More and more people want to start making money by exchanging cryptocurrencies. This type of income does not require large investments, but you need to have a clear understanding of some of the nuances. Earning money consists of buying cryptocurrencies, including bitcoin, and then selling them at a higher price. Sometimes people, counting on higher profits, hold this currency for a very long time, waiting for a higher exchange rate.

But there is another option for making a profit: you can buy and immediately resell cryptocurrency, making money on constant price fluctuations. But this method is more suitable for making a profit on cheaper electronic currencies than btc - Litecoin, Ethereum and Ripple. The most promising cryptocurrency for making money is the one that demonstrates the greatest growth dynamics. For example, Kin, Dogecoin, MOAC, Stellar, TenX. The increase in their value per week is 30-50%.

Differences between an exchange and an exchanger

When figuring out how to make money by reselling cryptocurrency, you need to understand the main concepts. Most trading operations are carried out through exchanges, but exchangers are also actively used.

There are significant differences between an exchange and an exchanger that need to be taken into account. When using the second, interaction occurs directly with the exchanger. When working with an exchange, a person buys currency and sells it on the exchange. All transactions are concluded with the same participants.

Exchanges are superior in reliability. Most of them work many times more than exchangers and have a lot of positive reviews about their work. It is most dangerous to exchange currency on sites that were created relatively recently.

The differences are also in prices. On exchange offices the cost of purchase is always higher. That is why, in order to get real benefits, it is better to use exchanges.

You can make transactions on exchanges around the clock. At exchangers, the user will have to wait for the operator. Moreover, this applies even to large and trusted sites that have existed for several years.

The price situation on the exchange directly depends on the participants. The exchanger is an analogue of a standard offline exchanger. The value of the currency is uniform.

What are the risks?

You must be prepared for the fact that a price jump can be both in your favor (giving you a chance to make money) and in favor of your competitors (in this case, there is a risk of incurring losses).

Risks include a large commission when withdrawing funds to your wallet. The size of the commission may even exceed the difference that was formed when selling and buying cryptocurrency.

Very often citizens of the Russian Federation encounter this on foreign exchanges. When registering, you may be subject to an artificial increase in withdrawal fees. This risk is difficult to predict, but it is worth keeping in mind.

Earning algorithm

Trading has some peculiarities. The main goal is to buy funds and wait for the currency to rise. Earnings in this case are the difference between current rates. It is not always possible to make a big profit from the first transaction. You need to learn how to analyze and exchange funds in a timely manner.

The main ways to make money on cryptocurrency:

- Arbitration. A trader buys a currency at a low rate and then sells it where the rate is highest. To work, you will need to regularly monitor courses on proven sites.

- Online exchange. This is a more difficult way to make money. You need to create a website for buying/selling currencies. A person will be able to earn money from the difference in rates. You need to understand that starting is possible only if you have start-up capital.

- Purchase using fiat funds, reverse exchange after the exchange rate increases. You need to be able to analyze and predict a likely currency jump.

- Participation in referral programs. You can register on various sites as a partner. The job will be to distribute the affiliate link. Income will come from each attracted user.

Each option has both advantages and disadvantages. When choosing, you need to take into account your capabilities and preferences.

Not for beginners

Cryptocurrency arbitrage is more suitable for “sophisticated” traders who may be new to the field of digital money, but already have experience in trading other assets, says Sergei Troshin, head of the Six Nines data center. Maxim Krupyshev, CEO of the crypto payment system Coinspaid, speaks about this. According to him, now no one engages in arbitrage manually; for this they use trading bots - programs for automatically concluding transactions under predetermined conditions.

The most famous and profitable funds most often engage in arbitrage, and this reduces all activities to a technology race, Troshin explained.

“Arbitrage requires experience in writing a connector (software for connecting to a site where assets are traded) to an exchange and trading strategies, as well as the ability to write good software and use good servers,” added Troshin.

