Bonds (security, hereinafter referred to as Central Bank) are issued for a certain period. When selling the bond, the issuer (seller of the debt securities) records when the bond's maturity date occurs. In addition to the date, the client must pay attention to the redemption procedure and how the money is transferred, taking into account accrued interest. Particular attention should be paid to taxation. Let's consider how you can return money through the Central Bank, whether you need to pay taxes and in what cases early termination of the offer is provided.

What does bond redemption mean?

The maturity of a bond is the date on which it ceases to exist and the coupon is paid. In simple words, the promissory note ends and the seller pays the buyer interest, at a predetermined time.

It is important to consider that the validity period depends on their type. They are distinguished (you can purchase different ones of your choice):

- Short-term, up to 12 months.

- Medium-term, from one to 5 years.

- Long-term, more than 5 years.

The period during which the Central Bank operates is usually called circulation. In fact, redemption is the end of the circulation period when the issuer buys it back.

The redemption date is additionally specified in the instrument specification. For example, if a transaction is executed on the Moscow Exchange, then the date can be viewed in the card of the purchased Central Bank.

Good times

It must be admitted that in recent years, investors have made good money on debt securities, taking advantage of the fact that their prices rose when rates fell. For example, the largest exchange-traded bond fund of American companies, iShares Core US Aggregate Bond ETF (AGG), with a capitalization of about $90 billion, brought its investors a total return in 2022 of 8.68%, and in 2020 – 7.42%. This year, with a yield of 1.95%, the fund is still in the red by 1.08%.

Even more impressive were the results of the already mentioned iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) - 17.13% and 11.14%, respectively.

As already noted, there is now a high probability that prices for government and corporate debt securities may soon head down, which, as we see, is already built into the market. Those investors who own these assets will be doomed to losses. It is also possible that not all companies will be able to repay their debts on time.

Repayment procedure

Redemption of bonds is a standard procedure, the same for all types of securities. Just like to receive a coupon, you do not have to wait for the redemption date. You can buy or sell a security at any time during circulation. The main thing is to pay attention to liquidity, which can be low and high.

Bonds with a fixed maturity date

Most securities are issued with a fixed redemption date. This means that on the specified day the seller will make a transfer of money equal to the nominal value.

Once the funds arrive in the client's account, they can be withdrawn or used to purchase new assets. If the securities were purchased at a price below par, the investor will receive additional income. For example, the market price on the date of purchase was 900 rubles, and on the date of sale 1000 rubles. In this case, 100 rubles. - this is profit.

With the discount type, only payment of the par value is provided, without coupon income (CD). In this case, there are 2 methods of calculation:

- Cash, when the entire variable amount is transferred.

- Non-cash, in which an alternative method of repayment is used.

Bonds with an offer

This case is much more complicated than the fixed date method. In this case, an agreement is concluded, according to which the requirement for early return, before the established deadline, is specified. In this case, payment occurs at a nominal or set price.

It is important to take into account that the issuer independently makes the decision to return the money.

There are two types of offers:

- PUT – the buyer decides when to repay.

- Call – the decision is up to the seller.

Redemption of depreciation bonds

Depreciation is an installment payment for income. Those. The nominal value is not transferred to the client’s account immediately, but in several payments. This method is primarily beneficial to issuers, since they themselves decide how long the money will be returned.

It should be taken into account that on coupon payments, interest is not accrued on the entire nominal value, but only on the amount owed. Let's look at this type of payment as an example.

Example! Ilya Vasilyevich bought a bond worth 3,000 rubles with a maturity of 3 years. Coupon percentage – 15%. Payment was made as follows:

- 1 year. Received 1,000 rubles. and an additional percentage calculated using the formula: 3000 * 15% = 450 rub.

- 2nd year Fixed 1,000 rub. And the interest was calculated using the formula: 3000 – 1000 = 2000 * 15% = 300 rubles.

- 3rd year. As in previous years, 1000 rubles. and interest 150 rub. Interest calculation: 3000 – 1000 – 1000 = 1000 * 15%.

If the offer had a set coupon income, then Ilya Vasilyevich would have received (at 15%) 1350 rubles. for the entire period of time, instead of 900 rub. At the same time, 3000 rub. would be returned to the buyer at the end of the period.

Redemption of bond funds

The peculiarity of this type is that each security deposit has its own repayment period. At the same time, during the validity of the offer, the composition of the fund may change (update). Experts note that a unit fund is a kind of perpetual bond, without a fixed price. Its cost depends solely on the market, supply and demand. The key rate also influences.

Additionally, Central Bank funds can be selected for which the payment date coincides. In this case, on the appointed day, the fund is dissolved and the client receives the money. The downside is that it is almost impossible to know the cost of a share in advance. You can only guess the estimated price.

