Recently, a lot has been said and written in the media about the “tokenization” of paintings and other works of art. But what does this actually mean? From publications it is usually not possible to understand what specific meaning the author puts into this term (and often one gets the impression that he doesn’t mean anything).

Let's try to figure out what the notorious NFT tokens are and what it means to “tokenize” a work of art.

To do this, we will discuss some questions to which everyone seems to know the answers, but not exactly. I, too, will not strive for technical precision, but will try to convey the general meaning of the relevant concepts, sufficient for the purposes of legal analysis.

Let's start from the very beginning, namely with the concept of blockchain (for those in the know, you can skip the beginning).

What is blockchain?

Without going into technological details (which are very fascinating, but not about them now), it is enough to imagine a blockchain as a register of user accounts maintained in some kind of virtual decentralized computer.

virtual coins belonging to the corresponding user - imaginary objects characteristic of a given blockchain - is recorded on the account. Users have access to this ledger in the sense that each of them can transfer coins from their account to the account of any other user.

Links:

- Tech's Effect on Real Estate

- Tokenized Security & Commercial Real Estate

- Tokenized Real Estate: Creating New Investing and Financing Channelings Through Blockchains

- Fluidity: Tokenization of Real Estate Assets

- Tokenization of Assets – Research Papers

- Arizona Department of Real Estate – Statement on Real Estate Tokenization

- Letter Regarding Real Estate Tokenization to Wyoming Blockchain Legislative

- Real Estate, Vehicles, and Parts, Insurance on Blockchain

- SEC Offering Statement for Real Estate Tokenization Project – PropertyClub, Inc

- Tokenization of Assets is Disrupting the Financial Industry

- Token Taxonomy Acceptance of 2019

- Regulatory Approaches to Cryptoassets – Library of Congress

- Real Estate Digitization

Facebook Twitter Linkedin Print Email

This article is provided for your convenience and does not constitute legal advice. The information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations. Prior results do not guarantee a similar outcome.

Why are virtual coins needed?

For some purposes, virtual coins stored in blockchain accounts provide a convenient replacement for real (“fiat”) money.

For many users, the attractive feature of virtual money is the decentralized nature of the blockchain: unlike a bank, a blockchain cannot go bankrupt !

Another attractive feature is the absence or at least difficulty of government regulation of transactions in the blockchain. True, this does not prevent states from regulating transactions that exit the blockchain, such as converting virtual coins into real money on crypto exchanges.

Why are virtual coins bought with real money?

Virtual coins such as Bitcoin or Ether are simply an entry on a virtual ledger. They have no "intrinsic" value - in the sense that they do not give their holders rights to any value in the real world.

Virtual coins have value solely as a convenient means of payment and storage - just like cowrie shells were used by the Polynesians in their time. The value of virtual coins does not come from law or treaty, but rather from custom.

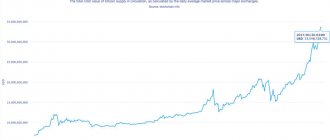

The specific value of virtual coins in real money is determined, as for any property, by the ratio of demand for coins and their supply. The supply depends primarily on the costs of mining a virtual coin (in fact, these are the costs of processing transactions on a given blockchain). The demand of participants in the turnover for this means of payment and savings depends on many different factors, including socio-psychological ones (due to which sharp fluctuations in the market price occur).

What is a smart contract?

Some blockchains (such as Ethereum, but not Bitcoin) give users the ability to create and host their own computer programs on the blockchain, which are called smart contracts.

The program is located in a virtual registry on a separate account and responds to external signals from users who can send coins or data to the address of this account. In response to such signals, the program performs the actions provided by its algorithm: changes the values of its internal variables or sends coins or data to certain addresses.

What is a token?

If a given blockchain supports a sufficiently rich programming language, then it is not difficult to write a smart contract that implements within itself a register of holders of certain imaginary objects (tokens) characteristic of a given smart contract, so that each user can transfer tokens from his account to another user's account.

Accordingly, any user of such a blockchain (for example, the Ethereum blockchain) can, if desired, issue their own tokens in this blockchain and distribute them to any users of the same blockchain - for money, for virtual coins, or just like that. Users can then transfer tokens to each other.

