Sberbank occupies a leading position in the Moscow Exchange ranking in terms of the number of registered clients. In terms of the volume of active users, the broker is on the 6th line. When considering trade turnover, Sberbank does not come into first place. The broker often receives prestigious awards. For example, for 2017-2018. the company received the following titles:

- the best investment bank from Global finance;

- innovative company according to Banker;

- the best investment broker in the derivatives market.

Sberbank offers the following financial services:

- opening individual and brokerage accounts;

- margin trading;

- providing funds for independently concluding transactions;

- purchasing and exchanging currency;

- transaction support;

- accepting money for trust management;

- educational programs;

- depository services.

How to close an account?

It is easy to close a brokerage account with Sberbank at any time. A client of an institution can call the support service and ask for a specialist or come to a bank branch and submit a corresponding application. To deactivate an account through your personal account, follow the link “Closing a deposit” in the “Deposits and Accounts” section. In the window, fill out the application form, click on the button and enter the confirmation code from SMS.

Sberbank broker has firmly occupied its segment in Russian brokerage. Despite criticism of the bank’s high commissions from traders, its stable reputation and many years of experience in the market testify to the reliability of the trading agent, and reviews of the Sberbank broker among traders are contradictory, but predominantly positive.

And a few more reviews from broker clients

1. Olesya Veter : Sber has recently begun to develop. Recently a new server for Quik appeared. They started sending me detailed SMS about dividends coming into my account, I have been waiting for this feature for a long time, I am very happy with it. It’s not in vain that I pay them my commission))). Even more or less sane information has appeared about a deposit in your personal account in Sberbank Online (although the company still has some work to do). Finally, they are sending completely readable broker reports in PDF format, which is also a big plus for me personally. In general, well done, keep it up guys, I hope they will confidently move further in the same direction)). If only they had finished the mobile version of Kwik well and they definitely wouldn’t have had a price).

2. Timofey Martynov : I’ll share my experience of how I tried to open an account with Sberbank. So I came to the largest branch of the mountains. Pushkin told them: I want to open a brokerage account and IIS. So the boy consultant at the entrance looked at me strangely, as if this was the first question on this topic in the history of his personal career. Well, the beautiful young girl who rolled out of Sberbank-Premier told me that she unfortunately had everything booked out for today, gave her her business card and offered to call me and make an appointment by phone. Thus, I left with absolutely no open account...

3. Dmitry : I opened my IIS a long time ago on Sberbank. I've been using it for over a year now. I like it a lot more than Alpha.

Among the minuses, I can highlight: - huge tariffs (I make purchases for IIS for retirement no more than once every 1 quarter). — The St. Petersburg Exchange is completely inaccessible and will not be available, unfortunately. — as for me, it takes a long time to deposit/withdraw money. When transferring more than 100k. rubles, a follow-up call is required (although this may be + but it is completely inconvenient).

On the plus side, of course they are trying to develop, but it seems to me that it is very slow.

+ tariffs for ETFs have been removed. + options for trading have become available only recently (and only for the next 6 months). + made a good integration of a brokerage account into Sberbank Online (of course it’s still a demo and still a little crooked, but already something). If you have your own reviews, write them in the comments below, we will be happy to receive them!

Investment instruments

Clients with any income will be able to find suitable offers.

The broker helps to conclude transactions using the following types of assets:

- Russian and foreign securities;

- derivatives market assets (options and futures);

- structured instruments (ETFs, mutual funds);

- Eurobonds;

- currencies;

- federal loan bonds for the population.

Criterion No. 4. Mobile app

Both brokers have apps. With their help, you can do everything: replenish your account, withdraw money, select securities, buy and sell them. Both applications have a test that will help you decide on suitable investment products. It can be completed in a few minutes, and the application will immediately generate recommendations based on the answers.

Tinkoff Investments

Rating on PlayMarket and AppStore: 4.8.

What services are there in the application:

- What to buy - a selection of current investment instruments.

- Investor calendar - allows you to track events in the economy that affect or theoretically may affect the value of shares.

