Ethereum is the second largest cryptocurrency in the world by capitalization. Experts predicted an ETH rate of $3,000 per coin in 2022, but so far Ethereum is close to breaking through the bottom, and not to a historical maximum. What is the market forecast for Ethereum price for 2022, is it worth selling this coin, and what is the prospect of Ethereum for 2022.

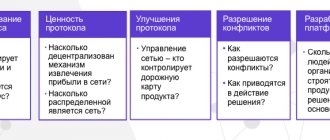

Creating a New Community: Constitution and Roles

Imagine creating a new community. The community will be called "Ethereum". A number of promises will be made to encourage people to join.

There will be several different roles within the community.

There will be a working class - a group doing the work necessary to maintain the community. She will receive payment for her work, but will also incur costs. Let's call this group miners .

There will be a rich class - a group involved in the founding of the community. Let's call this group participants in the initial coin offering .

There will be a ruling class - a group that sets the rules . This will be a small group. Let's call it key developers , and/or the Foundation, and/or Vitalik. This is a subset of the rich class.

And there will also be a class of subjects who obey the rules and benefit from the results of the work . This last class will be the most numerous. Let's call them the Etherians.

So, when this new community is formed, certain promises are made. One of these promises is that at some point in the near future, the need for the working class - miners - will disappear. This promise is even backed up by a rule that makes the job impossible after a certain period of time. This is Ethereum's promise to move from proof of work to proof of stake, backed by a rule known as the "difficulty bomb" that would lead to an "ice age." This rule, which should make mining impossible after some time, is embedded in the constitution of the community, or its code.

Another promise is that this community's computer code is its law. "The code is the law."

Forecasts for Ethereum until the end of the year from famous experts

Currently, bearish trends have been observed in the cryptocurrency market since May. However, well-known experts remain positive and forecast Ethereum growth for 2022.

Reddit co-founder Alexis Ohanian predicts that by the end of the year the price of Ethereum will reach $15,000, and Bitcoin will sell for $20,000 per coin.

Alexis Ohanian - co-founder of Reddit

Portfolio manager of a Canadian cryptocurrency fund, Martin Lalonde, gives a positive forecast for the future of cryptocurrencies on his Facebook:

“Those who think that interest in cryptocurrencies is falling are wrong. Exactly the opposite is happening. The crowd will return as soon as prices go up again. Bitcoin will reach a new high in the next couple of years.”

Error

But an error occurs early on that puts the wealthy class at risk of losing a significant amount of money. This is the notorious case of The DAO, a smart contract that collected $150 million worth of ether from early investors and was then hacked so that the hacker was able to withdraw most of the money from it. There are justifications and explanations why in this case it is necessary to make a one-time exception to the promise that “code is law.” To correct the mistake, the ruling class proposes changing the rules so that the rich class benefits at the expense of those who took advantage of the mistake. This seemed reasonable to most at the time.

Some, mainly from the subject class, believe that the promise that “code is law” cannot be broken. However, they are told that they must leave the community and create a new one called Ethereum Classic, which they do.

Meanwhile, in the Ethereum community, the ruling class enacts new rules (a hard fork) to undo the error. The rich class gets all their money back as an exception to the code is the law rule, and it has been promised that there will be no more exceptions.

What does the Ethereum price depend on?

Prediction of course behavior is based on analysis. In trading, there are technical and information analysis. You can look at charts for a long time, look for dependencies and trade based on them.

Technical analysis is a statistical and mathematical analysis of previous quotes with prediction of subsequent prices. But as the experience of IT specialists shows, bots trading based on technical analysis are ineffective.

The main factor determining the price is the information feed, the news. This, for example, happened when a rumor about the death of Ethereum founder Vitalik Buterin hit the media, causing the rate to fall by 13%-15%. Therefore, we compiled our forecast for the Ethereum cryptocurrency for 2022 based on news feeds, supported by links to news portals.

The ruling class gets the taste

After some time, they decide that some rules need to be changed in order to correct shortcomings and optimize. Another hard fork. This was not a surprise.

But at the same time, something previously unexpected happened.

One of the promises when the community was created was that the working class would receive five units of currency for every unit of work performed. That is 5 ethers per block. But the ruling class now decides that this is too much for such work. Therefore, the ruling class exchanges 5 ether for 4 ether per block. Consequently, compensation to the working class is reduced by 20%.

Some, especially in the working class, are unhappy. They are told that they can either accept the reduction or leave. However, the work is still lucrative, so many stay.

