Mining of cryptocurrencies using the Nakamoto consensus (PoW) is based on the network difficulty, which is determined by the number of mining devices on a global scale and their productivity.

It affects how financial investments in equipment will be justified, how many coins can be mined per unit of time, and what the final profit will be.

Let's look at what the complexity of the Bitcoin network is and how it affects the production of new coins.

- What is Bitcoin network complexity? Why is network complexity needed?

- The main factors changing the complexity of the Bitcoin network

- Calculation procedure

Why was the difficulty parameter introduced?

Mining Bitcoin, like many other cryptocurrencies, is profitable as long as the value of the mined coins exceeds the cost of equipment and electricity. The difficulty indicator is important for the cryptocurrency mining process, since it determines how much equipment and how much power needs to be used in the process.

Difficulty helps miners identify energy-efficient devices that provide the best returns. Also, through mining difficulty, the rate of emission of new coins is controlled.

How to count

Mining difficulty is calculated using cumbersome mathematical formulas. But for a general understanding of the process, it is enough to consider the situation using the example of one block. The essence of the calculation follows from the pattern discussed above.

Mining difficulty is equal to the product of two parameters: the time to create a block and the network hashrate. The first is measured in seconds, and the second in hashes. Therefore, the difficulty of mining is reflected in X*s. The formula shows that as the total power increases, the calculated parameter also increases.

In this way, the system seems to equalize the indicators and prevent miners from extracting coins in an accelerated manner. The balance of the system is maintained, and the risk of deflation and depreciation of the cryptocurrency is eliminated.

What determines the difficulty of mining Bitcoin? When does the difficulty of mining Bitcoin increase?

In the Bitcoin network, difficulty recalculation occurs every 2016 blocks and depends on the time it took to find the previous 2016 blocks. A block is found approximately every 10 minutes - as intended by Satoshi Nakamoto (to support the planned supply of 21 million coins). Thus, finding 2016 blocks takes about two weeks.

If the previous 2016 blocks were found faster, the difficulty decreases, if it takes longer, it increases. The more (or less) time spent finding the previous 2016 blocks, the more the difficulty decreases (or increases).

Forecast for the near future

Miners from different countries are trying to predict the difficulty of Bitcoin. Some say that they are already noticing an increase in the MTC stabilization indicators by approximately 8-10% over 30 days and are wary of further changes in the rate. Other mining enthusiasts claim that profits depend on the value of the currency, which changes frequently.

Mining experts report that very soon everyone will experience a new level of forecasting of financial markets, which will take into account all the changes and factors affecting numerous indicators of the growth of crypto coins.

Increasing difficulty of Bitcoin mining

The difficulty indicator depends on the network hashrate and the time spent finding previous blocks.

If the hashrate has increased, it means that new participants have joined cryptocurrency mining. They connected their equipment to the network, so the computing power of the network increased. Therefore, it will take less time to find a block than with a lower hashrate.

It follows that:

- the higher the hashrate, the more miners are engaged in mining coins, the less time they need to find blocks - the difficulty increases;

- the lower the hashrate, the fewer miners, the more time is spent on mining - the difficulty decreases.

The concept of "complexity bombs"

This term is mainly used in the context of the Ethereum cryptocurrency, although it is also related to Bitcoin. “Complexity bomb” is usually called the level of complexity of computational processes in a hashing algorithm. They are used to reward miners. The developers who planted the “bomb” can regulate how difficult it will be for users to receive new coins in the future.

Formally, a bomb is an old piece of code that gradually slows down the speed of coin mining, making it less profitable. The time interval between the generation of new blocks is growing exponentially. The first “bomb” was planted by the Ethereum developers back in 2015. They did this to stimulate the creation of Ethereum 2.0.

What is hashrate

Hashrate is the total computing power of all mining equipment connected to the network. It displays the mining speed, which is why it is also called the hash rate. Hashrate reflects the amount of resources spent on maintaining the network and mining new bitcoins. Measured in hashes per second.

Hashrate indicators are constantly changing. They can fluctuate by several percent throughout the day. But this does not mean that a large number of miners join or leave the network. Hashrate cannot be calculated accurately in real time: it is estimated based on publicly available Bitcoin data, including network difficulty metrics. Therefore, when they talk about hashrate indicators, they mean the weekly average.

