The Ethereum cryptocurrency service has made a powerful step forward in a short time. Now users do not need to lose money on transactions through intermediaries, paying interest. You can use a crypto wallet on your computer or store funds online on a specific service.

You can buy cryptocurrency on different exchanges and exchangers. Exchangers are not always profitable, since they make money on the difference in cost; the best options are exchanges or buying directly from a seller with a good reputation. It is worth remembering the security of the transaction; Many practitioners recommend buying cryptocurrency from sellers in your city.

According to the current situation, ignoring the cryptocurrency market on the part of the state is not a productive way to solve the situation. In our opinion, it is constructive to consider this phenomenon as an alternative to the existing system or as an addition to it. The following cryptocurrencies are popular:

- Bitcoin (BTC), the very first cryptocurrency created, confidently holds the palm in the world and in the Russian market. Now the price of the coin is approaching $5,000.

- Ethereum (ETH) is a cryptocurrency that was released only in 2015 based on Ethereum technology, which refers to a blockchain system based on the use of distributed databases. Ethereum can be used in various fields, while it is also an alternative currency to traditional instruments of the foreign exchange market. Price – about 32 US dollars. The growth of interest in this cryptocurrency was facilitated by the provision of the opportunity to trade the ETH/USD pair by the world's largest social trading and investment network eToro, as well as the blockchain association Enterprise Ethereum Alliance, which included Microsoft, Intel and Accenture.

The advantages of cryptocurrencies are anonymity, the opportunity for investment, relative reliability, independence from the political situation, efficiency, simplification of cross-border payments and access of small and medium-sized businesses to international sales markets, the opportunity for traders to earn money on cryptocurrency exchanges, open source cryptocurrency, etc.

However, like any other new phenomenon, cryptocurrency raises many doubts: in fact, it is an unsecured means of payment that does not have the GDP on which all traditional currencies rely; its emission is little controlled (at least in the traditional sense - emission is based on cryptographic methods and a Proof-of-work proof scheme; actions take place decentralized in a distributed computer network); Despite their super-powerful security, cryptocurrency exchanges are also vulnerable to hacker attacks.

However, despite institutional uncertainty, in 2017 Russia confidently became one of the leading countries in the use of cryptocurrencies. Ignoring by government agencies the fact that such advanced electronic technologies, which include electronic cash, are becoming one of the ways in Russia for mutual settlements between citizens and legal entities, is clearly an unproductive way to optimize the market. The most popular cryptocurrencies in Russia in 2022 are Bitcoin, Ethereum, Dash, Mopego, Ripple.

Subject to the constant improvement of IT technologies, proper cryptographic protection, legislative regulation, improvement of the infrastructure for the functioning of the new type of money, taking into account the dynamics of growth rates and overall capitalization, cryptocurrencies will occupy an increasingly prominent place in the lives of Russians. This requires measures to popularize business, stimulate the emergence of a liquid market, and create an IT school to systematize knowledge on the technical component of cryptocurrencies, especially security methods.

What affects the Ethereum price?

Recently, there has been a huge surge in Ethereum price growth. Over the past few months, people have begun to earn twice as much on their video cards, but not everyone understands what exactly influenced the increase in the cryptocurrency rate.

In March 2022, Ethereum reached its maximum rate, but did not stop and continues to move forward confidently. Some experts argue that this is all temporary and we should expect the same sharp drop in cryptocurrency in the near future. In fact, real events influenced the growth; in February, a meeting was held to create the Ethereum Alliance, which will be among the world's largest giants. It included about twenty co-founder companies and even an international bank.

Based on this information, it is worth talking about further prerequisites for the development of cryptocurrency. The interest of large players had a special impact on the growth of the rate, because any cryptocurrency, first of all, depends on the demand for it.

Latest news: the rate of Ethereum to the dollar was killed by cats - true or not

the exchange rate of ethereum to the dollar was killed by cats - true or not

Of course, only the lazy did not read the news about the game with crypto-cats, which can only be bought for “ether.” In general, the essence of the application is very simple: you need to add Ethereum to it in order to buy yourself a cute kitten with this amount, raise it, breed it and get offspring. Then these same cats can be sold for a much larger amount within the same game. But the most important thing is that settlements are carried out in one currency - Ethereum. Of course, cat prices are indicated in dollars.