Janis Kivkulis, leading strategist at EXANTE, also agrees that arbitrage is not very suitable for those who take their first steps in the market. The difference in the rates of liquid instruments on exchanges is “negligible”, so large sums of money are required to make significant money on arbitrage. In addition, it is difficult for private players to compete with large companies - institutional investors who use robotic schemes to track profitable patterns.

Step-by-step instruction

In order not to run into fraud and lose your funds during the first operation, you need to follow the step-by-step instructions. The optimal scheme for making money on the exchange is as follows:

- creating a wallet and replenishing it with the required amount;

- passing authorization on a cryptocurrency exchanger and linking a valid wallet or bank card to it;

- buying bitcoins for rubles;

- exchange bitcoins for rubles at a more favorable rate.

You may like: How to work with dropshipping: pros and cons

This simple option allows you to earn about 20-30% of your investment. The more you spend, the more you will get back.

Important. The exchange cycle can be repeated an unlimited number of times.

Exchange rates vary greatly across all sites. That is why you need to carefully monitor quotes. This will give you the opportunity to earn as much as possible.

Receiving cryptocurrency

In practice, it has been proven that there are several reliable ways to get btc without having a powerful PC or even get bitcoin without investments. Although this process is replete with various nuances, it is not nearly as complicated as it seems.

Making money on cryptocurrency exchange does not require too much investment, but it does require knowledge of certain nuances. The essence of such earnings is to buy bitcoin and then sell it at a higher rate.

You can hold cryptocurrency for a long time, counting on long-term profits. However, there is another option: play on daily price fluctuations, which allows you to earn money instantly. However, this approach is best used for cryptocurrencies that are less expensive than Bitcoin.

Any currency trading is a speculative transaction (arbitrage), the essence of which is to buy something cheaper and then sell it at a higher price. Cryptocurrencies are no exception in this sense. However, one should not confuse trading on the stock exchange with withdrawing cryptocurrency through exchangers.

Cryptocurrency rate: BTC. ETH. LTC. XMR. DASH - Real Time

On a cryptocurrency exchange, a transaction is made between two players. In an exchanger, you pay a certain amount directly to the site owner to convert your bitcoins into dollars or other currencies.

There are many ways to obtain virtual currencies for transactions. There are special “faucets” where coins are awarded for completing certain tasks. The option is attractive, but the annual income will be up to $10, it requires constant presence at the computer and there is a commission for withdrawal.

Mining using a PC or a video card farm is more effective. In this case, you can get more, but taking into account the energy costs and wear and tear of equipment, the level of profitability will be low. You also need cooling and sufficient Internet speed for mining.

It is more efficient to acquire production capacity. These can be special ASIC devices that can be purchased or rented from a cloud service. Such options have high profitability, and in the case of cloud mining, all technical issues are resolved by the company providing the services.

The easiest way is to buy cryptocurrency on a stock exchange, an exchange service, or an electronic wallet. The second and third options are the easiest, but the cost will be significantly higher than on the trading platform.

It is important to note that there are only two ways to receive crypto: free and paid.

Free methods

Ways to receive cryptocurrency without investment include:

- online services that pay for clicks up to $0.40 per hour;

- Bitcoin faucets - $0.05-0.08 per hour;

- freelance exchanges paying in crypto. For a simple task you can expect a reward of ≈ 0.00000339BTC;

- writing articles about cryptocurrencies. Everything here is individual and depends on the level of the copywriter. For example, previously BitcoinTalk organized a promotion and paid up to $2.67 per hour for writing short posts;

- writing news and articles for cryptocurrency blogs or news sites. Depending on professionalism, you can expect from $1 to $5 for 1000 characters or more;

- provision of various services. Programming, design, layout, translations, technical support, blockchain development, etc.;

- participation in Bounty campaigns, as well as AirDrops;

- mining on your PC;

- games without investments;

- referral programs;

- receiving crypt for answering questions.

