You can start earning electronic money even without having expensive ASIC equipment or large video card farms. There is an alternative method for mining cryptocurrency – the Proof-of-Stake algorithm. To earn money with it, you need to have a certain number of tokens in your wallet that use PoS. This whole process is somewhat similar to making a deposit in a bank deposit, more tokens in the account, higher earnings.

Proof-of-stake (confirmation of share) is a method of protection in cryptocurrencies, in which the probability that one of the users will form a new block in the blockchain is proportional to the share of the tokens belonging to them from their total number.

The essence of the algorithm

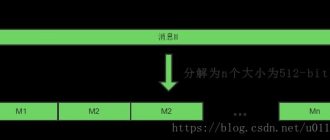

PoS is a consensus mechanism implemented back in 2012 on PPCoin. The essence of the work is that Stake (share) is used as a resource that determines the node that will be given the right to acquire the next block during pos mining. Using Proof of Stake, nodes hash information while searching for results that have a value less than a given value. Moreover, the level of complexity in each case is distributed proportionally and is comparable to the balance of a particular node.

To put it simply, POS takes into account the number of coins in the user’s electronic account. This means that the next block can be generated by the node that has more balance. Proof of Stake attracts miners due to its minimal system requirements and its use does not allow computing power to be wasted just like that.

Types of staking

- Independent technical (classical) . The money is frozen in your wallet, all that remains is to wait for the reward. The problem is the minimum amount, which may be unaffordable for 90% of users. So, in Ethereum it is 32 ETH ($67,000), in Tezos – 10,000 XTZ ($28,600), in DASH – 1000 ($133,000). Moreover, the required period for blocking coins can vary from a couple of days to several years. If the validator turns out to be offline, he will be fined.

- Cold. Money is kept on the balance of a hardware wallet (for example, Trezor, Ledger). No permanent online connection is required. Accruals stop immediately after withdrawal of funds. Suitable for large hodlers as it ensures maximum money security.

- Delegated. The coins are transferred to the balance of the intermediary, who places them together with the money of other clients. Thanks to the accumulation of funds, the intermediary receives a large market share and high chances of income. The main representatives of delegated staking are cryptocurrency exchanges, SaaS platforms (Staking-as-Service), staking pools (including DeFi). The main advantages for investors are that there is no need to understand complex technical settings, control and support the process.

Prerequisites for the appearance

For some time, Proof-of-Work was the only way to reach consensus. Today, the complexity of mining has increased significantly, the requirements for hardware and its price have increased. The rise in price of electricity leads to increased costs for “classical” mining and for users who do not have great opportunities, this process has become unprofitable. Despite the good security of the POW algorithm, the developers began to look for an alternative to it and they found a way out - this is the “proof of ownership” Proof of Stake.

Differences between Proof of Stake and Proof-of-Work

There are significant differences between the two algorithms Proof of Work and Proof of Stake; they use different concepts. But still, they are both widely used today. To understand how they differ, you need to consider them in detail.

What is Proof of Work (PoW)

What is proof of work? This algorithm was created before the advent of cryptocurrency. Back in 1993, Moni Naor and Cynthia Dvor, renowned researchers, proposed the idea of accessing network resources only after completing a mathematical problem. Three years later, Adam Back embodied the idea in a project called Hashcash, which was created to protect electronic systems from spam.

Attention! The name Proof of Work was introduced three years later; this term was used to describe an algorithm that protects servers from hacker DDoS attacks.

Already known to everyone, Satoshi Nakamoto (one person or a group of people, no one knows), Hashcash technology was embodied in Bitcoin in 2004. It turns out that Bitcoin is not just the world’s first cryptocurrency, but also the very first PoW cryptocurrency.

The principle of PoW mining

Proof of Work has the following operating algorithm:

- Transactions on the blockchain are randomly grouped into blocks.

- Users must confirm transactions by solving the most difficult problem (Proof of Work Problem).

- The miner who solves it first receives a reward for closing the block.

- Transactions that receive confirmation are added to the blockchain.

To search for a hash, a miner must use specialized and expensive equipment (mining programs, farms, Asic devices) to find one correct solution among a huge number of options.

Important! Miners with the most powerful equipment have every chance to be the first to solve a mathematical problem and make a profit.

Disadvantages of the PoW algorithm

Proof of Work has disadvantages:

- Energy costs are too high. Sometimes incompatible with earnings.