At the same time, the ultimatum “accept the pay cut or leave” was set not only by the ruling class. This change pleased the majority both in the rich class and among the subjects. Why? This change reduces the creation of new currency units that they themselves do not earn (since they do not do any work). Consequently, this gives them a larger piece of the overall money pie than it would have had without this change.

No one has seriously considered the moral issues of whether changing this rule violates the promise made when the community was created.

So the change was made

Ethereum Market Analysis

In January 2022, the Ethereum rate reached a maximum of $1.432. Then analysts gave a positive forecast for Ethereum for 2022 with the rate rising to $3,000. But the positive trends in analytics have not yet come to fruition. The Ethereum rate for August 7, 2022 was closed at $380 per coin. Ethereum's capitalization is $41.1 billion; in January, Ethereum's capitalization reached $135 billion. Is Ether close to its decline?

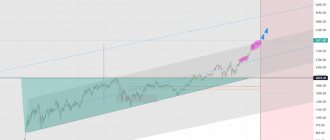

Ethereum price change starting January 1, 2022

Maybe it’s worth selling ETH and fixing the minus according to the principle: “a bird in the hand is better than a pie in the sky,” or is there no need to panic? We are looking for answers in ethereum forecast 2022 from RusCoinsInfo.

Another mistake: the ruling class does not fulfill its promise to abolish work on time

Time is running. The time for the explosion of the “complexity bomb” is approaching, which should lead to an “ice age”. If the bomb is activated, work will become impossible and the entire community will suspend activities. Everyone agrees that this will be bad.

However, the ruling class never drew up the rules that would fulfill the promise of a transition to proof of ownership. He cannot fulfill his original promise.

The ruling class offers a solution. This decision does not require him to sacrifice his wealth as punishment for a broken promise. It also doesn't remove the complexity bomb from the codebase. It only delays its operation.

The ruling class says something like:

“By postponing the complexity bomb and ice age, we are reaffirming our promise to launch proof of stake with a new timeline.”

Some people accept this statement without question. Others doubt it. “What if we can’t meet the deadline again? - they ask. “Are you going to delay the difficulty bomb again?”

They are given the now familiar ultimatum: “If you don’t like it, leave.”

A hard fork is being implemented to delay the difficulty bomb.

Another pay cut for the working class and another delay in proof of ownership

Time passes again. New hard forks are proposed and implemented for the same reasons as before.

Now the payment to the working class is reduced from 4 to 3 ethers per block - by 25%. Now miners earn 40% less per block than when they created the community, when they promised that the code was the law, and later the ruling class said that they would break this rule only once, for a particularly important reason. But the promise that code is law has been broken so many times that it is now routinely expected and even worried that “progress” will slow down if hard forks don’t happen often enough (to break that promise again).

As one would expect, the proof of ownership is again not launched on time, but the ruling class again does not bear any punishment for this. In fact, it is precisely the reduction in the income of the working class that appeases the subjects, who have begun to demand that the ruling class fulfill its promise. The ruling class happily sacrifices the money of the working class. After all, it's not his money.

The rich class and the subject class accept this sacrifice without asking the moral question: “Is it right that the workers in our community pay for the failures of the rulers?”

I'd like to pause here, because any reader should be thinking by now: “Something here sounds an awful lot like the system that cryptocurrency was supposed to fix. She had to eliminate the rulers. Everyone had to be responsible for their own actions. It was supposed to reward the smart, hard-working and capable, not the incompetent or those who make promises but don't keep them. But we see here a repetition of the old, flawed system.” Of course, such reasoning will not work if you only want to make a profit and not fix anything in our financial system.

Kim Kardashian and Floyd Mayweather were defendants in the case of cryptocurrency startup EthereumMax

Having lost the auction for the purchase of the first edition of the US Constitution, the group of crypto investors ConstitutionDAO found itself in a situation in which it, having a capital of $49.8 million, could not spend it. The organizers had permission to direct them to only one product, and since it was impossible to buy it, they decided to begin the procedure for returning funds to project participants. And this is where the problems started.

Image source: Miloslav Hamřík / pixabay.com

Recovering such a large amount is a complex process. Investors must request their funds themselves, but even a week later, tens of millions of dollars remain in ConstitutionDAO's possession. And since all the funds were collected in the Ethereum cryptocurrency, sending them back through the blockchain entails high transaction costs. And for many investors, this procedure turned out to be expensive. According to the latest data, $27 million, or about 54% of the total amount, was sent to investors, which means that about $23 million is still waiting to be returned. Fortunately, the ConstitutionDAO stated that shareholders can return their funds without any time limit.