Current situation

Tokens have undoubted advantages over traditional securities. Thanks to the blockchain, the token does not require intermediaries: depositories and exchanges. Due to its decentralized nature, the token is even more secure as a derivative financial instrument. All this encourages major market players to take a closer look at blockchain and test the technology.

But the development of tokenization is hampered by regulatory difficulties, infrastructure limitations, mistrust of market participants, problems with the creation and registration of such assets, their management, and licensing of issuing platforms.

However, despite all the difficulties, it seems that the market is almost ready for tokenized assets. There are no fundamental obstacles to tokenization; it is only necessary to adapt the financial sector and legislation. In the meantime, tokens are waiting for their assets, which will make them a full-fledged and legal financial instrument.

What are fungible tokens?

The technical characteristics of tokens are determined by the features of the smart contact, which maintains a register of token holders. According to the ERC-20 standard adopted in the Ethereum blockchain, only the total number of tokens owned by each user is recorded in the registry. This means that tokens do not have individual certainty - just like non-cash money. Such tokens are called “fungible”.

Such tokens can be used, in particular, as evidence of the right to a share in the assets or income of a certain business, that is, as an analogue of securities (security tokens). It should be remembered that a token is essentially nothing more than an entry in a virtual registry and in itself does not give any rights to a share in a business, etc. All such rights are of a contractual nature and, as a rule, are recorded in the white paper published by the issuer.

In some countries - primarily in the United States - the issuance of tokens similar to securities is indeed equivalent to the issuance of securities, and therefore is strictly regulated by the state.

The emergence of the first tokenization tools

Tokens and stablecoins have already been issued, tied to fiat currencies (Tether), precious metals (MyGold, Digix, Orebits), gold (Goldmint, Vaultoro), shares of large companies based on the marketplace (Blackmoon, Templum), real estate (Atlant), oil ( Petro), music and art (SingularDTV).

Special platforms also allow you to tokenize your assets. For example, Polymath, BankEx, Harbor, Smartlands, Trusttoken, Securitize, Swarm.Fund, OpenFinance Network, Atomic Capital and crypto exchanges LAToken, Openfinance. But the main problem with such projects is that there are more of them than the cases themselves.

In May 2022, the blockchain division of the investment company Morgan Creek Capital announced the conversion of the company's paper shares into digital token assets. Securities token exchange Overstock is also set to issue tZERO portfolio company tokens that will be SEC compliant. Holders of these tokens will be able to receive quarterly dividends from tZERO profits.

In January 2022, the licensed crypto exchange DX.Exchange was launched, allowing traders to buy tokenized shares of companies from NASDAQ and tokens for classic ETFs.

What is NFT?

Tokens do not have to be indistinguishable. According to the ERC-721 standard adopted in the Ethereum blockchain, the registry records not the number of tokens owned by the user, but the holder of each individual token. Accordingly, each of the tokens recorded in such a register is unique, and its full history can be traced from issue to transfer to the current holder. Such tokens are called “non-fungible tokens” (NFT).

Such tokens can be used, for example, as a certificate of ownership of a unique object , for example, a work of art. It should be borne in mind that such a token also represents only an entry in the virtual registry and in itself does not give any rights to the picture, etc.

The rights of the token holder to the corresponding object (i.e. the work) are of a contractual nature. To find out exactly what rights the token buyer has acquired - and whether he has acquired any rights at all! — you need to read the terms of issuing the token or other similar documents.

What striking examples of tokenization are there now?

The most striking example of tokenization is NFT tokens (non-fungible tokens). According to Coinmarketcap, the NFT market volume has exceeded $750 billion. The NFT market is based on certain works of art, which are often far from the concept of art. However, thanks to the properties of the tokens themselves, even a simple pixel image acquires its significant value.

Additionally, tokenizing works of art has become a trend. For example, some works by one of the most popular and iconic contemporary artists, Banksy, were sold in the form of NFT tokens.

Another promising industry for tokenization is real estate. According to the forecasts of the British company Moore Global, the expected volume of the tokenized real estate market could reach $1.4 trillion by 2026.

