Economist Nouriel Roubini - Forbes: “The crisis could happen in the next 3-5 years”

— They call you Dr.

Doom (Doctor Apocalypse) for the love of gloomy forecasts that sometimes come true, like in 2008, when you predicted the global financial crisis. Now you are also very generous with promises of crisis and depression.

Do you have optimistic forecasts? — In fact, I have been more optimistic than the market more than once. In 2015, during the crisis in Greece, everyone, including the major players on Wall Street, expected Grexit (Greek exit from the European Union), and I was sure that this would not happen. In 2016, during the slowdown in China, analysts said it would lead to a financial crisis. My position was that China has problems, but they have enough political tools to prevent a hard landing, and that’s what happened.

- So you don’t deserve this nickname?

Advertising on Forbes

- Yes, it's unfair. My forecasts are not always pessimistic, I am a realist, and often even an optimist. As in the case of Greece and China, I was much more optimistic than others.

Material on the topic

— Now, how would you assess the situation in China, where their largest developer Evergrande

is facing bankruptcy and is being compared to Lehman Brothers, whose collapse led to the global financial crisis?

— Comparing Evergrande’s problems with the collapse of Lehman Brothers is an exaggeration. China does have a high debt problem and is trying to solve it. The difficulty is that in order to maintain growth at 6%, China needs to increase investment, which increases its debt burden. As a result, authorities have to balance debt concerns with the need to maintain growth. But I think China is capable of dealing with this problem. First, the government maintains relatively low deficit and debt levels, so it can absorb some of the losses. Second, China controls capital flows, so a collapse caused by capital flight and a payments crisis is unlikely.

“But Evergrande is a large company, the bankruptcy of which could lead to serious problems for the entire development sector.

- Yes, this is not only a problem for Evergrande, there are many companies that have accumulated too much debt and built too many facilities. There is currently an oversupply in real estate, particularly commercial real estate. Some losses are inevitable, but China will not allow the Evergrande situation to cause chaos in the market. True, since the real estate sector accounts for about 30% of GDP, a decrease in the level of lending in the sector may lead to a slowdown in the growth of the entire country’s economy. This, in turn, will reduce Chinese demand for ore, metals and other raw materials, which, of course, will affect the global economy. But Evergrande’s problems will not cause a large-scale crisis; it will be a controlled decline.

Material on the topic

- This means that the global crisis that you predict will not come from China. Overall, will it be similar to the 2008 crisis? What are the differences?

“I’m not saying that the global financial crisis will break out tomorrow. I'm just talking about vulnerabilities of various types - economic, financial - that are accumulating and could lead to a crisis in the next few years. The coronavirus crisis differs from the global financial crisis in a number of ways. First, the pandemic has caused a synchronous slowdown in economic growth around the world. In 2008, it all started with the mortgage crisis in the United States and only then spread to other countries. In addition, the coronavirus caused a sharp decline in supply. Another difference is that the global financial crisis caused a decline in demand, a credit crisis and deflation. And this time, governments actively used monetary, credit and financial instruments to stimulate the economy, so the recovery was very strong. At the same time, due to disruptions in global supply chains, the problem of inflation has arisen. First, prices for goods increased, then for raw materials, and now we see an increase in prices for products. And when the service sector is fully operational after the lockdown, we will see an increase in prices there too.

— Some say that this is reflation - a rise in prices, which indicates economic recovery and growth.

— The problem is that there is no growth. Rather, we can talk about moderate stagflation. Starting from the third quarter, inflation occurs against the backdrop of declining growth. This is partly due to the emergence of the delta strain of coronavirus, which has caused disruptions in the supply of goods, services and labor. As a result, we have low growth and high inflation. Optimistic analysts say this is a temporary phenomenon - once the delta strain subsides, growth will strengthen and inflation will slow. But I see structural reasons for rising inflation in the global economy in the medium term. This trend is already evident in the USA, Europe, Russia, Turkey, and emerging markets. I believe that this is not a temporary transitional phenomenon. This is the beginning of a rise in global inflation that will continue for several years.

— Don’t you think that inflation is being exported - the United States, through its quantitative easing policy, is inflating prices, and the effect of this is being felt by consumers in other countries, including Russia?

— I’m not sure that the reasons for inflation in Russia, Turkey or Brazil should be sought in US monetary policy. Of course, loose monetary policies in developed economies lead to higher prices for raw materials, goods and agricultural products around the world. But at the same time, different countries also have specific factors that contribute to inflation. For example, in Russia this is a fall in world oil prices, which led to a depreciation of the ruble. A weak currency, of course, brings with it the import of inflation, which the Central Bank tries to control through interest rate changes. That is, a combination of internal and external factors leads to inflation in each country.

