Consensus is a concept from the world of cryptocurrencies, meaning that nodes working with a certain blockchain reach agreement on the state and events of a distributed transaction log. Proof of Stake, or PoS, is translated from English as “proof of stake”, one of the two most common algorithms used in cryptocurrencies for confirmation and mining (Proof of Work remains the first in popularity, but it is gradually losing ground).

The essence of the algorithm

So, Proof of Stake – what is it?

The PoS algorithm is an alternative to Proof of Work. The protocol appeared in 2012 and was first implemented in the PPCoin platform (better known as Peercoin). The main idea of Proof of Stake is the “share” of coins available to a node, Stake, which determines which network node will have the right to open a new block during the mining process.

In the process of mining according to the PoS principle, network nodes, as in PoW, perform some hashing operations, but the complexity of the calculations is distributed among each node in proportion to the share of virtual coins in the node’s account. That is, the more currency tokens a user holding a node has, the higher his chance of opening a new block.

Important : although the term “mining” was used above, technically it is not entirely correct. In Proof of Stake, there is no mining as such - all payments come from commissions to stakeholders. Those who confirm transactions and create blocks are called validators. In the text below, the process will be called mining for ease of understanding.

You can explain how Proof of Stake works and what it is in simple words using the following diagram. So, let's say we have a block that needs to be signed and added to the chain.

There are four validators with specific shares (40, 20, 25 and 15% of tokens):

Figure 1. Distribution of funds among validators.

Since validator 1 has the most coins, he is the one who signs the block. In addition, he receives a commission for all transactions contained in this block.

What coins are available for PoS mining in 2022?

The best coins for pos mining are regularly announced by experts who publish relevant reviews. To decide which coins to choose for pos mining, we recommend studying the following list.

| № | Coin name | Date of creation and number of exchanges | Website |

| 1 | Peercoin | Traded on 15 exchanges, founded in 2012 | https://peercoin.net/ |

| 2 | Decred | Traded on 35 exchanges, founded in 2015 | https://www.decred.org/ |

| 3 | BlackCoin | Traded on 5 exchanges, founded in 2014 | https://blackcoin.org/ |

| 4 | Novacoin | There is a PoS calculator on the website. Traded on 2 exchanges, date of creation 2013 | https://novacoin.org/ |

| 5 | Cardano | Closed private PoS mining. Traded on 85 exchanges, founded in 2015 | https://www.cardano.org |

| 6 | EOS | Traded on 250 exchanges, creation date 2022 | https://eos.io/ |

| 7 | LEOcoin | Traded on 1 exchanges, date of creation 2016 | https://www.leocoin.org/ |

| 8 | Stratis | Traded on 20 exchanges, created in 2016 | https://stratisplatform.com/ |

| 9 | Lisk | Traded on 45 exchanges, founded in 2015 | https://lisk.io/ |

| 10 | Diamond | Traded on 2 exchanges, date of creation 2014 | https://bit.diamonds/ |

| 11 | ICON | Traded on 45 exchanges, founded in 2014 | https://www.icon.foundation/ |

| 12 | SolarCoin | Traded on 3 exchanges, date of creation 2014 | https://solarcoin.org/ |

| 13 | EmerCoin | Traded on 5 exchanges, founded in 2013 | https://emercoin.com/ru |

| 14 | reddcoin | Traded on 10 exchanges, date of creation 2014 | https://www.reddcoin.com/ |

| 15 | PIVX | Traded on 17 exchanges, forked in 2016 | https://pivx.org/ru/home-ru/ |

The rating of cryptocurrency with pos mining is regularly updated and expanded, so if you work in this niche, do not stop following market news. The current list of coins for post-mining may contain a large number of cryptocurrencies with different yields and profitability.

Prerequisites for the appearance

For several years, “proof of work” remained the only method of achieving consensus (as in the Bitcoin network). Over time, however, the complexity of mining (the amount of calculations required to open a block and confirm transactions) increases, and the hardware requirements and cost increase. Electricity costs for mining are becoming higher, and this makes “classic” mining unprofitable for users with limited capabilities, and the profitability of the process is falling.