In the summer of 2022, Overstock's regulated exchange tZERO began trading security tokens that represent proof of fractional ownership of a luxury resort in Colorado. The launch saw record trading volume, but interest was dampened by the market slowdown caused by the coronavirus pandemic. Subsequently, tZERO also partnered with crowdfunding company NYCED Group to tokenize $18 million worth of real estate.

Another example from this space is that in September 2022, an Indian fintech company launched a blockchain-based registry to enable fractional ownership of real estate in the country.

What is tokenization of a work of art?

The press likes to use the term “tokenization,” but it does not have any specific legal meaning. Essentially, we are talking about the fact that the owner of the rights to a work of art issues a token on a certain blockchain and declares that, together with this token, he will transfer all or some of his rights to this work.

The exact scope of rights transferred with a token can vary significantly. Thus, the token may transfer the exclusive right to the image, or perhaps only a limited right to use it. The work itself as a physical object (painting, etc.) may or may not be transferred to the acquirer of the token. The buyer of the token may be granted other rights, for example, the right to have lunch with the author of the painting.

Accordingly, the specific meaning of “tokenization” is not predetermined. It all depends on the specific conditions of the token issue or a bilateral agreement between the seller and the buyer of the token. Of course, if desired, the same legal effect can be achieved without any tokenization, but simply by signing an agreement.

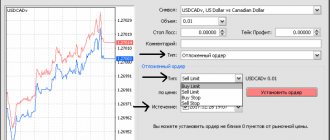

Benefits of credit card tokenization

Card tokenization significantly improves payment security.

Randomly generated tokens are only readable by the payment system, but even if they were revealed, they cannot be used.

We use subscription services: we pay utilities, listen to music, watch movies, read e-books. To subscribe, we go to the online store’s website, enter the card details and check the box confirming that we agree that the store will save the card data (PAN and expiration date) and will be able to independently initiate payment for a specific service.

Accordingly, the store must save the card data somewhere. It has the following options:

- store them on your own servers if they are certified for compliance with the PCI DSS standard, which not all online stores can afford;

- entrust their storage to a payment service, for example, Yandex.Checkout, which is PCI DSS certified for the highest level of security.

Most companies that collect and store sensitive data on their networks often find it very difficult to comply with PCI DSS standards. Data breaches and non-compliance with PCI requirements can result in significant fines from the PCI Council.

Tokenization allows merchants to comply with PCI DSS with minimal security obligations and costs.

By removing information about customer cards from the network, the risks of data leakage are minimized. The company no longer needs to invest a lot of money and resources in data protection - it is ensured by tokenizing the credit card.

Other sensitive data: passwords, addresses, secret files and customer accounts can also be protected using tokenization technology.

Is it possible to write a picture into a token?

Of course, a painting as a physical object cannot be “recorded” into a token. If we are talking about a digital image, a file with this image can, in principle, be written directly to the blockchain (as the value of one of the variables of the corresponding smart contract).

However, storing data on a blockchain is expensive: the transaction costs of creating a smart contract and then transferring a token can be prohibitive. In view of this, only a link to the Internet page where the image is stored is usually tied to the token.

One way or another, it is important to understand that the rights to the image in any case are determined not by where it is recorded, and not by who has physical access to it, but by the agreement between the owner of the rights to the image and the buyer of the token.

- So how did the burned Banksy painting turn into a token?

Morons, by Banksy

Indeed, in 2022, the press reported that one of the “blockchain companies” bought a Banksy painting for $95,000, after which it publicly burned it and “converted it into an NFT token,” which it then sold for $380,000.

The technical details from media reports are unclear, but of course the painting cannot be “turned into a token . Most likely, the buyer of the token was given some rights to a digital copy of the burned painting. Or maybe they didn’t transfer any rights at all, limiting themselves to only providing the digital copy file itself; who knows. It should also be kept in mind that there are many other “prints” (authorized copies and variants) of this Banksy work in the world, and each has its own rightful owner with its own rights.

Apparently, to a large extent, this was just an advertising campaign for the blockchain company: for relatively little money, its name thundered all over the world. It seems that the organizers of the event have a good sense of humor, since the painting itself is a mockery of the art market: it depicts an auction of paintings and is called “Morons”. Next to the auctioneer is a framed sign that reads: “I can’t believe these morons are actually buying this crap.”

