World reserve currencies are only 5 national currencies of the world (USD, EUR, GBP, JPY, CHF), used by all states to replenish the gold and foreign exchange reserves of their Central banks, along with gold.

The sixth currency for gold and foreign currency reserves is the IMF's SDR (Special Drawing Rights) , which is de facto a currency basket consisting of

- USD 41.73%;

- EUR 30.93%;

- CNY 10.92%;

- JPY 8.33%;

- GBP 8.09%.

List of five world reserve currencies

| List of reserve currencies in the world | ||||||

| № | State | National currency | Ticker | Banknote denomination | Financial regulator | |

| 1 | Austria | Euro | ECB | EUR | monetary units: 5, 10, 20, 50, 100, 200, 500 | F.M.A. |

| 2 | Andorra | INAF | ||||

| 3 | Belgium | FSMA | ||||

| 4 | Germany | BaFin | ||||

| 5 | Greece | CMC | ||||

| 6 | Ireland | C.B.I. | ||||

| 7 | Spain | CNMV | ||||

| 8 | Italy | Consob | ||||

| 9 | Cyprus | CySEC | ||||

| 10 | Latvia | FCMC | ||||

| 11 | Lithuania | L.S.C. | ||||

| 12 | Luxembourg | CSSF | ||||

| 13 | Malta | MFSA | ||||

| 14 | Netherlands | AMF | ||||

| 15 | Portugal | CMVM | ||||

| 16 | Slovakia | N.B.S. | ||||

| 17 | Slovenia | SPS | ||||

| 18 | Finland | FIN-FSA | ||||

| 19 | France | ACPR | ||||

| 20 | Montenegro | Centralna Banka CG | ||||

| 21 | Estonia | FSAEE | ||||

| 22 | Great Britain | GBP | Bank of England | GBP | monetary units: 5, 10, 20, 50 | FCA |

| 23 | Switzerland | Swiss frank | National Library of Switzerland | CHF | bills: 10, 20, 50, 100, 200 and 1000 | FINMA |

| 24 | Japan | Japanese yen | Bank of Japan | JPY | banknotes: 1000, 2000, 5000, 10 000 | JSDA |

| North America | ||||||

| 25 | USA | U.S. dollar | Fed | USD | banknotes: 1, 2, 5, 10, 20, 50, 100 | |

Japanese yen (JPY) – a respectable third place

Previously, the Japanese yen was considered one of the most powerful safe-haven currencies. But its popularity has definitely declined over the past few years. And today this monetary unit occupies only third place in the financial market. The yen was created in 1871, although other gold, silver and paper money existed in parallel with it. Well, the international title came to her on May 11, 1953, exactly when the International Monetary Fund legalized her relationship with gold weighing 2.5 milligrams.

Of course, its volume in the modern financial market is significantly inferior to the leading dollar and euro. But this does not at all prevent the Japanese yen from occupying an honorable third place among the world's reserve currencies. This monetary unit differs from its competitors in its fairly high round-the-clock liquidity throughout the world. And despite its position among the leaders, the yen is indispensable in international financial markets.

World “reserve” and “freely convertible” currencies: common features and differences

Financial analysts often mistakenly use the terms “world reserve” and “freely convertible” currencies as synonyms . These are similar but not identical financial concepts.

There are 18 “freely convertible” currencies in the world from 38 countries . Of these, only five are also reserve currency - the US dollar, euro, British pound, Japanese yen and Swiss franc. The remaining 13 official currencies are candidates for inclusion in the reserve currencies.

| List of freely convertible currencies in the world | ||||||

| № | State | National currency | Ticker | Banknote denomination | Financial regulator | |

| 1 | Hungary | Hungarian forint | National Library of Hungary | HUF | banknotes: 500, 1000, 2000, 5000, 10,000, 20,000 | National Library of Hungary |

| 2 | Denmark | Danish krone | National Library of Denmark | DKK | banknotes: 50, 100, 200, 500 and 1000 | DFSA |

| 3 | Norway | Norwegian krone | Norwegian bank | NOK | banknotes: 50, 100, 200, 500 and 1000 | NFSA |

| 4 | Sweden | Swedish krona | Bank of Sweden | SEK | banknotes: 20, 50, 100, 200, 500, 1000 | |

| Oceania | ||||||

| 5 | Australia | Australian dollar | RB Australia | AUD | banknotes: 5, 10, 20, 50, 100 | ASIC |

| 6 | New Zealand | New Zealand dollar | RB NZ | NZD | banknotes: 5, 10, 20, 50, 100 | FSPR, NZX |

| Asia | ||||||

| 7 | Hong Kong | Hong Kong dollar | Hong Kong parole | HKD | bills: 10, 20, 50, 100, 500 and 1000 | SFC |

| 8 | Israel | Shekel | Bank of Israel | ILS | banknotes: 20, 50, 100 and 200 | ISA |

| 9 | The Republic of Korea | South Korean won | Bank of South Korea | KRW | monetary units: 1000, 5000, 10000 and 50000 | FSC |

| 10 | Singapore | Singapore dollar | DKUS | SGD | banknotes: 2, 5, 10, 50, 100, 1000, 10,000 | M.A.S. |

| North America | ||||||

| 11 | Canada | Canadian dollar | Bank of Canada | CAD | monetary units: 5, 10, 20, 50, 100 | IIROC |

| 12 | Mexico | Mexican Peso | Bank of Mexico | MXN | banknotes: 20, 50, 100, 200, 500, 1000 | CNBV |

| Africa | ||||||

| 13 | South Africa | South African rand | SARB | ZAR | banknotes: 10, 20, 50, 100, 200 | FSCA |

Usage

As was said, world reserve currencies belong to each individual state and can be used for any purpose for the organization of the state itself. At the same time, however, all civilized countries of the world spend such funds in an extremely small number of cases, which in most cases is due to the possibility of a fall in the value of the main national unit and a further crisis.

The world reserve currency, regardless of state and regional standards, can be equally used as:

- the main means of resolving problems with the exchange rate of the main national currency in the event of significant foreign exchange interventions;

- significant investment asset in any area;

- fixed assets of the state intended to pay all particularly important bills during export operations.

Of course, these are only the basic possibilities that can be realized if the state has the reserve currencies of the world.

Status and functions of the world reserve currency

- Reserve currencies are a kind of “super league” of freely convertible currencies, equal in status to gold, which are included in the assets of the Central Bank and, on their basis, the national banks of the country

- maintains the exchange rate of its national fiat money (including through interventions in the foreign exchange market);

provide all export and import applications for payments from exporters and importers;

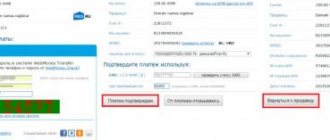

- ensure uninterrupted operation of all exchange offices in the country and international payment systems (Mastercard, WebMoney Visa, Paysend Yandex.Money, Skrill, Perfect Money, PayPal, Alipay Sberbank Online, UnionPay Alfa-click, etc.;

- Reserve currencies form 89.08% of the SDR (Special Drawing Rights) of the IMF, which means 89.08% participate in international lending to states. Read more in the main article - Creditors or to whom the world's population owes $244 trillion.

