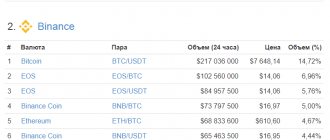

This overview of Binance and its ecosystem will give an overview of the Binance exchange and its features. BNB token within the ecosystem. Why is Binance today synonymous with a reliable cryptocurrency exchange?

Since 2022, the exchange has launched a futures division, Binance Futures, for margin trading.

Go to the Russian version of Binance Futures

Go to the Russian version of Binance

Useful links to the exchange in the media space: Telegram, Twitter, Medium, Instagram, Reddit, Facebook

What is the Binance exchange

The Binance cryptocurrency exchange is a marketplace that provides a platform for trading various cryptocurrencies. As of January 2022, Binance is the largest crypto exchange in the world by trading volume.

Binance was founded by Changpeng Zhao in 2022 in China. Previously, he developed trading software.

That same year, the exchange's headquarters were moved to Japan due to a ban on cryptocurrency trading in China. In March 2018, the company opened branch offices in Taiwan.

Also, in 2022, the headquarters of the Binance cryptocurrency exchange was moved to Malta after tightening cryptocurrency laws in Japan.

ICO Binance

The ICO conducted by Binance is considered a benchmark among the crypto community, judge for yourself:

- Binance ICO starts: July 1, 2022

- End of Binance ICO: July 21, 2022

- Collected: 15,000,000 USD

- Platform: Ethereum

- Token: Binance Coin (BNB)

- Total tokens: 200,000,000

- Tokens for sale: 100,000,000

Our last review was dedicated to the Bitmex exchange

Exchange team

| Changpeng Zhao | CEO. Founder |

| Roger Wang | Technical Director |

| James Hofbauer | Main architector |

| Sunny Li | Chief Operating Officer |

| Allan Yan | Product Director |

| Paul Jankunas | Vice President of Engineering |

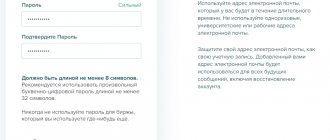

Registration on Binance

To register on the Binance cryptocurrency exchange, you only need an active e-mail. Registration of an account on the website and in the application is described below.

Registering an account on the site

Go to the official Binance website and click Register

Enter your email and password in the appropriate fields, check the box to agree to the Exchange Terms, and click Create account

.

Then it checks that a living person is registering (pull the slider to the right so that the puzzles match):

After verification, you will receive an email with a confirmation code:

Paste the code from the letter:

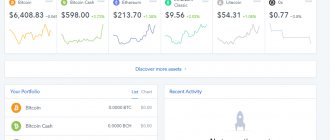

That's it, account registration is complete:

Also, after registration, it is recommended to enable two-factor authentication to protect your account. This is done in the Security

:

Registering a Binance account in the application

Download the Binance from Google Play or App Store:

Go to the application, click Register

(choose registration by phone number or e-mail):

Enter your e-mail or phone number, create a password, check the box to agree to the terms of use and click the Next . Then confirm that you are a human (combine the puzzles on the screen by dragging the slider to the right):

Enter the confirmation code that came by email or SMS if you registered by phone number:

Your account is now registered.

Note : Your login is the same for the site and application.

If you have previously created an account on the exchange website, you do not need to create it separately in the application. Click Login , enter your e-mail and existing password, you are authorized. Accordingly, on the contrary, if you initially created an account in the mobile application, then you will also log into your personal account on the website.

Options (Vanilla Options)

The options platform was launched by Binance at the end of December 2020. An option can be described as the right to do something at a certain time. The owner has the right to perform a specific action in the future at a given point in time, and the buyer can exercise this right or refuse it before the expiration date. The seller is obliged to comply with the buyer's decision.

On the Binance exchange, options are priced and settled in USDT. The tool gives users more options for portfolio diversification and managing market behavior. Users can purchase options for trading or hedging risks, as well as sell or issue them.

Verification of account on the exchange

In order to fund your account and trade cryptocurrencies, you must verify your data. Confirmation of personal data is a standard procedure for all exchanges. After passing verification, you will have access to the full functionality of the exchange.

