Bitcoin or Ethereum? Key differences between leading cryptocurrencies

Views: 3967

Comments: 0

There are many cryptocurrencies, but most often investors choose Bitcoin or Ethereum, which occupy the first lines of the rating. Often, novice investors do not see the difference between them, but the technologies have significant differences. Based on the analysis of investor communication on the network, a large number of beginners buy either bitcoin or etherium, based on the availability of free money, and professional investors invest in both cryptocurrencies.

What is Ethereum: key features of the system

Not all investors know what ether is. In short, ETN is a unique cryptographic environment for the development of decentralized blockchain-based applications using “smart contracts.”

The difference between Ethereum is that the Ethereum blockchain is based on smart contract technology, which not only tracks transactions, but also programs them.

ETH has long occupied an honorable second place in the ranking of cryptocurrencies by capitalization, although in these positions it is much inferior to Bitcoin (BTC). But there is still competition, and many consider ether technology to be better, so this crypt is in demand.

Tron cryptocurrency

Release date : November 2022

Authors: Tim Berners-Lee, Justin Sun

Website: tron.network

In recent months, the cryptocurrency Tron has been gaining popularity. Its developers relied on users of Internet games, video materials and content storage. Tron's mission is to make transactions cheaper and create a worldwide free entertainment system. Like many other cryptocurrencies, Tron is based on distributed storage technology. At the same time, the data is free and not controlled, so users can use the system for what they want and how they want. It is curious that Tron cannot be mined, but it can be received as a reward for active work and assistance in development. The online entertainment market continues to grow rapidly, and Tron claims to be an analogue of the AppStore and Google Play in the crypto world.

Advertising on Forbes

Main features of Bitcoin

Many doubt that a cryptocurrency can be created that will be better than Bitcoin. It represents an innovative payment network and a new type of money. Implemented the idea of the Bitcoin currency by Satoshi Nakamoto.

The basis of Bitcoin is the blockchain, the cryptocurrency has the following advantages:

- Possibility of using electronic money both online and offline.

- The state does not regulate or control the issuance of bitcoins; it cannot dictate terms to their holders.

Working with BTC is convenient. It only takes a few minutes to send money to the other side of the globe.

Digital gold

As originally conceived, there is a finite number of Bitcoins that will ever be created. This is necessary primarily to maintain the anti-inflationary properties that paper currencies suffer from. Only 21 million Bitcoins will ever exist, although millions of coins are already believed to be lost.

Additionally, the limited supply of Bitcoin has led to unexpected consequences. Although the tool was designed primarily as a currency, many users are now using BTC as a store of value. Coined as digital gold, Bitcoin acts more as an investment vehicle than as an everyday means of payment.

However, many cryptocurrency enthusiasts believe that Bitcoin's history is such that the blockchain could exist. In fact, one of the rising stars of blockchain has been around for quite some time and has been stable: Ethereum.

♥ ON TOPIC: Man with arms outstretched by Leonardo da Vinci: what is the meaning of the painting?

Advantages of the Ethereum platform

Ethereum is a cryptocurrency that is often called a replacement for Bitcoin. It has the following advantages:

- Easier to mine than Bitcoin. This means that people do not have to join pools to mine cryptocurrency. They will not have to divide it equally between the participants.

- Ethereum's block is optimized several times better than the Bitcoin block. If Bitcoin's transaction speed is on average 2 minutes, then Ethereum's is 12 seconds.

- ETH has its own Ghost protocol. Because of this, even outdated solved blocks continue to generate income for the owner.

- For each solved block, the miner receives income that does not decrease over time. For Bitcoin, the opposite is true: every 4 years, income is reduced by 3 times.

Ethereum is used by programmers for cryptography and centralization, and is also popular among optimizers. This means that the demand for cryptocoins will be supported by programmers, optimizers and other people working with smart contracts and businessmen.

Ether is not at all like the popular Bitcoin; decentralized projects can be created on the platform. The Ethereum network became available for use in 2013, it was founded by Vitaliev Buterin and Gavin Wood.

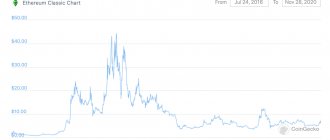

The technology turned out to be promising, so investors are actively investing in it. They often compared bitcoin vs ethereum, trying to determine the prospects for the development of networks. After 1.5 months from the opening, while the sale of shares was carried out, the developers received about $18 million.

Nuances when purchasing equipment

By purchasing an ASIC miner, you are forever tied to cryptocurrency mining using a specific mining algorithm. In the case of Antiminer S9, these are Sha-256 and Bitcoin. For profitable Litecoin mining, other miners have been implemented. If the difficulty of mining Bitcoin increases significantly, there will be no good options for changing direction. Only mining of Bitcoin forks is available.

Current ASIC models are produced in China. In the Russian Federation they sell used models with a certain level of wear. There are no guarantees for ASICs, repairs are almost impossible. Delivery of a miner from China takes 2-4 weeks. Due to tariffs on purchases over $1,000 online, miners often buy rigs from China itself.