- Reserve currencies provide 90% of the formation of currency pairs in the Forex market. Please note that the most popular quotes and online charts with the smallest spreads are available for currency pairs involving reserve currencies. This

a) between two reserve currencies - EUR USD, GBP USD, USD JPY, USD CHF, USD CAD, NZD USD, AUD USD, EUR CHF, GBP JPY, EUR JPY, EUR GBP, GBP CHF, CHF JPY,b) between two hard currency - candidates for reserve currency status: GBP AUD, AUD CHF, EUR NZD, EUR AUD, EUR CAD, EUR NOK, EUR SEK, AUD JPY, NZD JPY, CAD JPY, NZD CHF, CAD CHF, USD SGD , USD HKD, USD ZAR, USD ILS, USD MXN, GBP CAD, GBP NZD, GBP SEK, GBP NOK, USD SEK, ZAR JPY USD NOK, USD CNY,

c) compare with other currency pairs involving partially convertible currencies, which are rarely found among bank brokers, dealers and forex brokers - USD INR, GBP ETB, USD CZK, GBP NAD, EUR XAF, USD TND, USD RUB, CAD UGX, USD THB, JPY SDG, EUR RUB, EUR SOS, USD UAH, CAD SCR, USD BYN, GBP LYD, GBP RWF, USD PLN, JPY MZN, PLN RUB, GBP KES, CHF MAD, USD TRY, GBP MRU, EUR ZMW, USD XOF, RUB TJS, CAD CDF, JPY MGA, RUB EGP, EUR TZS, CAD MUR, EUR TZS, USD NGN,

. Read more in the main article Criteria and possibilities of the “freely convertible currency” status.

This situation is not accidental:

- the minimum spread is formed for currency pairs formed from 2 reserve currencies (or a reserve and a freely convertible official currency);

- the maximum spread is observed for currency pairs involving partially convertible currencies (Belarusian ruble, Ukrainian hryvnia, Polish zloty, Serbian dinar, Czech crown, Albanian lek, Bulgarian lev, Bosnia and Herzegovina convertible mark, Moldovan leu, etc.).

Stable Swiss franc (CHF)

People first started talking about this currency back in 1850. In terms of its nominal value, this monetary unit was equal to the French franc. The main advantage of this currency is that it is practically the most stable in the world. Throughout history, the devaluation of the franc has been recorded only a few times. Thanks to this, it enjoys high trust among citizens around the world.

Traditionally, the Swiss franc is classified as the currency of low-tax zones with zero inflation. As a reserve currency, it has secured fourth place. And although it represents the only monetary unit that is not part of the EU and the G7 countries, and its share almost never rises above 0.3%, thanks to its “eternal” stability, it never loses its position in the world market . Although, with the introduction of the European single currency, the constancy and immutability of the Swiss franc exchange rate was somewhat diminished.

The system of reserve currencies and the key rate of the Central Bank in the world

The fourth significance of reserve currencies is the formation of a global trend to increase or decrease the key rate in the world . All banks in the world are guided by the key interest rates of the Central Bank of reserve currencies and, if they change, they immediately carry out a similar action (increase or, conversely, decrease).

Next, commercial banks change interest rates on their retail loans and deposits , accelerating (or slowing down) the development of business processes in their countries, the level of inflation, the average salary by sector of the economy, followed by the degree of devaluation / revaluation of their own national currencies, the filling of the state budget and the size its deficit (or surplus).

Key rates of the world Central Bank:

| Key rates of the Central Bank of the world on Forex currencies | |||||

| A country | central bank | Currency and its ticker | Central Bank key rate | Date of entry | Financial regulator |

| Australia | RB Australia | Australian dollar (AUD) | 0.5% | 03.03.2020 | ASIC |

| Great Britain | Bank of England | pound sterling (GBP) | 0.25% | 11.03.2020 | FCA |

| Hong Kong | Hong Kong Monetary Authority | Hong Kong dollar (HKD) | 0,86% | March 2020 | SFC |

| European Union | European Central Bank | euro (EUR) | 0% | 12.03.2020 | MiFID (EU requirements), ACPR and AMF (France), BaFin (Germany), Consob (Italy), CySEC (Cyprus), MFSA (Malta), AFM (Netherlands), FSAEE (Estonia), CMVM (Portugal), FSMA ( Belgium), CNMV (Spain), FCMC (Latvia) |

| Canada | Bank of Canada | Canadian dollar (CAD) | 1.25% | 04.03.2020 | IIROC |

| China | People's Bank of China | Yuan (CNY) | 4.35% | 20.11.2019 | CSRC, FinCom |

| New Zealand | Reserve Bank of New Zealand | New Zealand dollar (NZD) | 0,25% | 15.03.2020 | FSCL |

| Singapore | Monetary Authority of Singapore | Singapore dollar (SGD) | 1.26% | February 2020 | M.A.S. |

| USA | US Federal Reserve | US dollar (USD) | 0.25% | 15.03.2020 | NFA, CFTC, SEC |

| Switzerland | National Library of Switzerland | Swiss franc (CHF) | -0.75% | 12.12.2019 | FINMA |

| Japan | Bank of Japan | Japanese yen (JPY) | -0.1% | 16.03.2020 | JFSA |

| Other forex currencies in Europe | |||||

| Albania | Bank of Albania | Albanian lek (ALL) | 1% | 18.12.2019 | FSC Albania |

| Belarus | National Library of the Republic of Belarus | Belarusian ruble (BYN) | 8,75% | 19.02.2020 | ARFIN |

| Bulgaria | Bulgarian People's Bank | Bulgarian Lev (BGN) | 0% | 2.01.2020 | FSC Bulgaria |

| Bosnia and Herzegovina | Central Bank of BiH | Convertible mark | 3.03% | 15.02.2020 | Central Bank of BiH |

| Hungary | National Library of Hungary | Hungarian forint (HUF) | 0.9% | 28.01.2020 | HFSA Hungary |

| Gibraltar | Treasury of Gibraltar | Gibraltar pound (GIP) | May 2020 | Treasury of Gibraltar | |

| Denmark | National Bank of Denmark | Danish krone (DKK) | — 0.75% | March 2020 | DFSA Denmark |

| Iceland | Central Bank of Iceland | Icelandic krona (ISK) | 2,75% | March 2020 | FSA Iceland |

| Moldova | National Bank of Moldova | Moldovan leu (MDL) | 4.5% | 04.03.2020 | Licensing Chamber |

| Norway | Norwegian Bank | Norwegian krone (NOK) | 1% | 13.03.2020 | NFSA |

| Poland | National Bank of Poland | Polish zloty (PLN) | 1.5% | 08.01.2020 | PFSA/KNF |

| Russia | Bank of Russia | Russian ruble (RUB) | 6% | 07.02.2020 | Bank of Russia (until 2013, Federal Financial Markets Service) |