- Proof of Work is exposed to a very serious threat, it is called the 51% vulnerability.

- Dependence on real money. Farm owners, even with thousands of coins, must pay for electricity and buy video cards with fiat money.

At first glance, there are few shortcomings, but they are significant, for this reason a new algorithm appeared, which the developers prepared for a long time.

What is Proof of Stake (PoS) and how did it come into being?

What is Proof of Stake? The idea of adopting a new consensus algorithm was first voiced on the famous forum bitcointalk.org in 2011. Its essence was that validators now became not users who had the most powerful equipment, but those miners who owned a larger share of coins in the network. When mining using Proof of Work, the user who solves the first mathematical problem receives a reward, and the closed block of transactions is added to the blockchain. Proof of Stake mining is different in that the participant with a larger stake is more likely to become the “creator” of a new block.

Working with the PoW algorithm, the user receives a reward for confirming transactions, and with POS technology, those users who have more coins are more likely to have the right to confirm them and receive a reward for this.

The principle of POS mining

Proof of Stake has the following operating principle:

- The user selects an electronic currency that supports the PoS algorithm, buys coins and then puts them into an electronic wallet.

- After this, in some cases it is also necessary to download an additional miner program, which is launched separately, after which you need to enable the electronic wallet for forging.

- Waits until the wallet is activated, downloads the entire blockchain and contacts nearby nodes, usually this does not take much time, launches the downloaded program on the PC.

- The utility performs the necessary calculations, as in “classical” mining, and after some time, the funds are transferred to the electronic wallet.

The forging program can be installed on any PC; all you need is a stable and unbreakable connection to the network.

Important! The main condition when working with Proof of Stake is that the funds in the account cannot be moved anywhere, they are located there and participate in the confirmation of transactions. Over time, the user receives a significant profit for this.

Disadvantages of the POS Algorithm

Proof of Stake has some disadvantages:

- Activity may be limited. When you move funds from your wallet or disconnect.

- Increasing centralization. The income of those investors who are richer will always be greater.

- Threat of a big conspiracy. If most of the token owners unite, they can begin to dictate their terms of operation of the network.

Despite the shortcomings, most serious experts believe that the PoS consensus algorithm is more practical, more economical and safer than PoW.

Features of PoW

PoW consensus (also called Nakomoto consensus) was the most innovative solution proposed in Satoshi’s article “Electronic Cash”. PoW solves many electronic money problems, such as Sybil attacks. In addition, PoW ensures fairness in the network: the success of a miner is proportional to the computing power of his equipment (hashrate). If a miner's hashrate is 1% of the entire network, then it is most likely that he will create 1% of the blocks and receive 1% of the reward. This is why Bitcoin appeared on the basis of PoW.

However, for all its coolness, PoW has its drawbacks. Some people consider them significant:

- Lack of utility: Computations performed for proof of work serve no useful purpose (other than to provide security). Solving cryptographic problems occurs for the sake of solving them. At the same time, in order to make calculations, you need to spend resources, primarily electricity. It turns out that the resources spent on mining in PoW are wasted;

- The problem of maintaining decentralization. About 80% of Bitcoin's hashrate is now located in China. Centralization, in theory, could help miners unite and conduct malicious activities. If such miners become the majority (the so-called 51% attack), they will be able to ignore blocks of other miners, distributing the reward only among themselves, or double-spend the same crypto coins.

Advantages of the PoS algorithm

This algorithm has a number of specific advantages:

- Electricity is not wasted just like that, although the PC must be turned on, it does not waste a lot of electricity, since it does not carry out complex calculations.

- There is no need to build up or increase computing power.

- There is no need to think about where to place the equipment and how to cool it.

- The fact that you need to have a large number of coins in your account protects against a possible attack on the network. If suddenly a scammer decides to buy coins in huge quantities, their price will begin to actively and immediately rise. Further purchase of coins will be absolutely unprofitable for him.

- Even if you manage to collect a fortune on your balance sheet, the one who attacks will be the first to suffer, this is due to a violation of the stability of the system.

It’s not difficult to start making money with the PoS algorithm; there is a low “entry threshold”, which cannot be said about PoW, where you need to spend hundreds of thousands on equipment.