The high amount of transaction fees turned out to be a problem even at the stage of fundraising, but now the situation has developed in such a way that for some investors, a refund does not make sense at all. These fees, known as “gas,” decrease only slightly as the volume of funds sent decreases, so small investors were forced to pay relatively high fees just to transfer their contributions. Thus, engineer Alex Kroeger had to pay about $50 for “gas” to send $170 to the project. According to his own data, when collecting the entire amount, investors had to pay a total of more than $1 million.

Anyone who wants their money back will have to pay for the gas again, and over $200,000 has already been spent on this. This is not a problem for large investors, since a $50 fee does not seem catastrophic if they receive $100,000. However, the median contribution to the project is $217 - that is, almost half of this amount has to be paid for gas. And this is also an “optimistic” estimate: one of the participants reported on Twitter that his “one-way” commission was $70, which is a $140 net loss on a $200 deposit. In some cases, the commission turned out to be higher than the deposit amount, and for such investors, the return of funds simply makes no sense.

However, the situation is complicated not only by the Ethereum commission. Many project participants hoped that ConstitutionDAO would shift its focus and use the money raised to purchase another item of value. For some time, the organizers actually decided to restart the project, but soon changed course and announced plans to close. This was a disappointment for many on the group's Discord channel, where members were supposed to be able to make decisions together. The group failed to achieve its goal of not only purchasing the first edition of the US Constitution, but also of becoming a Decentralized Autonomous Organization, whose activities are controlled by all members, not just the initiators.

The outcome of the project demonstrates both the promise and challenges of DAO and other cryptocurrency communities. In just a week we managed to collect an impressive amount. However, high fees made it difficult for small investors to participate in the project, and instead of the promised decentralization, in reality the project was controlled by a small group of participants. And those who have contributed the least have suffered the most.

But how did we get to this point?

So we come to the current situation.

We have a community where the ruling class has failed to deliver on its promises over and over again. Doesn't remind you of anything? We have a community where those who work are forced again and again to pay for those who do not work. Doesn't remind you of anything? We have a ruling class whose solutions to all problems, even if they are created by them, are always such that they themselves do not have to pay anything. Doesn't remind you of anything? We have the complicity of classes that benefit from the decisions of the ruling class at the expense of the working class. Doesn't remind you of anything?

This all resembles the corrupt fiat monetary system that we are trying to escape from. How did we get to this point—returning to the very system we were trying to get out of? I think the reasons were the following.

First, due to the initial coin offering, or pre-sale, or pre-mine, a class has arisen to which most of the wealth belongs.

The DAO hard fork would then correct the naive mistake made by this wealthy class. However, the resulting controversy has created a precedent in which those who set the rules can issue an ultimatum to those for whom the rules are intended: accept or leave.

In addition, the rule makers have never been held financially responsible for failing to deliver on their promises.

Instead, the ruling class sacrificed working class money time and time again to appease members of other classes who felt they deserved compensation for the ruling class' broken promises.

And these other classes accepted these sacrifices.

That's why I don't like Ethereum. I blame him for constantly breaking promises, which makes him completely unreliable. I condemn him for victimizing the only group in his community that actually fulfilled its responsibilities.

As a Bitcoiner, I find such actions unacceptable. I know none of this would ever be accepted in Bitcoin. We would not dare authorize the installation of a bomb capable of destroying the system, much less entrust it to a small group. We would never break our promise that code is law to enrich one class at the expense of another. We would never make promises that are simply cleverly worded. We will never break the promises that made our community possible, because what makes it so attractive is that there is no ruling class to exploit other classes.

I also wonder what all those who have supported the ruling class time and time again see as their ultimate fate. How will they answer the questions: What will happen if the working class is truly abolished? Will the ruling class suddenly stop looking for victims in order to enrich themselves? After all, the ruling class has the power to do whatever they want. He can speed up the release of ether for himself. He can make money even more ultrasonic by burning existing coins (not his own, of course, but Etherians' coins) for various reasons, claiming that it is good for the community. Its ability to control currency is limitless. Ethereum is vulnerable to all the same abuses that a central bank digital currency can be subject to, especially considering that its ruling class has already changed the rules multiple times to tilt the situation in their favor and stay in power.