Despite the fact that high complexity to a certain extent protects the PoW network from “51%” attacks, developers began to look for alternatives, and one of the results of these searches was the Proof of Stake algorithm.

What is the profitability of Ethereum PoW mining?

Let us immediately note that all calculations of the profitability and payback of PoW mining are helped by the 2CryptoCalc calculator. He knows not only the profitability from one video card of a different model for different periods, but can also share links to downloads of miner programs and settings for them at the same time.

For example, this is what a page with different video cards and their payback looks like. At the same time, you can indicate the cost of the device that is relevant for your region - this way you can get more accurate data.

Payback of various video cards

For example, let’s take data on the Nvidia RTX 3070. The starting price of the device was $580, but now you can’t find such prices. We have clarified the latest data: on the DNS website this model can be purchased for 102 thousand rubles, that is, for $1,410.

Available Nvidia RTX 3070 graphics cards on the DNS website

It is most profitable to mine Ethereum on the RTX 3070 - as for many other video cards.

Best cryptocurrencies to mine on Nvidia RTX 3070

We indicate the appropriate price and see that it will take at least 10 months to pay for the device.

Payback of the Nvidia RTX 3070 video card

Since the video card earns about $96.74 per month, we get $1,160 in income per year. This is almost 82 percent of the invested funds, which is 15 times more profitable than the current PoS staking.

Ethereum mining profitability on Nvidia RTX 3070

It is important to note that it is absolutely possible to get better results. To do this, you need to get confused and buy a video card that has already been used. It will cost less than a new one, which means the payback will come faster, which will increase income.

Let's say that you decide to mine on a large scale and purchase eight of the specified video cards, making a full-fledged rig out of them. As follows from our material on assembling an Ethereum farm, the cost of construction and materials will be about $600. Let’s assume that prices have increased significantly, and let’s take $700 in expenses with a reserve.

Eight RTX 3070 cards will cost $11,280. Taking into account the costs of the rig, it comes out to about 12 thousand.

Now we calculate the profitability. Each video card produces a hashrate of 41 Mh/s with a consumption of 125 W. This is 328 Mh/S, which will provide about $26 per day.

Mining profitability on eight Nvidia RTX 3070

But that's not all - you need to remember electricity. The farm will consume about 1200 W, which at a tariff of 5 rubles per kW/h turns into approximately $2 per day. We get 24 dollars net.

Payback will take about 500 days ($12 thousand costs / $24 daily profit), that is, approximately a year and four months. The profitability in this case is 73 percent, since the profit for the year will be about $8,760.

We took the average price of electricity, which can be either more expensive or cheaper. The lower the expenses, the faster the payback will come and the higher the profitability will be.

It is important to note that although the farm does not pay for itself in a year, the profitability of mining on video cards is still significantly higher than staking. Still, in a year in this case, we recouped 73 percent of the initial investment, earning almost 9 thousand dollars. If you wish, you can sell the devices at any time, thus ensuring yourself a profit.

Cryptocurrency miner

And if the Ethereum rate increases, the payback will come even faster.

Ethereum daily price chart

Advantages of Ethereum PoW Mining

Against the backdrop of Ethereum staking, PoW mining using video cards primarily pleases with its profitability. Some video cards - especially used ones - can be repaid in a few months, after which pure earnings will begin.

Cryptocurrency miner

In addition, video cards are universal, which is why they can be switched to other cryptocurrencies. This is especially useful for new projects, the difficulty of mining for which is quite low, and the rate has not yet had time to clear up.

Finally, video cards will be easy to sell. Given the current shortage of devices, this will not pose any problems. Besides, you might be able to make money.

Disadvantages of PoW cryptocurrency mining

As we have already noted, there are certain problems with the availability of video cards now. They are difficult to get, and if you can, they are overpriced. However, this does not stop miners, because the payback of the devices so far allows them to pay for themselves fairly quickly. And this encourages sellers to increase the price tag even more.