The hashrate value depends on the power of mining devices. If the hashrate grows, it means that new miners are connecting to the network - it will take less time to generate a block, and mining difficulty increases. If the hashrate drops, miners turn off - the time to find a block increases, the difficulty decreases.

The level of hashrate directly determines the profitability of BTC mining. The higher the hashrate, the lower the profitability of each device. The profitability of mining is also affected by the cost of electricity, equipment power and the price of the coin.

Hashrate is an important indicator for assessing the security of the Bitcoin network. The higher it is, the more difficult it is for attackers to carry out attacks.

Actual information

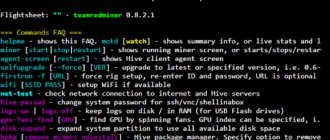

To get a summary of the current difficulty level, enter the getDifficulty command into the programming interface of the mining device. For further study of the issue or preliminary familiarization, the following resources are most often used:

- Bitinfocharts.com is a platform that provides information for the entire period of Bitcoin's existence, from 2009 to the present. Scaling of individual sections of the graph is available to study details, as well as additional tools;

- Blockchain.info is the main resource for obtaining information, built on the principle of “nothing superfluous.” As in the previous case, the graph is scaled, the history is viewed from the moment the first block of Satoshi Nakamoto was generated. This is enough for most users, but the lack of additional tools is rather a disadvantage.

The vertical scale on the graphs indicates the difficulty level, the horizontal scale indicates time.

How mining difficulty and hashrate affect the price of Bitcoin

Difficulty and hashrate indicators affect the profitability of mining, and, consequently, the cost of Bitcoin.

Mining difficulty adapts to the hashrate - when miners turn off equipment, the hashrate decreases and pulls the difficulty down with it, and vice versa.

Most often, as the hashrate increases, the value of the coin also increases. But, for example, in October 2022, the Bitcoin network hashrate collapsed, but there was a bullish trend in the market and the price of Bitcoin did not fall. Therefore, although the hashrate and the cost of a coin are interrelated, power indicators cannot be used to accurately predict the price, especially in the short term.

Current indicators

The complexity of Bitcoin is rapidly increasing, this can be seen from the statistics:

- $13,351.88 – market price (according to leading bitcoin exchanges);

- 1.06 megabytes – the average size of one block (information is taken per day);

- 435,793 transactions (transactions completed over the last 24 hours);

- 118,292,897 bytes (number of transactions that are waiting to be confirmed).

Over the past year, mining turnover has exceeded all expectations; the difficulty of Bitcoin mining today is 1.347T.

On many sites you can view cryptocurrency statistics: the total volume of coins in circulation, market capitalization, transaction volume, detailed information about the current block, hash rate, Litecoin price analysis.

Halving

As we have already mentioned, the possible number of Bitcoins is limited. A total of 21 million coins can be issued.

Satoshi Nakamoto programmatically laid down halvings in the Bitcoin network, and every 210 thousand blocks, that is, once every 4 years - until the moment when the emission of cryptocurrency is completed with the extraction of 21 million coins (presumably in 2140), the reward to miners is reduced by half.

On May 11, the third halving in history took place on the Bitcoin network at block #630000. The specified block, the reward for which was 6.25 BTC, was mined by the AntPool pool at 19:23 GMT (22:23 Moscow time).

Halving does not in any way affect the complexity of the cryptocurrency network. Bitcoin mining difficulty does not change, there are simply fewer coins in the block.

Natural limitation of Bitcoin mining

Each of the miners tries to ensure maximum productivity of their own labor in order to mine a large number of crypto coins. To do this, people often purchase special mining equipment called Bitcoin pools. The computing power of data centers is also often used. Every experienced miner has their own equipment, for some it is their computer, other people buy special video cards and the best expensive pools.

The number of electronic money should not increase sharply, because if people mine too many crypto coins, then the virtual money will be exhausted, therefore, it will not be in circulation - this is the difficulty of mining bitcoins.

