For 12 years now, Bitcoin has been the main cryptocurrency in the world. It has the largest capitalization, trading volumes, number of investors and market share.

Immediately behind him is Vitalik Buterin’s Ethereum network, which continues its transition to the Proof-of-Stake (PoS) consensus algorithm. The launch of Ethereum 2.0 could radically change the balance of power and finally bring ether to the forefront.

This year, the explosive growth of decentralized finance (DeFi), applications (dApps) and the NFT market has only driven the price of ether to record levels. Together with experts, we figured out what the chances are that Ethereum will overtake Bitcoin and become the main cryptocurrency on the market.

By what indicators is Ethereum catching up with Bitcoin?

The Bitcoin (BTC) network is ahead of Ethereum (ETH) in most key indicators: capitalization, trading volumes, mining profitability, number of active wallets, transactions, network hashrate. But this gap is gradually closing, and sometimes Ethereum even gets ahead. For example, in the spring, ETH miners earned more than BTC miners, and the Ethereum blockchain periodically takes the lead in the number of processed transactions.

On the day of the release of Article 1, the BTC costs $47,059, its capitalization is $873 billion. The price of 1 ETH is $3,108, capitalization is $359 billion. The difference in capitalization is 2.4 times. However, it decreases over time. For example, at the beginning of 2022 the difference was 23 times, in January 2018 - 2.7, in January 2022 - 9.36, at the beginning of this year - 6.75.

The daily trading volume with BTC is $35.7 billion, and with ETH - $18.8 billion. But at the same time, the number of ETH transactions has increased by more than 50% since the beginning of the year, while in the Bitcoin network, on the contrary, it has decreased.

Currently, the market share of VTS is 44%, ETH is 18.1%. Since the beginning of the year, Bitcoin dominance has decreased by 32%, while the share of ETH has increased by only 5.5%.

Graphs of shares of military-technical cooperation and ETH in the market. Most of the time, PTS is the clear leader. Only in June 2022, the share of VTS dropped to 37.9%, and the share of ETN rose to 33.2%.

Trading the ETH/BTC pair

The ETH/BTC pair is one of the most popular on the market.

An important feature of the ETH/BTC pair is the ability to build your trading strategy based only on specific factors characteristic of cryptocurrency markets. Depending on the timeframe being studied, the Ether/Bitcoin chart reflects various situations - both trend channels in which the ETH/BTC rate moves without going beyond the support and resistance lines, and periodic surges that leave the range. On a monthly chart, the ETH/BTC exchange rate may occasionally fluctuate above 5%, but daily ETH/BTC fluctuations can reach 10% depending on the situation in the markets as a whole.

Advantages of Ethereum over Bitcoin

Bitcoin and Ethereum are two very different projects. Let's look at their key differences.

Bitcoin is first and foremost a cryptocurrency. It has a limited range of use cases - it is a digital asset for those looking for an alternative investment vehicle. The Bitcoin blockchain operates on a Proof-of-Work (PoW) consensus algorithm, in which the success of a miner depends on the power of its equipment. Previously, we talked in detail about Bitcoin mining.

PoW is now considered an outdated technology that is poorly suited for money transfers - new projects tend not to use it. After all, PoW has a lot of disadvantages:

- low speed and poor scalability - the maximum transaction speed in the Bitcoin network is 7–10 operations per second;

- high miner fees;

- high energy consumption, mainly obtained from the combustion of fossil fuels.

Ethereum is already technically superior to Bitcoin. The speed of this network is 30 transactions per second, and thanks to second-level solutions, the throughput can reach 2,000 - 4,000 transactions per second. Checking blocks takes 12 seconds, versus 10 minutes for BTS.

Ethereum 1.0 also runs on PoW. But the network is already actively transitioning to state 2.0, when the network will operate on a PoS basis, there will be no mining, consensus will be achieved by validators, and new coins will be mined through staking.

The update will improve the speed, efficiency and scalability of the Ethereum network, and will also make Ether mining more environmentally friendly. Previously, we talked in detail about how Ethereum 2.0 will work and what stages the network will go through on the way to the update.

However, Ethereum is much more than a cryptocurrency. This is a huge decentralized computing network in which you can run smart contracts, decentralized applications, DeFi protocols, tokens and NFTs. It turns out that ETH is only a unit of value that exists in the Ethereum blockchain.

Ethereum has many use cases; dozens of large and popular ecosystems are built on its basis: financial and credit protocols, games, social networks, accounting systems and many other crypto market projects.

Trade ETH/BTC on the Currency.com platform

- Fast trading

It only takes 3 minutes to create a new account on the Currency.com platform. After registration, the user has access to all trading operations with tokenized assets. The tokens themselves are stored in a wallet on Currency.com.

- Cryptocurrency or fiat money

An account on the platform can be replenished with fiat money via bank transfer or credit card, or with cryptocurrency directly from a crypto wallet.

- Charts and analytics

To work with analytical data, the user has more than 70 different technical indicators, as well as advanced charts and trading signals.

- Use of borrowed funds

Each user of the Currency.com platform is given access to borrowed funds, the leverage size is 100x. The minimum deposit is 0.002 ETH.