Ethereum

The disadvantages of Ethereum mining on video cards include device maintenance. And even if everything goes well with them, the release of a miner update may force you to select new overclocking parameters, frequencies and other little things. And this is a considerable waste of time.

The most obvious disadvantage of PoW mining is the need for physical space for the devices. They need to be kept somewhere - preferably in a protected area - not to forget about cooling, and also be ready to repair something. As well as being able to understand technology and its structure.

Peculiarities

In the cryptocurrency world, there are various implementations of Proof of Stake, but they are united by a common idea: a resource through which the “weight” of a node’s vote in the system is calculated—coins of a particular cryptocurrency. The more coins deposited in the account, the higher the chance of breaking a block and receiving a reward.

As is already clear, for mining you need to have a certain number of virtual coins in your account - the more, the better.

Important: in projects using the PoS algorithm, mining can only begin with the purchase of a certain number of tokens; an “empty” node with a zero balance will not be able to confirm transactions. So, to create a full DASH node, at least 1000 tokens are required.

To start mining you need:

- install cryptocurrency client software;

- top up your balance in any convenient way;

- ensure the presence of the node online.

Actually, this is where all actions end in the general case. Now the user’s chances of opening a new block depend only on the volume of the share of tokens he has.

Cloud PoS

The problem with PoS mining is that the owner of the wallet must maintain a constant connection to the server, and the profitability depends on the amount held in the account. To increase profitability and solve the problem of holding a wallet online, cloud services have been created that unite those who want to earn cryptocurrency.

The mining server has registered cryptocurrency wallets with support for post-mining and a reliable Internet connection. Owners of coins transfer them to a cloud service account, where they are accumulated to ensure maximum profitability. The profit received is distributed among investors in proportion to the size of their deposits.

Service fees allow server owners to pay for equipment maintenance and make a profit from their activities.

Investors in cloud mining also do not lose money thanks to the advantages that the service provides:

- the profitability of investments increases due to the accumulation of a large number of crypto coins in one wallet;

- There is no risk of losing profits due to a blackout of the Internet or power supply.

Cloud services for PoS mining minimize the barrier to entry, allowing even those who do not have a computer with stable access to the Internet to join cryptocurrency mining.

Mining and earnings in PoS

In projects working on the Proof of Stake principle, new coins are mined by paying a certain commission to the node that opened the new block. The process goes like this:

- coin owners (stakeholders) place tokens on their balance sheet;

- these funds are blocked for some time;

- After voting in the system and opening a block, the user who opened it is awarded some reward.

Important: as follows from the above, the funds in the wallet for mining must remain motionless and cannot be spent. To conduct your own operations in the system, you should create a separate wallet. Also, the node participating in mining must be online all the time.

In addition, you can try to make money on the difference in exchange rates on the exchange. In particular, modern decentralized exchanges, or DEXs - PancakeSwap, Uniswap, SushiSwap and others, use algorithms from the PoS family.

Interesting: besides “pure” PoS, there are other variations of this algorithm. For example, the Proof of Importance protocol used in the NEM cryptocurrency uses a three-component confirmation system. The number of coins in the account, the time the node is online and its activity (number of transactions) are taken into account. The influence of the first parameter is inversely proportional to the sum of the “weights” of the second and third.

Another option is the Delegated Proof of Stake algorithm, or DPoS, when network users select a number of nodes that have the right to confirm transactions. This is, for example, the Bitshares project created by US programmer Dan Larimer.

These options will be discussed in more detail below.

How to start PoS mining?

To get started, you should first study the project, namely the technical part of the emission component - this will reduce costs and prevent irrational investments. It’s convenient to look at the Bitcointalk , where all projects maintain their own threads.

First of all, you should create your own local crypto-wallet on your computer - your assets will be stored here and you will be able to manage your own funds. Storing funds on the exchange will not bring profit, since synchronization will require a dedicated IP.