Tax on income from Eurobonds and foreign bonds

The tax on bonds issued abroad continues to apply in 2022. Russian residents owe 13% of the coupon income or discount to the budget (we will also dwell on the nuances of taxation of the discount in more detail below).

When calculating the tax on such bonds in 2022, it remains possible to offset taxes paid in another state against the reduction of Russian personal income tax. This is acceptable if Russia and the country of issue of the foreign bond have an agreement on the settlement of double taxation for individuals.

Example

In 2022, a Russian citizen will receive a coupon on bonds of a company incorporated in the United States in the amount of 1,000 USD. On the payment date, a dollar costs 77 rubles.

In the country of incorporation, a 10% local tax is immediately withheld. That is, the owner of the bond from Russia received:

1,000 – (1,000 * 10%) = 900 USD

There is an agreement between the countries on the avoidance of double taxation, including with regard to taxes levied on individuals. Therefore, tax collected in the USA can be offset against personal income tax in Russia.

Total income: 1,000 * 77 = 77,000 rubles

Full tax amount in the Russian Federation: 77,000 * 13% = 10,010 rubles

Amount of tax paid in the USA to be credited: 100 * 77 = 7,700 rubles

Pay additional personal income tax in Russia: 10,010 – 7,700 = 2,310 rubles.

Additionally, we will mention exchange rate differences that may arise when selling foreign bonds denominated in foreign currency. Exchange differences are considered income for personal income tax purposes in Russia.

Example

A Russian citizen purchased a bond for 2000 USD at a time when the dollar was worth 70 rubles. And I sold it for the same 2000 USD, but the exchange rate on the day of sale rose to 78 rubles.

Investor income subject to Russian personal income tax:

2000 * 78 – 2000 *70 = 156,000 – 140,000 = 16,000 rubles

Personal income tax for additional payment to the budget of the Russian Federation = 16,000 * 13% = 2,080 rubles

Early repayment of bonds

Early repayment of bonds (bonds) is regulated by the Law “On the Securities Market”. According to Article 17.1, the buyer has the right to terminate the offer early if the issuer violates its obligations.

Causes:

- The issuer did not transfer the accrued interest to the client's account within the time period established by the agreement (usually 10 days are given for the transaction).

- Debt obligations without financial collateral. In this case, the investor has the right to terminate the contract early and receive money within 15 days.

You can terminate the contract at your own request. The only nuance that should be taken into account is that in this case the investor almost always remains at a loss.

Additionally, there is partial repayment of the bond (depreciation). Many municipalities offer this type. Payment by amortization means that the funds are transferred in installments.

Example of bond amortization payment:

To understand whether it is worth terminating early or not, you should make a calculation. Let's look at how to do it yourself and understand the percentage of losses.

Let's say you purchased a securities for 1 year, with a nominal value of 1000 rubles. There are four coupon payments of 60 rubles per year. The deal was concluded at a price of 120%.

Calculation:

| Condition | Redemption at the end of the term | Redemption after the first coupon payment. The issuer announced the price at 100%. |

| Purchase costs | 1000 rub. (nominal) * 120% = 1,200 rub. | 1000 rub. (nominal) * 120% = 1,200 rub. |

| Amount to be returned to the client | 1000 rub. (face value) + 60*4 (coupons) = 1240 rub. | 1000 rub. * 100% + 1 coupon payment 60 rub. = 1,060 rub. |

| Income | 1240 rub. (amount to be returned) – 1200 rub. (purchase expenses) = 40 rub. 40 rub. (net profit) * 100/1200 rub. = 3.33% per annum. | 1060 rub. – 1200 rub. = -140 rub. (loss) - 140 * 100/1200 = - 11.67% per annum. |

| Note | The calculation did not take into account coupon income. | Losing your money. The dependence of the coupon payment in this case plays a big role. |

It turns out that if after the first coupon payment an early termination is issued, the investor remains in the red.

Closer to life

I admit that I cheated a little when, immediately after government bonds, I introduced the reader to an exchange-traded fund of securities that are designated as High Yield - highly profitable, and they are also often called “junk” due to the relatively high risks of default. How much do bonds of “normal” companies bring in?

Here is the fund of the already familiar iShares iBoxx family $ Investment Grade Corporate Bond ETF (LQD). Its capitalization is more than $40 billion and the portfolio includes bonds of companies that are, as a rule, in good financial condition and have appropriate credit ratings. Here are some of them: General Electric, Goldman Sachs Group, CVS Health, AT&T, Wells Fargo & Company, etc. The return of this fund is much lower than the previous one - only 2.48%, and the total return since the beginning of the year is -1.36%. Here we have already come closer to the real risk-return ratio for corporate bonds, but that’s not all.

Reasonable risk: how the pandemic made developing country bonds attractive

Taxation

Tax laws changed at the end of 2022. According to the new changes, investors are required to pay taxes on coupon income. In simple words - on the profit you receive, you must pay 13% for citizens of the Russian Federation and 30% for foreigners. The amendment came into force on January 1, 2022.