More and more cryptocats are born every minute, but their possible number is limited, and offspring will not be born all the time, but will stop at a certain number. Doesn't remind you of anything? This is all well-known blockchain technology. In addition, cats have their own code, all transactions with them are encrypted, etc. In general, blockchain has leaked into the world of games, and crypto cats are a new token. Since Ethereum is needed to purchase them, the number of transactions with it has increased sharply.

Before the release of the game, the system and the broadcast client could not cope with the load, and the gas limit turned out to be insufficient, which led to a freeze. Blocks were added even more slowly, causing transaction fees to increase. Of course, this did not suit anyone, so the developers are urgently looking for a way out of this situation. Most likely, the gas limit will be increased, and the commission for blockchain transactions with Ethereum will be reduced. It is possible that new modifications will appear before sharding occurs and Casper is implemented.

Ethereum price drop due to gas limit

Due to client overload, low block adding speed, and high fees, the value of the cryptocurrency dropped sharply. The cats only slightly influenced the fact that the exchange rate of Ethereum against the dollar fell sharply, despite the increase in the rating of the cryptocurrency. If on November 28, 2017 it almost reached $500 and cost 478, then a day later there was a decrease to $428. No correction is even expected. As for the game, so far there has been artificial PR and hype around it.

Of course, many associate the collapse with other reasons, even an artificial decline. Perhaps someone is actively buying Ethereum in order to later “merge” it at a higher rate. But then trading volumes and other indicators would also change. Still, the ether rate fell due to problems with processing transactions and adding blocks. Everyone is waiting for a new fork (a branch of Ethereum) with other possibilities.

How has the complexity and size of the Ethereum network changed the income of miners?

Compared to Bitcoin, Ethereum has never claimed to be the global currency. It is used to pay for special services, and the market is supported by other cryptocurrencies. This currency has not followed the path of development of Bitcoin, while it can be earned from a home computer; the more nodes, the higher the cost of the cryptocurrency.

In 2014, the creators launched an advertising campaign for the sale of Ethereum and then already received $14 million for them. These funds were able to ensure the further and initial issue of this cryptocurrency. A few years later, the protocol managed to produce 5 ethers for each block. Inflation is expected to be constant, that is, infinite. The emission of bitcoins is more stringent, because there are restrictions in the code.

Miners have always influenced the price of Ethereum; they still make money by creating new blocks, for which they receive 5 ETH. When the transition to the new protocol is completed, the size of the reward for miners will decrease, validation of transactions by nodes will become impossible until the deposit is made. As soon as the new algorithm considers that the validator has created something unacceptable, its account will be invalidated.

What is the meaning of Ethereum

The main concept of Ethereum is the blockchain on the basis of which smart contracts are carried out (smart contracts that do not require human intervention and remove the element of trust from transactions). The project works on the Proof of Work concept, but plans are made to switch to Proof of Stake, which will simplify the functioning of the system, increase transaction speed and make mining less expensive by moving away from generation using GPUs (video card farms). More details about ETH mining will be discussed in the next article. After the launch, Microsoft, IBM, Acronis, Sberbank and others became interested in the platform.

The difference between Ethereum and Bitcoin

For a long time, Bitcoin has been the leader of cryptocurrencies in terms of capitalization, recognition, and high growth potential, which makes it attractive for investment. But then the Ethereum cryptocurrency appeared, behind which there is a blockchain platform that simplifies people’s lives through smart contracts.

Smart contracts carry out transactions using a computer program that verifies the terms of the transaction and checks whether the parties comply with their obligations. When all conditions are met and obligations are fulfilled, the contract is automatically executed by the machine and the parties to the transaction are satisfied. Transactions made using the platform are automatically recorded on the blockchain and can be tracked in real time. Bitcoin also contains smart contracts, but their functionality is greatly reduced, which is what the creators of Ethereum corrected.

With the help of smart contracts, many processes can be transferred from real life, and the speed of transactions will only be limited by the speed of reconciliation of the block chain and the speed of the Internet. The issue of trust is also resolved, because the machine is impartial and executes the program code embedded in it.

