In this article we will try to describe in detail the main task of commissions in Bitcoin, how they work and what they influence. We will explain the reasons for the volatility of commissions, delays in confirming transactions, and describe approaches to solving these problems. In addition, let's clarify exactly how the Segregated Witness update helps reduce transaction costs. And as a bonus, we’ll share our thoughts on how friendship with miners reduces commissions to zero and what this trend may lead to in the future. So let's get started.

Time for complete transaction confirmation

It is important to distinguish the process of processing transactions (verification) from the process of confirming them (confirmation). On the Bitcoin network, transactions are processed almost instantly and confirmed within an hour. In other digital currencies, everything can be done within a couple of seconds. What determines the time for complete confirmation of a transaction in a decentralized environment? Mainly, from the mechanism for achieving consensus. In its pure form, PoW cannot achieve consensus in less than one hour. In turn, PBFT-based consensus protocols and DPoS-based protocols can achieve consensus in a few seconds. However, the level of decentralization and independence of such systems is much less than in Bitcoin.

According to the rules of the Bitcoin protocol, the owners of the majority of the computing power must confirm the transaction (the block in which the transaction is contained) for it to be considered fully confirmed. That is, based on the block in which the transaction received the first confirmation, several more blocks must be built. Moreover, this chain should be the longest, and there should be no competitive chains. The number of these blocks (transaction confirmations) is determined by the payee at his own discretion. He is guided by a rule that states that the more confirmations a transaction has, the less likely it is to be subsequently cancelled.

PS

Some fun arithmetic. Bitcoin is often compared to payment systems Visa, MasterCard, etc. or with WesterUnion instant transfer systems. Let's do our simple calculation:

We look at the latest blocks on the network: https://blockchain.info/ru/blocks Take, for example, block 490375: https://blockchain.info/ru/block-height/490375 Number of transactions: 2668 Miner reward: 12.5 BTC + 0.96 BTC = 13.46 BTC ($75,376) 1 transaction cost almost $30.

EEE... EEEEEEE... Is everything okay? What about WesternUnion's replacement? Or maybe Bitcoin = bubble? Welcome to our chat, we discuss everything there. By the way, we often post similar arguments on the Telegram channel and they don’t have time to reach the site, subscribe.

Do you think it's better on air? Oh well. Soon he will get it from us too. Wait a bit.

Bandwidth limitation

With the growing popularity of Bitcoin, the flow of new transactions on the network has increased significantly. It is known that the block size is determined by the rules of the protocol and is strictly limited. In Bitcoin, the maximum block size is 1 MB, hence the throughput is limited (1.7 KB/s). If the flow of new transactions exceeds the throughput, not all of them will be processed. And such situations happen often. Which transactions will receive confirmation first and which will remain waiting is a question that requires a clear answer. Its essence is that transactions must compete with each other.

What is Bitcoin commission and why do you need to pay it?

First, let's figure out how to send coins to another address:

- The payment is checked for validity by each of the computers containing a copy of the blockchain (these computers are called nodes). At this point, nodes check your Bitcoin transaction history to prove that you actually own the funds you want to transfer.

- When the nodes have confirmed that the transaction is valid, it is sent to the mempool (i.e. queue). There she waits for the miner, who will “pack” her into a block (group). Each block contains a link to the previous block, this is how the blockchain is built. At this stage, the transaction has not yet been confirmed.

- Once a miner has included a payment in a block, it is considered confirmed.

A block can contain a limited number of records, so in those moments when the network is crowded and there are a lot of pending transactions in the mempool, the miner prioritizes those payments that contain the greatest reward for him - a commission. It turns out that commission fees are a way to let the miner know how urgent the transaction is. If it is important to receive confirmation faster, it is recommended to increase the commission amount, and vice versa.

Fees are always charged only to the sender and not to the recipient.

The role of commissions

The commission mechanism in Bitcoin is necessary to pay for distributed network services, where the network service, in essence, is reliable data storage. Users of the Bitcoin network actually pay for each byte of data added to the common database. Because this database has limited bandwidth, users compete for write priority.

When forming transactions, users set a commission in the form of a certain amount of satoshi per byte of data. In this case, each validator node queues all unconfirmed transactions in such a way that first it confirms transactions that pay a large commission per unit of their weight. Obviously, those transactions that end up at the end of the queue may remain unconfirmed for a long time.

