On average, cryptocurrency exchanges charge up to 0.25% of the order amount for completing a transaction, which sets them apart from simple exchangers. However, the commission level is not the only criterion that determines the convenience and safety of using such resources. It is also important to take into account the volume of transactions, the number of currency pairs (including fiat money), the possibility of margin trading, the convenience of the terminal, compatible EPS and accessibility for the domestic user. There are several hundred similar resources on the current market, and therefore if you are interested in the best cryptocurrency exchanges, the 2022 rating will help you significantly simplify the selection process.

Why are cryptocurrency exchanges needed?

There is an opinion that only select wealthy entrepreneurs who can afford to risk large sums can make money on stock exchanges. This opinion is true in relation to stock exchanges, where the entry barrier is indeed very high. Cryptocurrency trading, which has no budget restrictions, is a completely different matter. There have been cases where people started with a few dollars and became successful traders.

On exchanges you can exchange one cryptocurrency for another or cryptocurrency for fiat. At the same time, users trade with each other, and not with the exchange. The important thing to understand here is that if you win on a particular trade, someone else loses on it and vice versa.

Exchange one cryptocurrency for another

Binance

Also, a fairly young but ambitious crypto exchange, which opened only in 2022, confidently takes its place among the best.

Currently the largest Bitcoin trading company .

The crypto service is based in Hong Kong and is subject to local laws.

The idea behind the creation was to orient the crypto service to the requirements of today’s market.

Binance is quite comfortable to use also because it has high performance.

It is capable of processing a large number of transactions simultaneously.

But even during the boom in closing registrations of new crypto users, it temporarily stopped “launching” newcomers.

The margin is relatively low, only 0.1%, but with all this, the security of transactions is guaranteed on the project and this wins the trust of a large number of investors.

In addition, the site interface is well adapted for use on a mobile device.

The number of types of coins is extensive and more are added every day.

Like BitFlip, Binance has its own development - BinanceCoin (BNC) , which consists of circulation only within the service itself and is designed to create additional privileges for holders.

It is more profitable for BNC to pay margin, because instead of 0.1%, when paying using BinanceCoin, the commission will be 0.05%.

The constant growth of the exchange coin rate is another advantage of the holder.

There is good news for beginners and small investors - Binance does not require mandatory verification, because without it the daily withdrawal amount is 2 BTC.

For holders of a large investment budget who plan to withdraw up to 100 bitcoins per day, verification is necessary.

go

Basic criteria for choosing an exchange for trading

- Work experience. The more the exchange operates, the lower the risk of fraud and the higher the chance that in case of problems, technical support will answer you quickly enough (sometimes the processing time for complaints takes weeks) and help solve them. Trading platforms that have been operating for several years value their reputation and care about their clients.

- Trading volume. On large exchanges it can reach hundreds of millions of dollars. This is an indicator that many people choose this service. In addition, on large platforms it is easier to exchange funds at a favorable rate.

- Number of exchange directions. The more assets and trading pairs are represented on the exchange, the more convenient and profitable it is to work on it. This means that you will not have to lose on commissions from additional (intermediate) exchanges.

- Commission. The average level for crypto exchanges is from 0.1% to 0.5%. Everything is simple here: the lower the commission, the more profitable the deal.

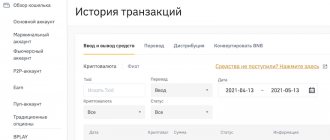

- Features and methods of depositing/withdrawing money. The more there are, the more diverse they are, the higher the chance of finding the ideal option. It’s great if the exchange provides the opportunity to top up your balance by card or through a payment system (WM or YaD). The downside of many exchanges is the ability to work only with cryptocurrencies.

- Safety. Be sure to learn how the marketplace keeps your investment safe. Is registration and verification required, what amount is available for withdrawal without verification, what is the waiting period for confirmation, etc.

- Customer trust. Try to find real reviews online about the cryptocurrency exchanges you are going to work with and study them.

- Site interface. The convenience of working on the stock exchange, the availability of the necessary information, additional tools and indicators are very important. For example, Fibonacci and Bollinger levels, which help assess the situation on the market.

Working with cryptocurrency

Should you pay attention to the rating of crypto exchanges?

Should you pay attention to the rating of crypto exchanges?

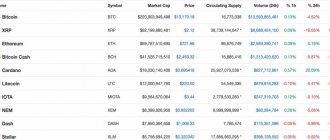

Cryptocurrency exchange ratings are formed quite often. The first positions contain the sites with the highest daily exchange volume. Sometimes several other factors are used in ranking. In general, ratings are created so that users can quickly learn about the largest crypto exchanges and look at their performance.