There is another cryptocurrency on the market with a similar name - Ethereum Classic, which is directly related to the ETH cryptocurrency. This token appeared as a result of the separation of part of the platform due to a violation of the principle of blockchain technology by the developers. The creators of the project and the community decided to do this because in July 2016, as a result of a hacker attack on the investment management platform The DAO, assets worth $50 million were stolen. After this money was returned to the owners, part of the community separated and created a separate blockchain in the form of the new cryptocurrency Ethereum Classic.

Important!

Please note that Ethereum has poor cryptocurrency mining prospects due to the transition to the Proof of Stake protocol. If you already own a farm, you will have time to recoup your investment. But buying a farm in March 2018 for mining the ETH cryptocurrency is an extremely dubious undertaking.

How has the Ethereum rate changed over the past 2 years?

Ethereum is still a very young cryptocurrency; it has been operating since 2015. It is not so difficult to track changes in the exchange rate, but thanks to such information, you can draw your own conclusions regarding future development and the need to invest your own funds in such an asset. If you compare a cryptocurrency and its rate with any other on the Forex market, it is difficult not to notice that it shows more frequent jumps, but even with a small capital it can be significantly increased.

Ethereum and Bitcoin: platform or cryptocurrency

Despite their greater similarities, Bitcoin and Ethereum have fundamental differences. Bitcoin is a decentralized currency that is an end product. Digital alternative to money. Ethereum is a platform designed for implementing projects with blockchain services and smart contracts. Thus, the price forecast for Ethereum is determined not only by interest in cryptocurrency as an alternative means of payment. Ethereum represents the equivalent value of a sought-after digital service.

Therefore, the demand for coins will be relevant as long as users are interested in providing the service. Ether here is a means of payment for paying for access to system services. If an enterprise needs to transfer projects to the blockchain, it has to buy or mine ETH. Therefore, the prospects for Ethereum are closely linked to the future of blockchain technology. It also has a chance to completely replace centralized projects concentrated in one hand.

If we consider ether as an asset, then its future is determined by the same factors as the future of any real currency (dollar, euro and others). Therefore, its future is determined by many factors, from articles in the media to the rate of economic growth. Therefore, he, like others, is obliged to go through four periods: growth, stability, decline and oblivion. The only question is timing. Therefore, it is important not only to invest money on time, but also to withdraw it from the asset.

Ethereum cryptocurrency rate since its appearance on the market

At the very beginning of the development of cryptocurrency, it could be purchased for just $2. Two and a half years later, the cost has risen to $200-$400 and fluctuates constantly. With simple mathematical calculations, it is obvious that the capital invested several years ago could be increased by almost two hundred times.

Many traders today continue to make money from speculation in this currency. For example, we can take June 14, when the starting Ethereum rate for the day was $395, and an hour later its price rose to $411. There are also disadvantages to selling cryptocurrency - it can quickly rise in price or, conversely, fall in value.

This happens due to the deliberate actions of the holders of the maximum amount of cryptocurrency; when necessary, they begin to sharply drain their own assets, reducing the value to a minimum. This will definitely be followed by a sharp rise in value, which is expected at the beginning of 2022.

Where and how best to look at the exchange rate of Ethereum to the dollar: all the ways

Anyone who needs to see the Ethereum rate simply looks for the first information they come across on the Internet. Of course, he finds it, perhaps even relevant. But there is always an opportunity to see the bigger picture. There are many tools on websites for this. Let's look at the most effective of them:

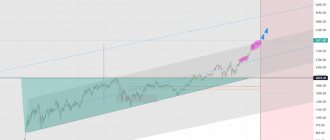

- Ethereum to dollar exchange rate chart in the form of a curve. The website with ether quotes often has charts. They represent a curve and two axes: time and the amount of currency, such as the dollar. First, find the date of interest on the x-axis, and then find the corresponding number of dollars on the y-axis. Then you can find out the exchange rate of Ethereum to the dollar on a specific date. The time can be changed, for example, setting the rate for 24 hours, a week, a month, a year, or even hourly values.