Another important problem that the commission mechanism solves is the “tragedy of the commons”. In the Bitcoin context, this means transaction spam protection. The presence of mandatory commissions means that it will be expensive for an attacker to clog the network with fake transactions over a long period of time if he has such intentions.

TL;DR

- The Bitcoin network commission does not depend on the transfer amount (be it 0.001 BTC or 100,000 BTC).

- When choosing the price for processing a transaction, you should take into account the commission per 1 byte.

- Before sending a transaction, you should look into the mempool and bitcoinfees.

- Exchanges do not allow you to choose the size of the commission, while they can even take part of it for themselves; you just have to accept it and wait until the transaction goes through.

Record Price Volatility

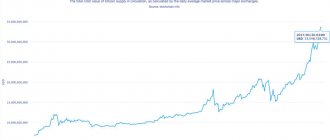

Users of the Bitcoin network occasionally experience unusually high volatility in fees.

For example, in 2022, the average price of recording one byte of data in the Bitcoin blockchain ranged from 1 to 500 satoshi. And the queue of unconfirmed transactions varied from several KiB to tens, and even hundreds, of MiB. Due to the fact that the price of recording data can change dramatically, users are forced to compete with each other almost blindly. This is due to the fact that the actual transaction will be confirmed on average within 8 minutes, while the processing fee must be set before it is signed. Therefore, the issue of a properly set commission still remains relevant, because everyone wants quick confirmation of their transactions with minimal costs. Naturally, paying more than 50 USD for a typical transaction is not the best option, especially when you can save up to 90% of this amount if you calculate the commission correctly.

The consequences of a sharp increase in the flow of new transactions is the emergence of a large queue of transactions awaiting entry into the blockchain. Among them are those transactions whose senders either did not pay attention to the change in the entry price, or formed the transaction at the moment before the sharp increase. Often the problem lies not in the user himself, but in the software of the wallet or bitcoin management services. An active user often comes across software products for working with Bitcoin in which commission management is completely hidden.

How much should I pay miners? Reasonable savings

Always look at the mempool size before transferring Bitcoins. This will give an understanding of what is happening with the network. If the mempool is practically empty, your transactions, even with the lowest possible commission, will go through quite quickly.

We recently tested the Bitcoin network: with a mempool size of 4 MB, a transaction of 225 bytes in size with a commission of 1 Satoshi/byte was completed in 3 blocks. We paid 225 Satoshi = 0.00000225 BTC = $0.01

Wallets shamelessly lie about the estimate of the required number of blocks (= time) to process a transaction when setting a commission. Why is it important? For example, there are 10,000 transactions in the queue, only 2,500 can go through the next block. 9,000 transactions cost a commission of 1 Satoshi/byte. There is no point in setting a commission of 10 Satoshi/byte, because even at 2 Satoshi/byte your transaction will end up in the first block.

We recommend the service https://bitcoinfees.21.co/

The service shows what commissions Bitcoin users paid for their transactions over the last 24 hours and over the last 2 weeks. Below the graph is the optimal commission value that must be set in order for your transfer to be processed in the next blocks.

At the time of writing, the mempool size is 15 MB. Site recommendation:

Which fee should I use?

The fastest and cheapest transaction fee is currently 200 satoshis/byte, shown in green at the top. For the median transaction size of 226 bytes, this results in a fee of 45,200 satoshis.

Considering that, on average, a transaction takes 226 bytes, the site recommends paying 200 Satoshi per byte. The total transfer fee will be 452 mBTC ($2.5). This is very expensive, but the transaction will be processed almost immediately.

Solving the problem with commission volatility

Regardless of the ability to manually control the recording priority of generated transactions, Bitcoin wallets can use mechanisms to estimate the current price of data recording, rather than using constant or manually updated values.

This gives a great advantage to the wallet in terms of managing the priority of recording a transaction in a common database and saving money on commissions. It is worth noting that forecasting the price of a recording is also possible, but often such forecasts only work over very short periods of time (on average several minutes). If the forecast is outdated and the transaction has not been confirmed, then it is likely that you can wait for its confirmation for a long time - most often several hours, and sometimes even days.

transaction fee = transaction size * byte price

Dynamic or adaptive calculation of transaction fees means automatically estimating the final transaction size in bytes and estimating the cost of writing one byte to the Bitcoin blockchain for the next few hours. For both assessments, there are specific algorithms for analyzing transactions and network activity. After obtaining an estimate of the transaction size in bytes and the cost of writing one byte, these values are multiplied to obtain the actual amount of Bitcoin that needs to be added to the transaction as a fee.

