3K 3 min.

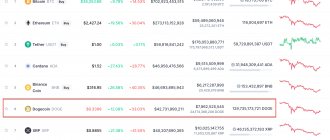

Elon Musk’s two-day silence on social networks ended with the explosive growth of the Dogecoin cryptocurrency. After several tweets from the head of Tesla, the value of the asset jumped by 80%. The entrepreneur first published a photo of a rocket flying into space, with the caption Doge, and then added another tweet, where he wrote: “Dogecoin is a crypt for the people.” Last week, an army of private investors from Reddit drew attention to this asset. It was announced on the forum that Dogecoin needed to be brought into the top 3, and its price began to rise by hundreds of percent. Will they be able to achieve their goal with the support of Elon Musk? And why exactly do his posts have such a strong impact on market quotes? Details from Vladislav Viktorov.

Photo: Hannibal Hanschke/Pool/File Photo, Reuters

Photo: Hannibal Hanschke/Pool/File Photo, Reuters

Less than two days have passed since Elon Musk announced that he was temporarily leaving social media, and he again published several explosive tweets. In them, he only succinctly mentions the Dogecoin cryptocurrency, and immediately its quotes, like that very rocket in one of the photographs, take off upward. There was a similar reaction to the entrepreneur’s publications, where he mentioned Bitcoin, Polish game developers CD Projekt RED and GameStop. The phenomenon has already been called the “Elon Musk effect.”

The most popular meme cryptocurrency

In 2022, Dogecoin, created as a joke, surpassed Bitcoin in the number of search queries on Google.

The reason is the incredibly rapid rise in price, supported primarily by mentions of Elon Musk and other celebrities.

Dogecoin might be my fav cryptocurrency. It's pretty cool.

— Elon Musk (@elonmusk) April 2, 2019

“Dogecoin might be my favorite cryptocurrency. He's pretty cool."

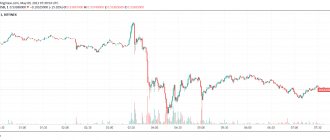

The meme coin has indeed always accelerated its growth following the Tesla founder's tweets about "the people's cryptocurrency" and "Doge barking at the moon." The graph below shows this.

Data: Cryptowatch, Twitter, Galaxy Digital Research report.

An important role was played by the general activation of the cryptocurrency market against the backdrop of the coronavirus crisis and unprecedented fiscal and monetary measures by governments and central banks trying to revive national economies.

In 2022, the meme coin eclipsed Bitcoin and Ethereum in growth rates. The incredible rise brought DOGE to listings on top exchanges, including the Winklevoss brothers' Gemini. The daily coin trading volume exceeded $20 billion.

Data: Galaxy Digital Research.

Many stores have added the ability to pay for goods and services with hype cryptocurrency.

The founder of Tesla and SpaceX promised to launch the Doge-1 satellite to the Moon. According to him, the mission was fully paid for by the meme cryptocurrency Dogecoin. In addition, Musk invited users to vote on his Twitter whether his company should accept payments in Dogecoin. Almost 80% of respondents supported the businessman’s idea.

I'm looking for a shiba pup!

— Elon Musk (@elonmusk) May 7, 2021

Soon, the Tesla founder announced that he was collaborating with Dogecoin developers to “improve transaction efficiency.” The coin reacted with growth again. It subsequently turned out that a team of four main developers of the meme cryptocurrency has been collaborating with Musk since 2022.

Dogecoin clones like Shiba Inu (SHIB) have appeared, also reacting extremely positively to Elon Musk’s tweets. SHIB was quickly listed on Binance, Crypto.com and other well-known platforms. This increased liquidity and accelerated the growth of the price of the coin, whose capitalization exceeded $11 billion.

According to the observations of The Block researcher Igor Igamberdiev, a certain user accumulated 70 trillion SHIB, spending a total of 37.65 ETH in August-October. At the beginning of May the following year, his unrealized income was more than $2 billion.

The top 10 pools of the leading Ethereum exchange Uniswap included pairs with Dogecoin clone coins. The first place was taken by the SHIB-ETH pool, whose daily turnover exceeded $2 billion.