Paid methods

Paid methods include:

- activities of an escrow agent related to the arbitration of crypto transactions. Income may vary;

- gambling (gambling). We do not recommend investing there;

- trading (suitable for experienced ones);

- sites for investing in cue ball (mostly a scam!);

- cloud mining;

- cryptocurrencies in debt. A very risky activity, we do not recommend it for beginners. The income here depends on the interest rate and the humanity of the borrower;

- exchanging fiat money for crypto within exchangers.

Several methods can be used, but preference is best given to the most profitable from an economic point of view. We recommend making preliminary calculations and opening a reliable wallet. This will take some time, but will help determine the best option.

Which coins are best to build a business on?

Bitcoin (Bitcoin or BTC) is where it all started. It was created by a Japanese programmer in 2008. The initial valuation of this electronic currency was a few cents. Few people believed in the future of cryptocurrencies, so its value did not increase significantly for many years.

Litecoin (Litecoin or LTC) appeared in 2011. Its difference from the first one is that the issue is adjusted to the real prices of precious metals.

No less popular is Ethereum (Ethereum or ETH). Its peculiarity lies in its more reliable program code than Bitcoin.

Of course, this is not a complete list of digital currencies; in mid-2022 there are already more than 1000 of them. And each has its own characteristics, which could take a very long time to list.

Currency exchange

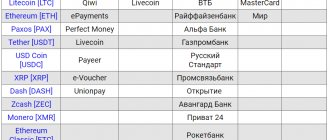

There are 2 options for receiving currency - an exchanger, where the rate is quite high, and an exchange, where the commission is lower, but it is also more difficult to understand. To choose the best option you need to use Bestchange. It is there that you can see data from all existing exchangers and exchanges. This way you can exchange currency most profitably.

Registration on the site is not required. Simply select the currency you are interested in and all rates will be downloaded instantly.

Most popular strategies

Bitcoin is not an ordinary monetary unit, but a simple digital file in which special names and digital balances are entered. Such numerical indicators have value; people who possess them want to exchange goods and services for the coins they receive.

Virtual currency is valuable, users see this advantage, as in other currencies on the planet.

Important! To obtain currency in the required quantity, you can use two effective methods - faucets and Bitcoin exchange.

Opening your own exchanger

If you have a large accumulated amount, then the best option would be to create your own exchanger. In this case, you will be able to get an almost completely passive, impressive income.

Required documents

This is the most important question that primarily worries budding entrepreneurs. There is no law regulating the cryptocurrency market as of September 2022. That is why the exchanger can open a database of any licenses and permitting documents.

It is important to take into account that the introduction of a certain law has been planned for a long time. Information may change at any time, so you should check it first to ensure it is up to date.

Formally, opening an exchanger will not be considered a violation, since there is no law at the moment.

Initial Investment

Initial investments vary from person to person. It will take about *5 thousand to develop a website if it is made according to a template. Individual development will cost many times more. You will have to spend from *10 to 100 thousand on advertising, depending on the scale.

You need to purchase the necessary currency taking into account your capabilities. You can spend either *100 thousand or several million.

*Prices are current as of September 2022.

How much can you earn

It all depends on the commission charged. If it is 2%, and $5,000 worth of transactions are made per day, then the monthly income will be about $3,000.

How to make money from Bitcoin faucets

So, faucets reward the user for completing tasks with small amounts of BTC. These amounts are usually measured in satoshi (one hundred millionth of Bitcoin). Tasks appear with a certain frequency, for example, every hour or once a day. This, as well as the individual conditions of the faucet, determines how many Satoshi you can get for one task. Often this number is made random within certain limits. Of course, smaller payments are more common.

Faucets can automatically send payments to a crypto wallet whose address is provided by the user, or make payments every few days. It is convenient to use special wallets for microtransactions for this purpose, for example, FaucetPay - many faucets are linked to them by default, that is, you cannot use the faucet without creating a wallet account.