Go to the Binance , log in, hover over the account icon (top right) and click Verify

:

You are taken to the Basic information

.

Click Verify

:

Select your country from the list, then click Start

:

In the required fields, enter your first name, last name, date of birth, residential address (here this is the street name, house number, apartment), zip code and city:

After sending the data for verification, go back to the Basic information

:

Click Identity and Face Verification

:

Select the type of document that proves your identity. It is best to have international documents, such as a passport or driver's license). Then click Continue

:

Upload a photo (scan) of the passport page where your name and photograph are indicated (all information must be legible) and confirm sending. After this, you need to take a photo of the person with the document and also upload it to confirm your identity.

The verification process lasts from an hour to several days. Usually within a few hours. A notification will be sent to your email stating that identity verification has passed or failed (the letter will indicate possible reasons).

Note : The most common reason for denial of account verification is an error when filling out the data or an illegible photo. Be careful when filling out the application. Also, the conditions for identity verification may differ for different countries, due to legal features or restrictions.

After passing verification, you can top up your balance and start trading cryptocurrencies.

Binance reviews

Having scoured the Internet in search of positive and negative reviews to give a qualitative assessment and answer the question of whether Binance is a scam or a profitable long-term investment, the following examples were found.

Binance Review #1 Binance Review #2

Review of Binance #3

Binance Review #4

How to open/replenish an account (deposit) on Binance

To start trading cryptocurrencies, you need to fund your account on the exchange. To deposit money using a regular credit card, point to Buy Cryptocurrency

(top left).

After that, click on Credit/Debit Card

:

A window will open for selecting the currency in which you will make the payment, the payment amount and selecting the cryptocurrency you want to buy:

For example, you want to buy Ethereum (ETH) for $100. Enter the deposit amount, select the USD currency and the required cryptocurrency below:

You confirm the payment and in a few minutes the cryptocurrency is in your balance.

Competitions from Binance (Competitions)

Among hundreds of other cryptocurrency exchanges, Binance stands out for its regular competitions and competitions, during which prizes are by no means the cheapest.

The competition is held in collaboration with various projects whose cryptocurrencies are listed on Binance.

Often the competition has one formula: The winner receives SOMETHING for the maximum traded volume of SOMETHING for SOME period.

An example would be competitions involving such cryptocurrency projects as BitTorrent, which was held on February 21, 2022.

$BTT Trading Competition, 200,000,000 $BTT To Give Away!https://t.co/BXBv8oRyBR pic.twitter.com/tjSoMv6a7k

— Binance (@binance) February 21, 2019

There is a possibility that such events are nothing more than a customized PR move. Since it is not uncommon for the organization of a competition to lead to a pump in the exchange rate. Thus, any information about listings or planned competitions is strictly classified.

How to withdraw money from the Binance cryptocurrency exchange

There are several ways to withdraw funds (for example, rubles) from your Binance wallet. The simplest one is withdrawal directly to a bank card.

Log in to your account, hover over the Wallet

(top right) and click on

Fiat and spot

:

You are taken to the Main Account

, click on

Output

:

Click on the Fiat

:

Next, select the desired currency. For each currency, withdrawal methods may differ. For example, you want to withdraw Russian rubles (RUB). Select rubles from the list and the available withdrawal options will open:

There are currently 5 options, three of which are currently unavailable for technical reasons (Suspended for maintenance). As you can see, withdrawing rubles directly to a bank card is inactive. Fiat transfer

is a transfer of currency within Binance, that is, to another account.

It is possible to withdraw rubles to the virtual wallet of the Advcash service (payment service). According to the conditions, this operation will be without commission. Before making a transfer using this method, you must have an active Advcash account.

Then withdraw money from your wallet to any card in the world. For example, for Russian, Ukrainian and Kazakh cards the commission will be 2.5%.

For example, for Ukrainian hryvnia (UAH) there are two withdrawal methods available. There is already a commission for the operation, but it is possible to withdraw directly to the card:

It is worth noting that the conditions and methods of withdrawal of funds may change on the exchange. You can always check the latest information on the website. In turn, the Binance administration additionally notifies users of changes.