- Forecasts - bank analysts review the situation and make calculations on the current state of the market, as a result they offer a list of securities that could potentially generate income.

- Social network “Pulse” - you can read news about economics and finance and communicate with other investors.

In the application you can view analytics on your assets.

Sberbank Investor

Rating on PlayMarket and AppStore: 2.7 and 3.4.

Sber also has a mobile application for customer service, through which you can open a brokerage account. Technical support usually responds quickly. You can set up to receive dividends and coupons both to your brokerage account and to your card.

In the Sberbank Investor application you can find out the recommendations of analysts and choose where to invest

Exchange rate and purchase of currency through the broker "Sberbank Investor"

This information must be studied before performing each operation. You can see the exchange rate:

- Through "Personal Account". The information is located in the same tab where assets are purchased and sold. The rate may change during the application process.

- On the website sberbank.ru. To view rates, go to the “Currency calculator” section. At the top of the page are quotes. Below are graphs of price changes. The site provides more favorable exchange conditions than a bank branch.

A convenient tool with visual indicators.

The exchange rate is determined by the exchange positions of the pairs. During the day it can change in any direction. The bank concludes transactions in its favor: the sale price is always higher than the purchase price.

What is Sberbank Investments

Broker Sberbank Investments

Sberbank Investments

is a brokerage division for retail clients, part of the corporate and investment company Sberbank SIB, which in turn is a subsidiary of the largest state-owned bank in the Russian Federation (Sberbank).

This service allows ordinary Russian citizens to conduct transactions for the purchase and sale of bonds, shares, futures, currencies, ETFs and other assets traded on the Moscow Exchange (there is no access to the securities markets of foreign companies). The service was launched in August 2018 as a functionality built into Sberbank Online.

☝️

Subsequently, it was separated into a separate instrument, implemented in the form of the Sberbank Investor mobile application.

Also, clients of this brokerage service can use the web or PC version of the Quik terminal for trading. Professional trading platforms such as MetaTrader are not supported.

Users of the Sberbank Investor application have the opportunity to activate demo mode for 30 days

to familiarize yourself with its functionality and gain skills in conducting transactions with exchange assets using virtual funds, without risking losing your real savings. This brokerage service also provides leveraged trading, that is, using borrowed funds.

Sberbank Investments is considered one of the most reliable brokers in the Russian Federation and this status is fully confirmed by statistics on the number of clients - today more than 1.5 million people are registered in this service. A little more than 1 million of them opened individual investment accounts (IIA). As of April 2022, about 160 thousand Sberbank Investments users are active.

You can download the Sberbank Investor application on GooglePlay

Benefits of cooperation

Working with a broker has the following positive aspects:

- Easy to open an account. You can perform all actions through Sberbank Online. To gain access, you must enter into a card service agreement.

- Free terminals for trading. Experienced brokers use the QUIK program, which they install on their PC. There is also an online version of the site, which is launched through a browser. A convenient option for smartphone users is the Sberbank Investor program. Simple instructions help a beginner quickly understand how to use the main functions. Installation is easy; just download the program from the App Store or Play Market. When you first log in, use your account number and create a password.

- Easy to replenish your account. You can deposit rubles through Sberbank Online. When using currency, you will have to visit a bank office in person. Through the application, money is credited using the “Other Payments” section, the “Brokerage Services” item.

- Withdrawing money online from your phone without commission. Applications are submitted through the brokerage application. It is enough to indicate the required amount and the details of the account to which the funds will be transferred.

- No commission for low activity. Brokerage account fees have recently been waived. There are also no fees for additional services.

- Possibility of opening an individual account. The action is performed in the same way as when creating a broker balance. The procedure for purchasing currency and commissions will be the same. There is no need to top up your individual account immediately after opening. The balance may be zero until the first transactions are made.

- Reliability of the company. There is no insurance program for money held in a brokerage account. Therefore, you need to cooperate with trusted companies. There are no reliability criteria, but there is no need to doubt the reputation of Sberbank.

- Developed network of bank branches. Brokerage services are not provided in all offices, but you can top up or cash out your account at any branch.