The complexity of the bitcoin network also includes a certain amount of electronic funds (no more than 21 million bitcoins). What if people want to mine more coins? It is impossible to prohibit miners from trying their luck and making money; if they do not make transfers and use the wallet, the system will simply stop developing, as a result of which it will collapse and stop working. Therefore, there is only one current limitation - the stabilization rate of Bitcoin computing.

The conditions for mining virtual money change if the number of bitcoins grows excessively - the difficulty of mining is recalculated and changes. With such increases, the bitcoin rate becomes less profitable, because energy costs eat up all income.

Changes in the direction of reducing mining power indicate that coins will be more difficult to mine and replenish your bitcoin wallet with them. With such sharp fluctuations, miners start working again and try to increase their income.

Mining prospects taking into account the dynamics of growth in computing power

As technology advances, new, more powerful computing devices appear that consume less energy, resulting in an increase in mining difficulty.

The constant increase in computing power has a bad effect on the income of miners engaged in mining cryptocurrencies using the PoW algorithm. The increase in the overall network power is inversely proportional to the income of each individual mining farm owner. The situation is aggravated not only by this, but also by the general drop in capitalization and prices of major cryptocurrencies.

Maintaining a constant level of mining income requires periodic increases in productivity, which can only increase significantly with the purchase of new devices.

Dynamics of finding bitcoin and bitcoin cash blocks

For the dynamics of finding bitcoin and bitcoin cash blocks, you should pay attention to the size of the block chain, the average block size, the number of transactions performed per 1 block, the time of the block, its market capitalization and average cost, the block transaction size, abandoned or mined blocks.

Internet resources provide information about Bitcoin list, Bitcoin rich list, Bitcoin explorer, average transaction amount median and total transaction amount in the public domain.

As of December 5, 2017, the size of the block chain is 144,740 megabytes, the average block size is 1050 megabytes, the number of transactions per current block is 2,279 transactions, the average transaction confirmation time is 13 minutes. The median commission is the commission for 1 transaction, which is 3,586 BTC.

You can buy Bitcoin at a crypto bank. Exchange rate for today: 1 BTC = 10,969.99 dollars. Only purchasing from a reliable bank can prevent online fraud. The price per transaction is $72.

Okay, what if we increase the block size?

Yes, this is a fairly widely discussed topic. If the block size increases, regardless of complexity, then more transactions will fit into the block, therefore more transactions will be processed in a given time period. While this may look like a solution, it really isn't. There are several arguments against increasing the block size, one of which is that longer block propagation times between nodes will lead to a higher rate of orphan blocks. Essentially, this is a trade-off between scalability and security, however, it is only a temporary solution at the cost of network integrity.

Large Hodlers and Institutional Investors

Institutional investors and large Bitcoin holders have the opportunity to seek the services of analysts to avoid unnecessary losses. However, this threatens market stagnation, the expert warns.

“New injections of money into both mining and directly into the cryptocurrency market will stop. Many investment rounds will be on hold until the situation becomes clearer. Altcoins will not have time to react to such lightning-fast growth of Bitcoin, and blockchain projects that do not have time to enter fiat currency will end up bankrupt.”

The situation will return to normal after a correction, which will inevitably occur, throwing out “extra” participants from the market, adds Ushakov. However, such “slides” are not very attractive for institutional investors - no investment model provides for such risks.

Miners

With the price of Bitcoin at $300,000, owners of mining equipment, even the currently unprofitable Series 9 ASICs, will return to mining. This will happen even in countries with expensive electricity, such as Japan and South Korea, since the cost of electricity will no longer play a significant role, the expert believes.

“The growth of global hashrate will approximately double the complexity of calculations. Equipment written off at the moment will still remain profitable and will generate enormous income. The only question is its placement and provision of uninterrupted power and service.”

Part 1: Analysis of Bitcoin energy capacity: how much, where and at what price

In this first section, we will attempt to measure, locate and price miners' energy capacity, and evaluate their profitability. Through more than 60 conversations with miners, hardware manufacturers and retailers, and data from 45 public sources, we have tried to provide as complete a picture as possible of what energy capacity is available for Bitcoin mining, where it is located and how much miners pay for the electricity they use. .