The advantage of the adaptive pricing approach is that a more accurate fee is included in the transaction, which will be above the minimum threshold, but not too high, which saves the user money. Moreover, the likelihood that a transaction will end up deep in the unconfirmed queue is minimal. However, there are exceptions. Therefore, let’s take a closer look at what is important to do in an emergency.

How to set a commission when transferring Bitcoin from a wallet

Let's look at the process of setting commissions using the example of three well-known crypto wallets.

Blockchain

In your Blockchain wallet, click the Send button.

transfer from Blockchain wallet

Selecting the commission amount

At the bottom of the window that opens, you will see a field that allows you to select the amount of deductions.

- Regular – the minimum possible fee. It is not recommended to choose, since the payment in this case will almost certainly not go through or will take a very long time.

- Priority is the current optimal commission. It is recommended to select.

Alternatively, you can click Customize Fee and specify the number yourself.

Exodus

In the Exodus wallet, you cannot manually select an indicator here. The transaction fee is dynamic and changes itself as the blockchain becomes busy.

transfer from exodus wallet

Click the Send button on the main screen. Enter the required amount or click All to transfer all funds at once.

transaction and commission information

Commission information is visible at the bottom of the window. In this case, we see that it is 0.00026216 BTC ($2.12). Click Send to confirm the payment. You can track the status of the transaction using the link provided:

Jaxx

Jaxx wallet has average fees by default. You cannot change this indicator when creating a transaction, but you can do this in the settings.

On the main screen, click on the three-bar button:

jaxx wallet

Go to the Mining Fees section.

Mining Fees

A modest window opens with a choice of only three items:

The first button sets reduced commissions. This is less expensive, but payments will take longer. The second button is the golden mean, where a balance is maintained between speed and high cost. The third is high commissions and high transaction processing speed.

Increase in commission after sending a transaction

Note that the Bitcoin protocol is very flexible in terms of fees.

For example, there are two protocol improvements: replace-by-fee and child-pays-for-parent, which allow you to increase the commission of an already generated and sent transaction. Unfortunately, very few wallets implement this functionality for the convenience of their users, although more are becoming available over time. In addition, this feature has a number of technical nuances and organizational requirements for its correct use. One of these requirements is that the user (or the software automatically) must re-evaluate the transaction fee, create and sign a new (alternative) transaction, distribute it to the network and continue monitoring its status.

Bitcoin transfer fee calculator

If you use a wallet that does not offer the optimal commission size or even do not trust the value that it calculates, then Bitcoin commission calculators will be useful to you. There are a large number of them and you don’t even need to look for these services, since I have already compiled a selection of the most popular calculators:

- Buy Bitcoin Worldwide - the calculator will help you calculate the optimal commission based on how many inputs and outputs there are in a transaction.

- Bitcoinfees is not exactly a calculator, but rather a service that will tell you what the time delay will be for a specific commission. The user can estimate how long it will take to wait if he pays a certain amount of Satoshi for the transaction.

- Bitinfocharts is a statistical service that provides information on the current value of the average commission.

- Xchange – provides information about current fast, standard and slow transactions with the designation of the commission in each specific case.

How Segregated Witness Helps

One of the protocol changes introduced by the Segregated Witness update is the introduction of a new transaction format and transaction weight.

Before the advent of Segregated Witness, commission calculations typically took into account only the size of the transaction. Now the size, transaction and its weight are also important. The new transaction stores proof of coin ownership in a separate structure (witness data). To convert the size of a transaction (total size) into its weight, the size of the witness data is multiplied by a smaller factor than the rest of the transaction data. The transaction weight is calculated using a special formula: weight = base size * 3 + total size

.

In this case, base size is the size of the transaction excluding the size of witness data. As you might guess, any data that is included in witness data requires 4 times less commission than the rest of the transaction data. This approach allows miners to determine a more profitable transaction in terms of the space occupied in the block and the reward received.