- Possibility of free use of the Sberbank Premier package if there is a sufficient amount for this in the brokerage account. For residents of the capital, the minimum balance is 2.5 million rubles, for the regions - 1.5 million.

The application allows you to fully control the work process.

How to withdraw money from a brokerage account

Before withdrawing money from an IIS, you need to study in detail the conditions for such an operation.

Firstly, when withdrawing funds, the individual investment account is automatically closed.

Secondly, if the withdrawal transaction is completed before the expiration of 3 years (from the date of opening the account), then the investor will not be able to take advantage of tax benefits. If he has already received them, he will have to return them. So, the procedure for withdrawing money from an IIS in the Sberbank application is as follows:

- You need to go to the Sber Investor application and select the “Other” tab.

- On the page that opens, select the “Translations and Conclusions” tab.

- Next, you need to click on the “Withdraw” button, enter the code from the SMS in the appropriate field and click “Continue”.

- The system will generate an order to withdraw money. Here you need to enter the amount and click on the “Send” button.

After completing all the steps, a message will appear on the screen indicating that the order was successfully sent. Within a few hours the money will be credited to your account.

What are the restrictions on purchasing and exchanging currency?

To start working with a broker, you need to have an account with the bank in question. Commissions and restrictions depend on the selected tariff plan: “Independent” or “Investment”. In the first case, there is a single commission for transactions on the exchange of 0.3%. When using the “Independent” tariff with a turnover of less than 50 thousand rubles. 0.16% is written off. If the transaction amount is 50-500 thousand rubles, the commission is reduced to 0.12%. At high speeds this parameter will be even lower.

Users of the “Investment” tariff pay higher commissions for the opportunity to view analytical reviews and economic news. Commissions for purchasing assets on the derivatives market are 0.5 rubles. for opening, 10 rubles. for self-closing.

Is it worth opening an account for trading on the stock exchange with Sberbank for individuals?

A significant advantage of Sberbank is the ability to carry out most registration procedures and operations online: concluding an agreement, registering a bidder, creating an account. When a trader opens a personal account, to access the interface on the official website, you need to download and install specialized software for interacting with a broker: the Sberbank Investor application or the QUIK trading platform. Versions available for iOS and Android X.

The threshold for starting trading is relatively low: the minimum deposit is from 1 thousand rubles. Additional convenience - many options for withdrawing earned funds: to a card or to a bank deposit through any of the popular payment systems, including Internet banking, mobile applications, Kwik terminals and voice orders.

Among the advantages of working with Sberbank are comprehensive analytical and statistical reports provided by the broker. This allows the investor to quickly monitor changes in the market situation and adjust the trading strategy in time.

The opportunities for investment enterprises are wide: Sberbank allows private investors to choose an attractive market segment themselves. Investments in securities are available on the stock market: bonds, shares, depository receipts. The currency exchange offers to play on the dynamics and differences in rates of financial pairs. The specificity of the derivatives market is trading in futures and binary options.

Thus, thanks to the experience gained over the years, Sberbank as a broker provides its clients with a whole range of services.

Pros and Limitations

The positive aspects of purchasing currency with the help of Sberbank include:

- moderate commissions (from 0.02%);

- depositing and withdrawing funds without additional payments;

- remote execution of all operations;

- currency exchange at the most favorable rates.

The main limitation is the need to purchase assets in fairly large lots, for example $1,000. This means that you can invest only if you have a capital of 80 thousand rubles.

Tariffs Sberbank Investments

Tariffs in Sberbank Investments

The cost and content of brokerage services in Sberbank Investments depends on the client’s choice of one of the following tariffs:

- Investment

- assumes the presence of a mailing list with trading ideas from service analysts and access to financial reviews of the Sberbank research division. Commission deductions for transactions with assets of the Moscow Exchange stock market for any amount will be 0.3%, on foreign exchange - 0.2%, on over-the-counter (OTC) - 0.1% (for sales) and 1.5% (for purchases) ; - Independent

- there is no client support in terms of providing analytics, investment ideas and access to financial reviews. The commission on the stock market will vary from 0.018% to 0.06% depending on the trading volume, on the foreign exchange market - from 0.02% to 0.2%, on the OTC - from 0.17% to 1.5%.