Binance Commission

At the time of writing, the Binance exchange charges an average commission of 0.1% for each transaction made by the user. Those who choose to pay via Binance token (BNB) can get a 50% discount on trading fees, which is a good option to save money over the long haul. So far, this exchange has some of the lowest fees.

The commission for withdrawing funds from the exchange correlates from one cryptocurrency to another.

The table below shows the main types of commissions for withdrawing funds from the platform

| Cryptocurrency | Ticker | Commission | Type of payment |

| Binance Coin | BNB | 1 | BNB |

| Bitcoin | BTC | 0.001 | BTC |

| Ethereum | ETH | 0.01 | ETH |

| Litecoin | LTC | 0.01 | LTC |

| Neo | NEO | Free | NEO |

| Qtum | QTUM | 0.01 | QTUM |

| Status | SNT | 10 | SNT |

| Bancor | BNT | 1.2 | BNT |

| Eos | EOS | 0.7 | EOS |

| Bitcoin Cash | BCC | 0.0005 | BCC |

| Gas | G.A.S. | Free | G.A.S. |

| USDT | USDT | 50 | USDT |

There are no restrictions on the number of coins for transfers on the exchange, but there is a limit on withdrawals. Initially, registered users have a withdrawal limit of 2 bitcoins; in order to increase the amount of cryptocurrency for a one-time withdrawal, they must undergo verification.

How to withdraw cryptocurrency from Binance

Go to the Fiat and spot

in your account's Wallet:

Click Output

top right:

In the Cryptocurrencies

select the desired coin (for example, ETH):

Next, fill in the required fields. We recommend checking the recipient's wallet address very carefully so as not to accidentally send it to another user.

Then select the network over which the funds will be transferred. As you can see, there are three network options available for Ethereum. Other cryptocurrencies will have their own available networks.

Please note that transfer fees vary. Choose the one where the transaction fees are minimal, only the recipient’s wallet must also support this network. The recipient's available wallet networks are indicated in the services where they are registered.

After entering and verifying the recipient's address, selecting the transmission network and the amount of cryptocurrency, send the payment. Then you confirm it and wait for a notification that the payment has been completed.

Mining pool

Earn money using the Binance Pool mining pool

Miners can earn money by connecting to the Binance Pool. Supported hashing algorithms are SHA256 and Ethash. Thus, you can mine the cryptocurrencies BTC, BCH, BSV and ETH. Income is distributed according to the FPPS and PPS+ models; Maximum stability of income is ensured by instant payments.

The pool commission is 2.5% of earnings. By working in conjunction with the Binance crypto exchange, the user gets a convenient opportunity to earn assets and immediately use them for trading/investing.

How to withdraw rubles from the Binance cryptocurrency exchange

Using P2P transfers, that is, between users, you can withdraw Russian rubles (RUB) from the Binance exchange platform directly to your card without commission.

Go to the P2P transfers

:

At the top is a list of currencies available for transfers.

First you need to select rubles from the Fiat

, since the exchange takes place between the RUB/RUB pair.

Then go to Sell

. The currency you want to sell from your balance and transfer to your card must be RUB.

From the list below, select the most suitable conditions and make an exchange, following the further instructions. The list first displays the most favorable user conditions in terms of commission.

In this case, the first place is the user, from whom you can buy up to 30 thousand rubles by paying for a transfer to a QIWI wallet. In addition, for every ruble you receive, you receive 1.01 RUB (that is, you earn an additional 1% of the amount). In the second case, the exchange takes place 1:1, but it is possible to pay with a Sberbank or Tinkoff card.

Thus, the platform itself does not charge any fees. The terms of exchange are offered by the users themselves. However, the exchange acts as an intermediary and protects you from fraud. Until you receive funds on the card and confirm this, another user will not receive money from you.

Into real P2P transfer

the most profitable and fastest way to withdraw rubles to a bank card.