Five of the top 10 pairs on Uniswap are dog meme coins. That's $1.55 billion in volume over the last 24 hours. Just for reference, Uniswap v2 didn't cross daily volume like that for almost the first year of its existence. pic.twitter.com/JjJvv371Yq

— Larry Cermak (@lawmaster) May 11, 2021

The excitement around the ERC20 token SHIB has increased activity on the Ethereum blockchain. On Tuesday, May 11, the average transaction fee on the Ethereum network reached an anti-record of $60.

Data: Blockchair.

It turned out that the largest holder of Shiba Inu is the creator of Ethereum, Vitalik Buterin. Its public wallet initially contained 505 trillion SHIB - more than 50% of the intended quadrillion coins. He subsequently withdrew assets from Uniswap pools and donated funds to charities.

The endless positivity around the main meme cryptocurrency is reflected in many positive statements about Dogecoin and price forecasts. For example, billionaire Mark Cuban predicted an increase in the rate to $1, calling unlimited emission an advantage. He is convinced that issuing 5.2 billion coins annually is a good thing.

Asset manager SkyBridge Capital Anthony Scaramucci did not rule out that Dogecoin will become “digital silver” in relation to Bitcoin. The latter, he said, will remain a “superpredator” among digital assets.

Before understanding the fundamental features of meme cryptocurrency, let’s look at the history of this coin.

Another big statement

SpaceX and Tesla founder Elon Musk and Mark Cuban, an American entrepreneur and billionaire, said that Dogecoin (DOGE) is the most reliable means of exchanging digital assets.

This is such a dizzying story that has developed around what seemed like a joke and gag. At the beginning of 2022, Dogecoin has created thousands of new millionaires, while thousands have lost most of their investments in this coin.

No one knows how all this will end in the future. Dogecoin can be hated, Dogecoin can be loved, but it cannot be ignored.

How and why Dogecoin was created

Dogecoin is one of the oldest altcoins, appearing 1.5 years before Ethereum and long before many other well-known assets. The cryptocurrency meme was created in 2013 by Jackson Palmer, who then worked in the marketing department of Adobe Systems, and programmer Billy Marcus.

The coin was conceived as a kind of parody of Bitcoin and other cryptocurrencies that showed growth at the turn of 2013-2014. It is named after the then popular Internet meme Doge. The latter usually contains a photo of a Shiba Inu dog named Kabosu. The image is often accompanied by text in Comic Sans MS font using various colors.

“Unlike many other crypto projects, Dogecoin is not even trying to become anything more than the most fun currency in the world. There is no strategic vision, no claim that Dogecoin will change the world,” says the Galaxy Digital Research report.

In November 2013, Palmer tweeted: “Invest in Dogecoin. I'm sure this is a serious new thing." Shortly thereafter, he created the site dogecoin.com, aimed at beginners, where you can download a wallet and get acquainted with the main features of the meme cryptocurrency.

On December 6, two days after the site was launched, the Dogecoin genesis block was generated. At the turn of 2013-2014, Dogecoin began to appear on exchanges, trading in the range of $0.0002-$0.0018.

From a technical point of view, Dogecoin is a fork of the Luckycoin coin, created on the basis of Junkcoin. The latter is a fork of the Litecoin (LTC) cryptocurrency, which, in turn, is technologically close to Bitcoin.

Dogecoin uses the Scrypt PoW hashing algorithm. Miners can mine both LTC and DOGE at no additional cost through merged mining.

On December 8, 2013, the r/Dogecoin subreddit appeared, one of whose members wrote:

“Publish addresses here to exchange and receive Dogecoin.”

The launch of Dogecoin took place against the backdrop of the peak of Bitcoin's first rally, when the price of the first cryptocurrency broke $1,000 for the first time. Within a year of its introduction, the meme cryptocurrency was listed on at least 30 exchanges. Of these, according to the observations of analysts at Galaxy Digital Research, only five have survived to this day: Poloniex, Bittrex, Kraken, HitBTC and CEX.io.

In 2014, just a few months after the genesis block appeared, the r/Dogecoin subreddit already had over 35,000 members. This forum thread currently has 1.81 million users. For comparison, the Ethereum subreddit has 0.89 million members, and r/Bitcoin has 2.9 million users.

Over time, a bot appeared on Reddit that allows you to send DOGE to community members as a reward for interesting and high-quality posts.

“Almost all Reddit users had Dogecoin coins,” Palmer was quoted as saying by CNET.