☝️

By the way, only qualified investors can access the above-mentioned portal with financial reviews. Therefore, if you do not have this status, there is no point in choosing the “Investment” tariff either.

If applications are submitted not through the Sberbank Investor application, but by telephone, a commission of 150 rubles will be charged for each order (starting from the 21st for a month).

More details about the nuances of Sberbank Investments tariffs can be found in the corresponding section on the bank’s website.

Purchasing currency in the Sberbank Investor application

The procedure includes several stages:

- opening an account;

- crediting money to the balance;

- submitting an application to purchase currency.

Depositing money and topping up your account will not be difficult, thanks to the user-friendly interface.

Opening a brokerage account

This action is performed like this:

- Go to the “Other” section of the “Sberbank Online” application. Select the desired markets: stock (for purchasing securities, mutual funds, ETFs), futures (for working with options) or foreign exchange (for purchasing options and futures). It is recommended to check the boxes next to all fields.

- Choose a tariff. It is recommended to use the “Independent” option with more favorable terms of service.

- Enter account details for withdrawing money. It is recommended to apply for a savings card.

- They prohibit the use of assets for overnight transactions (they refuse to provide a loan to the bank). The risk in case of permission increases, but the investment will bring an additional 2% per year.

- Refuse to use leverage by unchecking the corresponding item. The use of borrowed funds often leads to the loss of the deposit.

- Open an individual account or refuse to perform this action.

- Check the correctness of the entered data. Indicate the purpose of the invoice. Press the “Submit Application” button. Enter the code received via SMS.

The bank opens an account within 2 days, you can start trading in another 1 day.

Refill

This operation can be carried out through online banking or a mobile application. In the first case, perform the following steps:

- Log in to the system using a computer. At the top of the window find the “Other” section. Select the item “Brokerage services”.

- Enter the contract number and click on the “Top up balance” link.

- In the line “Trading system” indicate “Forex market”. Enter the payment amount and the card from which the money will be debited. Funds are credited within 5 minutes. This period increases to 24 hours when sending an application after 23:40.

Through the mobile application, the account is topped up as follows:

- Log in to your “Personal Account”. Open the “Pensions and Investments” tab.

- Click on the account name. Select the account to which the money will be credited. Click the “Top up” button.

- Enter the amount and debit account details. Choose a trading system. If this item is filled out incorrectly, the money may go to another account.

It's easy to top up your account through the regular app.

Submitting an order to purchase currency

The procedure is performed like this:

- Download and install the SB Investor program. Log in to the system by entering the brokerage agreement number and the password issued by the bank.

- At the bottom of the page find the “Market” section, the “Currency” item. Select a pair and click on it.

- Study quote charts and economic news. Click the “Buy” button.

- Enter the password received via SMS to gain access to trading operations. Indicate the number of lots and price. Click “Buy” again.

How Sberbank Investments works

How to make money with Sberbank Investments

The easiest way to work with the service is through the Sberbank Investor application. How Sberbank Investments works:

- Open the application and go to the “Market” tab.

- Decide on the category of market assets.

- Open one of the available assets or trading pairs.

- Place an order to buy or sell an asset.

- Confirm the transaction using SMS password.

Now let's look at interaction with the service through the Sberbank Investor application in more detail. The first thing you need to do is install it on your smartphone by scanning the QR code suitable for your operating system on the Sberbank website.

After launching the application, you need to log in to your account using the login and password received via SMS after completing the procedure for creating a brokerage account.

By default, the “My Accounts” tab is loaded, which displays information on the balance of funds and the total value of the user’s investment portfolio, as well as its change in percentage and in the current application currency.

Just below there is a detailed list of open transactions, where you can monitor their profitability in real time. Also on this tab in the upper left corner there is a button for changing the currency in one click, in which all financial data in the application is displayed.