Ethereum Classic (ETC) Mining Profitability

Ethereum Classic (ETC) is the original Ethereum network, which opposed the use of a controversial update by Ethereum developers back in 2016, breaking away from the main ETH branch as a result of a hard fork.

Ethereum Classic miner

After a series of very powerful 51% attacks on the ETC network, the developers of this currency realized that it was unsafe to remain in the shadow of Ether and use the same mining algorithm and slightly changed the currency algorithm. Additionally, they halved the size of the DAG file located in the video card memory and allowed even cards with 3 GB on board to mine. The ETC DAG file is, of course, growing again, and in 2022, 3 GB cards will no longer be able to mine this currency, even on Linux systems.

Now this currency is optimal for a huge number of old video cards with 4 GB of memory on board. In addition, it is present on a large number of cryptocurrency exchanges, which ensures quick exchange to other cryptocurrencies or fiat money with minimal losses.

Ethereum Classic price chart for the year

- Mining algorithm: Etchash (Cold ❄️)

- Minimum video card memory size: 3 GB

- Block reward: 3.2 ETC

- Average block time: 13 seconds

- Traded on exchanges: Binance, Huobi, Gate, Bittrex, KuCoin, Coinbase and others

- Place in the cryptocurrency ranking: .

According to rough estimates, ether-classic is mined by 90 thousand miners around the world or approximately 900 thousand video cards with an average speed of 30 Mx.

Profitability of mining Ethereum Classic on Nvidia RTX 3080 Ti

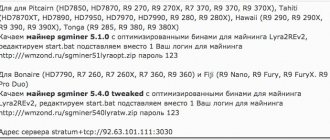

A ready-made bat file for mining can always be found on the “How to start” page of the Ethereum Classic pool. Example for the lolMiner miner (AMD video cards).

lolMiner.exe --algo ETCHASH --pool etc.2miners.com:1010 --user YOUR_WALLET_ADDRESS.RIG_ID pause

Here is the data for Gminer, it can be used for AMD and Nvidia.

miner.exe --algo etchash --server etc.2miners.com:1010 --user YOUR_WALLET_ADDRESS.RIG_ID pause

And for T-Rex (Nvidia only).

t-rex.exe -a etchash -o stratum+tcp://etc.2miners.com:1010 -u YOUR_WALLET_ADDRESS -w RIG_ID -px pause

A description of Ethereum Classic mining is here.

List of popular PoS coins

There are quite a few coins, but the most popular of them are:

- LEOcoin. If the user owns more than 50 thousand coins, they will provide a yield of 20% per annum. Traded on 5 major exchanges, system capitalization is more than $24 million.

- ReddCoin. It has a low rate of return of 5%, but this coin is interesting as an investment with the prospect of great growth. The capitalization of the system exceeded $41 million. Trading is carried out on Bittrex and on 7 exchanges.

- ClubCoin. The yield is 20% per annum, but trading is carried out only on 2 exchanges, including the well-known Bittrex. Capitalization exceeds $43 million.

- NovaCoin. The creators of this coin promise that its profitability will be 100% per annum. Capitalization over $8.5 million The coin is traded on 8 exchanges.

- OK Cash (OK). The yield is 20% per year, trading is carried out on Bittrex in small volumes.

When choosing a POS cryptocurrency, you need to focus on the interest rate, preferably it starts from 5% per year, on the other hand, if the interest rate is too high, this should serve as a signal that you need to be especially careful with such a cryptocurrency.

Possible income level

Directly depends on the status of the cryptocurrency, volume and method of investment. Well-known and stable coins will give from 5% to 10% per annum, while here there is the least risk of a collapse in the price of the asset itself. New projects can promise 150% or even 1000%, but in the end this is done only for a pump on an unknown exchange with the subsequent death of the coin.

- DASH – 9%,

- Tezos - 8%,

- Quantum – 6%,

- Waves – 5%,

- ADA - 5%,

- Tron – 5%,

- EOS – 4%.

The Binance cryptocurrency exchange offers the following types.

- Fixed staking. Funds are deposited for 15-90 days at a rate of 2.5% to 46% per annum. If you close the deposit ahead of schedule, only the original amount will be returned, without accrued interest.

- DeFi staking. User funds are invested in staking pools of projects from the field of decentralized finance. Binance is not responsible for possible risks of hackers hacking external platforms. A floating rate is applied (adjusted daily), flexible blocking (money can be withdrawn at any time without expending interest). Yield from 1.7% to 10.25% per annum.