If the client has opened an IIS (individual investment account) through which bonds were purchased and type “A” deduction is selected, then the broker will automatically deduct contributions from the coupon. In this case, the client does not need to pay anything! Many Russian brokers act as tax agents.

If type “B” is selected according to the IIS, the investor is exempt from paying 13%. If a different type of agreement is drawn up, then it is best for the client to contact the broker in advance to clarify information regarding taxation. If the 13% is not paid by the broker, the client will need to submit a declaration himself.

Important! Personal income tax from coupons can be returned using a tax deduction. All available deductions are presented on the official website of the Federal Tax Service. You can submit a declaration remotely, if you have a personal account on the tax service website. If it is missing, you should contact the federal tax service.

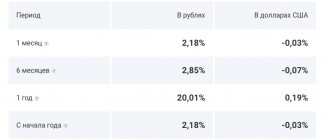

Buy mutual funds

If you don’t want to understand trading programs or search for the right security, you can invest in bonds through a management company (MC). To do this, it is enough to buy a share in a mutual fund (mutual investment fund). A mutual fund is a large portfolio with bonds of companies from different industries. The manager will take on all the headaches.

The managers themselves claim that investing in bonds through them is not only more convenient, but also more profitable than investing on your own, because a professional is looking after the funds.

“Last year was very successful for the bond market, and the yield of bond mutual funds was 13-14%,” says Alfa Capital analyst Andrey Shenk.

However, no manager can promise a guaranteed return, so you can earn more or less on a mutual fund than on independently purchased bonds.

From the amount of income you need to subtract commissions, which in the case of management companies are much higher than in the case of brokers. A management commission is added (1-2% of the fund’s assets), discounts/surcharges that are paid by the investor at the time of purchase/redemption of fund shares. In total, about 1.5-2% will have to be subtracted from the profit received for the management and redemption of the share. However, the share can also be put into an IIS and receive a tax deduction in the amount of the same 13% per annum.

Where does the money go when repaid?

When making an offer, the broker and the buyer agree on the method of receiving income. In practice, several accounts are used:

- IIS (Individual Investment Account). Tinkoff Bank offers to open an account for the holder of the Central Bank for free and top it up afterwards with any amount. At Sberbank, to open an IIS, you must make a minimum contribution of 10,000 rubles. In practice, financial experts recommend opening investment accounts to receive a tax deduction, or to avoid paying tax on the profits received.

- Regular brokerage account. You can open it for free at a bank or through a broker who sold the securities. When choosing an account, you should pay attention to the withdrawal fee and the timing of depositing money. For example, Tinkoff offers to withdraw money for free only to your bank card. Then withdraw money from an ATM of another bank without commission. They do not provide transfers to cards of third-party banks.

- Bank account. It opens for free and does not require you to place money on it. You can withdraw the income received only through the cash desk of the office in which it is opened. As an alternative, you can arrange a transfer to a card of any bank, taking into account the commission.

In practice, income is paid to the account where it was deposited.

To summarize, it can be noted that the repayment procedure depends on factors such as: the type of securities, the date of issue, how long the issue (circulation) was valid. It should be understood that this can be a transfer in one installment at the end of the offer or in installments (in installments, in the case of depreciation). The security may be returned early. The initiator can be not only the client, but also the issuer. No matter when the bond is sold, there are tax considerations to keep in mind. In practice, 13% of the income received is paid by the broker, not the holder.

How do investors report in Russia?

All investment income can be divided into those received from sources that bear obligations as a tax agent for income tax, and from those who are not obliged to comply with the laws of the Russian Federation regarding withholding taxes for individuals.

Usually, if income is paid by a Russian person (company, broker), then he has an obligation to withhold tax from the payment and transfer it to the budget of the Russian Federation.

If the payer of the income is a foreign person, then (as we saw in the example above) he will withhold taxes due in his country, and will not make calculations with the Russian personal income tax.

When personal income tax is withheld immediately at the source, and the owner of the bond has received a payment reduced by tax, the owner does not need to take any further action.

If the income on the bond came from a non-resident, then the Russian owner who received the income is obliged to calculate and pay tax in his own country.

Beginning in 2021, bonds tax declarations for individuals must be made no later than April 30 of the year following the reporting year. But only if there is tax not withheld at source (for transactions with foreign securities).

Such personal income tax must be paid before July 15 of the year in which it is declared.

But you can declare a deduction under IIS within 3 years from the year in which such a right appeared.

If you lose the right to already claimed deductions, you must also declare this by filing a 3-NDFL. The document must show the withdrawal of previously received deductions and the amount of tax that needs to be returned. Such a report must be submitted within the same time frame as 3-NDFL with additional tax - before April 30 of the following year. And you must pay before July 15 (as in the situation with independent tax calculation).