My Accounts and Other tabs in the Sberbank Investor application

Before moving directly to transactions through Sberbank Investments, it is worth visiting the “Other” application tab. In addition to security settings and withdrawal functionality, it contains a FAQ (frequently asked questions) section that will help a beginner understand all the nuances of working with the Sberbank Investor application. Also here, if necessary, you can ask for help via online support chat.

☝️

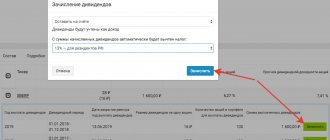

Trading ideas from Sberbank analysts are presented on the “Ideas” tab, and they are sorted by risk level - high, low and moderate.

In addition to the name of each of them, the expected return as a percentage is displayed. To view the contents of any idea, you just need to click on one of them. You can go to purchase the recommended asset directly from the page with its description using the “Invest” button.

Trading ideas in Sberbank Investor

The main section of the application that will most often be used by active investors is called “Market”. This displays a list of all assets available for trading, divided into the categories “Shares”, “Bonds”, “Funds” and “Currency”.

For each item, the current price is displayed here, as well as the change in the exchange rate per day in percentage and in currency. Using the sort button (top left of the word “Market”) you can sort assets by name, trade turnover and change in value.

Selecting assets to purchase at Sberbank Investor

Tapping on one of the items in the list will open a page with detailed information on it - chart, current, minimum and maximum prices, as well as the percentage change in the exchange rate for the period under review. The chart here is not very informative, it cannot be converted into a detailed candlestick chart or any technical indicators can be applied.

The “News” tab displays the latest events related to the asset, and the “Trade” tab displays the history of already completed transactions with it.

To purchase an asset, you need to click the “Buy” button and fill out a transaction request, indicating the investment amount and the number of lots.

☝️

In this case, you need to pay attention to how much of the acquired asset is included in one lot (for example, 100 shares).

If o, the purchase will occur at the last market selling price +2%.

Purchasing an asset in the Sberbank Investor application

By disabling this option, you can specify your own version of the price at which you would like to purchase the share. At this stage, a serious drawback of the Sberbank Investor application usually emerges - the lack of a market order book. That is, you see only the current price, but cannot see the balance of power of buyers and sellers.

If an asset is purchased for a medium-long term, this is, in principle, not critical. But short-term speculators will find trading extremely inconvenient without this functionality.

Registration of a transaction in Sberbank Investor

After specifying the necessary data, the application must be confirmed using the code from SMS and wait for the transaction to be executed. Its details can be viewed on the “Trade” tab.

Details of the transaction carried out at Sberbank Investor

When the transaction takes place, the purchased assets will appear on the “My Accounts” tab. After waiting for their value to increase, you can move on to taking profits. This is done according to a template similar to the one that was originally used for the purchase - open a page with details of the asset, click the “Sell” button, indicate the details of the transaction and confirm its completion.

The amount of profit received in this case will depend on the initially invested amount and the percentage change in the value of the asset from the moment of purchase to sale.

Selling an asset in the Sberbank Investor application

In the “Orders” tab you can see a list of all orders for the purchase/sale of assets, both active and already completed. Clicking on one of the positions will open detailed information on transactions.

History of applications and transactions in Sberbank Investor

You can also view the history of transactions carried out through Sberbank Investments on the website in the Sberbank Online account by visiting the “Brokerage Services” section. In the latter case, it will be possible not only to view, but also to download the full list of transactions in the form of an Excel table.

The video below will allow you to understand even better the functionality of the mobile application from Sberbank Investments:

Review of Sberbank Investments

How to withdraw money?

Withdrawal of funds is carried out to the account number that was specified in the investor’s application form. It is necessary to take into account the time interval allotted for the receipt of profit after the transaction is completed. It is possible to withdraw money 4 days after the sale of securities.

You can submit an application in 2 ways:

- The order is transmitted by telephone to the trade desk (amount over 100,000 rubles). Withdrawal occurs after 2 days.

- They use trading terminals (Sberbank Investor, QUIK).

The minimum remaining amount in the account is not subject to fees. The commission is included after the operation.