| Romania | National Bank of Romania | Romanian leu (RON) | 2.5% | 07.02.2020 | A.S.F. |

| North Macedonia | People's Bank of the Republic of North Macedonia | Macedonian dinar (MKD) | 2% | May 2020 | National Library of Macedonia |

| Serbia | People's Bank of Serbia | Serbian dinar (RSD) | 2,25% | March 2020 | National Library of Serbia |

| Ukraine | National Bank of Ukraine | Ukrainian hryvnia (UAH) | 11.0% | 30.01.2020 | NCCPF |

| Croatia | Croatian People's Bank | Croatian kuna (HRK) | 2.5% | February 2020 | HANFA |

| Czech | National Bank of the Czech Republic | Czech crown (CZK) | 2% | 06.02.2020 | CNB |

| Sweden | Bank of Sweden | Swedish krona (SEK) | 0% | 12.02.2020 | (FSA Sweden) |

| Forex currencies in Asia | |||||

| Azerbaijan | Central Bank of the Azerbaijan Republic | Azerbaijani manat (AZN) | 7.5% | February 2020 | MBA |

| Armenia | Central Bank of the Republic of Armenia | Armenian dram (AMD) | 5.5% | 07.01.2020 | Ministry of Finance |

| Afghanistan | Yes Afghanistan Bank | Afghan Afghani (AFN) | 15% | March 2020 | Yes Afghanistan Bank |

| Bangladesh | Bangladesh Bank | Bangladeshi Taka (BDT) | 6% | March 2020 | Bangladesh Bank |

| Bahrain | Central Bank of Bahrain | Bahraini Dinar (BHD) | 1% | March 2020 | Central Bank of Bahrain |

| Brunei | Brunei Monetary Authority | Brunei dollar (BND) | 5,5% | March 2020 | UDOB |

| Butane | Royal Monetary Authority of Bhutan | Ngultrum (BTN) | 7,04% | March 2020 | HLC Bhutan |

| Vietnam | GB of Vietnam | Vietnamese dong (VND) | 6% | February 2020 | SSC |

| Georgia | National Library of Georgia | Georgian lari (GEL) | 9% | 29.01.2020 | National Library of Georgia |

| Israel | Bank of Israel | Israeli shekel (ILS) | 0.25% | 09.01.2020 | ISA |

| India | Reserve Bank of India | Indian Rupee (INR) | 5.15% | 06.02.2020 | SEBI |

| Indonesia | Bank Indonesia | Indonesian rupiah (IDR) | 5% | 21.02.2020 | Bappebti |

| Jordan | Central Bank of Jordan | Jordanian dinar (JOD) | 2,5% | March 2020 | Central Bank of Jordan |

| Iraq | Central Bank of Iraq | Iraqi dinar (IQD) | 4% | March 2020 | Central Bank of Iraq |

| Iran | Central Bank of the Islamic Republic of Iran | Iranian rial (IRR) | 18% | March 2020 | Central Bank of Iran |

| Yemen | Central Bank of Yemen | Yemeni rial (YER) | 27% | March 2020 | Central Bank of Yemen |

| Kazakhstan | National Bank of the Republic of Kazakhstan | Kazakhstan tenge (KZT) | 12% | 17.03.2020 | AFSA |

| Cambodia | National Bank of Cambodia | Cambodian riel (KHR) | 1,46% | March 2020 | National Library of Cambodia |

| Qatar | Central Bank of Qatar | Qatari rial (QAR) | 2,5% | March 2020 | Central Bank of Qatar |

| Kyrgyzstan | National Bank of the Kyrgyz Republic | Kyrgyzstani som (KGS) | 4,25% | January 2020 | National Library of Kyrgyzstan |

| DPRK | Central Bank of the DPRK | North Korean won (KPW) | n.d. | n.d. | Central Bank of the DPRK |

| The Republic of Korea | Bank of South Korea | won (KRW) | 0.75% | 16.03.2020 | FSC |

| Kuwait | Central Bank of Kuwait | Kuwaiti Dinar (KWD) | 1.5% | 16.03.2020 | Central Bank of Kuwait |

| Laos | Bank of Lao PDR | Laotian kip (LAK) | 4% | March 2020 | Bank Lao PDR |

| Lebanon | Bank of Lebanon | Lebanese pound (LBP) | 6,75% | March 2020 | Bank of Lebanon |

| Malaysia | Bank Negara Malaysia | Malaysian ringgit (MYR) | 2.5% | March 2020 | Bank Negara Malaysia |

| Macau | Macau Currency Authority | Macau pataca (MOP) | 0,86% | >March 2020 | UDOM |

| Mongolia | Bank of Mongolia | Mongolian tugrik (MNT) | 11% | 05.01.2020 | Financial Regulatory Committee of Mongolia |

| Myanmar | Central Bank of Myanmar | Myanmar Kyat (MMK) | 10% | March 2020 | Central Bank of Myanmar |

| Nepal | Nepal Rastra Bank | Nepalese rupee (NPR) | 5,5% | March 2020 | Nepal Rastra Bank |

| UAE | Central Bank of the UAE | UAE dirham (AED) | 1,5% | March 2020 | Dubai? FSA |

| Oman | Central Bank of Oman | Omani rial (OMR) | 2,15% | March 2020 | CMA |

| Pakistan | State Bank of Pakistan | Pakistani rupee (PKR) | 11% | March 2020 | GB of Pakistan |

| Saudi Arabia | ADO SA | Saudi Riyal (SAR) | 1,75% | March 2020 | CMA |

| Syria | Central Bank of Syria | Syrian pound (SYP) | 0% | March 2020 | Central Bank of Syria |

| Tajikistan | National Bank of Tajikistan | Tajikistani somoni (TJS) | 12,75% | January 2020 | National Library of Tajikistan |

| Thailand | Bank of Thailand | Thai baht (THB) | 1.25% | 05.02.2020 | Bank of Thailand |

| Turkmenistan | Central Bank of Turkmenistan | Turkmen manat (TMT) | 5% | January 2020 | Central Bank of Turkmenistan |

| Türkiye | Central Bank of Turkey | Turkish lira (TRY) | 10,75% | 19.02.2020 | C.M.B. |

| Uzbekistan | Central Bank of Uzbekistan | Uzbek som (UZS) | 16% | March 2020 | Central Bank of the Republic of Uzbekistan |

| Philippines | Central Bank of the Philippines | Philippine Peso (USD) | 3,75% | March 2020 | Central Bank of the Philippines |

| Sri Lanka | Central Bank of Sri Lanka | Sri Lankan rupee (LKR) | 7,5% | March 2020 | Central Bank of Sri Lanka |

| Forex currencies in Africa | |||||

| Algeria | Bank of Algiers | Algerian dinar (DZD) | 3.75% | March 2020 | EFSA |

| Angola | National Library of Angola | Angolan Kwanzaa (AOA) | 15,5% | May 2020 | National Library of Angola |

| Benin | Central Bank ZAG | West African franc (XOF) | 4,5% | ay 2020 | Central Bank ZAG |