What is tokenization? Blockchain and NFTs for Dummies

Recently, a lot has been said and written in the media about the “tokenization” of paintings and other works of art. But what does this actually mean? From publications it is usually not possible to understand what specific meaning the author puts into this term (and often one gets the impression that he doesn’t mean anything).

Let's try to figure out what the notorious NFT tokens are and what it means to “tokenize” a work of art.

To do this, we will discuss some questions to which everyone seems to know the answers, but not exactly. I, too, will not strive for technical precision, but will try to convey the general meaning of the relevant concepts, sufficient for the purposes of legal analysis.

Let's start from the very beginning, namely with the concept of blockchain (for those in the know, you can skip the beginning).

- What is blockchain?

Without going into technological details (which are very fascinating, but not about them now), it is enough to imagine a blockchain as a register of user accounts maintained in some kind of virtual decentralized computer.

The number of virtual coins belonging to the corresponding user - imaginary objects characteristic of a given blockchain - is recorded on the account. Users have access to this ledger in the sense that each of them can transfer coins from their account to the account of any other user.

- Why are virtual coins needed?

For some purposes, virtual coins stored in blockchain accounts provide a convenient replacement for real (“fiat”) money.

For many users, the attractive feature of virtual money is the decentralized nature of the blockchain: unlike a bank, a blockchain cannot go bankrupt!

Another attractive feature is the absence or at least difficulty of government regulation of transactions in the blockchain. True, this does not prevent states from regulating transactions that exit the blockchain, such as converting virtual coins into real money on crypto exchanges.

- Why are virtual coins bought with real money?

Virtual coins such as Bitcoin or Ether are simply an entry on a virtual ledger. They have no "intrinsic" value - in the sense that they do not give their holders rights to any value in the real world.

Virtual coins have value solely as a convenient means of payment and storage - just like cowrie shells were used by the Polynesians in their time. The value of virtual coins does not come from law or treaty, but rather from custom.

The specific value of virtual coins in real money is determined, as for any property, by the ratio of demand for coins and their supply. The supply depends primarily on the costs of mining a virtual coin (in fact, these are the costs of processing transactions on a given blockchain). The demand of participants in the turnover for this means of payment and savings depends on many different factors, including socio-psychological ones (due to which sharp fluctuations in the market price occur).

- What is a smart contract?

Some blockchains (such as Ethereum, but not Bitcoin) give users the ability to create and host their own computer programs on the blockchain, which are called smart contracts.

The program is located in a virtual registry on a separate account and responds to external signals from users who can send coins or data to the address of this account. In response to such signals, the program performs the actions provided by its algorithm: changes the values of its internal variables or sends coins or data to certain addresses.

- Why are smart contracts needed?

The field of possible application of smart contracts is very wide. In particular, they can be used to automate the execution of certain contracts (hence the name “smart contract”).

But other options for using smart contracts are also possible: conducting voting, creating virtual organizations, issuing tokens, etc.

- What is a token?

If a given blockchain supports a sufficiently rich programming language, then it is not difficult to write a smart contract that implements within itself a register of holders of certain imaginary objects (tokens) characteristic of a given smart contract, so that each user can transfer tokens from his account to another user's account.

Accordingly, any user of such a blockchain (for example, the Ethereum blockchain) can, if desired, issue their own tokens in this blockchain and distribute them to any users of the same blockchain - for money, for virtual coins, or just like that. Users can then transfer tokens to each other.

- What are fungible tokens?

The technical characteristics of tokens are determined by the features of the smart contact, which maintains a register of token holders. According to the ERC-20 standard adopted in the Ethereum blockchain, only the total number of tokens owned by each user is recorded in the registry. This means that tokens do not have individual certainty - just like non-cash money. Such tokens are called “fungible”.

Such tokens can be used, in particular, as evidence of the right to a share in the assets or income of a certain business, that is, as an analogue of securities (security tokens). It should be remembered that a token is essentially nothing more than an entry in a virtual registry and in itself does not give any rights to a share in a business, etc. All such rights are of a contractual nature and, as a rule, are recorded in the white paper published by the issuer.

