- Does Litecoin have a future?

Recent news about the Litecoin price forecast for 2022 has provoked interest in the coin among cryptocurrency market investors. Litecoin has many advantages: it is highly liquid, transactions on the network are carried out quite quickly and the fees for conducting them are relatively low. However, brand awareness is still low and market share is declining. Don't rush to invest your entire budget in Litecoin. Study the opinions of experts on changes in the coin’s exchange rate, find out what they think will happen to Litecoin in the near future.

What is Litecoin or Lightcoin?

Litecoin was founded in 2011 by Google employee Charlie Lee. At the time, it was one of the first cryptocurrencies, so there were many similarities Bitcoin At that time, BTC was called digital gold and Litecoin was called digital silver. It uses blockchain technology, which has developed a decentralized peer-to-peer currency. Because of this, your identity may be hidden and third parties will not have access to sensitive data.

Litecoin is available in many places around the world and because of this it is also considered as a form of payment. This way, you can buy various things with these coins and no one will know about it. The cryptocurrency is specifically designed to eliminate the long waiting times for Bitcoin. Transactions on the Litcoin network are faster. At the same time, it is worth highlighting lower transaction costs, which is actually a huge plus.

Litecoin was also designed to support BTC in payments. Because of this, new coins are also constantly being developed so that there is no danger of running out of supply. Ultimately, the goal is to have four times as many coins as Bitcoin, which means Litecoin will also have a lower price since the supply of coins is much greater. Therefore, it may be attractive for novice investors to take a look at these coins and they will immediately become more accessible for everyday use. Overall, this cryptocurrency retains the features of Bitcoin, so users can always work with a reliable network.

Can Litecoin Reach $500?

At the time of writing, Litecoin is the seventh largest virtual currency on the market by market capitalization after Bitcoin (BTC), Ethereum (ETH), XRP, Bitcoin Cash (BCH), Tether (USDT) and Bitcoin SV (BSV). This means that Litecoin is one of the most loved and popular coins to invest in.

At the time of writing, Litecoin is trading at ~$40 and has a market capitalization of ~$2.58 billion. Given this, the virtual currency would need to grow by 733% within a year and a half to reach $500.

One of the things that could help Litecoin reach the $500 mark is the event that Bitcoin will experience in May 2020 - the halving. This means that the Bitcoin mining reward will decrease from 12.5 BTC to 6.25 BTC per block, meaning miners will receive less BTC for the work they do.

Find out more about what halving is, when it will happen and what to expect:

subscribe

Pros and cons of Litecoin

Since Litecoin uses the BTC network, you are provided with a stable network. However, changes have been made to make it more accessible. One of them is transaction speed. With BTC, you often have to wait 10 minutes for the block time to pass. With Litecoin it's a maximum of 3 minutes, which means payments are credited to the recipient's account much faster. It also makes payments more attractive to many industries around the world. Think about international trade, where payments can often take several days due to the payment option chosen.

Litecoin transaction fees are also a big advantage of this network. LTC cryptocurrency is designed for daily microtransactions. Usually there is a lot of money flowing into the world of cryptocurrencies, but with this cryptocurrency the situation may change. Therefore, transaction costs must also remain low, because otherwise it is no longer attractive to the user. Indeed, as many users as possible should be able to make a profit at the lowest possible cost with each payment. Thus, cryptocurrency can be accepted everywhere as a means of payment, and this is the cool feature of LTC, fast transactions with minimal costs.

How much will Litecoin cost in 2021?

Litecoin price forecast paints a positive future for crypto money. But potential investors should not forget that this market is subject to high volatility. Therefore, you should not give free rein to your emotions when deciding to buy or sell altcoins. It is much wiser, having already invested in Litecoins, to wait out a possible drop in value, since it may be followed by rapid growth. Such changes are typical of the current situation and should not cause serious concern. And it’s worth getting rid of electronic money only in situations where there is no doubt that the decline in value will be protracted, or when a more promising, promising competitor appears.

Litecoin forecast LTC/USD for 2022 and 2022

Unlike many other digital assets, Litecoin has a slightly different twist. This is because for many cryptocurrencies, it is important to have as high a value as possible in order to attract the attention of investors. Litecoin, on the other hand, wants to keep the cost relatively low so that more users will come to use the network. However, the value of the asset is highly volatile. The more popular a cryptocurrency becomes, the higher its price will be. However, Litecoin has less fluctuation than other cryptocurrencies and therefore there will also be less high profits when trading cryptocurrencies and therefore the growth potential will not be as great.

The expected price of Litecoin is constantly predicted by experts. However, such predictions vary depending on many factors, including the popularity of the coin. Partnerships also play a big role. The more partnerships there are, the more Litecoin will be in the news. Again, this is interesting. So, despite the desire of developers to keep prices low, popularity may shift prices.

As part of the Litecoin price forecast for 2022 and 2022, we should not exclude the development of a correction to the level of $70 per coin. Where can we again expect a rebound and continued growth of the Litecoin rate with a potential target above $1,500 in 2022?