In 2014, the Jamaican bobsled team had the opportunity to participate in the Winter Olympics for the first time in 10 years. The problem was that the team did not have enough funds to perform. The Dogecoin community, which included many fans of the film “Tight Turns,” decided to help the team with cryptocurrency. Within a few hours, the #CoolRunnings2 campaign raised nearly $30,000 in DOGE.

Dogecoin supporters have funded NASCAR driver Josh Wise on several occasions, and have also helped people in Kashmir (Doge4Kashmir) and Cambodia (CESHEO). The Doge4Water campaign was launched in 2015 to improve access to clean water.

As already mentioned, Marcus and Palmer created Dogecoin “for fun”, not at all for personal enrichment. They expected to see some hype on social media, little interest from miners, and a gradual fading of interest in the project. However, something went wrong - the community’s interest in the coin exceeded all their expectations.

As Dogecoin expanded into the cryptocurrency ecosystem, the founders began to become disillusioned with the project. Contrary to its original intent, DOGE began to be increasingly perceived in the community as a tool for speculation.

Soon Marcus left the project, saying that he did not want to be a “cult leader.” In January 2022, he admitted that he made this decision "due to harassment from the community."

In the letter, Marcus noted that he does not understand the talk about a rally to $1 and the market capitalization of the coin approaching the level of large American companies. He called the true value of Dogecoin the community and its potential to “do good.”

“Pump and dump, unbridled greed, scams, bad actors, hype without research, taking advantage of others—all of these are useless […] Joy, kindness, learning, empathy, fun, community, inspiration, creativity, generosity, levity, absurdity “This is what makes Dogecoin valuable to me,” said the developer.

Palmer left the r/Dogecoin subreddit in June 2014. In 2015, he said he was “going on an extended vacation” and called the cryptocurrency ecosystem “toxic.” Palmer later deleted his YouTube and Twitter accounts.

Dogecoin's Fundamental Flaws

Dogecoin inherits the Script language and unspent transaction outputs from its cousin Bitcoin.

At first, mining the meme cryptocurrency assumed a random block reward size, like Luckycoin. This value ranged from 0 to 1 million DOGE.

The source of “randomness” was the hash of the previous block. Therefore, miners had the opportunity to calculate their potential future reward.

Some miners, including F2Pool, took advantage of this opportunity. This allowed them to maximize their mining income, as one of the first people to tell the community about was Reddit user u/paul_miner.

Soon, the Dogecoin codebase underwent changes - the coin began to be mined together with Litecoin, and the “random” block reward was replaced by a fixed one.

Against the backdrop of the 2022 hype, the profitability of LTC+DOGE mining has increased significantly.

For several years, almost no attention was paid to the Dogecoin codebase; the development of the project practically stopped. The exception is the Dogethereum project, which slightly revived the DOGE price.

It was a system designed to be a bridge between the Dogecoin and Ethereum blockchains and potentially scalable to other compatible ecosystems. Judging by the “dead” social media accounts, work on the project has stopped—there has been no news about it for the last few years.

Dogecoin hardly boasts a developed infrastructure consisting of custodians, regulated trading and lending services, and other attributes of a mature market.

The meme cryptocurrency lags significantly behind Bitcoin in a number of fundamental metrics, covering on-chain activity, distribution of assets by address, cost of a 51% attack, and many other parameters.

The graph below compares the dynamics of the number of active addresses of Bitcoin and Dogecoin.

Data: Coin Metrics.

Obviously, in this regard, meme cryptocurrency is significantly inferior to digital gold. Although in 2014 DOGE briefly overtook BTC in the number of active addresses, and in 2022 the figure returned to the levels of seven years ago.

No less significant are the differences in the number of addresses with a non-zero balance. Bitcoin has more than 35 million such addresses, Dogecoin has 3.6 million.

Data: Coin Metrics.

Unlike Bitcoin, Dogecoin has an unlimited supply. Also, meme cryptocurrency has a higher annual inflation rate.

Comparison of the supply curves and inflation rates of Bitcoin (left) and Dogecoin (right). Source: Coin Metrics, Galaxy Digital Research.

Approximately every minute, 10,000 DOGE is distributed among miners. This means that the supply of meme cryptocurrency increases by 14.4 million DOGE per day, and by 5.2 billion DOGE every year.