| Botswana | Bank of Botswana | Botswana Pula (BWP) | 4,25% | ay 2020 | Bank of Botswana |

| Burkina Faso | Central Bank ZAG | West African franc (XOF) | 4,5% | ay 2020 | Central Bank ZAG |

| Burundi | Bank of the Republic of Burundi | Burundian franc (BIF) | 5,25% | ay 2020 | Bank of the Republic of Burundi |

| Guinea | Central Bank of the Republic of Guinea | Guinean franc (GNF) | 11% | ay 2020 | Central Bank of the Republic of Guinea |

| Egypt | Central Bank of Egypt | Egyptian pound (EGP) | 12.25% | 16.01.2020 | COSOB |

| Zambia | Bank of Zambia | Zambian kwacha (ZMW) | 11,5% | ay 2020 | SEC |

| Zimbabwe | RB Zimbabwe | US dollar, pound sterling, rand | 25% | art 2020 | RB Zimbabwe |

| Cameroon | Bank of Central African States | Central African franc (XAF) | 3,25% | ay 2020 | B GCA |

| Kenya | Central Bank of Kenya | Kenyan shilling (KES) | 7% | ay 2020 | Central Bank of Kenya |

| Congo | Central Bank of Congo | Congolese franc (CDF) | 7,5% | ay 2020 | Central Bank of Congo |

| Ivory Coast | Central Bank ZAG | West African franc (XOF) | 4,5% | ay 2020 | Central Bank ZAG |

| Libya | Central Bank of Libya | Libyan dinar (LYD) | 3,32% | ay 2020 | Central Bank of Libya |

| Mauritius | Bank of Mauritius | Mauritian rupee (MUR) | 2,85% | ay 2020 | Bank of Mauritius |

| Mauritania | Central Bank of Mauritania | Mauritanian ouguiya (MRU) | 6,5% | May 2020 | Central Bank of Mauritania |

| Madagascar | Central Bank of Madagascar | Malagasy Ariary (MGA) | 9,5% | May 2020 | Central Bank of Madagascar |

| Morocco | Bank al-Maghrib | Moroccan Dirham (USD) | 2,25% | March 2020 | AMMC |

| Mozambique | Bank of Mozambique | Mozambican metical (MZN) | 11,25% | March 2020 | Bank of Mozambique |

| Namibia | Bank of Namibia | Namibian dollar (NAD) | March 2020 | Bank of Namibia | |

| Nigeria | Central Bank of Nigeria | Nigerian Naira (NGN) | 13,5% | May 2020 | SEC Nigeria |

| Rwanda | National Library of Rwanda | Rwandan franc (RWF) | May 2020 | National Library of Rwanda | |

| Seychelles | Central Bank of Seychelles | Seychelles rupee (SCR) | 5% | May 2020 | FSA (SC) |

| Senegal | Central Bank ZAG | West African franc (XOF) | 4,5% | May 2020 | Central Bank ZAG |

| Somalia | Central Bank of Somalia | Somali shilling (SOS) | May 2020 | Central Bank of Somalia | |

| Sudan | Central Bank of Sudan | Sudanese pound (SDG) | 16,5% | May 2020 | Central Bank of Sudan |

| Tanzania | Bank of Tanzania | Tanzanian shilling (TZS) | 5% | May 2020 | CMSA |

| Tunisia | Central Bank of Tunisia | Tunisian dinar (TND) | 7.75% | February 2020 | Central Bank of Tunisia |

| Uganda | Bank of Uganda | Ugandan shilling (UGX) | 8% | May 2020 | Bank of Uganda |

| Chad | Bank of Central African States | Central African franc (XAF) | 3,25% | May 2020 | GCA Bank |

| Equatorial Guinea | Bank of Central African States | Central African franc (XAF) | 3,25% | ay 2020 | GCA Bank |

| Ethiopia | National Bank of Ethiopia | Ethiopian birr (ETB) | 5,21% | May 2020 | National Bank of Ethiopia |

| South Africa | South African Reserve Bank | South African rand (ZAR) | 6.25% | 16.01.2020 | FSCA |

| Forex currencies in Latin America | |||||

| Argentina | Central Bank of Argentina | Argentine Peso (ARS) | 38% | March 2020 | CNV |

| Bahamas | Central Bank of the Bahamas | Bahamian dollar (BSD) | 4% | April 2020 | SCB |

| Belize | Central Bank of Belize | Belize dollar (BZD) | 2,3% | April 2020 | IFSC |

| Bermuda | Parole Bermuda | Bermudian dollar (BMD) | 0% | April 2020 | B.M.A. |

| Bolivia | Central Bank of Bolivia | Boliviano (BOB) | 2,79% | March 2020 | ASFI |

| Brazil | Central Bank of Brazil | Brazilian real (BRL) | 4.25% | 06.02.2020 | CVM |

| Haiti | Bank of the Republic of Haiti | Haitian gourde (HTG) | 22% | April 2020 | Bank of Haiti |

| Honduras | Central Bank of Honduras | Honduran Lempira (HNL) | 4,5% | April 2020 | Central Bank of Honduras |

| Grenada | Eastern Caribbean Central Bank | East Caribbean dollar (XCD) | 0,25% | April 2020 | Eastern Caribbean Central Bank |

| Dominican Republic | Central Bank of the DR | Dominican Peso (DOP) | 4.5% | February 2020 | DFSU |

| Colombia | Bank of the Republic | Colombian peso (COP) | 4.25% | March 2020 | Bank of the Republic |

| Costa Rica | Central Bank of Costa Rica | Costa Rican colon (CRC) | 2,79% | March 2020 | SUGEVAL |

| Cuba | Central Bank of Cuba | Cuban Peso (CUP) | 2,25% | January 2020 | Central Bank of Cuba |

| Mexico | Bank of Mexico | Mexican Peso (MXN) | 7.00% | 13.02.2020 | CNBV |

| Nicaragua | Central Bank of Nicaragua | Nicaraguan Cordoba (NIO) | 7,2% | April 2020 | SIBOIF |

| Panama | NB of Panama | Panamanian Balboa (PAB) | 1,36% | April 2020 | NB of Panama |

| Paraguay | Central Bank of Paraguay | Paraguayan Guarani (PYG) | 1,25% | April 2020 | Central Bank of Paraguay |

| Peru | RB Peru | Peruvian salt (PEN) | 1,25% | 13.02.2020 | SBS, SMV |

| Saint Vincent and the Grenadines | Eastern Caribbean Central Bank | East Caribbean Dollar(XCD) | 0,25% | April 2020 | FSA St. VG |

| Chile | Central Bank of Chile | Chilean peso (CLP) | 1.75% | 30.01.2020 | SBIF |

| Jamaica | Bank of Jamaica | Jamaican dollar (JMD) | 0,5% | March 2020 | FSC Jamaica |

Comments Wiki Masterforex-V : Please note that the key rates on all reserve currencies are very, very low, which allows you to issue loans in Swiss francs, Japanese yen, pounds, euros and US dollars at a very low interest rate, which in turn increases the attractiveness of these reserve currencies.