It is known that about 60% of all transaction data consists of proof of ownership of coins (i.e., such that can be recorded in witness data). Accordingly, the weight of transactions of the new format will significantly decrease. Thus, the user can pay less to confirm a new transaction, while it will have the same priority among miners when included in a block as the old transaction with a higher commission.

The diagram shows the dependence of the cost of writing one byte of data in the Bitcoin blockchain on the load (flow of unconfirmed transactions), expressed in bytes per second. The conclusion can be made very simple: if the flow of new transactions is lower than or equal to the throughput of the accounting system, then the cost of recording is practically zero. And if the flow of new transactions exceeds the throughput, the price rises sharply.

Commissions for trading and withdrawal of cryptocurrency on crypto exchanges

Cryptocurrency exchanges differ from each other in various ways, and commission fees are one of them. It depends on how the management has set priorities and what the platform is going to make money on: trading commissions, fees for withdrawing money, providing leverage, etc.

In addition, the fees for the seller (maker) and the buyer (taker) usually differ.

Examples of trading commissions for popular platforms:

- Bitfinex – for taker up to 0.2%, for maker up to 0.1%

- Poloniex – for taker up to 0.2%, for maker up to 0.08%

- Yobit – for everyone 0.2%

- Binance – for taker up to 0.1%, for maker also up to 0.1%

- Currency – for everyone 0.2%

- EXMO – 0.2%

Commissions for transferring BTC cryptocurrency from the exchange

Each crypto exchange sets a commission for withdrawing cryptocurrency. Usually, the value is higher than optimal. This is explained by the fact that exchanges are interested in the user receiving coins as soon as possible; the transaction is not stuck on the network; There is no way to update commission fees in real time. As of May 14, 2019, the average fees on trading platforms are 0.0005 BTC.

- Commission for withdrawing cryptocurrency on the EXMO exchange:

EXMO commissions - On LocalBitcoins:

LocalBitcoins commission - Bitmex (you can specify any commission, but not less than 0.00012 BTC):

commission for withdrawing Bitcoin to Bitmex - On the DSX exchange:

DSX Commissions - On Binance:

Binance exchange commissions - Gate.io:

Gate.io cryptocurrency exchange fees - Bitmax Exchange:

fees on Bitmax - Livecoin:

commissions on Livecoin - BitForex:

withdrawal fees bitforex

Option with a miner friend

Imagine that you have a friend who is engaged in mining and controls 10% of all the computing power involved in the Bitcoin network. On average, it generates a block once every 100 minutes. In this case, you can create your own transaction, in which you set the commission to zero, and then send this transaction to your friend for confirmation.

There is a 50% chance that your transaction will receive the first confirmation within 50 minutes, and a full confirmation - on average 50 minutes after the first. As a result, your transactions will receive full confirmation within approximately 100 minutes. If you didn’t have such a friend, the transaction would receive full confirmation within approximately 60 minutes, but with the payment of a full commission.

As you can see, when it comes to saving money, you are lucky if you have a miner friend. But if there is no such friend, then there may be alternative options for paying for a place in the block.

What could it be like?

Bitcoin commission can range from a few cents to several tens of dollars. At the same time, several factors influence the optimal price for the operation:

- Network congestion . When the Bitcoin rate reached its peak, large sums had to be paid for transactions, since everyone was buying the coin and the number of transactions was a record number. The network was not ready to process such a number of transactions, so users had to increase the commission and they reached serious amounts.

- What wallet is the sender using ? Wallets that support SegWit compress the transaction in such a way as to reduce its size as much as possible. For wallets that do not implement this function, the transaction will take more bytes and you will also have to pay more for it.

- Number of recipients . If you send coins to several users at once, the transaction will have several outputs and will weigh more. In order for the transaction to go through, you will have to increase the commission.

Option with place tokenization

Typically, a miner follows a standard scheme and sorts transactions according to the cost of writing 1 byte of data to the blockchain.

It seems like everyone is doing it now. However, it is possible that the miner may have better motivation. He can independently formulate a policy for monetizing his activity. In other words, he can act non-standardly with respect to the transactions that he will record in his block. If he can find better terms than just taking a fee for your transaction, he will most likely change his policy. This approach assumes that users will pay the miner for confirming their transactions not through a predetermined commission, but directly (according to their own scheme).