Material on the topic

— You are talking about the problem of debts and the debt trap.

This week, the US is again discussing raising the debt ceiling.

Will he be promoted again? — I would separate the global problem of the growth of private and public debt over the past 20-30 years from the specific situation around raising the US debt ceiling. We have a strange rule that requires us to raise the debt ceiling every few years when there is a budget deficit in order to continue borrowing money. At the same time, the market fully allows the United States to borrow huge amounts of money. This is purely a political game - Democrats and Republicans are always arguing about this ceiling. For me it is something like Kabuki theater. No one really believes in the possibility of a default on US debt. In the end, of course, they will reach some kind of compromise and raise the national debt ceiling.

— What is the danger of the problem of growing global debt and what can it lead to?

— In 2022, the sum of private and public debts was about 220% of GDP, now it is 360% of GDP, and in developed economies it is 420% of GDP, and these figures are growing. This debt is still quite easy to service because short-term interest rates in developed countries are zero or negative. It is difficult to say how this situation will be resolved. It is unlikely that governments will cut spending - this is fraught with social problems. On the contrary, the pandemic is forcing spending to increase. Taxes are also unlikely to be raised. This is politically difficult and reduces the attractiveness of private business investment. Therefore, the budget deficit will remain high. Most likely, central banks will take the path of least resistance and continue to monetize debt. This means they will cover the budget deficit through quantitative easing and other instruments. Such actions lead to increased inflation, which, in turn, reduces the real amount of public debt. Central banks are now in a debt trap, where debts are too high and tightening monetary policy could lead to a crisis. So I'm afraid that gradually - not suddenly, it will happen gradually - we will end up in a world with very high inflation.

Advertising on Forbes

— Once this debt bubble bursts, how long can it continue to inflate?

- This cannot go on forever. In the near term, we will face inflation amid slowing growth due to supply shortages, deglobalization, the breakdown of global supply chains, an aging population, restrictions on migration from south to north and from poor to rich countries, and deteriorating relations between China and the United States. In addition, the pandemic is disrupting supply chains, global warming is increasing the cost of production, and cyber warfare is forcing higher costs to defend against cyber attacks. All of this could lead to what I call a stagflationary debt crisis. We will have stagflation, interest rates will rise due to inflation, and some governments and entire sectors of the economy may default.

- When can this happen?

— The crisis may happen in the next 3-5 years. Moreover, this is a worldwide problem. Of course, there are stronger and weaker countries, but in the end, global inflation and the debt crisis will affect everyone.

— What options for the development of the situation for Russia do you see?

Advertising on Forbes

— Russia has a fairly stable macroeconomic situation—a sound monetary policy, a low level of both external debt and debt burden among the population. With rising oil and commodity prices, the country's trade balance may even improve. The problem in Russia, and I think your government recognizes this, is its very low level of potential growth. Without structural reforms to improve productivity, economic growth will remain at a low level of 2% for such a country. We can talk about several key obstacles to development. First, there is the problem of state-owned enterprises, which still account for a significant share of the economy. This limits dynamic growth opportunities for companies. Secondly, problems with institutions and the rule of law, which lead to a lack of certainty and a deterioration in the investment climate.

The Russian government is investing in digitalization and modernization, but in order to move the potential growth bar from 2% to at least 3%, much more attention needs to be paid to institutions, the judicial system, the fight against corruption and other factors that hinder the growth of private business. The future development of the world economy is associated with digitalization, robotization, artificial intelligence and technology in general. Basic science and human capital in Russia have always been at a good level, the missing link is the ability to turn scientific knowledge into products, and here private business must play a key role. The question is whether the Russian government is ready to open up opportunities for more dynamic business development. Some think it's ready, others are skeptical.

— What will this 2% growth mean for Russia against the backdrop of global inflation and the debt crisis in the next five years?

— If macroeconomic stability is maintained, I do not see any significant risks of a serious financial crisis in Russia. It would rather be a situation where the macroeconomy is normal, but there is no growth, per capita income is low, the birth rate is low, and life expectancy is falling. Everything will be stable, and you will most likely be able to avoid major financial stress. But if reforms that strengthen private business are not carried out, there will be mediocre stability. If Russia wants to be more ambitious, it must develop a knowledge economy and private business. This requires certain political decisions. In principle, this is real - Russia has a qualified workforce and developed science, but at the institutional level there are still no incentives for dynamic development.