If you decide to work independently, then the condensed procedure is as follows:

- Buy coins on a crypto exchange or exchanger;

- Download the wallet to your computer;

- Synchronize the wallet, which takes a day;

- Send funds to a local wallet (PC);

- Storing coins in your account and receiving proportional rewards.

Advantages and disadvantages

The proof-of-stake protocol has a number of significant advantages for the consumer:

- There is no need for expensive mining equipment or creating a farm. All you need is a computer with a wallet and tokens of the selected cryptocurrency on your balance.

- There is no need to think about where to place the equipment, how to ensure its uninterrupted power supply and cooling.

- Relatively low entry threshold, unlike PoW currencies, especially those whose complexity requires the purchase of ASIC miners costing hundreds of thousands of rubles.

- Environmental aspect – electricity is saved, the production of which requires irreplaceable natural resources, and the environment is polluted in the process of energy generation.

- There is no equipment “arms race” usual for Bitcoin and similar projects - the hashrate is limited by the number of coins in the wallets of stakeholders.

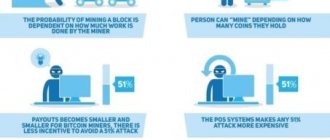

An important advantage of PoS is that it makes the “51%” attack more difficult. To accomplish this, the attacker must not ensure superiority in computing power, but purchase 51% of the cryptocurrency tokens, which turns out to be financially unprofitable. In addition, such an attack will disrupt the balance of the network and the stability of the cryptocurrency, that is, the attacker himself will suffer.

But there are also some disadvantages that cause concern among experts:

- a tendency towards centralization stemming from the essence of the algorithm: it encourages stakeholders to accumulate and hold funds on their balance sheets;

- a sufficiently large group of token owners, having accumulated a significant amount of coins in their accounts, can begin to dictate the rules of the network;

- theoretically possible problem of Nothing-as-Stake, or “empty stack”: an attacker can, using non-existent “virtual” resources, create a fork of the blockchain, carrying out, for example, a “double spending” attack, rejection of operations, etc.;

- low user activity. An example is Curve Finance, whose users have blocked just over 6% of their tokens from voting.

How does an ICO work with PoS?

During the initial placement of coins, the price is usually much lower than after listing on exchanges. This situation could theoretically be taken advantage of by scammers who are confident in the profitability of the new cryptocurrency in the future. By purchasing a “controlling stake” at the ICO, they would become full owners of the blockchain, without the risk of losing investments.

The following steps can be used to prevent such a situation.

- Conducting sales in several stages.

- Selling less than 50% of the total.

- Allowing participation only to those who have fulfilled the requirements (for example, frozen a certain cryptocurrency in their wallet). Simply having the money to buy out a 51% share is not enough.

- Creation of a reserve fund (in Tron it accounted for 35% of the total minting volume).

Differences between PoW and PoS

The debate about the differences, advantages and disadvantages of one consensus system from another does not subside, and both sides provide a lot of argumentation. The infographic below outlines the key differences:

Figure 2. How do PoW and PoS algorithms differ?

As you can see, there are several main differences:

- in the method of confirming transactions and choosing the node that does this;

- in the mechanism for accruing income to the validator;

- in energy efficiency due to the absence of the need for powerful equipment.

Ethereum Migration

In 2022, it was decided to gradually transfer Etherium from the PoW algorithm to PoS. Phase 0 started in December, when more than 16,000 validators with stakes of 32 ETH began working on Beacon Chain, the new second-generation Ethereum blockchain. They received a reward of 21.6% per annum, but already in 2022 it dropped to 7%.

The more ether is added to staking, the lower the incentive will be, however, due to the growth of the rate, the enterprise can be very profitable. If the fall begins, you won’t be able to quickly leave the pool - the freeze lasts from 12 to 24 months.

The first phase is the beginning of full-fledged work with 64 shards.