The world government also has its own currency. It will be launched on August 23

In his small investigation, Doctor of Economic Sciences, head of the Russian Economic Society, Valentin Katasonov shows how the innocent financial instrument “Special Drawing Rights” is gradually becoming the official currency of the new world government.

Globalists' lifesaver coin

Back in 2022, active conversations began in and around the International Monetary Fund (IMF) that the Fund should issue a large batch of SDRs. This abbreviation hides the English term - Special Drawing Rights (SDR, special drawing rights). This is supranational non-cash money, which only the IMF has the right to issue; they can only be used for very specific purposes.

The decision to create such a “limited use” currency was made back in 1969, and the first batch was released on January 1, 1970 - more than half a century ago. Then there were several more issues, and in total in the early 1970s there were 9.3 billion SDR units in the world.

SDRs are distributed among states in proportion to their shares in the capital of the Fund and are placed in special accounts of member countries. This “money” is part of national international reserves and can move from account to account of IMF member countries as a result of purchases of other currencies from international reserves or as a result of the provision of mutual loans. SDRs cannot currently be used for regular trading or investment purposes.

At the time of the birth of the SDR, this currency was equated to the US dollar (1 SDR = 1 $) and was dubbed “paper gold”. Moreover, it was expected that the gold dollar standard would be replaced by a standard based on the SDR. But that did not happen. In 1976, at the Jamaica Conference, a decision was made to demonetize gold (depriving gold of the status of money) and to establish a paper dollar standard. The American dollar was proclaimed the ruler of the monetary and financial world. And how the SDR rate is determined now, I wrote not so long ago on Constantinople.

They seem to have forgotten about SDR. True, in 1979-81. More issues were carried out for a total of 12 billion SDRs, but they did not make a difference. But after almost three decades, the IMF again conducted two issues - in August and September 2009 for a total amount of SDR 182.7 billion - many times more than during the entire period of existence of this quasi-currency!

The Fund itself and experts commented on such a gigantic issue by saying that it was urgently necessary to extinguish the fire of the global financial crisis of 2008-09. The capabilities of individual states were exhausted, and then the world financial authorities remembered such a “stick”, or rather a “magic coin” (although this currency is not issued in physical form), as SDR.

A decade of the IMF crisis

The IMF's resource base in the second decade of this century did not look very strong; it might not be sufficient to extinguish the fire of the next global crisis. There were discussions about the need to reform the Fund by increasing the contributions of member countries to its capital while simultaneously changing state quotas in this capital. A number of countries have significantly strengthened their positions in the world economy and, naturally, demanded an increase in their quotas, and with them an increase in their share of votes). First of all, these are the BRICS countries. Traditional world leaders, and primarily the United States, of course, did not want such a revision, because feared the loss of their control over the Foundation. Currently, the United States has a voting share of 16.51%, which allows it to use such an important management tool as the veto, which requires at least 15% of the votes. Thus, the United States can block any financial decision important for the planet - a good help for issuing a reserve currency and military dominance!

The Fund's reform has reached a dead end. And then an alternative, compromise option was born to strengthen the Fund’s resource base - through a large-scale issue of “paper gold”. Of course, many developing countries would like to see a large-scale emission of SDRs carried out simultaneously with a revision of quotas in their favor. But the West resisted. In the end, developing countries began to agree to emissions even without revising quotas. But then the Fund’s main shareholder, the United States, unexpectedly began to resist. President Donald Trump believed that a large-scale issue of SDRs would strengthen countries such as China, Russia, Iran and the like, i.e. countries with anti-American foreign policy. In general, in the past decade there has been a lot of talk about a possible issue, but they all turned out to be empty.

Vaccinate at any cost

The case moved forward in 2022. The impetus was given by the COVID-19 pandemic and the subsequent global economic crisis. This spurred negotiations on a large-scale issue of SDRs by the Fund. At the end of last year, Joe Biden won the US presidential election, and he, unlike Trump, did not object to expanding the IMF’s resource base through the large-scale issue of international “currency.”

At the end of 2022, another argument was added in favor of issuing “paper gold,” which was very far from finance. The World Health Organization has announced a policy of universal vaccination. But vaccinating 80% of the world's population against the virus is very expensive.

Of course, rich Western countries, especially those whose central bank “printing presses” (US Federal Reserve, ECB, Bank of Japan, etc.) operate at full capacity, do not have such problems. But for third world countries, especially the poorest, this problem is extremely difficult to solve. The IMF, of course, tried and is trying to “help” such countries by imposing loans. But the latter almost do not react to free cheese in a mousetrap.

So, it is necessary to vaccinate hundreds of millions, and maybe even a billion people in countries where there is no money for this either in the pockets of citizens or in the state treasury. The plan of the WHO (and the world behind it) may fail.

No money - no health

In order not to be unfounded, I will provide vaccination data for individual countries as of August 2 of this year (share of fully vaccinated people in the total population, %; in brackets - the share of those who received at least one dose of vaccine in the total population, %):

- USA – 49.51 (57.58)

- Germany – 51.69 (61.06)

- UK – 56.34 (68.65)

- Nigeria – 0.66 (1.20)

- Rwanda – 1.90 (3.18)

- Republic of the Congo – 1.17 (2.34)

- Papua New Guinea – 0.11 (0.86)

- Mozambique – 0.99 (1.16)

- Mali – 0.25 (0.69)

- Central African Republic (CAR) – 0.17 (1.74)

- Chad – 0.04 (0.13).

As they say, feel the difference between the “rich North” and the “poor South”. There is no money - please die from the coronavirus on your health (although, of course, the benefits of vaccinations are not so obvious). There are many countries where complete vaccination still falls short of one percent. For more than a year now, the countries of the “rich North” (primarily the G7) have been discussing the issue of chipping in and helping the “poor South” carry out universal vaccination. The IMF and the G7 countries have even calculated how much money needs to be raised for such “humanitarian aid” - about $100 billion. But nothing was agreed upon. Therefore, they decided that the most painless way to help the “poor South” was to authorize the issue and distribution of SDR.

Tsargrad recently wrote about Russia’s share in this project and how much the donated 18 billion SDR (dollars) will cost us.

They issued it themselves - they divided it themselves

In early June, at the next annual G7 summit in England, its participants gave the final go-ahead for the preparation of the Fund’s issue of SDRs. The exact amount was determined - the equivalent of 650 billion US dollars. The exact date was not determined, but they committed to carry out the operation until the end of summer 2022.

The wheels of the IMF bureaucracy began to spin quickly. And on Monday, August 2, the Fund’s Board of Governors approved the allocation of SDRs in the amount of $650 billion. The distribution of this amount between countries according to their quotas is scheduled for August 23. Experts have already calculated what the distribution will roughly look like. An amount equivalent to $375–400 billion will go to rich (“economically developed”) countries. For everyone else – $250–275 billion. At the same time, low-income countries (“the poorest” countries) will receive only 21 billion, or about 3% of the total SDR emission volume.