But it cannot be said for sure that the site in the first positions of the ranking is 100% safe or convenient for a novice trader. The history of cryptocurrency exchanges knows examples when sites suddenly closed and froze for several hours or days. Sometimes withdrawal requests take quite a long time to process, but support is silent. But still, large resources take care of the security of transactions and quickly solve the listed problems. Therefore, ratings help beginners find out which crypto exchange is really worthy of their attention.

Join our group on VKontakte

The best cryptocurrency exchanges 2018

We list the largest exchanges with the highest trading volume. Unfortunately, almost all of them do not have a Russian-language interface.

Binance

Type : multicurrency Ruble support : no Verification : not required

The most popular international exchange, which began operating in 2017. and in just a few months it became one of the three largest trading platforms in the world. Daily trading volume is over $1 billion. Works exclusively with cryptocurrencies. Supports 118 coins, including all the most popular (except Ripple), has the lowest commissions: 0.1%. Without verification, you can withdraw up to 2 BTC per day. It has its own internal coin, bibance coin (BNB). Technical support is available in English only.

Bittrex

Type : multicurrency Ruble support : no Verification : required

Popular American trading platform. Its feature is a long list of supported altcoins (more than 180), which promise to grow in the future. It has a reliable security system: in addition to 2-factor authentication, email confirmation is required every time the IP is changed. Trading volume - $55.748 million. Main cryptocurrencies: bitcoin, ether, USFT stablecoin, commission - 0.25%. Operates in English.

Bitfinex

Type : multicurrency Ruble support : no Verification : required

Hong Kong trading platform, the eighth most popular and second in daily trading volume. Provides the opportunity for margin trading; documents for processing transactions must be translated into English. Supports transactions with fiat currencies (after user verification). The exchange list includes 24 cryptocurrencies and 59 pairs. The interface is convenient, with a large number of settings.

Yobit

Type : multicurrency Ruble support : yes Verification : optional

Russian trading platform for exotic fans. The list of assets it supports is perhaps the longest: 1,025 cryptocurrencies, of which 3,744 trading pairs are made up. Most of these coins are rare and in little demand, so many direct purchase and sale transactions can be completed exclusively on Yobit. The exchange has a multifunctional website where you can not only trade, but also play Dice, receive “free coins” daily, and participate in the IntestBox investment program. You can deposit and withdraw both cryptocurrencies and fiat using payment systems Qiwi, Yandex, Payeer, Advcash, etc.

HitBTC

Type : multicurrency Ruble support : no Verification : not required

A trading platform with five years of experience, registered in Britain, one of the leaders in terms of trading volume. The interface is very simple, intuitive even for those who do not know English well. That is why this platform has many users from post-Soviet countries. But there is another reason for HitBits’ popularity: it is usually one of the first to list new coins after an ICO. The number of cryptocurrencies presented on the site is impressive - 335, and any of them is suitable for replenishing your balance. Technical assistance is only in English.

Poloniex

Type : multicurrency Ruble support : no Verification : not required

A popular exchange operating since 2014. Initially created only for users from the USA, but soon became available worldwide. A very convenient platform for beginners, as it has a simple interface and a large number of analytical tools. Trading volume reaches $230 million, commissions range from 0.15% to 0.25%. Verification on the site is required only when withdrawing more than $2 thousand per day. Poloniex supports more than 60 coins, the main trading volume is in pairs with BTC, ETH, USDT, XRP.

Kraken

Type : multicurrency Ruble support : no Verification : required

Trading platform headquartered in San Francisco. It is one of the oldest (founded in 2011). Bloomberg was the first to be added to the terminal, the first to undergo a serious audit and still remains one of the most popular. The daily trading volume is $350.68 million. There are 17 coins on the exchange listing, the main ones being USD, EUR. The interface is somewhat confusing, in English and Japanese. Verification is required for users. Commissions - from 0.16% on sales to 0.26% on purchases.

Bithumb

Type : multicurrency Ruble support : no Verification : required

An exchange headquartered in Seoul, which accounts for about 75% of BTC trading in South Korea. Year of creation - 2015, commission size - 0.15%, trading volume for 24 hours - $1.62 billion. Significant disadvantages of the platform are an inconvenient interface, lack of tools for analysis, working only with Korean won (from fiat). There are also few supported cryptocurrencies: ETH, Dash, LTC, ETS, XRP, BCH, XMR, Zcash, EOS, BTG. Trading pairs are not designated; exchanges can be made between all listed coins.