In some countries - primarily in the United States - the issuance of tokens similar to securities is indeed equivalent to the issuance of securities, and therefore is strictly regulated by the state.

- What is NFT?

Tokens do not have to be indistinguishable. According to the ERC-721 standard adopted in the Ethereum blockchain, the registry records not the number of tokens owned by the user, but the holder of each individual token. Accordingly, each of the tokens recorded in such a register is unique, and its full history can be traced from issue to transfer to the current holder. Such tokens are called “non-fungible tokens” (NFT).

Such tokens can be used, for example, as evidence of ownership of a unique object, for example, a work of art. It should be borne in mind that such a token also represents only an entry in the virtual registry and in itself does not give any rights to the picture, etc.

The rights of the token holder to the corresponding object (i.e. the work) are of a contractual nature. To find out exactly what rights the token buyer has acquired - and whether he has acquired any rights at all! — you need to read the terms of issuing the token or other similar documents.

- What is tokenization of a work of art?

The press likes to use the term “tokenization,” but it does not have any specific legal meaning. Essentially, we are talking about the fact that the owner of the rights to a work of art issues a token on a certain blockchain and declares that, together with this token, he will transfer all or some of his rights to this work.

The exact scope of rights transferred with a token can vary significantly. Thus, the token may transfer the exclusive right to the image, or perhaps only a limited right to use it. The work itself as a physical object (painting, etc.) may or may not be transferred to the acquirer of the token. The buyer of the token may be granted other rights, for example, the right to have lunch with the author of the painting.

Accordingly, the specific meaning of “tokenization” is not predetermined. It all depends on the specific conditions of the token issue or a bilateral agreement between the seller and the buyer of the token. Of course, if desired, the same legal effect can be achieved without any tokenization, but simply by signing an agreement.

- Is it possible to write a picture into a token?

Of course, a painting as a physical object cannot be “recorded” into a token. If we are talking about a digital image, a file with this image can, in principle, be written directly to the blockchain (as the value of one of the variables of the corresponding smart contract).

However, storing data on a blockchain is expensive; the cost of transactions to create a smart contract and then transfer the token can be prohibitive. In view of this, only a link to the Internet page where the image is stored is usually tied to the token.

One way or another, it is important to understand that the rights to the image in any case are determined not by where it is recorded, and not by who has physical access to it, but by the agreement between the owner of the rights to the image and the buyer of the token.

- So how did the burned Banksy painting turn into a token?

Morons, by Banksy

Indeed, in 2022, the press reported that one of the “blockchain companies” bought a Banksy painting for $95,000, after which it publicly burned it and “converted it into an NFT token,” which it then sold for $380,000.

The technical details from media reports are unclear, but of course the painting cannot be “turned into a token.” Most likely, the buyer of the token was given some rights to a digital copy of the burned painting. Or maybe they didn’t transfer any rights at all, limiting themselves to only providing the digital copy file itself; who knows. It should also be kept in mind that there are many other “prints” (authorized copies and variants) of this Banksy work in the world, and each has its own rightful owner with its own rights.

Apparently, to a large extent, this was just an advertising campaign for the blockchain company: for relatively little money, its name thundered all over the world. It seems that the organizers of the event have a good sense of humor, since the painting itself is a mockery of the art market: it depicts an auction of paintings and is called “Morons”. Next to the auctioneer is a framed sign that reads: “I can’t believe these morons are actually buying this crap.”

- Can you give an example of NFT?

Koshkat, by CryptoKitties

Perhaps the most famous non-fungible tokens (NFTs) are those of the game CryptoKitties, which exists as a set of smart contracts on the Ethereum blockchain.

The essence of the game is that participants buy tokens from the organizers, each of which symbolizes a cat with unique properties. The cats can then be sold, bought and “breeded” (kittens are born from a cat and a cat, inheriting the properties of their parents, all this is programmed in smart contracts). Each token corresponds to a unique image of a cat, which is stored not on the blockchain, but on a separate server by the game organizers.