Screenshot: Oxford Famine Relief Committee (Oxfam.org)

The fact that issuing SDRs in an amount equivalent to $650 billion will not fully solve the problem of universal vaccination was discussed behind closed doors at the last G7 summit. There were calls for rich countries, which will receive about $400 billion as a result of the distribution of SDRs, to donate at least a quarter of this amount to help poor and extremely poor countries to urgently eliminate the consequences of the pandemic, that is, to fully vaccinate the population of such countries. However, the call remained a call: no specific agreements were reached on the mobilization of one hundred billion. Ideologists of universal vaccination called this a blatant manifestation of “national egoism.”

Both after the G7 summit and after the final decision of the Fund’s Board of Governors on the issue of SDRs, the question of where to find the missing $100 billion remains. Some observers note that even when the Fund's 190 member countries receive their SDR amounts due in their accounts on August 23, the problem of a shortage of funds for vaccination of poor and poor countries may remain.

The Fund will become a Bank, and SDR – a full-fledged currency?

Some experts are closely following the plans for issuing SDRs and come to the conclusion that the governments of the G7 countries and the Fund itself are simultaneously discussing the issue of a possible radical reform of the IMF. The famous publication The Daily Reckoning published an article entitled “The Great Reset Is Here.” Its author is Jim Rickards, an economist, lawyer, and a well-known person in the world of finance. He was the government's chief negotiator during the 1998 rescue of hedge giant Long Term Capital Management. Rickards is also the author of the acclaimed book The Road to Ruin: The Global Elites' Secret Plan for the Next Financial Crisis, which was published in 2016. Currently, he is the Chief Executive Officer of Market Intelligence at the consulting firm Omnis, Inc.

Jim Rickards is a very informed man. He claims that after the global financial crisis of 2008-2009. It became clear to many that the Jamaican monetary and financial system, based on the paper dollar, would not last long, and that it was necessary to prepare an alternative to the US dollar. And such an alternative can and should be a half-forgotten currency called “SDR”. At the same time, the International Monetary Fund, as the issuer of SDRs, should be transformed into the World Central Bank. This is very reminiscent of what the head of the British delegation, the famous economist John Maynard Keynes, proposed at the Bretton Woods Conference in 1944. He wanted to make the main currency the supranational monetary unit "bancor", which should be issued by the International Clearing House - the prototype of the World Central Bank. Then Keynes's version was rejected in favor of the American version of the gold-dollar standard.

But Keynes' idea never died.

The SDR monetary unit became a unique version of the “bancor”. Jim Rickards notes that after the financial crisis of 2008-2009. The Fund has begun preparations to replace the dollar with “paper gold”:

01/07/2011 The IMF released a master plan to replace dollars with SDRs. It included the creation of the SDR bond market, SDR dealers and supporting mechanisms such as repos, derivatives, settlement and clearing channels, and the entire apparatus of a liquid bond market.

Let me remind you that the executive director of the IMF at that time was Dominique Strauss-Kahn. He actively supported the project of transition from the dollar to the SDR, for which he paid the price - he received a set of strange accusations of a sexual nature, which, as I assume, were inspired by supporters of maintaining the paper dollar standard (the main shareholders of the US Federal Reserve). Ten years ago, in May 2011, he lost his post as executive director of the Foundation, and an investigation began against him.

States are no longer needed

According to Jim Rickards, in the near future the Fund may begin reforming the procedure for distributing issued SDRs. New tranches of “paper gold” will be distributed not only among member countries: part of the emissions will go to international organizations such as the World Bank and the UN - and they, in turn, will use the money received for vaccination, combating pandemics, climate change and other goals. Decisions about the distribution of money will be made by officials who are not accountable to nation states. Here is an excerpt from Jim Rickards' remarks on this topic:

In the next few years we will see the issuance of SDRs to international organizations such as the UN and the World Bank, which will be spent on climate change infrastructure and other elite pet projects without oversight from any democratically elected body.

Jim Rickards's discussions about the International Monetary Fund's plans to issue SDRs lead to the following, not very happy, conclusions.

First . The planned issue of an amount equivalent to $650 billion is just the first step. It will be followed by even larger-scale issues of SDRs. A gradual, unadvertised replacement of the US dollar with the supranational currency “SDR” .

Second . The International Monetary Fund will gradually emancipate itself from the influence of member countries and transform into the World Central Bank, the main function of which will be the issuance of a supranational currency.

Third . In parallel with the creation of the World Central Bank (WCB), the creation of a world government will take place, which will receive supranational currency from the WCB. The money will be used to implement projects covered by the Great Reset plan.

Fourth . The world government is already being created on the basis of the UN and its specialized bodies. The pilot project is worldwide vaccination. This project is managed by the WHO, a specialized UN body that is no longer under the control of sovereign states. Now, on the contrary, sovereign states, members of the UN, find themselves under the control of the WHO and the forces behind it, imposing the “Great Reset” plan on humanity. Tomorrow, the same metamorphoses may occur with other specialized bodies and the entire UN as a whole.

* * *

Briefly, the diagram looks like this.

- Globalist structures are once again proving their inability to fully govern the planet as long as democratic procedures exist and leaders who do not obey behind-the-scenes commands, such as Donald Trump or Vladimir Putin, can come to power.

- A pandemic of a not too dangerous, but very contagious disease begins at the right time.

- Untested, but actively advertised vaccines are quickly coming into the world. As a rule, they are free for the population, but not for the state.

- The world is rapidly becoming poorer due to production stoppages and massive unexpected costs.

- The resulting liquidity deficit is covered by the half-forgotten quasi-currency SDR, for a share in the issue of which there is an active behind-the-scenes struggle.

- The possibilities for using SDR are expanding, “drawing rights” are becoming a full-fledged or almost full-fledged currency.

- The International Monetary Fund becomes a Bank that issues money at its own discretion and directs it to any desired point on the planet. There is no talk of any security for this currency, but it is capable of supporting or collapsing any national economy in the world (Napoleon also flooded Russia with counterfeit money, an old trick).

- Complete control of the world passes to those who control the release of SDR. Whether they will call themselves a world government or prefer to remain in the shadows is not as important a question as it seems.

We are now between the fifth and sixth stages of this exciting process. How many will live to see the eighth depends on how actively behind the scenes they will carry out their plan to optimize the population through economic and epidemiological levers.

Log in or register to leave comments.