For comparison, the total supply of Bitcoin is limited to 21 million BTC, of which about 89% of coins have already been mined. The reward is distributed among miners approximately every 10 minutes.

The inflation rate of digital gold is halved due to halvings that occur every four years. The next such event will take place around May 4, 2024 - the size of the reward for miners will decrease from the current 6.25 BTC to 3.125 BTC.

Dogecoin does not have halvings, and there is no limit to the supply of cryptocurrency. However, the rate of inflation decreases as the DOGE monetary supply increases.

The Dogecoin supply is distributed predominantly among large players. Bitcoin has a much higher share of retail market participants.

Distribution of Bitcoin and Dogecoin supply across different address categories. Source: Coin Metrics, Galaxy Digital Research.

Dogecoin is average in terms of the even distribution of assets across different address categories. Its supply is more dispersed than XRP and relatively new assets like UNI and DOT. In this context, Dogecoin falls between Ethereum and Litecoin. The monetary supply of the latter is somewhat more concentrated at large addresses.

Last year, a huge number of DOGE began to move after a long hibernation - more than 60% of coins. According to analysts at Galaxy Digital Research, this indicates a movement of assets from older investors to new market participants.

Dogecoin HODL waves. Data: Coin Metrics.

A similar situation in the context of Bitcoin is considered by most researchers as a bearish signal. This is due to the fact that many perceive Bitcoin as a means of long-term storage of value.

With regard to Dogecoin, it is difficult to say what exactly such on-chain activation signals.

“It is possible that new participants have longer-term plans for the coin than those who held DOGE in previous eras,” Galaxy Digital Research experts shared their opinion.

Meme cryptocurrency is significantly inferior to digital gold in terms of the daily number of transactions and the volume of transferred value. The main reasons: the underdevelopment of the Dogecoin infrastructure and, as a result, limited options for using the asset.

The graph below shows that in all previous years, Bitcoin significantly exceeded the meme cryptocurrency in terms of the volume of value transferred. The situation changed at the beginning of 2022 amid the hype around Dogecoin.

Dynamics of volumes of value transferred through the Bitcoin and Dogecoin networks. Data: Coin Metrics.

In addition to the increase in the number of transactions and the volume of value transferred, the average Dogecoin commission has increased.

Galaxy Digital Research experts concluded that the cost of carrying out a 51% attack on Bitcoin is 11 times more expensive than on Litecoin. Since Dogecoin is mined in conjunction with “digital silver”, this value corresponds to DOGE. In their calculations, the researchers used data on the cost of SHA-256 and Scrypt hashing power on the NiceHash website, as well as the HowManyConfs.com service.

Historically, Dogecoin revenues from pooled mining have been viewed by miners as a small additional source of income at little marginal cost. Thanks to the recent price surge, DOGE's share of miner earnings has exceeded LTC earnings.

Data: Coin Metrics.

This situation caused an increase in prices for mining equipment using the Scrypt algorithm. The price of the popular Antminer L3 device from Bitmain has increased since the beginning of the year from $83.26 to $547.71, according to the Hashrate Index.

Dogecoin has also surpassed Litecoin in terms of market capitalization - this is the first such case among jointly mined coins.

Coin in terms of technology

“Dog cryptocurrency” was developed based on Litecoin. The developers changed the coin algorithm, but for the most part the new currency retained all the features of the previous version. Dogecoin was designed to have a very large supply of coins. This makes cryptocurrency more accessible.

Dogecoin mining uses the Proof-of-Work algorithm. In 2018, statements were made that the coin was planning a transition from Proof-of-Work to Proof-of-Stake (principles of protecting systems in cryptocurrencies. - Ed.) Official statements were expected from Dogecoin at the September 2022 conference, however, this did not happen It happened.

And in May 2022, Alex Mashinsky, CEO and founder of Celsius Network, made a statement that the platform may be planning a transition, but in the next 2 years, not earlier.

Previously, the reward for each block received in the cryptocurrency network was set arbitrarily, but in March 2014, the size of the miners’ reward became fixed - 250 thousand DOGE. Initially, the developers planned to release 100 billion coins, but later removed this limitation. By September 2022, 116 billion coins had been mined, by September 2022 – 131 billion.