Ripple's total number of partner institutions has now exceeded 200, and the company says its blockchain network is constantly adding new member institutions. In addition, Ripple has surpassed Ethereum and is now considered the second largest cryptocurrency by market capitalization.

However, blockchain is a technology that is poised to advance commerce and society for decades to come. Real innovations in the coming years could wipe out Ripple's current small successes. What happens if Ethereum and other projects continue to scale and dapp developers become more aware of the capabilities of tools like Solidity? Although Ripple has been making headlines lately, it can be assumed that its long-term prospects are insignificant compared to other projects.

In this article, we present the eight main reasons that will most likely lead to Ripple's complete collapse.

Ripple and Ripple Labs are separate companies:

Ripple is a financial technology company that offers xCurrent, xRapid and xVia solutions that enable financial institutions and businesses to make cross-border payments.

xCurrent is used to settle international transactions, somewhat reminiscent of SWIFT in that banks can send messages to each other in real time to confirm payment details, initiate transactions and confirm settlements. XRapid is a liquidity solution for financial institutions that use Ripple's XRP token as a bridge currency. xVia is Ripple's latest product that can be used by corporations, payment processors and banks that need to send payments across multiple networks using a standard interface. The xVia API requires no software installation and allows you to send payments worldwide.

So far, the main international payment systems are working slowly and fragmentedly. The XCurrent product provides a better alternative to existing solutions such as SWIFT, however it does not use the XRP token at all. It turned out that the overall XRP asset grew thanks to news about Ripple’s partnership with Ripple Labs in the banking sector. However, this partnership was only for cross-border products like XCurrent, while the well-known token XRP is a completely different animal. Thus, the hype around XRP is actually due to Ripple's corporate decisions, and not the token itself.

SEC

SEC

The first questions were introductory, Garlinghouse told a little of his biography, when he learned about Bitcoin, and also shared his opinion on the future of cryptocurrencies. In his understanding, Bitcoin and, of course, XRP have it. When asked why he did not mention Cardano or other coins, Brad replied that he is not a trader and does not follow the market itself. But even before he started working at Ripple, he was an investor in Protocol Labs of the Filecoin developers, so he also included this cryptocurrency in the list of promising ones next to Bitcoin and XRP.

As for the Ripple and SEC court and the state in which everything is now. Garlinghouse notes that in his opinion, the SEC is wrong in fact and wrong in law, but the judicial system does not work quickly and the process will likely drag on for quite a long period. At the same time, the head of Ripple notes that he has long advocated for clear rules for cryptocurrencies, according to which investors and users could participate in this process.

If we take the last three weeks, the key decision of the court is Garlinghouse's approval of Ripple's request to disclose SEC documents in which they decided not to recognize Bitcoin and Ethereum as securities. Brad says this will shed light on the regulator's logic in how it classifies cryptocurrencies.

He believes that the previous head of the SEC, Jay Clayton, was an enemy of cryptocurrencies, which affected the development of the industry during his tenure and therefore, in the last days of his leadership, he decided to sue Ripple. Garlinghouse also spoke about the presence of a conflict of interest among the SEC. Thus, their representative Simpson Thatcher receives a salary from the Ethereum Enterprise Alliance.

If we talk about the new head of the SEC, Gary Gensler, he previously taught a course on cryptocurrencies at the university. He should have a better handle on the issue than Jay Clayton, so Garlinghouse is optimistic that the SEC will now be more transparent and understandable.

And Brad also commented on the participation of the XRP community in the lawsuit. We are talking about recent statements that the SEC does not represent the interests of the real owners of XRP and they intend to become a third party in this process. So Garlinghouse and the entire Ripple company are surprised by this support, they are not against it and note that due to the start of the trial, the capitalization of XRP fell by $15 billion. People lost money and the SEC is to blame for this, which provoked a wave of delisting of XRP.

The centralized Ripple ecosystem is a big risk:

In the Bitcoin and Ethereum ecosystems, anyone can become a developer and submit proposals for their improvement. For Bitcoin, such offers are called BIP, and for Ethereum, they are called EIP.

However, the Ripple ecosystem does not provide for such an approach, and there are simply no democratic ways to improve the platform. The only way to claim an improvement is to contact Ripple Labs, which alone resolves such issues.

