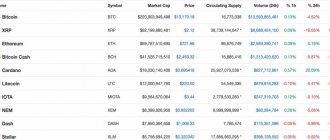

Daily review of rates: as of 6:00 Thursday 2022 Moscow time, most TOP-10 cryptocurrencies have positive dynamics of rate development.

The positive attitude established yesterday continues to please. Although Bitcoin, after the evening demonstrative growth to $38,235, was unable to continue its upward movement, the first cryptocurrency still remains in a positive mood, pulling the market along with it. Some altcoins really believed and added 11-15% per day (for example, Dogecoin and Polkadot).

The market capitalization of all cryptocurrencies is

$1,752,036,651,771 and plus 3.9% per day.

home

Bitcoin started the day on a positive note. The largest cryptocurrency by market capitalization is currently trading at $39,307, according to CoinMarketCap. Ethereum rose to $2,887, while Binance Coin rose 10.17 percent and is currently trading at $427. Bitcoin rose more than 5% to $38,000 in the last day. The altcoin market is also trying to recover and is showing significantly higher growth rates. The $40,000 level has now become a crucial resistance level. In fact, this level serves as a barometer of investor sentiment and short-term expectations in the cryptocurrency market.

The failure of attempts to break the low over the past two weeks acted as a bullish signal, causing Bitcoin to rise above $39,000 today.

The Greed and Fear Index for Bitcoin and other leading cryptocurrencies is still in the "extreme fear" zone. By its nature, this index should show high hopes of reversing growth at current levels, but upward and downward trends may take much longer.

Less persistent crypto enthusiasts seem to have already sold their assets, which ended up in the hands of large investors. Those expecting real growth are currently institutional investors. This stopped further decline. If market participants push the price of Bitcoin above $40,000 and continue to move higher, we could see a resurgence in demand from non-professional investors.

According to CoinMarketCap rankings, the top 10 currencies are green. The market capitalization of all currencies listed on CoinMarketCap is $1,743,417,491,226.

On May 19, the BTC/USD rate fell 30% in a fierce sell-off. The price touched $30,000 briefly before returning to $42,990. Over the next two weeks, the price stayed within these parameters, often moving on either side of the $36,495 average price range. The range in which Bitcoin is traded is getting smaller and smaller over time. This caused the formation of a pennant on the map. This formation is typical for a market that is trying to find a catalyst. This is also evidenced by the decrease in trading volume over this period.

Bitcoin price fell as low as $34,650 on Sunday before bouncing off a rising trendline at the lower end of the formation. The subsequent rally saw the price rise to $38,208 just below the downward trend line of $38,495.

The price action then stayed true to the range again and over the last 24 hours, BTC/USD fell from resistance to $37,475.

The top of the range is currently $38,355, and the downside remains vulnerable as long as the price is below that level. However, BTC recently broke above this pattern and is trading above $39,300. If the price continues to rise outside the narrowing range in the coming hours, a strong rally could occur. A break of the trend line will indicate that the price is finally recovering. Thus, Bitcoin will target the May 19 peak at $42,990.

If Bitcoin price returns to a narrow trading range, it could fall to $34,600. In such a case, the above bullish forecast will be invalid.

Bitcoin could reach $333,000 by May 2022

Bitcoin could reach $333,000 by May 2022 if the US Federal Reserve delivers a "perfect storm" of low rates, a new forecast claims.

Uncannily Accurate Price Forecast Update On December 27, filbfilb, co-founder of trading platform Decentrader, made some mind-boggling conclusions about BTC's price action over the next year. After almost full action throughout 2022, BTC/USD is set to make huge gains in the next six months if conditions remain the same.

The Fed is poised to make two interest rate hikes next year, and they are likely priced in, experts say, but the sudden change in tact could have far-reaching consequences. For Filbfilb, by analyzing Fibonacci sequences along with historical price action in previous halving cycles, Bitcoin could top $300,000 as a result of Fed officials scaling back rate hikes.

“To get there parabolically, we would likely need a perfect storm where the Fed fails to raise rates (which are likely priced) and raises inflation, causing a flight to safety in BTC,” he said.

The accompanying chart posted on Twitter in December 2018, when BTC/USD bottomed at $3,100, shows how predictable the price action has been since then.

“Price is exactly where forecast,” the analyst told Twitter followers.

“You don’t have enough cryptocurrency for what happens in 2022.”

As astonishing as it may sound, such a scenario is—at least technically—not as far-fetched as it seems. Signs are already permeating the market as more and more indicators line up to call for a breakout to the upside. Even low time frame data is encouraging - on December 27, for example, BTC/USD closed a four-hour candle above a significant 200-day moving average (MA) for the first time in six weeks. The last time the uptrend hit these same legs was in late September, at the start of the run that led to the current all-time highs of $69,000.

Commentators argue that on the macro front, the future looks the same for equities, with the US dollar cooling, even if rates do rise as expected. George Gammon, author of the investment newsletter Rebel Capitalist Pro, has been bullish since the last week of 2022 began.

“I think you could see the stock market rally over the next couple of months as the 'end of the pandemic' narrative continues,” he predicts.