We then explored how mining capacity might grow in the future depending on the availability of electricity, the efficiency of mining rigs, and the constraints that might be imposed by the price of Bitcoin, the availability of capital, and semiconductor chip manufacturing technologies.

We estimate that the Bitcoin mining industry has access to at least 9.6 GW of electricity.

Our assessment is based on the following logic: On May 10, just before the halving, Bitcoin's hashrate reached 136,098 petahash/sec. and on May 17 fell to 81,659 petahesh/sec. We recognize that to some extent these extreme values could depend on simple chance - for example, a number of successfully and quickly found blocks could artificially inflate the calculated hashrate value, just as the decrease in the speed of finding a block could also partly be a consequence of chance. However, we remove this randomness factor from our model and make simplifying assumptions to get a rough idea of how much energy the Bitcoin network consumes. Our assumption here is that the source of all hashrate remaining after the decline to the May 17 lows is the more profitable, newer generation of hardware belonging to the "S17 class", which includes Bitmain's Antminer S17 and T17, the Whatsminer M20, and devices from Canaan, Innosilicon, Ebang, etc. We also assume that all devices taken offline between May 10 and May 17 were older generations of less profitable S9 class hardware (like the Antminer S9 and Whatsminer M3).

Please note that we use the designations "S17 Class", "S9 Class" and "S19 Class" as categories that include both devices from Bitmain and equipment from competing manufacturers that have similar characteristics. We refer to the class names by Bitmain models because they have been the dominant player in the "S9 class" and, to a lesser extent, "S17 class" hardware market. In addition, in all relevant calculations we assume a PUE (Power Usage Effectiveness) value of 1.12, which means that for every 1 MW spent directly on Bitcoin mining, another 120 KW is spent on maintaining all related infrastructure, including cooling systems, lighting, servers, switches, etc.

And the classification of equipment by key classes used by BitOoda. Sources: BitOoda, Bitmain, Canaan, MicroBT, Halong, GMO, AsicMinerValue.com.

The figure below shows that if all the hashing power online on May 17 was S17, it would consume 3.9 GW of electricity. In addition, if all 54 exahash/sec. of hashrate that went offline between May 10 and May 17 belonged to older generation equipment, the S9 class, this would correspond to an additional 5.7 GW of electricity. We make these simplifying assumptions to arrive at some general understanding of the industry, recognizing that in reality most but not all of the shutdown capacity was S9, and some small portion of the remaining capacity is likely S9. , operating in markets with very cheap electricity. A key factor in the capacity reduction was the reduction in hardware profitability as a result of the halving, coupled with the timing of the movement of mining equipment from the north to the south of China to take advantage of cheaper electricity (more on the impact of the Chinese hydroseason in the second part of the article). Based on these assumptions, we estimate the amount of electricity available for Bitcoin mining to be at least 9.6 GW.

Bitcoin hashrate and power consumption at the recent peak on May 10th and low on May 17th. Source: BitOoda, Blockchain.com, Kaiko, Coinmetrics

.

We estimate that the Bitcoin mining industry uses ~67% of the 9.6 GW of available electricity and is growing at ~10% per year. Most current devices are classified as S17, but future growth will largely come from the next generation of equipment, S19. Some of the hashrate that returned to the network after May 17 likely came from S9-class mining rigs, either located in extremely low-cost jurisdictions or, with some delay (to avoid equipment downtime in the days leading up to the halving), moving from more expensive regions of northern China to the provinces Sichuan and Yunnan to take advantage of cheaper electricity during the annual flood season.

In addition, despite supply chain disruptions, by this time limited supplies of the next generation equipment - Antminer S19 and Whatsminer M30 - had begun, as well as some shipments of the S17 class, partly thanks to which the hashrate was restored.

Hashrate, power consumption and installed base of Bitcoin mining hardware as of 07/01/2020. Source: BitOoda, Blockchain.com, Kaiko, Coinmetrics.

About 50% of mining capacity is concentrated in China, another 14% in the USA.

We obtained information about where mining facilities are located and how much miners pay for electricity from various open sources, as well as from confidential communications with miners and manufacturers and sellers of mining equipment. We were able to locate ~4.1 GW of energy distributed among 153 mining operations, including 67 enterprises (with a total energy consumption of ~3 GW) that provided pricing data on condition of anonymity.