On DeFi exchanges, the average range of offers for staking various tokens is from 2% to 400% in some areas. As a rule, big Xs promise to retain highly specialized or new, unpromoted assets. The main danger in this case is increased volatility, due to which the price of the locked token can collapse at any moment.

Differences between pos-like consensuses

There are a large number of consensus algorithms on the blockchain market, some are known, and users are just beginning to learn about some. Let’s look at several variations of “proof of stake” techniques:

- Leased PoS (LPoS). This algorithm allows you to rent out your coins to other nodes. Rented coins increase the “weight” of the node, which gives it a much greater chance of opening a block and receiving a reward. The node that rented them gives a portion of the profits to its lessor.

- DPoS – Delegated Proof of Stake. The principle of delegated proof of stake implies that stakeholders select nodes that create new blocks in the network and add them to the chain.

- Proof-of-Importance (PoI). Takes into account both the number of tokens and the participant’s activity in the blockchain network. It entices you to actively use funds rather than keep them in your wallet.

- Proof-of-Burn (PoB). Using this algorithm, the miner sends tokens to a random generated hash address. Cryptocurrency cannot be spent from such an address, since the key cannot be found. For this, the miner gets the opportunity to find a PoB block and naturally receive a reward.

- Proof-of-Capacity. In order to become a miner in this network, you need to provide public access to your hard drive, that is, to part of it.

- Proof of Activity. Proof of activity. Both PoS and PoW coexist here with great success.

Most of all platforms do not use PoS in its pure form, but use the Proof-of-Work and Proof-of-Stake algorithms together, as well as their variations and all sorts of combinations.

Important! In any projects using the PoS algorithm, mining can begin only after at least 1000 tokens have been purchased. A node with zero balance is unable to confirm transactions.

Stages and strategies of POS production

How to start mining PoS currency:

- Select the PoS currency (below is a description of some currencies) that you will mine.

- Create a crypto wallet.

- Buy currency.

- Wait until blocks appear in the feed (the process will take about 24 hours).

- Install the software client on your computer.

- Activate wallet.

There are several POS mining strategies.

The simplest is to purchase some kind of PoS currency (hybrid PoW-PoS currencies are also suitable, for example, PutinCoin), which is listed on at least one of the major exchanges. You start mining it, extracting new blocks and receiving a reward for them, your earnings will consist of two components:

- change in the price of a currency based on the results of trading on the exchange.

- reward for blocks in the form of cryptocurrency, which you can also sell on the exchange.

A slightly more complex strategy in terms of time investment is buying a new cryptocurrency that is not yet listed on the exchange. The goal is to purchase the maximum amount of currency at the minimum price in order to sell it when it appears on the exchange. This method has a significant drawback - the currency may never begin to be traded anywhere. However, you risk almost nothing, so you can try your luck. Crypts of new generations appear on the network every now and then, giving hope with their technological effectiveness.

Some craftsmen mine PoS currency collected from faucets. This method also has a right to exist, however, the profitability of such mining is relatively low.

Prospects for Proof of Stake

Most cryptocurrency specialists have long noticed that the Proof of Work algorithm has become very complex, expensive and does not provide benefits for the average user.

For this reason, the Proof of Stake algorithm, as well as its various variations in the latest cryptocurrency projects, has a bright future. Of course, the algorithm and projects have certain shortcomings, but the developers are actively working to eliminate them and will be able to fix them.

Most likely, in the near future, the number of PoS projects in the world of cryptocurrencies will begin to increase strongly and rapidly, and the Proof-of-Work algorithm will become outdated and fade into the background. Perhaps this will happen neither tomorrow nor in a year, but if we look at it in the long term, it will definitely happen, thanks to the following advantages:

- high energy efficiency;

- low cost of “entry”;

- high degree of security;

- decentralization, which does not depend on computing power.

These and a number of other advantages allow the Proof of Stake algorithm to count on a great future in the world of cryptocurrency projects. But today it is still difficult to say which one is better than POW or PoS. Each of the algorithms has its opponents, as well as supporters, and each of them will defend their own point of view. Nowadays, the most popular are hybrid versions of systems that combine Proof of Stake and Proof-of-Work algorithms.

You may also be interested.

Blockchain 0