Another interesting feature of Ripple's centralized governance system is their ability to freeze balances or even confiscate any user's tokens at any time. Although Ripple has success in cross-border payments, there is no talk of decentralization of this coin. On the contrary, it seems that there is a very strong centralized power here. Thus, in order to use Ripple, you must place a certain degree of trust in someone.

Another centralized component of Ripple is the circulation of XRP tokens. Ripple itself stores a large number of XRP tokens - 100 billion coins were distributed even before the launch of the project. 80 billion of them are slowly and piecemeal released to the market, and 20 billion were distributed among the co-founders. Ripple still controls more than half of the XRP in circulation. This is fraught with many risks in the market, since only a few participants own capital, which can lead to market manipulation.

Prospects for investment and forecasts for the future

But nevertheless, this affected the prospects of the Ripple cryptocurrency less than it might seem at first glance.

This drop was very predictable, although expectations were ultimately slightly exceeded. Still, cryptocurrencies react very painfully to bad news. However, for long-term investment this cryptocurrency still remains very profitable. Do not forget that for a long time the cryptocurrency cost around twenty cents and the December rise was mostly speculative, but now the cryptocurrency will slowly take its real position in the market. But judging by the latest activity of Ripple Labs, the number of attracted investments and concluded contracts, we can judge that the price will not return to its previous level. Those who purchased at old prices, and those who bought currency as soon as Ripple began to grow, definitely do not need to worry. Those who bought at prices above two dollars will most likely be in the red for a long time, but it is better to wait out this situation without throwing away coins in a panic. If you just now want to enter the Ripple market, then carefully study the quote chart. It is quite possible that now is the optimal moment for long-term investments for several years to come.

Exiled Ripple Co-Founder as a Potential Pump & Dump:

Jed McCaleb, one of the founders of Ripple, left the company in 2016 with 6 billion XRP coins. McCaleb initially tried to liquidate his coins, but lawsuits from Ripple Labs stopped the process as it could have caused a sell-off in the market. As a result, the parties came to an agreement according to which the sale of tokens by McCaleb should be carried out gradually, over several years. However, many people seem to expect nothing good from this.

McCaleb later went on to create a rival coin, Stellar, which he actually built on the blockchain. Taking a shot at his old colleagues, McCaleb said that “a blockchain project must be decentralized to succeed.”

Excursion into history

The history of the creation of the Ripple coin dates back to back in 2004, when the talented Canadian programmer Ryan Fugger developed the new payment system Ripplepay.

It is he who can be called the creator of Ripple, since although modern cryptocurrency differs from the payment system that appeared initially, the future development of Ryan and his partners is based on Ripplepay. The release version of Ripplepay was released in 2005, but despite all efforts, it was never able to gain popularity. However, Fugger did not give up and continued to support the system until in 2011 he met Jed McCaleb, the developer of the eDonkey file sharing service. Together they significantly reworked the system, bringing it almost to the form we know today. And next year, Chris Larsen joined them, and a subsidiary company, OpenCoins, was created, which continues to work on the functionality of the system.

In 2013, most of the founders of Ripple left the company, and Chris Larsen continued to lead the project. OpenCoins are renamed RippleLabs and since then the Ripple crypto has received the look we have already become accustomed to. Larsen decides to direct all the team’s efforts to cooperation with large banks, and from that moment the long path of cryptocurrency to success and recognition begins.

The first success of Ripple awaited him quite soon, namely in 2014, when the large Munich bank Fidor drew attention to the promising system. After concluding a cooperation agreement with a German bank, quite expectedly, RippleLabs received other offers from major players, in particular, financial market giants such as Western Union and the Commonwealth Bank of Australia turned their attention to the young structure.

Ripple appeared on large cryptocurrency exchanges, and in terms of capitalization, for the first time, it managed to enter the top ten among cryptocurrencies around the world. However, this was just the beginning, and the developers only planned to build on their success. In 2016, Ripple received investments totaling $55 million from National Australia Bank, Shanghai Huarui Bank, BMO Financial Group and Standard Chartered. And at the beginning of 2017, RippleLabs simply showered the Japanese banks Nomura Trust, Sumitomo Mitsui Trust, ORIX Bank, Daiwa Next Bank, Mizuho Bank, as well as the largest bank in the UAE, National Bank of Abu Dhabi, with dollars.

Currently, Ripple continues its active growth, the company enters into new agreements with banks, and the currency itself is becoming increasingly popular among private investors. At the end of last year, Ripple managed to achieve a phenomenal performance, increasing its value several times and taking second place in the capitalization rating for the first time in its history.