“This gives the Fed cover to raise rates after zero QE. Once the market digests and realizes that the economy is going to be destroyed and then sees the impact of higher rates, the downturn could be big.”

Thus, the impact on Bitcoin in such a scenario will depend on its correlation with stocks, as well as whether it can recover from the sudden decline, as Gammon suggests, in the same way as in March 2022. Despite this, popular opinion remains convinced that Bitcoin has yet to peak since the turnaround in early December.

Reasons for growth: the position of skeptics

According to senior information analyst Vadim Iosub, all such explanations for this growth lacked a simple and clear fundamental idea: something like an active influx of new investors from among individuals or new financial institutions, qualitative breakthroughs in the field of security or transaction speed.

Iosub is confident: “Given such a sparse information background, it can be assumed that the reason for the growth is price manipulation carried out by several large players. They did this in order to pump up the market and sell their bitcoins at a high price.”

Bitcoin Heads to $9,000, Ignoring SEC Refusal

Bitcoin - parabolic rise to $9500?

The full launch of Binance Chain and Binance DEX is expected this month

Indeed, among many analysts there is an opinion that the Bitcoin exchange rate is now almost entirely dependent on the actions of speculators who actually manipulate the coin at their own discretion.

There is reason to believe that Bitcoin will not soar above May levels in the near future. The fact is that even during this month, the cryptocurrency has already slipped down more than once. A similar scenario was indicated by the events of May 17, when the price quickly dropped to $6,500, recalls Vadim Iosub. Although after that it rose again above $8,000, and then dropped to $7,600.

“We still do not see fundamental reasons for the long-term sustainable growth of the price of Bitcoin and believe that the price will return to previous levels,” says Iosub, “in the near future it could return to $6,500, and during June return to $5,000 – a level with which this strange growth began at the end of April.”

According to International Financial Center expert Gaidar Hasanov, in June Bitcoin will continue to decline and will drop to $7,000 dollars, or even lower. According to him, since the end of April, artificial demand has been created for cryptocurrencies, largely due to the fact that there were too many people willing to compensate for their losses. Large funds and investors suffered huge losses as Bitcoin plummeted in price throughout 2022. Mining farms, on which considerable funds were spent to mine bitcoins, turned out to be absolutely unprofitable, Gasanov believes. The rise in price helped them compensate for losses, but the analyst does not yet see any grounds for further strengthening of Bitcoin.

The head of Binance in the Russian Federation said whether Bitcoin will remain the main cryptocurrency

St. PETERSBURG, June 1 — PRIME. Bitcoin is a kind of gold in the world of cryptocurrencies, and its dominant role in the near future is likely to remain, Gleb Kostarev, director of the largest cryptocurrency exchange in Russia by trading volume, Binance, said in an interview with RIA Novosti on the eve of the St. Petersburg International Economic Forum.

Experts tell us what you can buy with bitcoins in 2021

“Bitcoin was the first decentralized cryptocurrency and, of course, remains a kind of benchmark for the entire industry. As Bitcoin grows, other cryptocurrencies follow suit. When Bitcoin falls, the entire market falls. And Bitcoin is a kind of gold in the world of cryptocurrencies. And, most likely, the dominant role of Bitcoin will continue in the near future,” he said.

Kostarev noted that there are other promising cryptocurrencies. “For example, Ethereum, since a large number of different decentralized applications are built on it, Ethereum has smart contracts. The Ethereum blockchain gives many opportunities to developers and projects and generally moves the entire industry forward,” he added.

As for the Dogecoin cryptocurrency, according to the expert, it can hardly compete with Bitcoin and Ethereum, since there is no innovative technology behind it; the hype around it is largely due to Elon Musk’s tweets.

“If we talk about Dogecoin, then, of course, it is worth noting that this asset is unlikely to compete with Bitcoin and Ethereum. Much of the hype around it is due to Elon Musk’s tweets. And here you just need to understand that such hype coins, which actually do not have any innovative technology behind them, are most susceptible to manipulation, pumps and dumps. And, of course, in the future they have every chance of depreciating,” he said.

Answering the question whether Dogecoin can still grow significantly, Kostarev noted that everything will depend on the state of the crypto market. “Everything will depend on whether the current bull run (the period of rising prices - ed.) has ended or continues. If the bull run continues, the current correction remains local, then Dogecoin, among other things, may rise. If, after all, the market ceases to be bullish and becomes bearish, then in this case most of the cryptocurrencies, including Dogecoin, will lose value,” he said.

The Dogecoin cryptocurrency was created as a joke back in 2013, but became widely known this year. At the beginning of the year, Dogecoin was worth $0.005, and in May it reached an all-time high of $0.73, but then corrected to $0.3. The rise of the cryptocurrency was largely facilitated by Tesla CEO Elon Musk, who often mentions Dogecoin on his Twitter. In particular, he wrote that he bought this cryptocurrency for his youngest son.

The St. Petersburg International Economic Forum in 2022 will be held on June 2-5 in a face-to-face format. MIA Rossiya Segodnya is an information partner of SPIEF.

Read the full text of the interview on the website of the RIA Novosti agency (Russia Today media group) ria.ru at 9.30 Moscow time.