- Candlestick charts. They only have thin rectangles of two colors. If you look at them, you can also see a curve. Candles are needed in order to understand how the trading took place. For example, each rectangle has a dash at the top. This is the maximum price of Ethereum during trading. The bottom line is the minimum price, the top of the rectangle is the opening price, the bottom is the closing price.

- The graphics are live. They show the Bitcoin exchange rate in real time, that is, online. The broadcast is carried out from the largest exchanges, and the data is updated every second. Such charts always display accurate quotes. Accuracy is maintained down to several decimal places.

Where and how best to look at the exchange rate of Ethereum to the dollar

But not only charts help you see quotes and conduct analysis. In addition to them, there are the quotes themselves. Example:

- USD/ETH. This quote shows the number of dollars that 1 Ethereum is currently worth.

- ETH/USD. Displays the amount of Ethereum that must be given for 1 dollar.

Of course, most people immediately pay attention to the USD/ETH quote, since it displays the cost of Ethereum in dollar equivalent. It is worth paying attention to other indicators. For example, websites often show the values of growth, decline, deviation of Ethereum in percentage and monetary equivalent. All these figures are the subject of analysis and further forecasting of the exchange rate.

Ethereum to dollar exchange rate in the table on the website

Sources where you can see the exchange rate of Ethereum to the dollar online:

- Cryptocurrency exchanges. They also have live charts and analytics.

- Exchange services where one currency is exchanged for another online.

- Converters.

- Online calculators.

- Websites on finance, cryptocurrencies, blockchain, etc.

- Forums.

Where exactly to look and analyze the ethereum exchange rate is everyone’s business, but for traders, investors and other experts, exchanges are suitable. There are live and other charts, indicators and data for analytics. If it is important to simply look at quotes, then exchangers and aggregators are the best option. For instant calculation, you should use online converters and calculators. With their help, you can quickly calculate how much currency you need to give for ether and vice versa.

Average Ethereum price forecast for 2022

The Ethereum rate in 2022 is of interest to users not so much because it is useful information, but because you can make good money on it, even if you do not understand what we are talking about in principle. Regular increases in the cryptocurrency rate allow you to quickly earn money, especially if you have several thousand dollars in your pocket.

There is another strategy; some users prefer to wait until there is a significant jump in cryptocurrency.

None of the experts doubt that sooner or later this currency will reach a rate of $1,000 per ether, but this will happen gradually and closer to 2022. As for the forecasts for next year, they remain positive. We can safely say that in 2022 this cryptocurrency will reach the $500 mark; of course, there will be pullbacks from time to time, but experts advise just waiting it out.

An excursion into the history of ETH in numbers

To predict the medium-term as well as the long-term course of any asset, one cannot do without an excursion into its past. As for the broadcast, then:

- BTC 2.0 appeared (this is the designation this cryptocurrency received from birth) in 2014;

- startup ICO duration is one month;

- fundraising for the startup was in bitcoins. More than 31 thousand 500 BTC were received from investors for 60 million 102 thousand ether tokens, which by that time was the equivalent of more than 18 million 439 thousand American money;

- thus the starting price was $0.31.

Should you keep your savings in ether in 2022?

If we talk specifically about investing your own savings in cryptocurrency, then there are already examples of real people who managed to get rich from this. Ethereum is still a young currency that is striving for its own development, so the prospects will be encouraging at least until 2022.

Since the beginning of the year, this currency has risen in price by 5000%, in this expression it managed to take a significant share even from Bitcoin. Demand is constantly growing, which means Ethereum itself will continue to develop. If you have a few thousand spare to invest, this is not a bad option, especially during a crisis, when other investments are more risky.

Want to know how to earn over 450% per annum in the stock market?

Get a free course on investing in high-yield instruments that brought in more than $1 million in 2022.

I, Andrey Abrechko, an investment expert with 12 years of experience and the founder of the Academy of High Profit Investments, invite you to take part in my free course, where you will learn:

— which instruments are the most profitable in 2021;

— what are IPOs and SPACs and how to start making money on them from 100% per annum;

I will analyze my real case, where I will show with a clear example how I managed to make more than 450% per annum for 2020.

The course consists of 5 small lessons that will be sent to you via Telegram and you can watch them at any convenient time.

Follow the link and start free training