Despite the simplicity of the game, it is wildly popular. There are already more than a million crypto-kitties in the game, and the record price for one cat was 140 thousand dollars. For true enthusiasts, the organizers' website offers kitties for a million (but there are also ones for $40, for the poor).

- Are there any examples of legally correct tokenization?

An example is the same CryptoKitties tokens. Of course, their value for the user is primarily collectible, that is, stemming from the pleasure of the very fact of owning a unique cat. However, as a bonus, the organizers also grant the token holder the right to use the image of their cat.

At the same time, they took care to write a competent license agreement. The organizers reserve exclusive rights to the picture. By agreement, the user can use the image for personal, non-commercial purposes (hanging a portrait of the cat above his bed), as well as in connection with transactions with the cat itself (sale, etc.). In addition, he can use the image for commercial purposes (for example, selling T-shirts with the image of his cat), but only on a limited scale: income from sales should not exceed $100 thousand per year.

The authors invite everyone to use this agreement as a model for tokenizing images.

- Why do they pay such huge sums for tokenized works?

Everydays, by Beeple (2021)

Leaving aside phony PR sales, the value of a tokenized work appears to be made up of two components: the economic value of the rights attached to the token, and the collectible value of the token, which comes from the pleasure of owning a unique object and from the hope for its subsequent profitable sale or exchange. True, in practice it is quite difficult to separate one from the other, as well as from the “PR markup”.

The record price for a tokenized work was apparently $60 million (or $69 million including commissions). We're talking about digital

“Everydays: The First 5000 Days” by the artist known as Beeple (Mike Winkelmann). The painting was sold for the mentioned amount at Christie's with a starting price of $100. The painting does not exist as a physical object; as a sign of its acquisition, the buyer was given an NFT token on the Ethereum blockchain.

The amount looks quite impressive, but keep in mind that the piece is actually a collage of 5,000 full-length works created by the artist over 5,000 days (one per day). It can be assumed that for his money the buyer received the exclusive right to each of the works. The works are quite suitable for creating posters, etc. based on them. I don’t know what the prices for digital paintings are these days, but the amount of 12 thousand (even 14 thousand) for the work of a famous artist does not look supernatural.

- What kind of tokens did Lindemann issue?

Till Lindemann (still from video, 2021)

In 2022, Rammstein frontman Till Lindemann, with the permission of the Hermitage, recorded a video with the song “Beloved City” in the museum’s halls. Subsequently, he “tokenized” the videos and photos taken in the Hermitage, putting the corresponding tokens up for sale at prices ranging from 199 euros to 100 thousand euros (which for some reason caused strong discontent among the Hermitage management).

Tokens are issued on the Polygon blockchain (this is a functional analogue of Ethereum, but transactions there are cheaper). It is not entirely clear what, if any, video and photo rights the tokens correspond to. It is possible that there are no rights, and the tokens have only purely collectible value, like magnets with pictures.

It is only known that the most expensive tokens (for 100 thousand) come with a trip to Moscow for two and dinner in Moscow with Lindemann himself.

- What kind of tokens does the Hermitage issue?

Madonna Litta by Leonardo da Vinci, 1490

In August 2022, the State Hermitage Museum announced that it had “issued” tokens “with images” of five paintings from its collection. According to the director of the Hermitage, Mikhail Piotrovsky, he is going to sell the tokens on a cryptocurrency exchange, but “he is not going to make money” from this, since “it is ridiculous to solve financial issues with the help of tokens.”

It should be borne in mind that the museum, as a rule, does not have exclusive rights to its exhibits; and most of the Hermitage exhibits have long been in the public domain. However, the museum has the exclusive right to the photograph of the painting it created. According to Russian law, the museum also has the right to permit and prohibit the commercial use of images of its exhibits.

It is not yet entirely clear what rights the Hermitage intends to transfer to token buyers. It is possible that none. In any case, according to Piotrovsky, “the person who has the right of ownership does not prohibit anyone from reproducing it,” since “these rules are laid down when creating NFTs.” The conditions for issuing tokens have not yet been published.

It is also unclear on what platform the tokens were issued (if indeed they have already been issued). The platform was previously called Binance, but in August Piotrovsky said that “there are different platforms, different offers.”