— In April, Russian media

wrote

that you allowed the US to lift anti-Russian sanctions.

Do you still think this is possible? Advertising on Forbes

— I don’t remember that I talked about lifting or reducing sanctions against Russia. The point is rather that, due to relative macroeconomic stability, neither the sanctions introduced in 2014 nor the recent sanctions against public debt have a significant impact on Russia. And if there is no escalation of the conflict between Russia and the United States, the situation will remain stable.

I said that Russia should work to improve relations with other countries, and in this case, if contradictions can be resolved and sanctions are lifted, this will spur economic growth. I don't think sanctions can be lifted in the foreseeable future. Unfortunately, relations between Russia and the United States leave much to be desired. I don't want to place the blame on either side for this, but the fact is that we have a lot of disagreements and they won't be resolved any time soon. We can only hope that the relationship will not get worse. The active participation of both sides is needed to resolve these differences. At the moment this is not happening - I would say that now we are frozen in this position. I don’t think that relations will become noticeably better or worse in the coming years.

— The Russian economy is heavily dependent on the export of raw materials, in particular hydrocarbon fuels. How might it be affected by the global energy transition, given the plans of importing countries to achieve carbon neutrality in the coming decades?

— On the one hand, Russia has the problem of excessive dependence on energy exports. To reduce the volatility of the economy due to fluctuations in fuel prices, it is necessary to work on its diversification, developing production and technology. This is already happening, but slowly. Regarding decarbonization specifically, I see two scenarios. First, everyone will actively invest in green technologies and reduce carbon emissions as much as possible. In this case, the demand for renewable energy will increase and the demand for fossil fuels will fall. This is another reason to reduce dependence on fuel exports, because in the near future the price may peak and then fall. We must be prepared for such a development of events.

But there is a second scenario. Now there are many loud statements about the transition to renewable energy sources, this is already leading to a decrease in investment in the development of fossil fuels. If, at the same time, green energy does not develop so quickly, then the increase in energy demand will cause an increase in oil and gas prices. We're already seeing some manifestations of this with gas prices. Sometime in the future, fossil fuel prices will fall, but in the short term, energy prices could skyrocket.

Advertising on Forbes

Material on the topic

- You periodically

talk

about the dangers of the cryptocurrency bubble.

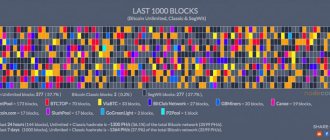

How long will this bubble continue to inflate? — Cryptocurrencies are a very volatile asset, they can rise by 20% in one day and fall by 20% the next day, so it is a high-risk investment. It's like gambling. There are about 10,000 cryptocurrencies, 80% of them were created as part of fraudulent ICOs, where people simply collected money from investors and disappeared.

— What is the forecast, will Bitcoin rise or fall?

— I stopped trying to predict what is happening in the cryptocurrency market. My main point is that it is incorrect to call them currencies at all. There is nothing that can be valued in Bitcoin or Ether. Bitcoin is not a scalable means of payment. The experiment in El Salvador failed disastrously. I sometimes go to blockchain and cryptocurrency conferences, and even there you can't pay to participate in Bitcoin. Why would a seller accept as payment something that could drop in price by 20% the next day and completely wipe out the margin? The means of payment must be stable. Or imagine if you took out a mortgage in Bitcoin and it went up 50%. It's as if a few years ago people in Russia had mortgages in dollars.

“It was so, I even know these people.”

Advertising on Forbes

- And what happened to them? They went bankrupt and were left without money and apartments! It would be the same with bitcoins.

“But people don’t use them for these purposes; for many, it’s more of an investment tool.”

— 95% of bitcoins are in 2% of all electronic wallets. There are so-called whales who own large amounts of cryptocurrency assets. They became super-rich, at least on paper, and everyone else is just pawns who help them get rich by buying cryptocurrencies at their peak. My opinion: if you want to play in a casino, go to Las Vegas, but this is not an investment. You can, of course, invest 1% of your funds in one of the cryptocurrencies and see what happens, but you need to be aware of the risks.

Material on the topic

— How will the emergence of central bank virtual currencies affect the cryptocurrency market?

China plans to release its own in the near future and has introduced restrictions on transactions with cryptocurrencies because of this. Russia has also announced plans to create a digital ruble.