- Management of risks

Automatic stop loss and take profit orders allow you to control risks and avoid unwanted drawdowns.

Why will the price and use of ETH only increase?

We think that the gap between ETH and BTC will decrease over time. There are several main reasons for this view.

Constant development. Ethereum has a powerful and experienced development team that has been working on developing and scaling the network for many years and is not afraid of change. Ethereum now and in 2015 are different projects, and there is still a transition to PoS ahead, which can make this blockchain the most advanced project on the market. Bitcoin has hardly changed in 12 years. The last major changes occurred in 2022, when the SegWit protocol was activated, increasing the block size.

Ian Balina, founder and CEO of Token Metrics, noted in comments to Insider that Bitcoin is overvalued. BTC had a first mover advantage, but in the long run ETH will surpass it due to its technical excellence.

“If you look at developers, they're all pretty much using Ethereum now. Ethereum has 10 times more active monthly developers than Bitcoin. “BTC now, in my opinion, is just a store of value, digital gold, but ETH is the next Internet ,” says Balina.

Prospects for Ethereum. Ether can be the basis for any blockchain technology and has many use cases in the real economy. Bitcoin is unlikely to go beyond storing value and transferring money. Thus, Todd Morley, co-founder and former executive director of the investment giant Guggenheim Partners, in comments for Bloomberg TV noted that ETH brings much more benefits than BTC.

Investment potential. As the crypto market matures, investors are beginning to increasingly pay attention to altcoins and evaluate the long-term potential of the project when making investment decisions. Since ETH is much cheaper than BTC, its potential for price growth is higher. The probability that ether will rise in price 10 times and cost more than $30,000 seems greater than the similar increase in BTC to $500,000.

Also fueling the future price rally will be the DeFi and NFT markets, which are growing at an astronomical rate. Thus, over $85 billion is now locked in DeFi protocols - and a year ago this figure was only $7 billion. The total sales volume of NFTs exceeded $217 billion. All this increases the demand for ETH and leads to an increase in the price of the coin. As a result, more and more cryptocurrency investors are considering ether as one of the best options for long-term investments.

Margo Pazhinskaya, a financial analyst at the DotBig investment platform, said that she believes that, unlike BTC, as well as many other altcoins, the growth points of ETH are quite clear - they largely depend on the technologies that the Ethereum platform develops and implements.

Dmitry Kolotov, entrepreneur, investor and founder told us that Bitcoin is not the best investment in the potential of 10 years. The potential for its rapid growth is almost exhausted. The BTC will definitely not grow tens or even hundreds of times - after all, then the coin will cost several times more than all the gold in the world, and this is unlikely.

Interest from institutional investors. Large investors are increasingly looking at ETH - and they are investing not just in the coin, but in the Ethereum ecosystem as a whole. For example, the Grayscale Investments ETH Trust, the world's largest digital asset manager, holds more than $10 billion in assets.

Environmental friendliness. With the transition to PoS, energy consumption in Ethereum will be reduced by 99%. Gradually, the energy consumption factor will become increasingly important, especially for institutional investors.

What is Bitcoin

Since its introduction in 2008, Bitcoin has revolutionized financial markets, despite skepticism in the early years, and is now one of the most traded cryptocurrencies in the world. Bitcoin remains the base currency for many cryptocurrency pairs, with daily trading volumes reaching tens of millions of dollars.

Interesting facts about Bitcoin

- In 2010, you could get only $0.003 for one bitcoin, so for one dollar you could become the owner of 300 bitcoins. Now one dollar is not even enough to cover the commission for buying one bitcoin, which has since risen significantly in price.

- The invention of Bitcoin is associated with the name of Satoshi Nakamoto, although in fact the existence of a real creator has never been confirmed.

- Losing the keys to a crypto wallet means that you permanently lose the bitcoins stored in it. Therefore, it is important to take care of the safety of your keys.

- The Bitcoin supply is limited to 21 million coins.

- There are already trade organizations around the world that accept cryptocurrency as a means of payment.

- The first real purchase for bitcoins was made in 2010 by Lazlo Hanyec. He paid 10,000 coins, or $30 at the time, for two pizzas. Later, this amount could turn into tens of millions of dollars.

What affects the Bitcoin rate

The main factor in changes in Bitcoin quotes is the balance of supply and demand for the cryptocurrency. A change in mining profitability also has a noticeable impact, since an increase in mining costs implies an increase in the cost of BTC, otherwise this process may become unprofitable.

An important factor for quotes is the change in the number and capitalization of competing cryptocurrencies. In addition, the number of exchange sites is important. The actions of governments in the field of legislative regulation of the use of Bitcoin also have a significant impact.

How soon can Ethereum overtake Bitcoin?

Ethereum's versatility has attracted the attention of prominent financiers and investors, who view the coin as an investment opportunity and the most likely competitor to Bitcoin.