Transfer money from Spot wallet to P2P wallet

To buy or sell through P2P, you need to transfer the desired currency in which you will make transactions to your balance. If you want to sell rubles, you must first transfer them from a spot wallet to a p2p wallet.

Go to P2P wallet :

Find rubles in the list and click Transfer :

Choose to transfer from Spot wallet to P2P wallet and enter the required amount.

Note

: When working with other users using a P2P scheme,

never confirm a transfer order until you receive money on the card or cryptocurrency on an external wallet. Once confirmed, it will no longer be possible to challenge the situation.

Flexible and fixed deposits

Binance allows you to earn a certain percentage income on your unused cryptocurrency. There are two options for this:

- Fixed rate deposit. Implies blocking of funds for a period of 7 to 90 days. After this, the funds are returned with interest. This method is only available for stablecoins USDT, USDC and BUSD.

Earn money on Binance with fixed deposits - Floating rate deposit. There is no specific period, you can withdraw assets at any time, but the rate is much lower. The option is available for a large number of different cryptocurrencies and stablecoins (about 60).

Earn money on Binance with floating deposits

The process of depositing and withdrawing funds is extremely simple, carried out in a few clicks. Simply click “Transfer Assets” for the selected cryptocurrency, then enter the amount, specify the term (for fixed-rate deposits), agree to the platform terms and confirm the transfer.

How to trade on the Binance cryptocurrency exchange

To trade on the stock exchange, you first need to understand each type of trading, then you can choose the right one and practice.

In the Trading section on the exchange portal there are the following types of trading:

- Conversion

- Classical

- Advanced

- Margin

- P2P.

Trade type “Conversion”

The essence of this type of trading is very simple. You exchange/convert one cryptocurrency to another. Here you need to monitor the exchange rates of the currencies you are interested in, buy them cheaper and sell them more expensive. The difference will be your earnings.

It is worth noting that the rate of many cryptocurrencies has high volatility and changes very often. Therefore, with this type of trading, you need to be on guard all the time and monitor the course. This makes the process very difficult.

The exchange occurs as follows. For example, you have some ETH. You want to buy Dogecoin (DOGE). In the top field, enter the amount (let's say 0.1 Ether) you want to convert and select ETH. In the lower field, select the cryptocurrency into which you want to convert your Ethereum. Click Preview

to see how much DOGE currency you will receive (14,705 coins). Then make the conversion and the coins are on your balance.

>Classical

The classic type of cryptocurrency trading on the stock exchange occurs in the same way as in classic securities trading. Next, we will consider in detail the personal account of a crypto trader and how to make transactions.

Go to the Classic

trade:

Overview of the account for trading on the Binance exchange

You are taken to the trading room. It may seem difficult only at first. After several hours in it and conducting several transactions, you will get your bearings and understand the principle of trading on the stock exchange.

The office is divided into several main zones:

At the top left is the current trading pair (default BTC/USDT, bitcoin to dollar) and the BTC rate.

Below is a zone displaying changes in the Bitcoin exchange rate online:

In the center is a graph of BTC price changes with various parameters:

Below, under the rate chart, is a section on operations for the selected pair (buying and selling Bitcoin):

In the upper right corner is the area for selecting a trading pair:

All trading transactions on the exchange are displayed below. In the My transactions

, respectively, your operations:

Selecting a trading pair

The selection of a trading pair occurs in the office at the top right. It has six subsections by which you can filter for a specific currency. To select a cryptocurrency pair, we are interested in four subsections:

- BNB – cryptocurrency pairs relative to the Binance Coin (BNB) exchange token

- BTC – here are the pairs relative to Bitcoin

- ALTS – this subsection separately includes the main altcoins: Ethereum ETH, Tron TRX and Ripple XRP. Accordingly, pairs are selected relative to one of these three currencies

- FIAT – fiat currencies are included here (dollars, euros, rubles, etc.)

That is, to select the AAVE/ETH pair (for example), you hover your mouse over ALTS. There, click on ETH, then click on the first pair in the AAVE/ETH column (the list is formed alphabetically).