As for the Binance platform, it is unclear from the terms of its standard contract which blockchain it uses (perhaps its own, specifically designed for NFTs). At the same time, the standard conditions of the platform involve the transfer to the buyer of a token of a very modest set of rights to digital works: (1) personal non-commercial use, (2) use on the marketplace in connection with the purchase and sale of a token, (3) use on third party websites in connection with transactions with a token.

If so, the lucky owner of the “Hermitage” token will not be able to issue T-shirts with “Madonna Litta”.

Can you give an example of NFT?

Koshkat, by CryptoKitties

Perhaps the most famous non-fungible tokens (NFTs) are those of the game CryptoKitties, which exists as a set of smart contracts on the Ethereum blockchain.

The essence of the game is that participants buy tokens from the organizers, each of which symbolizes a cat with unique properties. The cats can then be sold, bought and “breeded” (kittens are born from a cat and a cat, inheriting the properties of their parents, all this is programmed in smart contracts). Each token corresponds to a unique image of a cat, which is stored not on the blockchain, but on a separate server by the game organizers.

Despite the simplicity of the game, it is wildly popular. There are already more than a million crypto-kitties in the game, and the record price for one cat was 140 thousand dollars. For true enthusiasts, the organizers' website offers kitties for a million (but there are also ones for $40, for the poor).

Probability of a “bubble”

Separately, it is worth considering that uncontrolled unlimited access of any person (unqualified investor) to the market not only brings democratization of the market, but also threatens another “bubble”.

In a free, unregulated market, the “quality of investors” drops sharply: there is an influx of small, unhedged, insolvent retail investors. This usually does not lead to an increase in liquidity, but to a decrease in the value of the asset. Such a bubble of low-quality liquidity, if it inflates, will soon burst - after all, investors have no investment discipline.

Businesses are interested in tokenization not because it is profitable and convenient for small retail investors. And not because the existing trading system does not cope with its tasks. Against the backdrop of a protracted crisis in the crypto market and declining margins, tokenization for businesses is an opportunity to accelerate the liquidity of a new asset and manage to make money on it before it falls.

Are there any examples of legally correct tokenization?

An example is the same CryptoKitties tokens. Of course, their value for the user is primarily collectible, that is, stemming from the pleasure of the very fact of owning a unique cat. However, as a bonus, the organizers also grant the token holder the right to use the image of their cat.

At the same time, they took care to write a competent license agreement. The organizers reserve exclusive rights to the picture. By agreement, the user can use the image for personal, non-commercial purposes (hanging a portrait of the cat above his bed), as well as in connection with transactions with the cat itself (sale, etc.). In addition, he can use the image for commercial purposes (for example, selling T-shirts with the image of his cat), but only on a limited scale: income from sales should not exceed $100 thousand per year.

The authors invite everyone to use this agreement as a model for tokenizing images.

Four Russian companies will join the Visa tokenization service

Visa has announced the addition of 28 new partners worldwide to its Visa Token Service. The new partners will help improve the security of their customers' digital transactions using Visa cards through tokenization.

Tokenization is a system of protecting card details that a merchant typically stores on a customer's card by replacing those details with a token provided by Visa. This replacement eliminates the risks of misuse of payment details and increases convenience for both cardholders and e-commerce merchants.

Among the new partners of Visa Token Service are four Russian companies operating in the field of e-commerce: Mail . ru , Payture , RBK . money and Yandex.Money .

that have joined in different countries are Aurus , BlueSnap , Braspag , Bam bora , Fat Zebra , eGHL , Infinitium , iPay 88 , Moneris , One Inc. , Omise , Payvision , Spreedly and Windcave . Once testing and certification are completed, all 28 partners will have the ability to tokenize their customers' stored Visa card numbers, providing an additional layer of security for merchants and consumers.

Tokenization not only provides a higher level of payment security, but also helps make the payment process easier and more convenient, since customers do not need to manually update the details of a Visa card stored with partners if it is lost, stolen or has expired. This will allow trade and service enterprises to reduce the number of unfinished payments, and service consumers to avoid, for example, fines, late payment fees, and interruption of service provision.