This option for growth of LTC/USD quotes will be supported by a test of the support area of the relative strength indicator; it is worth noting that the values have dropped below the level of 30 twice in the entire history of the coin. After which growth occurred. Therefore, for a reliable signal, you should wait for the next drop in the indicator values to level 30 and buy LTC/USD for the long term. The second signal in favor of a rise in the LTC/USD price will be a rebound from the upper border of the “Triangle” model.

Thus, the Litecoin LTC/USD forecast for 2022 and 2022 suggests an attempt at correction and a test of the support area near the $70 level. Where can we expect a rebound and continued growth of the LTC/USD rate to the area above $1,500 already in 2022? An additional signal in favor of growth and the strongest one will be a fall in the RSI indicator values below the level of 30.

The Litecoin price has increased significantly recently. Currently, Litecoin is among the top 15 largest cryptocurrency coins in the world. At the time of writing, Litecoin has a market value of over $10 billion. There are 66,494,454 Litecoins in circulation, most of which are traded on the Binance exchange. Litecoin has been in the news a lot lately in a positive way, this has had a positive impact on Litecoin's price and price.

Litecoin's market capitalization is still small compared to Bitcoin, which could mean the price could still rise greatly as the market value increases. The maximum number of LTC issued is 84 million.

Litecoin Events

One of the most important events happening on the Litecoin network involves private transactions. These private transactions will provide functionality for users who want to protect their privacy when processing transactions.

This is one of the most important things happening on the Litecoin network, which is expanding despite the recent decline in digital asset prices. At the same time, the Litecoin Foundation is planning new partnerships that could help boost the price of this virtual currency.

One of the latest partnerships is between Litecoin and MeconCash, a company from South Korea. Thus, users in this country will be able to sell their LTC and receive Korean won anywhere in the country through 13,000 ATMs.

This will be useful for near-instant transfers where users will receive cash at any ATM associated with the promotion.

How mining affects the price of Litecoin

flikr.com/Marco Verch

Mining a cryptocurrency affects its price much more than it seems. It is the mining of coins that ensures the normal functioning of the network. The period of stagnation in the development of Litecoin (2014-2015) is associated, first of all, with the fact that miners preferred Bitcoin, which was more profitable to mine at that time.

There is an inextricable connection between the price of a coin and its mining. At the same time, up to a certain point, the peculiarities of token mining can slow down the growth of its value, and after passing point X, on the contrary, stimulate it. When Litecoin began to trade above $30, its mining on ASICs tailored for the Scrypt algorithm became profitable. The popularity of crypto has increased significantly. In addition, today there is a sufficient selection of miners using the Script algorithm, which means the possibilities for coin mining are expanding. None of the “crypto miners” will want to sell their silver for cheap. In addition, it is no longer possible for the price of a crypto to fall below that which ensures break-even mining.

Litecoin and the opinion of John McAfee

John McAfee is an extraordinary expert and forecaster. He is not ready to eat his reproductive organ for Litecoin, but his forecasts for Bitcoin give grounds for certain conclusions. Everyone knows that according to John, in 2022 the cue ball will trade at a price of at least $1 million. We have already talked about the inextricable connection of the BTC/LTC pair. Following the logic of the American Bitcoin guru, digital silver should cost at least $5,000, if not $10,000. A very interesting assumption. At his age, Mr. McAfee can safely voice such forecasts, giving his instrument of procreation as collateral. We advise men who read us not to become like an expressive expert, but to take a more balanced position.

Litecoin Price Prediction: Historical Analysis

It’s not just that we made an excursion into the history of litecoin pricing and revealed the reasons for its growth. The role of historical patterns in forecasts should not be underestimated. However, it should not be exaggerated.

Pixabay.com

Please note that the first serious pump is almost identical to the growth of 2017-2018. It is significantly lower and more extended in time in proportion to the prices shown. This was followed by a 3-year flat. Yes, the token gave several jumps, but they were not so serious.

This absolutely does not mean that we should wait another 3 years for the next growth. Just the opposite. The arrow in the picture above shows the position in which, from the point of view of historical patterns, the market is located today. This is evidenced by the long flat that we can observe today. A new wave of growth in the market is expected in the winter of 2022. It looks very likely that Litecoin will be able to grow by 100%. A market where they ask for 100-120 US dollars for this coin is a logical outcome of events.

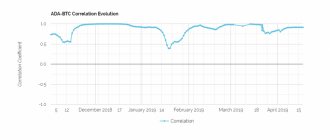

Correlating the timeline and the Litecoin rate, we can state the “acceleration” of the market. The period between pumps is reduced by at least 2 times. The logic of events suggests that after the price rise, we should wait for a year-long flat. Accordingly, in 2022, a new wave of serious growth will begin, comparable to the price jump in 2017.

Litecoin price forecast from Charlie Lee

The creator of this cryptocurrency got rid of its reserves so that no one could doubt his integrity. Accordingly, his forecasts can be quite objective. However, everyone can make mistakes. (Charlie Lee predicted that Litecoin will overtake Bitcoin Cash as early as 2022.)

The flipping (ETH>BTC) will never happen. But the flappening (LTC>BCH) will happen this year.