A number of experts believe that Ethereum will one day, and perhaps within the next few years, overtake BTC in terms of capitalization and use cases. For example, John Wu, president of Ava Labs, the developer of Avalanche, Dan Morehead, founder of the large cryptocurrency investment fund Pantera Capital, Mike Novogratz, founder and CEO of the crypto investment company Galaxy Digital, Nathan Cox, chief investment officer of the Two Prime crypto fund, Mark Cuban, think so. Billionaire investor, Charles Hoskinson, founder of Cardano and co-founder of Ethereum.

A May report from investment bank Goldman Sachs said:

“Ethereum is the cryptocurrency with the highest real use potential... and the most popular smart contract application development platform.”

Given the importance of real-world use cases in determining the true value of a project, investment bank experts believe that ETH has every chance to replace BTC as the main digital asset. They believe that Bitcoin's current leadership is based only on first-mover advantages and could easily be lost. The most likely candidate for the role of the new leader is Ethereum.

For ETH to catch up with BTC in capitalization, its price must rise to $8,000. But with such a bull market, Bitcoin is unlikely to stand still, therefore, in order to confidently overtake Bitcoin, Ether needs to gain a foothold at the level of $10,000 to $20,000. Experts predict that the coin will price of $4,000 - $5,000 by the end of the year, and up to $10,000 - $20,000 over the coming years. There is even a point of view that ETH could reach $100,000 by 2025.

Why doesn't Ethereum threaten Bitcoin's status?

Despite all the technical advantages of Ethereum and the potential of its use, its future leadership is not at all guaranteed.

- Firstly, some of Bitcoin’s problems, due to which they predict it will hopelessly lag behind Ether, can be solved. For example, we have already written that Bitcoin mining can be environmentally friendly - most of the coin’s production can be converted to using energy from renewable sources. The use of second-layer solutions, primarily the Lightning Network, can also solve the problems of slow and expensive transactions.

- Secondly, Ethereum is not the only technically advanced project on which DeFi smart contracts are based. There are dozens of strong alternatives on the market, such as Cardano, Solana and Polkadot.

- Thirdly, the value of Bitcoin is not in its technology - it has long been perceived as a digital analogue of gold. The asset has every chance of becoming a generally accepted form of accumulation and preservation of wealth. And for these purposes, transaction speed is not important. Trust and security are much more important. In this regard, Bitcoin has no equal in the crypto market.

Most likely, in the coming years, the speed of development and price growth of ETH will be higher than that of military-technical cooperation. Perhaps Ether will overtake the first cryptocurrency in terms of capitalization, and maybe also in price and market share. But even this will not deprive Bitcoin of its status as digital gold.

Ethereum is much more technologically advanced than Bitcoin and is the basis for a huge ecosystem. But it does not compete directly with Bitcoin. And if Ether overtakes Bitcoin by some indicators, this does not mean that oblivion awaits the first cryptocurrency.

Dmitry Machikhin, partner at GMT Legal, noted that even as a means of payment, ether does not have any special advantages over Bitcoin:

“There are a lot of shortcomings, for example, inaccuracies in emission, premine, the possibility of changing the basic protocol, etc.”

The expert believes that Bitcoin can lose its leader status only if a project appears on the market that can copy the main properties of BTC and will be better than it in them. But so far there is nothing similar on the market.

“Ether may overtake Bitcoin in market capitalization, but this will not have a long-term impact on the market. Bitcoin is the strongest brand in the crypto market, and depriving it of its pioneering and absolute leader status is like trying to replace the Earth’s core. At least in the next few decades ,” says Dmitry Machikhin.

Sergey Khitrov, founder and CEO of Listing.Help, believes that ETH will not be able to take the place of BTC, since these projects face completely different tasks. But in the event of serious changes in the market, ETN may well overtake BTC in capitalization. For example, this could be facilitated by the transition of Ether to state 2.0 or tightening regulation of Bitcoin.

Sergey Khitrov noted that in order for ETH (or any other project) to take first place in capitalization and overtake BTC, a combination of a number of factors will be required:

- network stability and security;

- speed and low cost of transactions;

- breadth of cryptocurrency use; recognition from government regulators;

- demand from large institutional companies;

- Widely recognized by private investors.

But now no cryptocurrency project has such a combination of factors. Therefore, in the near future, BTC will retain its place as the leader among cryptocurrencies in terms of capitalization.

In the debate over Ether's prospects of becoming a market leader for investors, there is a practical takeaway: don't bet everything on one asset.

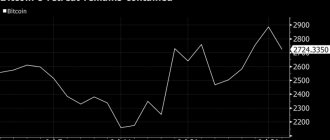

Bitcoin exchange rate according to popular cryptanalyst and trader Willy Wu

According to a chart by crypto analyst Willy Wu, retail traders are buying up Bitcoin's current market correction as quickly as they were during the pandemic crash last year.

Source: Twitter

The last time retail bought a dip this much was at the bottom of the COVID crash.

Willy Woo also shares a chart showing how Bitcoin hodlers, or holders with little history of selling, have historically bought dips and how they are doing so now.

Source: Twitter

Buying a visualized fall (spot volumes are visible along the chain). It's happening, it's moderate, but the most important thing is that there is no sign of a further cascade of sales yet .