Practical applications of XRP are very limited

XRP now has large transaction volumes on various cryptocurrency exchanges, but only a small portion of the circulating coins are actually used for cross-border payments. Currently, only 12 financial institutions have either implemented xRapid or are planning to implement it.

For optimal use of products like XRapid, there must be institutional partners who are willing to use XRP as a liquidity tool. However, many blockchain protocols are improving their scalability and security, which may make them Ripple's closest competitors in the cross-border payments market. Bitcoin, Ethereum or any stablecoins may well qualify for the same niche as Ripple.

Last news

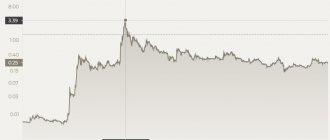

The latest news from the Ripple cryptocurrency is not very encouraging for investors. After a sharp rise in price at the end of December last year, Ripple also went down sharply. At the time of writing, it had more than doubled in price and lost the same amount in capitalization. The maximum value of the currency was recorded on January 4th, namely $3.84 per XRP; now the price fluctuates around $1.7. Capitalization decreased from $148 billion to $75 billion, returning Ripple to third place in the cryptocurrency rankings.

Experts attribute such a sharp drop to a very large oversaturation of the market, which was further fueled by the news that the Coinbase crypto exchange did not confirm rumors about the imminent addition of the currency to its trading pairs.

Ripple's consensus mechanism is highly centralized

The consensus mechanism in a blockchain is a process used to reach agreement on a single meaning of certain data that is located in a distributed system. In Bitcoin, this mechanism is known as Proof-of-Work. To reach consensus on the Bitcoin network, all nodes must reach 51% agreement on a certain decision.

Ripple's consensus algorithm is based on transaction verification by a fixed group of nodes, and Ripple users must use a "recommended" list of identified and trusted participants - the UNL.

Ripple uses only UNL votes to validate transactions, while in Bitcoin consensus is agreed upon by each node. Since the UNL nodes are known in advance, the Ripple consensus algorithm appears to be more efficient than Proof-of-Work. Transaction confirmation times take just a few seconds and are much faster than other popular matching algorithms such as Proof-of-Work or Proof-of-Stake. However, here Ripple has clearly sacrificed decentralization and democratization for the sake of efficiency. The value of anonymous consensus algorithms is that they are “trustless.” However, in the case of Ripple, you must trust this small group of nodes. If they choose to act unethically, then the stakeholders associated with Ripple will not be able to do anything about it.

How to buy and where to store Ripple?

The Ripple XRP cryptocurrency is now popular on many cryptocurrency exchanges, so you should have absolutely no problems purchasing it. If you plan to buy Ripple for fiat money, then a good place to purchase it would be the Exmo trading platform, popular in the CIS countries. Here you can buy Ripple for almost any fiat currency; you can choose from trading pairs with rubles, hryvnias, dollars, euros and Polish zlotys. In addition, cryptocurrencies are usually traded on Eksmo at a slightly lower rate than the market average, which will also be a plus when purchasing.

If you want to purchase Ripple by exchanging it for another cryptocurrency, for example, Bitcoin, then the best place to carry out such an operation would be the world-famous Poloniex exchange. This exchange usually has the highest daily trading volumes, so you will most likely be able to find the required amount of Ripple in the shortest possible time. The only obstacle that may encounter you on this path is the lack of Russian language. However, now there are many guides on the Internet on how to use this trading platform, so this fact should not stop you.

If you wish, you can also store your Ripple savings directly in wallets provided by cryptocurrency exchanges, but from the point of view of the safety of funds during long-term storage, it is better to choose another method.

The most reliable way to store Ripple today is a hardware wallet from the Ledger company. It is a device similar to a regular computer flash drive and costs approximately 60 euros. In addition to Ripple, the wallets of this manufacturer also support Bitcoin, LiteCoin, Ethereum, Zcash and many other cryptocurrencies. Using such a wallet, you can be one hundred percent sure of the safety of your funds.

If this method is not suitable for you for some reason, then creating a wallet on the GateHub resource may also be a very good option. During the registration process, you will have to face some difficulties, namely: you will have to provide the system with complete information about yourself, as well as photos and copies of documents. But as a reward, you can be confident in the reliability of the system and receive a bonus of twenty XRP.