In practice, any sufficiently large mining pool can conduct its own campaign in order to increase profitability and use simple mechanisms for this, for example:

- determine your transaction sorting priorities;

- enter into a partnership with some service (exchange, store, browser);

- sell guarantees for some space in the block in the future.

Moreover, the pool can even tokenize the free space in its blocks (yes, in order to sell tokens).

Bitcoin vs. Fiat: A New Look at Transaction Processing Costs

The first step in understanding Bitcoin transactions is to understand the difference between how fees are calculated in Bitcoin compared to the traditional financial system. These two value transfer markets are fundamentally different, so how they react to market conditions and prices themselves also depends on various factors. Attempting to directly transfer habits or experiences between these markets could potentially cause a fair amount of headaches for new Bitcoin users.

The main difference between the two lies in understanding what exactly you are paying for. When comparing with Bitcoin, I will focus mainly on credit card transactions, since they are the ones we encounter most often in everyday life. In the case of credit card transactions, like bank transfers, the three main resources consumed and therefore sources of overhead are:

- administration and bureaucratic overhead (all software systems, points of sale, terminals, auditors, etc.);

- taking on risk from the time a transaction is initiated until it is finally settled - usually by an intermediary like Visa, but often also by merchants in the form of payment reversal risk;

- liquidity.

To support credit card transactions, merchants often pay a 1-3% fee on each transaction. For our comparison with Bitcoin, two characteristics are relevant here:

- the transaction fee depends on its amount ($3 for a $100 transaction and $30 for a $1000 transaction);

- this fee is hidden and is often built into the price of the product or service purchased rather than being stated separately on the receipt.

In Bitcoin the situation is completely different. There are no point-of-sale or ATM costs, no administrative costs, no liquidity restrictions and virtually no counterparty risk. So what are you paying for? Without getting too technical, Bitcoin processes transactions by distributing them across the network through nodes, including them in blocks by miners, and distributing, validating, and storing the resulting blocks on each full node.

All costs here are associated with data storage and verification of cryptographic signatures. The more data you want to entrust to other network participants, the more you will have to pay for the privilege. This can be compared to the need for a more expensive data plan if you want to stream HD movies on your mobile for days, and not just check your email periodically. Another analogy is paying by weight when shipping a package: you pay more for faster delivery, for higher weight and, often, for delivery during peak periods (such as Christmas).

In other words, Bitcoin allows for price discrimination and priority processing, which, from an economic point of view, can also provide a more elastic demand curve: someone who cares about having their transaction processed faster pays a higher fee, thereby partially subsidizing transaction processing for everyone else.

Finally, one final characteristic to keep in mind regarding Bitcoin transactions: one of the ways the protocol helps limit the cost of processing data for all participants in the network (as well as limiting the free-rider effect) is by limiting the block space, that is, the maximum amount of data allowed. , which can be written to each block (from ~1 MB to 4 MB depending on the type of transaction, but this is beyond the scope of the article). This means that as the demand for transaction processing increases, the amount of relative block space available decreases.

If something shifts the demand curve to the right (for example, when MicroStrategy or Square buys more BTC), the intercept moves to the right, closer to full blocks and with higher fees.

Bitcoin commission in exchangers and payment systems

In addition to exchanges, Bitcoin can also be exchanged in various electronic payment systems and exchange sites.

For example, webmoney, one of the first platforms with electronic money, also integrated a Bitcoin wallet. At the same time, you can enter BTC for free, but withdraw with a commission of almost 3%. That is, if you send 0.01 BTC, the transaction cost will be 0.0003 BTC.

Important: bitcoin network commission in exchangers often depends on the exchange rate. Be careful: sometimes banks with which exchangers cooperate may charge an additional commission. We will try to make the process more clear.

How a transaction occurs using an example

We chose the exchanger baksman.org because of its good reviews and Russian interface. However, the principle of operation is the same everywhere. You can choose your option based on the rate and user ratings on Bestchange.ru.

We select Bitcoin BTC in the right column, and electronic money from popular Russian banks in the left column.

Next, we’ll find out what the Bitcoin commission is at this bank. For example, the price of 1 BTC in Sberbank is 424123.88 RUR, in Gazprombank 437770.62, in Tinkoff 427028.68.

As you can see in the example, before buying/selling bitcoins, you need to study all the options and choose the most profitable one.