What characterizes all the reserve currencies of the world (what they have in common)

- 100% liquidity with the ability to instantly convert reserve currency in any bank or exchange office in the world into any other money, banknotes or coins;

- unlimited international transfers of reserve currencies anywhere in the world without the cost of exchanging it for a third currency;

- almost 100% probability of opening a deposit in any serious bank in the world in a reserve currency;

- constant demand for reserve currencies from all more than 150 National Banks of the world;

- the opportunity to freely purchase wholesale quantities of various commodity futures on any of the largest commodity exchanges in the world. Everything in the world is sold for reserve currencies - Brent oil, WTI, zinc, URALS, tin, Oman Crude Oil, gold, natural gas, palladium, gas oil, rice, platinum, fuel oil, rubber, corn, nickel, gasoline, aluminum, steel, uranium, cotton, lead, diesel, soybean, molybdenum, biodiesel, polypropylene, methanol, coal, lithium, electricity, cobalt, kerosene, silver, sugar, liquefied gas, brass, wheat, etc. For more details, see the list of the world's largest commodity exchanges

| A country | Exchange | National currency | Financial regulator |

| North America | |||

| USA | ICE (Intercontinental Exchange, theice.com), CME (Chicago Mercantile Exchange, cmegroup.com), CBOT (Chicago Board of Trade, cmegroup.com/company/cbot.html), COMEX (Commodity Exchange, part of NYMEX, cmegroup.com/ company/comex.html), Minneapolis Grain Exchange (MGEX, mgex.com), NADEX (binary options exchange, nadex.com), NYMEX (New York Mercantile Exchange, cmegroup.com/company/nymex.html) | USD | NFA, CFTC, SEC |

| South America | |||

| Argentina | Rosario Futures Exchange ROFEX (rofex.com.ar), Buenos Aires Futures Exchange MATBA (matba.com.ar) | A.R.S. | CNV |

| Asia | |||

| Malaysia | KLSE (Kuala Lumpur Futures Exchange, bursamalaysia.com) | MYR | Labuan FSA |

| Singapore | SGX (Singapore Exchange, sgx.com) | SGD | M.A.S. |

| India | MCX (mcxindia.com), NCDEX (ncdex.com) | INR | SEBI |

| China | Dalian Commodity Exchange (dce.com.cn), Zhengzhou Commodity Exchange (CZCE, english.czce.com.cn), HKE (hkex.com.hk) | CNY | CSRC |

| Taiwan | TWSE (Taiwan Stock Exchange, twse.com.tw) | TWD | CSRC |

| Türkiye | BIST (Borsa Istanbul, borsaistanbul.com) | TRY | C.M.B. |

| UAE | Dubai Gold and Commodity Exchange (DGCX, dgcx.ae), Dubai DME Exchange (dubaimerc.com) | AED | Dubai? FSA |

| Japan | Tokyo Commodity Exchange (TOCOM, tocom.or.jp), Osaka Dojima Commodity Exchange (ODE, osaka-dojima.org) | JPY | JSDA |

| Europe | |||

| Russia | MOEX (Moscow Exchange, moex.com), St. Petersburg International Commodity Exchange (spimex.com), JSC National Commodity Exchange (namex.org), FORTS (Moscow Exchange derivatives market, moex.com/s96) | RUB | Bank of Russia |

| Great Britain | LME (London Metal Exchange, lme.com), LIFFE (London Futures Exchange, theice.com/futures-europe) | GBP | FCA |

| Oceania | |||

| Australia | ASX (Australian Securities Exchange, asx.com.au) | AUD | ASIC |

| Africa | |||

| South Africa | Safex (South African Futures Exchange, jse.co.za/trade/derivative-market/commodity-derivatives) | ZAR | FSCA |

| Ethiopia | Ethiopian Commodity Exchange (ECX, ecx.com.et) | ETB | National Bank of Ethiopia |

Monetary gold

The term "monetary gold" refers to the yellow metal in the form of bars or coins. In the Russian Federation it is stored in Gokhran.

The amount of gold stored is constantly changing. For example, in 1953 the mass was 2050 tons, which is a record. By 1991, the stock stood at 484 tons.

At the beginning of 2022, Russia's gold and foreign exchange reserves amounted to 2,271 tons.

Countries with the largest volume of gold in gold reserves (from Wikipedia at the beginning of 2020):

- USA – 8133;

- Germany – 3366;

- Italy – 2451;

- France – 2436;

- Russia – 2271;

- China - 1948;

- Switzerland – 1040;

- Japan – 765;

- India – 625;

- Netherlands – 612;

As a percentage by the share of gold in gold and foreign currency reserves as a percentage (from Wikipedia at the beginning of 2020):

- USA – 76.6;

- Portugal – 76.4;

- Germany – 72.8;

- Netherlands – 68.7;

- Tajikistan – 68.1;

- Italy – 68.0;

- Greece – 66.3;

- Cyprus – 64.7;

- Kazakhstan – 62.5;

- France – 62.4;

- Russia – 19.9;

In addition to gold, the Central Bank can purchase small shares of other valuable metals: palladium, platinum, silver, diamonds.

- How to buy gold for an individual - detailed description;

- Protective assets for ordinary investors;

Currency exchange rates: who, where and how determines them online?

Determined online under electronic trading conditions on five interconnected directions of the forex currency market. This:

- trading currencies on stock exchanges - so on the New York Stock Exchange and NASDAQ they trade the US dollar, SSE and SZSE - Chinese yuan, TSX Canadian dollar, BSE and NSE - Indian rupee, LSE - pound, WBAG, BME, FSE and Euronext - euro , SWX - Swiss franc, OSE - Norwegian krone, BMV - Mexican peso, etc.;

- trading currencies on commodity exchanges (for example, the Chicago Mercantile Exchange provides a trading platform for currency futures of the euro, dollar, Swiss franc, Japanese yen, Canadian, Australian and New Zealand dollars);

- trading on universal exchanges (MOEX - ruble, BCS - Chilean peso, Brasil Bolsa Balcao - Brazilian real, GPW - zloty, ADX - UAE dirham, SET - Thai baht, KRX - Korean won, NZX - New Zealand dollar, BIST - Turkish lira, HKE - Hong Kong dollar, HOSE - Vietnamese dong, Tadawul - Saudi riyal, ASX - Australian dollar, TASE - shekel, KLSE - Malaysian ringgit, QSE - Qatari rial, PSE - Philippine peso, SGX - Singapore dollar, etc., as a rule, fiat national money);

- trading on the over-the-counter forex market (all orders opened by investors and traders to buy or sell from all STP and NDD accounts forex brokers, PAMM brokers, CFD brokers, LAMM brokers, options brokers, bank brokers are required to automatically withdraw their PRIME broker to the bank , and he already sends the total position for buying / selling currencies to one of the above listed stock, futures or universal exchanges);

- Currency trading on ECN accounts is direct trading of foreign exchange market participants with each other online, when all orders of large players - trust funds, investment funds, hedge funds, banks, ETF funds, investment funds - automatically go directly to liquidity providers, from them to one of the stock and universal exchanges.

Read more in the main article Market participants: who and where exchange rates are determined. and Participants and place of trading in the forex market.

World foreign exchange reserves[edit]

The IMF regularly publishes the aggregate currency structure of foreign exchange reserves

(COFER).