“Today we are witnessing an unprecedented transition of consumers to online shopping in terms of speed and volume. Over the past few years, the growth rate of online commerce has exceeded the growth rate of traditional commerce. Under current conditions, this trend has accelerated significantly. Visa offers a service that increases security and convenience when making payments in e-commerce,” said Alexey Denisov, senior director for digital solutions Visa in Russia. “In addition, using the tokenization service in combination with other Visa services not only ensures that a merchant’s payment details are up to date, but also opens up new opportunities for bank clients to control where these payment details should be added and where they should be removed.”

In the context of the creation of ecosystems and super-applications, such functionality is becoming increasingly in demand. Now in Russia there are more than a dozen partners of the tokenization service in the field of e-commerce, behind which there are thousands of trade and service enterprises. As this service spreads, interest in tokenization on the part of payment aggregators, large merchants and banks is only increasing.”

The increase in the number of Visa Token Service partners occurs against the backdrop of rapid growth in the volume of tokenized transactions. Since the launch of the Visa Token Service in 2014, more than 150 partners (“token requestors”) from 137 countries have joined the service worldwide, including online stores, mobile device manufacturers, e-wallet and payment service providers, and acquirers. Visa recently unveiled data showing that Visa Token Service (VTS) participants process $1 trillion in digital payments, highlighting the new opportunities being created by the company's efforts to improve the security and convenience of payments.

Based on materials from Visa

Why do they pay such huge sums for tokenized works?

Everydays, by Beeple (2021)

Leaving aside phony PR sales, the value of a tokenized work appears to be made up of two components: the economic value of the rights attached to the token, and the collectible value of the token, which comes from the pleasure of owning a unique object and from the hope for its subsequent profitable sale or exchange. True, in practice it is quite difficult to separate one from the other, as well as from the “PR markup”.

The record price for a tokenized work was apparently $60 million (or $69 million including commissions). We are talking about the digital “Everydays: The First 5000 Days” by the artist known under the pseudonym Beeple (Mike Winkelmann). The painting was sold for the mentioned amount at Christie's with a starting price of $100. The painting does not exist as a physical object; as a sign of its acquisition, the buyer was given an NFT token on the Ethereum blockchain.

The amount looks quite impressive, but keep in mind that the piece is actually a collage of 5,000 full-length works created by the artist over 5,000 days (one per day). It can be assumed that for his money the buyer received the exclusive right to each of the works. The works are quite suitable for creating posters, etc. based on them. I don’t know what the prices for digital paintings are these days, but the amount of 12 thousand (even 14 thousand) for the work of a famous artist does not look supernatural.

What is real estate tokenization?

Tokenization is the process of creating a virtual token that represents a stake in real estate. Instead of registering ownership in an outdated paper-based manner, investors are able to transact digitally using tokens.

Tokenization is a fairly flexible tool. Tokens can represent an equity interest in real estate, a share in an enterprise that owns real estate, a claim secured by real estate, a right to a portion of income from real estate, and other types of rights.

Tokenization can cover any type of real estate, including single-family homes, apartment buildings, office buildings, warehouse buildings, retail space and any other properties.

While this may all sound like science fiction, there are currently several tokenization mechanisms in place, including:

- ownership of real estate through equity participation in a specially created company (this tokenization method is described in detail below).

- equity participation in a real estate fund

- equity participation in real estate

- investing and providing loans for development

- creation of tokenized real estate investment funds

What kind of tokens did Lindemann issue?

Till Lindemann (still from video, 2021)

In 2022, Rammstein frontman Till Lindemann, with the permission of the Hermitage, recorded a video with the song “Beloved City” in the museum’s halls. Subsequently, he “tokenized” the videos and photos taken in the Hermitage, putting the corresponding tokens up for sale at prices ranging from 199 euros to 100 thousand euros (which for some reason caused strong discontent among the Hermitage management).

Tokens are issued on the Polygon blockchain (this is a functional analogue of Ethereum, but transactions there are cheaper). It is not entirely clear what, if any, video and photo rights the tokens correspond to. It is possible that there are no rights, and the tokens have only purely collectible value, like magnets with pictures.

It is only known that the most expensive tokens (for 100 thousand) come with a trip to Moscow for two and dinner in Moscow with Lindemann himself.