Video cards give greater flexibility to the miner. It is possible to switch from mining one cryptocurrency to another. For example, from ether to ZCASH.

One of the problems is the growing cost of GPUs and the operation of the farm itself. The installation takes up more space compared to ASIC, requires cooling and operation control.

Advantages: warranty, possibility of repair and secondary sale.

Benefits of Bitcoin

Bitcoin became the first cryptocurrency, which influenced its popularity. This supported the demand for coins. The possibility of receiving passive income by increasing the value of the cryptocurrency ensures constant demand.

There are other advantages of coins:

- They were bought by banks and large investors, so bitcoins cannot quickly fall in price. They can be classified as reliable assets.

- Coins are accepted by trading platforms, exchanges, online stores, and payment systems work with them. In some countries, BTC can be used to pay for school fees or buy a car or real estate. This increasingly fuels demand and makes it possible to quickly conduct transactions, sell and buy cryptocurrency.

- Bitcoins can be exchanged for fiat money. Already in many countries terminals for cashing them out have been installed.

- BTC is open source.

- The use of cryptocurrency requires anonymity. There is no need to enter personal data, just dial the Bitcoin wallet number.

- High transaction speed.

- Low fees for transferring funds compared to standard money transfers. Bitcoin transaction fees do not depend on the amount transferred, but solely on the amount of data transferred.

The production of coins is limited; a total of 21 million can be mined. Even when Bitcoin was created, the developers introduced a rule that coins that had gone out of circulation would not be reintroduced into the system. Therefore, there will be no oversupply of cryptocurrency, and the withdrawal of bitcoins from circulation further increases the shortage, increasing the cost.

Members are not divided into categories like card users. Payment systems issue credit cards of different denominations, for example, platinum, gold or black. Bitcoin holders are on an equal footing.

Monero cryptocurrency

Release date : April 18, 2014

Authors: Riccardo Spagni, Francisco Cabañas

language : C++

Website: getmonero.org

Advertising on Forbes

Recently, against the backdrop of tightening the screws on cryptocurrencies by regulators around the world, the popularity of electronic coins with increased user anonymity has grown. Monero is just that case. This cryptocurrency uses ring signature technology, which makes users anonymous. Transactions are carried out upon presentation of the key, but the bearer cannot be identified. In addition, Monero has a special code that mixes transactions. As a result, it becomes completely impossible to understand from the outside how many coins are in a particular wallet or what the volume of a particular transaction is. It's no surprise that Monero is used in both legal transactions and the underground economy.

How is Ethereum different from Bitcoin?

Investors who are just starting to get involved in cryptocurrencies compare bitcoin vs ethereum. They believe that they are not much different from each other. The only criterion by which they can evaluate virtual coins is their value.

But ether differs from bitcoin in many ways. The difference lies not only in the technical plane, but also in the scope of opportunities that people can take advantage of.

To compare bitcoin and ethereum, you should pay attention to the technology for issuing cryptocurrencies, the number of coins and methods of their extraction.

Technologies

Among the variety of cryptocurrencies, investors' choice most often falls on the most reliable one, so they purchase Bitcoin, which is based on the blockchain. But ether can also influence the development of the virtual money sphere. Each cryptocurrency has its own advantages and disadvantages. ETH developers have focused on providing enhanced capabilities to users by implementing smart contracts. These computer algorithms are called “smart” because of their ability to conclude contracts and monitor and monitor their implementation without the involvement of intermediaries and guarantors.

Other advantages of the Ethereum system include the ability to raise money for the implementation of new projects. Other options for users are also provided. Ether coins began to be used to pay for goods or services, as well as for investment purposes.

They can be transferred to another person for the development of projects. The algorithm is as follows: any user inspired by his idea enters into a contract. He receives money from the community after asking for help. All transferred funds are stored on the Ethereum platform until the end of fundraising.

The resource guarantees that the user in need of money and the people who are ready to help him in the development of the project will not lose their funds. If the amount cannot be collected, all transferred funds will be returned back to their owners.

There are no strict rules for fees or commissions for transfers, and this is another advantage of the platform. With its help, you can implement various projects in the IT field, and this additionally attracts investors. The transaction speed of any crypto is high.

Mining and number of coins

The release of virtual currency is called mining, and this process is different for BTC and ETH. If ether can be obtained on more or less simple computers, then special equipment called “farms” will be required to produce bitcoins. When mining coins, you can achieve good results; what is better - mining Bitcoins or ETH, the computer owner must decide for himself. An Ethereum block is produced within 15 seconds, and BTC generation takes 10 minutes. While the release of BTC is limited, there is no such limit for Ether.

The only limitation is that no more than 18,000 broadcasts can be released per year. Currently, users already have 100 million coins, which is 6 times the number of issued bitcoins.