Geographical distribution of the mining capacity studied compared to the total estimated energy consumption of 9.6 GW. Source: BitOoda assessment, miners, ASIC manufacturers and sellers, public sources

.

From the information we received through personal contacts, we can come to the conclusion that most energy consumption is concentrated in the United States, Canada and Iceland, and only a relatively small part is in China and the “rest of the world” category. We asked miners not only about their own capacity, but also about how many other miners in their market they know and what, in their opinion, is the total amount of mining energy consumption in their region. We understand how approximate the data obtained in this way is, but nevertheless find this approach useful for estimating the overall geographic distribution of mining capacity.

Geographical distribution of the mining capacity studied compared to the total estimated energy consumption of 9.6 GW. Source: BitOoda assessment, miners, ASIC manufacturers and sellers, public sources

.

We estimate that 50% of Bitcoin mining capacity pays 3 cents or less per kWh, which is in line with the trend of a steady decline over the past few years. Some evidence suggests that in 2022 the figure was closer to 6¢/kWh. When income decreases by petahash/sec. Due to the increase in network hashrate, miners with high electricity costs were forced to either move to regions with lower electricity costs or close down.

Energy Cost Curve: Comparing energy costs to the share of grid energy consumption. Source: BitOoda assessment, miners, ASIC manufacturers and sellers, public sources

.

Based on our cost curve estimate, the average monetary cost of mining 1 BTC is around $5,000, with an upper confidence bound of around $6,000. This estimate includes cash operating expenses without taking into account depreciation or other costs of mining equipment.

The curve also shows that a small percentage of Bitcoins are mined at a monetary cost above the current BTC spot price. We believe that some of this uneconomical mining is driven by power purchase obligations and potential incentive payments to shut down capacity during peak periods of power demand and purchase Bitcoin in jurisdictions with limited or more costly trading opportunities.

Cost of mining 1 BTC based on network energy consumption at various energy costs, data as of 07/01/2020. Source: BitOoda assessment, miners, ASIC manufacturers and sellers, public sources

.

Note that for break-even mining on S9-class equipment at the current network hashrate, an electricity price of less than 2 ¢/kWh is needed, and it is likely that for such mining to remain viable, this upper bound on the price will have to decrease even more over time as hashrate continues grow. Our cost model assumes that it takes one person to manage 5 MW of power consumption. Because S9 class devices are less energy efficient than newer mining rigs and require more devices per petahash/sec. hashrate, they consume more power compared to newer devices and require more labor and overhead to achieve the same hashrate. On S19 class equipment to generate 1 petahash/sec. The hashrate required is about 30 kW and a little over 9 devices. On S9 class equipment to generate the same 1 petahash/sec. hashrate would require about 70 devices and more than 100 kW, and, accordingly, more labor and overhead.

Daily revenue and cash operating costs for various mining rigs at current hashrate and varying electricity costs. Note: To estimate the percentage of electricity actually used for mining, we assume a PUE value of 1.12. Source: BitOoda estimate, Blockchain.com, Kaiko, Coinmetrics. Labor costs are based on estimates received from miners regarding the cost of maintenance and operating personnel required to run a large-scale (>50 MW) project.

To summarize, we estimate the energy capacity available for Bitcoin mining to be ~9.6 GW, and its current utilization rate to be 60%+. This electricity has an average price of ~3¢/kWh, and the average monetary cost to mine 1 BTC is around $5,000. According to our estimates, China accounts for about 50% of total energy consumption, and the United States accounts for about 14%. Much of China's capacity migrates during the flood season to Sichuan and Yunnan provinces to benefit from cheap electricity. This phenomenon will be discussed in more detail in the second part of the article.

Current difficulty on the Bitcoin network

November 30, 2022 Bitcoin mining difficulty is 6,653,303,141,406.0 H/s. This is the highest indicator among digital currencies. The Bitcoin difficulty graph looks like this:

The information in the form of a diagram was taken from the site https://blockchain.info/ , this information is also provided by the resource https://bitinfocharts.com/ . To determine the value with the smallest error, it is advisable to use two or three sources at once, always taking into account the dynamics of the indicator.