It is also possible to select through a search in the list. This way you will see all available pairs for the token of interest:

After selecting a trading pair, all data will be displayed for the selected cryptocurrency:

Analysis of exchange rate dynamics

To analyze the dynamics of the course, by default a graph with basic functionality is displayed in the account.

For beginners, the basic functionality will be enough to understand the course analysis process. For deeper and more professional analysis, there is a TradingView

:

Buying and selling cryptocurrency

There are three types of transactions available to you for trading cryptocurrency:

- Limit

,

Market

,

Stop Limit

These types of trades are similar to traditional securities trading. Once you figure it out, you can trade on any other exchange.

Limit – purchase/sale of cryptocurrency at a specified price

This type is a pending buy or sell order. That is, you yourself offer the price at which you want to make a transaction. Once the offer is accepted by another user, the transaction will take place.

To purchase at Limit

You must fill in the price field at which you want to buy and the number of coins.

Total

field will display the amount that will be debited from you for this transaction.

Next, click Buy

and wait for the order to be executed:

Exactly the same for sale, only in the Sell

:

Market – buying/selling cryptocurrency at the current price

In the Market

orders to buy or sell can only be executed at the current market price. You select only the required number of tokens.

Stop limit – buy/sell when the specified price threshold is reached

Transactions based on Stop Limit

similar to

Limit

with one difference.

You indicate not only the desired token price and quantity, but also the threshold price ( Stop

). When reached, the order is put up for trading.

For example, you bought 100 AAVE tokens for $10 and expect the price to continue to rise. When the price doubles, you want to sell all 100 tokens and make money on the difference.

Then Stop Limit

will look like this:

- Stop – $15 (this parameter should be between $10 and $20, but closer to a higher value)

- Limit – $20 (at this price you want to sell tokens)

- Quantity – 100 (maximum limited by the presence of the token being sold in the wallet)

- Total – $2,000 (the amount you will receive upon completion of the transaction is shown)

After filling out and checking all the items, click Sell

and wait.

In order for orders to Limit

and

Stop Limit

did not conflict with each other; the exchange has an

OCO

.

OCO combines both types of trading. When one of the orders is triggered ( Limit

by price or

Stop Limit

by Stop value), the other will be automatically canceled.

Advanced type of trading

All trading functions are included here in one account. This is convenient for experienced traders who use various types of trading. Everything is in one office and always “at hand”.

Margin – trading with leverage

The margin type of trading on the exchange is similar to classical trading only with borrowed funds. That is, the user is provided with leverage. For example, you have 1 thousand dollars, the exchange provides 3x leverage. Then you can buy $3 thousand worth of cryptocurrency. Naturally, the loan must then be repaid with interest.

This type of trading involves high risk and is highly not recommended for inexperienced traders.

P2P cryptocurrency trading

In this section of the exchange, you have the opportunity to buy and sell cryptocurrency directly from other users. This is a kind of advertising platform where users offer their services under certain conditions. At the same time, payment methods can be very different, so everyone assigns them personally. The exchange only acts as an intermediary.

This video clearly shows the process of buying currency:

Fundamental or technical analysis

Fundamental analysis is a method of estimating the true value of a financial asset based on a number of factors. These could be macroeconomic indicators, such as the state of the economy or individual industries associated with the asset.

Some data obtained during fundamental analysis is quite difficult to analyze on your own . Therefore, in some cases it makes sense to obtain information from third-party sources and attract qualified specialists from specific areas. This applies, for example, to data science, which studies blockchain systems. Metrics can take into account the hash rate of the cryptocurrency network, the number of participants, capitalization, and much more. A simpler and more understandable method in this case is the method of technical analysis. ✅

Technical analysis is the study of price in the past to predict it in the future.

Technical analysis predicts the most likely change in the value of assets based on market behavior over the past period. For this, a number of tools are used, such as indicators, graphic figures, etc.

Depending on the specific trading strategy, one of these approaches or a combination of them may be used.

In short, technical analysis is best used for short-term trading , and fundamental analysis for long-term trading . For example, when day trading it is better to use technical analysis methods. Traders make money on price changes that occur within one day, when macroeconomic indicators do not have time to undergo significant changes.

Related article: