There are a lot of cryptocurrencies in the world. There are thousands of tokens and altcoins available for trading on exchanges. Every day new cryptocurrencies are developing and entering the trading market. Today, everyone wants to know which are the best and most promising cryptocurrencies of 2022 and possibly 2022.

The undisputed leader is still Bitcoin. On many exchanges he is already called “grandfather” or “Godfather”.

Many altcoins have improved on the original Bitcoin protocols through blockchain. Most of the new cryptocurrencies that exist today are now focused on utilities and decentralized applications. Many of them have become more adapted for use. Blockchain technology could one day revolutionize the computing industry the way the cloud is doing now.

Ethereum (ETH)

Ethereum, created by a 19-year-old Canadian with Russian roots, ranks second after Bitcoin. This is a great cryptocurrency for investing and trading. Its rate is about $470, although at the beginning of this year the price of ETH was less than $10. Ethereum has seen steady growth and more and more people are investing in ETH. It is believed that ETH could reach the first $1k mark this year.

Speculators as the engine and brake of progress

Regardless of what legal framework cryptocurrency finds itself in, speculators in the near future will no longer be able to earn as much as they do now. It will no longer be possible to work according to the old scheme of traders from the Russian Federation and CIS countries of the 90s: buy cheap and sell at a higher price tomorrow. Three significant opinions were expressed on this topic at once:

- Smith. Cryptocurrency must become stable so that its use can be comfortable for all people.

- Srinivasan. The time of the “Matrix” is coming, in which “the need for transactions without borders will exceed the current one.”

- Roberts (meeting moderator). New opportunities are needed that provide tangible advantages over fiat money. “Ideally there would be more to it than anonymous drug dealing.”

At the same time, experts pay tribute to speculators, thanks to whom a considerable part of the excitement was created. Despite their desire for easy money and attempts to get it by any means, including outright fraudulent ones, they managed to popularize tokens to such a level that leading economists and politicians of the world became interested in the coins.

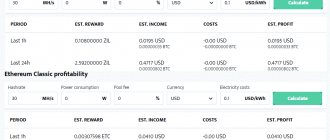

Ethereum Classic (ETC)

The cryptocurrencies Ethereum and Ethereum Classic are the same in every way until block 1,920,000, where a hard fork took place to return the stolen DAO tokens. All balances, wallets and transactions that took place on Ethereum were equal until the hard fork occurred. Further, cryptocurrencies have been divided into two parts and operate individually.

In May of this year, Ethereum Classic became the sixth most valuable altcoin to invest in.

Recently, China has also shown interest in Ethereum Classic. Now all major exchanges in China trade ETC.

Now the price is already estimated at 25-30 dollars per token with a market value of 1.6 billion dollars.

Ethereum classic is a promising project that is still showing excellent numbers.

Who can still work with Bitcoin?

There are market participants who can and should invest in Bitcoin. The list below will help ensure that you do not fall into this category.

Qualified speculators

We are talking about active traders who know how to make money on short-term market movements in both directions. Speculators don’t care whether the instrument becomes more expensive or cheaper. They know how to play up and down.

Volatility, which hurts long-term investors, helps short-term traders. Due to sharp price fluctuations, they have more opportunities to earn money.

By the way, practically safe conditions for trading Bitcoin have been created for aggressive speculators. In December 2022, in the midst of a wild cryptocurrency rally, the Chicago Board Options Exchange (CBOE) launched Bitcoin futures.

Bitcoin futures are an extremely interesting instrument. The futures contract itself is a derivative or a derivative security. It usually does not provide ownership of a real asset. When someone buys an oil futures contract, they cannot receive a barrel of oil in the contract. Settlements are made in money, this is stated in the futures specification.

That is, oil futures are a derivative instrument from a real asset. This is the idea of owning oil. Bitcoin futures are a derivative of a virtual asset. We get twice a virtual instrument or the idea of having an idea. Welcome to the crazy world of stock trading!

Cryptocurrency trading providers

Intermediaries do not risk their money. They make money on commissions, so they don’t care what the client is trading - Bitcoin, gold or NASDAQ index futures.

Miners

I don't understand anything about mining. If you can mine bitcoins and sell them for a profit, do it.

Creators of cryptocurrencies

In early October, famous boxer Manny Pacquiao launched his own currency, PAC Coin. If you know what's what, follow his example. Conduct an ICO and get real money for virtual coins. Just remember the New York court ruling: fraud with virtual cryptocurrencies in the United States will be tried according to real laws. In other countries you can also get real deadlines.

You can also mention arms and drug dealers, but it’s better not to.

The power of error. How to Deal with Failures

Ripple (XRP)

Ripple is an open source internet protocol that supports real-time gross settlement, fast money transfer and currency exchange. It is almost hundreds of times faster than Bitcoin and many other cryptocurrencies.

The RippleNet project is supported by several large banks and corporate organizations such as UniCredit, UBS, Axis Bank. XRP has a market value of $10 billion with a value of around $0.26 per coin. If you are willing to invest for the long term, then Ripple can definitely show a very high rate of return.

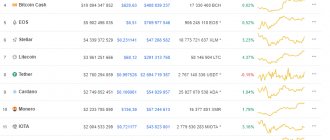

Top 10 most popular cryptocurrencies 2017-2018

The analytical service Coinmarketcap is extremely popular among crypto enthusiasts around the world. This is evidenced by the dynamics of growth in traffic to this resource, growing from month to month.

The Coinmarketcap service collects all cryptocurrencies that are listed on at least one exchange and that have a blockchain and open source code. At the time of writing this review, the service offers over 800 digital assets, sorted by capitalization. The latter is the product of the current price of a cryptocurrency and the volume of its supply on the market.

The digital currencies represented in the top ten of the Coinmarketcap rating are in greatest demand among traders and crypto investors. This is due to various factors, and the most important among them are high liquidity, stable exchange rate growth, prospects for further development of the ecosystem and the reputation of the developers.

It is also worth noting that in the world of cryptocurrencies everything is changing very rapidly. However, at the time of writing this review, the total capitalization of the first ten cryptocurrencies in the Coinmarketcap rating is $122.4 billion. If this number is compared with the total value of all cryptocurrencies ($138.8 billion) presented on this service, it turns out that the market share of the ten most popular digital currencies will account for 88%.

1. Bitcoin (stock ticker - BTC, sometimes - XBT). The first ever and most popular cryptocurrency in the world. Created at the turn of 2008-2009. Despite such a “venerable age”, the cryptocurrency is actively developing; developments are being carried out on the basis of the Bitcoin blockchain and various solutions are being implemented to improve it. It was the emergence of Bitcoin that was the reason for such a rapid development of the cryptocurrency market and the regular appearance of a wide variety of digital assets. Bitcoin is based on the revolutionary blockchain technology, which has been actively researched and developed by the world’s largest companies for several years now, and is also used in many industries.

The current capitalization of Bitcoin is $71 billion, which exceeds the value of many large world-famous companies. The supply of the first digital currency is strictly limited to 21 million BTC. On the Coinmarketcap website you can see the current volume of Bitcoin supply on the market - 16,506,412 BTC, the daily exchange trading volume, as well as various useful links to official sources of information, social media, block explorers, exchanges where this cryptocurrency is presented, etc.

2. Ethereum (ETH). It is a digital currency platform for creating decentralized blockchain-based online services (Dapps) powered by smart contracts. If Bitcoin is often called “digital gold” (due to the complexity of its production, limited supply and excellent investment qualities), then Ethereum is sometimes called the “digital analogue of oil.” This is because the ETH cryptocurrency is a kind of “fuel” for smart contracts and Dapps created on their basis.

There is ongoing debate in the crypto community about which investment object is more attractive: Bitcoin or Ethereum. Despite the relatively young age of the latter (the Ethereum network was launched on July 30, 2015), “ether” is preferred by fairly well-known personalities in the world of cryptocurrencies. They are convinced that the popularity of Ethereum will soon eclipse Bitcoin.

The rapid growth in popularity of Ethereum is evidenced by the following graph, which

These reflect the share of the most popular cryptocurrencies on the market:

Data: Coinmarketcap

So far, the market capitalization of “digital oil” ($28 billion) is approximately two and a half times less than the corresponding figure for Bitcoin.

At the same time, Ethereum's potential is high and attracts the attention of major software developers such as Microsoft and IBM. There are many ICOs (Initial Coin Offerings) conducted on the Ethereum platform, and many crypto tokens are created based on the underlying ERC-20 standard.

3. Ripple (XRP). This cryptocurrency is used in the real-time gross settlement system, as well as for currency exchange and money transfers. The Ripple protocol launched in 2012. Its goal is to provide "secure, instant and nearly free global financial transactions of any size with no chargebacks." According to some crypto enthusiasts, the Ripple payment system may in the future become an “alternative to SWIFT”.

The largest companies and banks in the world cooperate with Ripple, including BBVA, Mizuho, Mitsubishi UFJ, UniCredit, UBS and Santander. Ripple investors include names such as Accenture, Andreessen Horowitz, Google Ventures and Seagate.

The rapid rise in the price of Ripple (XRP) occurred in the first half of this year and allowed the cryptocurrency to confidently gain a foothold in the top three of the Coinmarketcap rating. Currently, the capitalization of the XRP cryptocurrency is approaching 7 billion. There have been times when the capitalization of Ripple exceeded the total market value of the digital currency Ethereum.

4. Bitcoin Cash is an “alternative to Bitcoin” that emerged as a result of a hard fork. So, on August 1, the Bitcoin blockchain split into two chains and a new digital asset appeared - Bitcoin Cash (sometimes - Bcash), which has a common history with Bitcoin, but is traded under a different ticker - BCC (less often - BCH).

After the hard fork, many exchanges and wallets gave holders of “digital gold” an excellent opportunity - to receive a certain amount of Bitcoin Cash tokens, which should correspond to the balance of Bitcoin in a 1:1 ratio. For example, if a user has 1 BTC in his wallet, then he receives 1 BCC after the hard fork.

Immediately after its appearance on the exchanges, the new cryptocurrency found itself in third place in terms of capitalization, leaving behind such market “veterans” as Litecoin and Ripple. However, shortly after exchanges made Bitcoin Cash deposits and withdrawals available, the “alternative to Bitcoin” began to plummet in price. So, if on August 2 the BCC price reached 0.485 BTC (approximately $1300) on the Bittrex exchange, then two days later its weighted average price slightly exceeded $250.

Not everything is going well with the new cryptocurrency. Bitcoin Cash is not as attractive for mining as “regular” Bitcoin, and its network experiences various problems every now and then. Apparently, the new cryptocurrency so far owes its capitalization of $4.8 billion only to the popularity of Bitcoin, nothing more.

5. IOTA. Cryptocurrency exchange network project for the Internet of Things. It is based on the unique Tangle consensus method. The main feature of the latter is the absence of miners. In addition, there are no transaction fees on the network - the latter are mutually confirmed by network nodes.

IOTA is also unique in that network participants are not divided into users and transaction validators. Each node both sends and confirms transactions that are not packaged into blocks (which distinguishes IOTA tokens from the vast majority of other digital currencies). The throughput of the IOTA network is proportional to the number of nodes and their activity.

IOTA tokens are traded primarily on the popular Hong Kong exchange Bitfinex. It is noteworthy that other trading platforms are not yet in a hurry to list this innovative cryptocurrency. On the other hand, IOTA is gradually gaining universal recognition. So, last month, the SatoshiPay service specializing in micropayments announced its intention to abandon the use of Bitcoin in favor of the IOTA cryptocurrency.

If we consider the global prospects of the new cryptocurrency, they seem quite interesting. Thus, according to research by TechNavio, from 2022 to 2022. the cumulative average annual growth rate of the global Internet of Things (IoT) market will be 4%. This means that the global IoT market will reach $1.37 billion by 2021, with 81% of the market growth coming from a variety of electronic gadgets.

Recently, the IOTA cryptocurrency has been showing strong growth and the price of one token has reached $0.88. IOTA market capitalization has crossed the $2 billion mark.

6. Litecoin (LTC). A popular fork of Bitcoin, often referred to as “digital silver.” Litecoin was one of the first to activate support for the SegWit protocol. However, even before the activation of Segregated Witness, Litecoin had a significantly faster transaction confirmation time than the same Bitcoin. Currently, the project continues to actively develop under the leadership of its famous creator Charlie Lee.

For several years, Litecoin was “in the shadow” of Bitcoin and other cryptocurrencies, trading around $3-4 per coin. In March of this year, on the eve of the implementation of SegWit, the price of “digital gold” began to rise rapidly. Now the price of Litecoin is approaching $50 per coin and, according to many analysts, this is far from the limit. Cryptocurrency is available on most exchanges and exchange platforms, and is also accepted by many companies as a means of payment.

The maximum supply of Litecoin is limited to 84 million tokens and there are currently 52.4 million LTC in circulation on the market.

7.NEO. The NEO digital asset platform (formerly known as Antshares) is often referred to as the “Chinese Ethereum.” Recently, project representatives completed the complete rebranding. In particular, the Chinese startup announced an upgrade of blockchain nodes, an update of technical documentation, social media, the official website, a change in the stock ticker, as well as a successful transition to the NEO 2.0 smart contract system.

The NEO coin has been demonstrating impressive growth for a long time, which allowed the cryptocurrency to take 7th place in the Coinmarketcap rating in a short period of time. In just the last three months, the price of the cryptocurrency has increased approximately 20 times and NEO is now trading around $45. The supply volume of NEO is fixed and limited to one hundred million tokens, of which 50 million coins are in circulation on the market. The market capitalization of “Chinese Ethereum” exceeds $2 billion.

It is also worth noting that the project is developing very actively and has already established cooperation with well-known blockchain startups, including Bancor, Coindash and Agrello. Chinese blockchain startup Red Pulse announced the creation of a platform for financial research, which will be built on the NEO 2.0 smart contract system. Also, in collaboration with the NEO project, a blockchain operating system called Elastos is being developed. According to the developers, it is intended to “explore the technological value of using blockchain applications in new Internet operating systems and further develop Smart Economy.”

8. NEM (XEM). This digital currency gained popularity in early 2015. It is distinguished from many other digital currencies by its original open source code and a number of interesting innovations. For example, the XEM cryptocurrency is based on the POI (Proof Of Importance) algorithm, a “proof-of-stake” modification. However, unlike PoS, in POI, in addition to proof of storage of a certain amount of funds, the user’s activity is also taken into account - the number of transactions he has made. Receiving a block reward on the NEM network is called “harvesting”.

A major update called Catapult is expected this year, during which NEM will switch from Java to C++. The new version of the private network has been tested for stable operation at speeds of up to 3000 transactions per second. The update will take place first on the private Mijin blockchain and then on the public NEM chain.

Also based on NEM, a new platform, COMSA, is being developed, which is designed to support projects in conducting transparent and orderly ICOs. According to project representatives, the new solution will significantly optimize the process of attracting investments in digital currency.

XEM's capitalization exceeds $2 billion. The coin is popular not only in its native Japan, but is also actively traded on a number of major exchanges, including Poloniex and Bittrex.

9. Dash. The launch of the cryptocurrency, which at that time was called Xcoin, occurred on January 18, 2014. From January 28, 2014 to March 25, 2015, the cryptocurrency was called Darkcoin.

Main features of the Dash cryptocurrency:

— transactions are anonymized thanks to the Darksend mechanism; — a combination of several cryptographic algorithms is used; — mining Dash requires less energy than Bitcoin; — decisions on the development of the system are made not by individual programmers, but by all members of the Dash network through a decentralized control mechanism.

The DASH network operates so-called masternodes - special nodes that ensure the operation of the PrivateSend transaction mixing mechanism. To stimulate the work of masternodes, a reward is provided, which is 50% of the miner’s reward for the found block. The DASH system also implements the InstantSend instant transaction service. Another feature of DASH is the use of the X11 hashing algorithm.

The DASH cryptocurrency has many supporters. Since its inception, the price of the cryptocurrency has increased several hundred times and Digital Cash is currently trading around $200.

10. Ethereum Classic (ETC). Appeared in 2016 as a result of the “twin brother” hard fork of Ethereum (ETH). In other words, this cryptocurrency is the same Ethereum before the hard fork. The goal of the project is to keep the original Ethereum decentralized, immutable, and uncensorable.

A year ago, many considered Ethereum Classic to be “stillborn,” but this turned out to be far from the case. ETC is still in the list of top 10 cryptocurrencies by market capitalization. An ardent supporter of Ethereum Classic is world-famous crypto enthusiast and head of the Digital Currency Group, Barry Silbert. Largely thanks to his efforts, the ETC cryptocurrency appeared in the professional computer system Bloomberg Terminal.

In general, the growth of Ethereum Classic greatly intensified in the spring of 2017, after the launch of the Ethereum Classic Investment Trust. The further growth of Ethereum Classic expects to be stable, at least thanks to the project’s balanced monetary policy, which provides for limiting emissions and reducing the block reward. In particular, the total number of coins will be approximately 210 million, but not more than 230 million; As for the reward for the mined block, it will be reduced by 20% after block number 5,000,000 and will be reduced by 20% in the future after each subsequent 5 million blocks.

Dash (DASH)

Launched in 2014, it has a high daily trading volume. It has undergone rapid growth in the past few months and has been able to maintain an impressive growth rate since its launch.

At the time of writing this article, Dash's market capitalization is $5 billion, at an exchange rate of $690. Dash is partnering with several companies to introduce a crypto-to-fiat debit card that can be used to make purchases anywhere. Dash coin is one of the fastest transaction currencies. On the other hand, Dash makes payments much easier than Ethereum. Considering the technical advantages of this cryptocurrency, it is definitely a promising alternative to Bitcoin.

IOTA

We start our cryptocurrency rating with the IOTA token. This cryptocurrency was developed for the Internet of Things. This is where it got its name. The basis of this system is Tangle (analogous to the Bitcoin blockchain). In many ways, this cryptocurrency is similar to Bitcoin. But there are also significant differences. For example, micropayments can be made in the IOTA system. At the same time, it is absolutely not necessary to be online. In addition, the concept of this cryptocurrency does not imply the presence of miners.

An important advantage of IOTA is the complete absence of commissions. Cryptocurrency market specialists note the great scalability of this “digital money”. With the growth of smart technology connected to the Internet, the IOTA cryptocurrency will also grow. By 2020, the number of IoT-enabled devices will exceed 1 billion, which will allow this cryptocurrency to become one of the most popular. An increase in capitalization will also lead to an increase in the cost of tokens. Therefore, now is a great time to invest in IOTA.

Litecoin (LTC)

Litecoin is one of the first cryptocurrencies after Bitcoin, created in 2011. Litecoin's goal is to correct several problems that Bitcoin had. It runs on Segregated Witness (SegWit) technology and adds network capacity while reducing transaction fees. The price of Litecoin has risen significantly over the past two months. Litecoin is currently trading at $90. LTC has also consistently shown good progress over the years and is suitable for investment, giving stable returns.

There will be regulators!

Even the most promising cryptocurrency should be controlled by government agencies and traditional banks in various countries, says Elena Kvochko (representative of Barclays Bank). This will eliminate threats to the security of the country and the financial situation of citizens, because the possibility of theft of funds by hackers or any other scammers is eliminated. In fact, representatives of states and banks have not yet presented any constructive theses in their favor, but are actively engaged in developments.

Now some countries have accepted tokens as an alternative official currency on their territory. Other active participants in the cryptocurrency business are developing restrictive measures. The latter include the USA, Switzerland, Singapore and Estonia, which makes it impossible not to take this trend into account.

Thus, it is unknown what awaits Bitcoin in reality, but Breitman recommends “remaining transparent” with each other until the situation is fully resolved.

Ripple or RIP

After May 2022, banking systems shuddered noticeably due to the development of decentralized systems. For a long time, it was the large banking houses that set the operating conditions for currencies, interest rates and other forms of activity, but now they cannot influence the process. To prevent total destruction or even minor disruptions in the functioning of the current fiat money system, the Ripple system was developed. She made a number of positive adjustments:

- increasing transaction speed;

- reduction of commissions;

- increased safety.

This approach slightly reduced bank profits, but made their work much easier and more convenient not only for ordinary people, but also for the organizations themselves. So banks now have a future. But the constant development of decentralized systems requires their centralized counterparts to take appropriate actions that keep up with the times.

NEM(XEM)

NEM runs on a commercial blockchain called MIJIN. MIJIN has recently been subject to stress testing by financial institutions in Japan. NEM currently has a market capitalization of $2.096 billion and ranks 13th. XEM, NEM's native token has a relatively low price of just $0.227. This coin will be a good choice for people who are not ready to invest large amounts.

We draw a conclusion

Choosing the best cryptocurrency is based on personal experience. Some users are interested in cryptocurrency mining. There are special ratings where you can choose the most promising ones. If the first number from the online rating of cryptocurrencies in terms of mining gives you doubts, then the last number may turn out to be much better, even if its capitalization is significantly less.

You should also constantly monitor the situation on the markets, because data is changeable and needs constant verification, especially if you are engaged or planning to engage in mining. Cryptocurrency rankings 2022 may be very different from those in 2022. It is convenient to monitor the situation on our website.

Some indicators of any of the mentioned cryptocurrencies can change for the worse or for the better in just a couple of days, so you should always be on guard.

Cardano (ADA)

This is a new promising next-generation decentralized cryptocurrency that appeared in October 2022. It is based on research. Cordano is a networking project that creates an intelligent protocol with significantly more complex features than other protocols. Cryptocurrency is open source. Code developers are engineers and researchers. Cordano ranks 11th in the cryptocurrency rankings and has a low exchange rate of $0.099687 per coin.

#1 Bitcoin

The first position is rightfully occupied by Bitcoin, a cryptocurrency that has remained the most popular since the first days of its existence. Today it is considered the most popular in the world and is used as a synonym for the word “cryptocurrency”. Bitcoins benefit from the following indicators: they are anonymous, not controlled by any state, not subject to inflation, etc. All kinds of cafes and restaurants, as well as online stores, use bitcoin to pay for goods and services, which makes the currency universal, because it can perform most functions , familiar to ordinary money.

Siacoin (SC)

Siacoin is a cloud storage platform that is decentralized. Anyone can provide storage space on their computer and receive a reward for doing so. Typically, cloud storage services are centralized and data is stored on a third-party server. However, in Siacoin, users contribute to a decentralized storage with their own share of resources.

Siacoin currently ranks in the top 40 of all coins based on market capitalization, which it has at $174 million. Factors influencing Siacon's valuation include limited storage and coin supply.

What to consider when choosing a cryptocurrency to invest in?

If you don’t know how to choose a cryptocurrency to invest in, consider the following points:

- Demand

– Do users need this or that platform? Will it be able to win the competition among other projects? What role does a token play in the entire ecosystem? - Activity

- here we mean not only the active development of the project, but dynamic work with potential partners, attracting new capital, promotion on the Internet, etc. The best way to check the team's activity is to monitor the projects' social networks on Twitter or Telegram. - Availability

– the easier it is to buy a cryptocurrency, the more likely it will be bought. Therefore, it is worth spending more time on assets that are traded on more popular exchanges.

It turns out that social networks (Twitter, Telegram) and analytical services (Coingecko, Coinmarketcap) are the best assistants for investors.