[13] Reserves of individual countries and reporting institutions are confidential. [14] Therefore, the following table provides a limited view of world foreign exchange reserves that only concerns allocated reserves: Currency Composition of Official Foreign Exchange Reserves (1965–2019)

| 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1995 | 1990 | 1985 | 1980 | 1975 | 1970 | 1965 |

| U.S. dollar | 60,89% | 61,74% | 62,72% | 65,36% | 65,73% | 65,14% | 61,24% | 61,47% | 62,59% | 62,14% | 62,05% | 63,77% | 63,87% | 65,04% | 66,51% | 65,51% | 65,45% | 66,50% | 71,51% | 71,13% | 58,96% | 47,14% | 56,66% | 57,88% | 84,61% | 84,85% | 72,93% |

| Euro (before 1999 - ECU) | 20,54% | 20,67% | 20,16% | 19,13% | 19,14% | 21,20% | 24,20% | 24,05% | 24,40% | 25,71% | 27,66% | 26,21% | 26,14% | 24,99% | 23,89% | 24,68% | 25,03% | 23,65% | 19,18% | 18,29% | 8,53% | 11,64% | 14,00% | 17,46% | |||

| German mark | 15,75% | 19,83% | 13,74% | 12,92% | 6,62% | 1,94% | 0,17% | ||||||||||||||||||||

| Japanese yen | 5,70% | 5,20% | 4,89% | 3,95% | 3,75% | 3,54% | 3,82% | 4,09% | 3,61% | 3,66% | 2,90% | 3,47% | 3,18% | 3,46% | 3,96% | 4,28% | 4,42% | 4,94% | 5,04% | 6,06% | 6,77% | 9,40% | 8,69% | 3,93% | 0,61% | ||

| GBP | 4,62% | 4,42% | 4,54% | 4,34% | 4,71% | 3,70% | 3,98% | 4,04% | 3,83% | 3,94% | 4,25% | 4,22% | 4,82% | 4,52% | 3,75% | 3,49% | 2,86% | 2,92% | 2,70% | 2,75% | 2,11% | 2,39% | 2,03% | 2,40% | 3,42% | 11,36% | 25,76% |

| French franc | 2,35% | 2,71% | 0,58% | 0,97% | 1,16% | 0,73% | 1,11% | ||||||||||||||||||||

| CNY | 1,96% | 1,89% | 1,23% | 1,07% | |||||||||||||||||||||||

| Canadian dollar | 1,88% | 1,84% | 2,02% | 1,94% | 1,77% | 1,75% | 1,83% | 1,42% | |||||||||||||||||||

| Australian dollar | 1,69% | 1,62% | 1,80% | 1,69% | 1,77% | 1,59% | 1,82% | 1,46% | |||||||||||||||||||

| Swiss frank | 0,15% | 0,14% | 0,18% | 0,16% | 0,27% | 0,24% | 0,27% | 0,21% | 0,08% | 0,13% | 0,12% | 0,14% | 0,16% | 0,17% | 0,15% | 0,17% | 0,23% | 0,41% | 0,25% | 0,27% | 0,33% | 0,84% | 1,40% | 2,25% | 1,34% | 0,61% | |

| Dutch guilder | 0,32% | 1,15% | 0,78% | 0,89% | 0,66% | 0,08% | |||||||||||||||||||||

| Other currencies | 2,56% | 2,47% | 2,50% | 2,37% | 2,86% | 2,83% | 2,84% | 3,26% | 5,49% | 4,43% | 3,04% | 2,20% | 1,83% | 1,81% | 1,74% | 1,87% | 2,01% | 1,58% | 1,31% | 1,49% | 4,87% | 4,89% | 2,13% | 1,29% | 1,58% | 0,43% | 0,03% |

| Source: World monetary structure of official foreign exchange reserves International Monetary Fund | |||||||||||||||||||||||||||

Percentage composition of currencies in official foreign exchange reserves from 1995 to 2019. [15] [16] [17]

| U.S. dollar | Euro | German mark | French franc |

| GBP | Japanese yen | CNY | Another |

- v

- T

- e

Recommended Forex brokers for trading the world's reserve currencies.

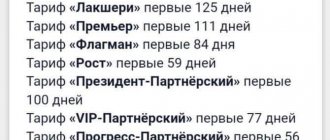

Masterforex-V Academy, based on its own Forex Broker Rating, recommends only 12 “best Forex brokers” of the major league (out of more than 400), selected by us over 15 years of monitoring dealers and brokers of Forex, cryptocurrencies, binary options, etc.).

| № | Broker name, year founded | Financial instruments | Licenses from financial regulators | ||||

| Currencies | Goods | Stock market | Cryptocurrencies | PAMM | |||

| 1. | NordFX (2008) | + | + | + | + | + | CySEC, MiFID |

| 2. | Swissquote (1996) | + | + | + | + | — | FINMA, FCA, SFC, Dubai FSA |

| 3. | Dukascopy (1998) | + | + | + | — | — | FINMA, FCMC |

| 4. | Alpari (1998) | + | + | + | + | + | ARFIN |

| 5. | FxPro (2006) | + | + | + | — | — | FCA, CySEC, FSB, Dubai FSA, BaFin, ACPR, CNMV |

| 6. | Interactive Brokers (1977) | + | + | + | — | — | NFA, CFTC, FCA, IIROC |

| 7. | Oanda (1996) | + | + | + | — | — | NFA, CFTC, FCA, IIROC, MAS, ASIC |

| 8. | FXCM (1999) | + | + | + | + | — | FCA, BaFin, ACPR, AMF, Dubai FSA, SFC, ISA, ASIC, FSB |

| 9. | Saxo Bank (1992) | + | + | + | — | — | Danish FSA, Consob, CNB, ASIC, MAS, FINMA, JFSA, SFC Hong Kong |

| 10. | FOREX.com (1999) | + | + | + | + | — | NFA, CFTC, FCA, ASIC, JSDA, MAS, SFC |

| 11. | FIBO Group (1998) | + | + | + | + | + | CySEC |

| 12. | FINAM FOREX (1994) | + | — | — | — | — | Bank of Russia |

Sincerely, wiki Masterforex-V, free (school) and professional training courses Masterforex-V for working on Forex, stock, commodity and cryptocurrency exchanges.

Why do you need a backup basket?

It is entrusted with large functions for global settlements and savings:

- Use as a means of payment in cross-country transactions.

- Maintaining the exchange rate of the national currency and carrying out foreign exchange interventions.

- Increasing the competitiveness of states whose national currencies are recognized as reserve ones.

- A certain lever of pressure on world society and the economy in the form of the issue of funds and the key refinancing rate.

- A method for preserving government assets and funds.

Requirements for the size of gold and currency reserves

The maximum size of gold reserves is not limited. But there are requirements for the minimum size of gold and foreign exchange reserves. The minimum size of gold and currency reserves is determined by the following requirements:

- Not less than 3 months import costs. The average values for the last 12 months are taken;

- According to the Guidotti criterion: not less than the amount of external debt payments over the next 12 months;

- According to Reddy's criterion. The sum of the previous two requirements is taken;

Emerging Economies The IMF uses the ARA EM composite indicator:

ARA EM = 150% × (0.05 × FE + 0.05 × M2 + 0.30 × ID + 0.15 × DPO)

Where:

- FE – export financing for the last 12 months;

- M2 – indicator of broad money supply;

- VD – the amount of payments on external debt for the next 12 months;

- LPO – the amount of long-term portfolio liabilities;