Huobi.pro

Type : multicurrency Ruble support : no Verification : not required

The Chinese cryptocurrency exchange, operating since 2013. In the fall of 2017, as a result of prohibitive measures by the Chinese government, it was closed, but a few months later it opened after reconstruction with a reorientation to the international market. The interface has been translated into 10 languages, including Russian. The daily trading volume is more than $970 million, commissions are 0.2%. Users of the site can work with 200 currency pairs. Most transactions are carried out with USDT, BTC, ETH. Fiat funds are available for transactions with dollars and yuan.

localbitcoins

Type : BTC Ruble support : yes Verification : optional

An unusual platform that cannot be called an exchange in the traditional sense of the word. It is more of a tool through which sellers and buyers of cryptocurrencies can find each other. The service operates under the jurisdiction of Finland and theoretically supports transfers to any cards, since they are made by the users themselves, and the system only makes sure that everything is correct. Only one cryptocurrency is supported - BTC, the daily trading volume is $1.140 billion. The interface is translated into several languages, including Russian. Commissions may vary depending on network load. Trading pairs: Bitcoin with any fiat money.

Cryptocurrency trading

BitMEX

The company is not new to the market; it is included in almost all the top crypto exchanges. HDR Global Trading Limited is founded (based in Seychelles).

The key feature of the exchange is that it supports work with derivatives, that is, derivative instruments from the underlying asset. If you can trade cryptocurrency on Binance, then on BitMEX you will have to work with cryptocurrency futures.

This allows BitMEX to offer leverage of up to 1:100 (for cryptocurrency futures trading only). Such leverage is an unprecedented offer in the cryptosphere; usually, if margin trading is offered, it is with a leverage of the order of 1:3-1:5. Forex brokers that allow you to work with CFDs on crypto are limited to a maximum of 1:10-1:30.

Let’s also note the meager commission, even lower than on Binance. If you absorb liquidity, then you will have to pay a 0.075% fee for each trading operation; for those who create liquidity, a fixed rebate of 0.25% is set.

In most ratings, BitMEX is not shown in the general list precisely because trading here is carried out in crypto futures. As for turnover, according to coinmarketcap.com statistics, the daily trading volume exceeds $3 billion. This is more than that of top crypto exchanges.

Much fewer cryptocurrencies are supported compared to Binance; there is no work with fiat. If you are planning to work here and use leverage, carefully study the section on margin trading. In particular, under what conditions positions are liquidated and what requirements the platform puts forward to secure them.

Where do Russian-speaking traders trade?

For your convenience, we list the sites that are popular among Russian-speaking users.

Non-verification exchanges

- EXMO

- Livecoin

- YOBit

- Cryptopia

- HitBTC

On these exchanges, you just need to register to start trading. Without verification, all functionality will not be available (some options for depositing/withdrawing money, certain types of trading, exchanging large amounts, etc.). But basic operations, popular among novice traders, can be carried out without restrictions.

Exchanges with ruble support

- EXMO

- YOBit

- WEX

- LiveCoin

- Cex.io

- BitFlip.

You can enter and withdraw rubles using a number of electronic systems and exchangers. The ruble is also included in some trading pairs.

Rating of exchanges in Russian 2018

According to an analysis of search queries and user activity, the rating of crypto exchanges popular among Russian-speaking traders currently looks like this:

- Binance

- BitFlip

- BitMex

- LocalBitcoin

- KuCoin

- Livecoin

- Bitfinex

- Exmo

- YOBit

- Cex.io

- Huobi.

We previously wrote about trading platforms that the US Futures Trading Commission (CFTC) suspects of manipulating cryptocurrency rates.

conclusions

In this article, we reviewed the best cryptocurrency exchanges 2022 with a simple conclusion, in Russian, compared them by main features, as well as trading volume. Now you know what exchanges exist on the market and you can choose which cryptocurrency exchange is best for you. Subscribe to our social networks so as not to miss new articles, and if you have any questions, ask in the comments!

If you find an error, please select a piece of text and press Ctrl+Enter.

Gemini

American stock exchange founded by the Winklevoss brothers. It is available in 45 US states, as well as the UK, Singapore, South Korea and Hong Kong. Gemini's only supported currency is US dollars, and it only trades Bitcoin and Ethereum. A low flat rate of 0.25% is charged on both buyer and seller transactions.

Gemini accepts ACH transfers for quick access to funds for trading. The downside of the exchange is that the interface is not particularly beginner-friendly.

Cryptopia

It was founded in 2014 and supports hundreds of cryptocurrencies. The exchange offers its clients additional services, for example, servicing cryptocurrency wallets.

Cryptopia does not support exchange for fiat money, but accepts a huge number of coins - 400 items. Trading fee 0.20% per transaction. This sets the Bitcoin exchange apart from many competitors.

Which of these exchanges would you choose? Write about it in the comments to the article.

Want more news? Watch here and on Telegram. Follow us on social media. networks: Twitter, Youtube, Google+, Instagram, Facebook, , . Subscribe. If you liked the article, share it with your friends, on forums, on social media. networks - it’s not difficult for you