The second phase is the start of applications and economic activity. Parallel operation of both Ethereum networks, first and second generation. Conversion of old coins to new is available.

List of PoS coins

Below is a list of some cryptocurrencies that use pure PoS and its variations.

Table 1. Examples of PoS cryptocurrencies.

| Consensus | Cryptocurrency |

| PoS |

|

| LPoS |

|

| DPoS |

|

| PoI |

|

| PoA |

|

| DBFT |

|

Interesting : in 2022, Vitalik Buterin’s team planned to transition the Ethereum network to the PoS protocol. The decision to transfer the cryptocurrency to Proof of Stake was made to avoid the negative consequences of a further increase in complexity on the current Proof of Work consensus. The release of the new Casper protocol, which was supposed to help in the transformation, took place in the fall of 2017. However, the event was postponed. In recent interviews, Buterin noted that the transition to PoS could still take place in 2022.

Other projects based on the PoS algorithm:

- Komodo, which runs on the dPoW protocol, a hybrid of PoS and PoW;

- the hybrid principle was implemented by Bitconnect;

- SP8DE platform, which conducted an ICO in February-March 2022.

Differences between PoS-like consensuses

Let's consider variations of methods for proving ownership shares:

- The PoS algorithm is discussed above; the chance of opening a block and receiving a reward depends on the share of coins in the account of any user of the system.

- Leased PoS (LPoS) is a mechanism that allows users to lease tokens to other nodes. Leased funds increase the “weight” of the node, giving it more chances to open a block and receive a reward. In exchange for tokens, the tenant node shares income with the lessors.

- DPoS – Delegated Proof of Stake. The principle of delegated proof of stake implies that stakeholders select some nodes that create new blocks and add them to the chain.

- Proof of Importance, or confirmation of importance. This principle was discussed above; it is based on a combination of node parameters - its balance, activity and network uptime.

- Proof of Authority, or confirmation of authority. Instead of token stacks, validators use their own reputation.

- DBFT. Hidden under the acronym is the concept of Delegated Byzantine Fault Tolerance, which redefines PoS consensus. The fault-tolerant Byzantine protocol allows holders of cryptocurrency tokens to choose the so-called. “bookkeeper”, and a group of several, chosen by the entire network of bookkeepers, will generate new blocks and be responsible for achieving consensus.

Prospects for Proof of Stake

Cryptocurrency experts rightly note that Proof of Work is becoming too complex, expensive and unprofitable for the end user. Therefore, Proof of Stake and its variations in new cryptocurrency projects most likely have a great future, despite some existing shortcomings, which the project authors are actively working to eliminate. And even current cryptosystems are switching to PoS - such as ether.

There is a good chance that the number of PoS projects in the cryptocurrency world will increase, and proof of work will gradually become obsolete and fade into the background, especially in the long term, due to the obvious advantages:

- energy efficiency;

- cost of “entry” and work;

- safety;

- decentralization, independent of computing power.

Mining

Mining is a process in which an individual or group of miners (a pool) use powerful computers that compete with each other to solve complex mathematical problems. Read here for a simple and professional explanation of mining

This computational math puzzle is a proof of work that miners must solve to keep the blockchain network secure and decentralized.

Mining is a secure encryption and continuous process that directs two processes in the cryptocurrency network:

- Validation of transactions on the blockchain network

- The introduction of new coins into circulation, which the miner receives to successfully verify each new block of transactions.

With many computers mining, the network becomes more decentralized and becomes very difficult to attack.

There are almost 1,000 coins in cryptocurrency that use Proof of Work, meaning these coins can be mined. Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Monero, Dash, Ethereum Classic, Zcash, Dogecoin and Ravencoin are some of the popular examples of mined coins.

At the same time, Ripple, EOS, Stellar, Tezos, NEO, NEM, Ontology, Wechain, Waves, QTUM, LISK and NANO are some of the popular examples of unmined coins. In fact, these are not tokens, but coins that cannot be mined.

So, what does a mined and non-mined coin actually mean in cryptocurrency?