— We will soon see tightening regulation of the cryptocurrency market in all G20 countries, not only in China. Cryptocurrencies complicate the fight against money laundering and compliance with the principle of “know your customer”, they are actively used for tax evasion, as well as to finance criminal activities and terrorism. No civilized state can allow billions of dollars to be instantly hidden. Gradually, all countries will come to the conclusion that this situation of complete chaos and the Wild West cannot continue, and will introduce strict measures to regulate this market.

Advertising on Forbes

Cash in the form of banknotes and coins is already gradually being washed out of circulation, so the transition to digital currencies is only a matter of time. As soon as central banks release their own currencies into free circulation, which are reliable, scalable and regulated, cryptocurrencies will disappear as unnecessary within 5-10 years.

— What will the spread of official digital currencies mean for the financial system as a whole?

— Digital currencies of central banks will hit not only the cryptocurrency market, but also the banking system. In the traditional scheme, money is stored in banks, which represent a key element of the payment system. With the introduction of digital currencies, the question will arise about their role in the new situation.

— When will these changes start to happen?

— I think central banks will introduce digital currencies slowly and gradually and learn from each other’s experience. Among developed countries, Sweden may introduce its currency in the next year or two, China may experimentally release it for the 2022 Winter Olympics, European countries and the USA - within 4-5 years, but in any case, everyone will do this in stages, checking different hypotheses.

Advertising on Forbes

— In your

article “The Death of Goldilocks,” you recommend that economic commentators “remember Cassandra, whose warnings were ignored until it was too late.”

Who is Cassandra here and what should commentators and economists do so that it is not too late? - Well, I’m not the only one who warns about the growing risks of inflation and stagflation, there are other voices - Larry Summers, Ray Dalio, Mohammed El-Erian, Ken Rogoff are talking about the same thing. I hope that we will be heard, but this requires serious decisions. Central banks are in a difficult position - no matter what they do, the result will be bad. If you ignore the risks, inflation is inevitable, and if you tighten monetary policy, the market may collapse, the economy may become weaker, and even a recession may begin. This is a dilemma with no easy solution. The system has accumulated so much debt that if monetized, it will lead to inflation, and if not, it could lead to financial collapse.

To soften the blow, countries around the world need to come together to address the challenges posed by the pandemic and work together to achieve financial stability and avert climate disaster. We need more global cooperation instead of destructive competition and zero-sum games. If we can achieve this, perhaps we can stabilize the international economy. For all our differences, logic demands that we find common solutions to global problems. If we don't do this, chaos awaits us.

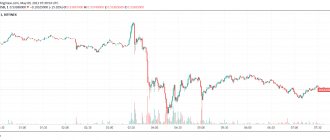

Gold and bonds

The value of gold

The price of gold is gaining strength and moving towards its historical maximum:

All time gold chart

Such popularity for the precious metal can be associated with the epidemic in China, which risks hitting the entire global economy. And if the Celestial Empire, according to official information, has already learned to contain the spread of the disease, then there are cases of infection in other countries, and there is no guarantee that the authorities there will respond at the same level.

According to Nouriel Roubini, the demand for gold is growing not only based on the current situation on the markets - it is stimulated by Russia and China, which have been accumulating the yellow metal in their vaults for several years now. And they do this with an eye to a possible future financial attack on the US economy. Both countries, and China especially, hold a large number of American government bonds, and if they decide to sell them, the effect will be comparable to a nuclear explosion.

It is clear that this is an extreme measure, but if the United States forces China to take such a step, they will be ready because they have accumulated enough gold and continue to do so.

Iran question

Financial crisis

It would seem that where is Iran and where is the USA. America is on a completely different social level, if states have them, and therefore is trying to impose its own conditions. But if you dig a little deeper, Iran is a key country in the Middle East and the war for this continent is being waged for a reason.

Yes, we specifically use the word “war,” although the media only tells us about some local conflicts between the troops of different countries with terrorists, government forces, opposition militias, and so on. But in fact, military clashes occur there regularly; artillery, aviation and missile weapons are used.

☝️

And the same USA, China, Turkey and Russia provide money and equipment for this local war. And what they share there is not the right of peoples to democracy, but access to oil fields and convenient routes for transporting black gold.

After the United States dared to eliminate the Iranian general, the conflict did not end, but, on the contrary, moved into a new phase. If Iran decides to openly confront the United States, it can only do so at the request of the countries that support it. But then he will have enough resources to stage a full-scale war.

Such a conflict would most likely involve only the Middle East and Africa, but the resources involved in it and the possible economic showdown between the countries that would support the warring parties would again lead us to a global crisis.

In addition, if humanity does not destroy itself on its own, nature may take over, we have had enough of it too.