BTC and ETH mining equipment

The days of Bitcoin mining through desktop computers and laptops are gone 6 years ago. Let's say more. If you think that Bitcoin is mined through video cards (GPUs), then you are seriously mistaken. Special-purpose integrated circuits are used to mine cryptocurrency gold. They are called ASIC or “ASIC” in the Russian manner.

This small installation serves one single task - cryptocurrency mining. ASIC does not solve any other problems. At this stage (autumn 2017), such miners are the only profitable equipment for Bitcoin mining. GPU mining of BTC is not profitable.

Current models for Bitcoin mining: Antiminer S7, Antiminet S9, Antimner D3. These ASICs are produced by the Bitmain brand.

The key indicator for miners is power consumption and hashrate. The S9 model has a hashrate of 12,000 to 14,000 Gh/S (giga hash per second). Power consumption: 1300-1400 Watt. All these miners mine using the Scrypt algorithm. Approximate prices:

The running Antiminer S9 model with a hashrate of 13.5 Th/S and a consumption of 1400 Watts will cost $2,200-2,500 or 150,000 rubles. You have to buy miners from the Chinese - only they produce them on an industrial scale.

Ethrerum mining is possible on video cards. A different algorithm is used here – EthHash. Therefore, it is incorrect to compare the hashrate of ASICs and farms.

For efficient mining, miners combine GPUs into installations - farms. To operate this design, you need a processor with PCI slots (number of slots = number of video cards), a powerful power supply, and a frame. The operation of the farms is accompanied by the release of heat from video card fans and a characteristic sound. Powerful installations are equipped with a cooling system.

Due to the growing interest in mining, the cost of video cards in the Russian Federation has doubled since the beginning of 2017. Those who want to start mining ether or other currencies often order equipment from the USA or China due to a shortage of equipment on the Russian market.

What to mine, Bitcoin or Ethereum: general characteristics

When choosing bitcoin vs ethereum, you need to pay attention to what computer power you have access to. Cloud mining services are widely used in the cryptocurrency community.

Investors need to take into account the differences between virtual coins; the difference between Ethereum and Bitcoin lies in the mining method and purpose. Computer owners should take into account the power of the machines and their financial capabilities; taking this data into account, it will be easier for them to decide whether to mine ETH or Bitcoin.

Bitcoin

Mining Bitcoin requires not just a lot of computing power, you need ASIC miners. It is believed that 90% of the coins will be mined in 10 years, and this will be done by industrial miners. If previously BTC was obtained on home computers, now the mining processes are very different; the operations differing in complexity force network participants to combine machines into a pool. Bitcoin was created for payments, so its use is limited. Investors can make money on changes in the value of an asset, so you need to look at the BTC rate. The cost of the crypt now fluctuates around 4 thousand US dollars, although in 2022 it rose to almost 20 thousand US dollars per coin.

Ethereum

This cryptocurrency is more interesting due to the fact that it not only uses the blockchain, being a payment cryptocoin, but also allows you to develop projects in a decentralized environment.

Cryptocurrency Dash

Release date : January 18, 2014

Author: Evan Duffield

Programming language: C++

Website: dash . org

Advertising on Forbes

Another anonymous cryptocurrency is Dash, which is characterized by fast transaction times and low fees. It's no surprise that it's already accepted by thousands of merchants around the world. The main feature of Dash is the masternode, a superserver that provides the network with additional functions. For example, the PrivateSend service, which mixes user coins through mutual exchange, as a result, an outside observer can neither track transactions nor determine the owner of a specific coin.

What is more profitable to invest in?

When choosing what is more profitable to invest in: ethereum or bitcoin, you need to take into account cost forecasts. Based on this criterion, it is more profitable to buy Bitcoin. But it is worth considering that there cannot be a single correct opinion on this issue. Some investors buy only BTC, others invest in both assets.

The optimal investment strategy would be to invest in both coins. For more effective management of your cryptocurrency investment portfolio, we recommend that you read our article “Basic principles and rules of investing in cryptocurrencies”

Decentralized Finance (DeFi)

Decentralized finance (DeFi), a financial system that does not discriminate against anyone and does not allow downtime, is one of the most practical and popular ways to use the Ethereum network. Using DeFi, Ethereum allows you to send, receive, borrow, and earn interest from anywhere in the world.

To avoid using the traditional banking system, users only need an Ethereum wallet and the Internet. This tool not only helps people living in areas where there is no access to financial services, but also reduces the huge costs associated with transactions.

♥ ON TOPIC: How many GB of memory can the human brain remember.

Non-fungible tokens (NFTs)

Apart from this, Ethereum also allows the use of non-fungible tokens (NFTs). NFTs revolutionize proof of ownership online and help creators tokenize their art, allowing them to automatically receive royalties whenever a creation is resold.

For this reason, creators can gain fraud protection, proper compensation, and even use their tokens as collateral for financial services. Additionally, NFTs help protect users from others profiting from their work without their consent.

♥ BY TOPIC: What is horsepower and how many horsepower is in one horse?