We understand the intricacies of calculating commissions for Bitcoin transactions

Views: 25091

Comments: 2

You have to pay for transfers on the Blockchain network. This fee is called a commission and it goes to the miners - the people who form the blocks. Bitcoin transfer fees are variable. It decreases and increases depending on the network load. If at the beginning of its existence there was no need to pay fees for Bitcoin transfers at all, then for several years now the fees have continued to rise.

In principle, you can change the standard board by setting more or less. But then it is not a fact that your transaction will not replenish the already existing number of unconfirmed transactions. To prevent this from happening, the Bitcoin transfer fee must be adequate.

Bitcoin transaction

To fully operate on the Bitcoin network, you need to pay a commission. But first, let’s look at where the deductions will be made: 1 Bitcoin = 1000 mBTC = 100 million Satoshi. That is, 1 Satoshi is 0.00000001 Bitcoin. It is in satoshis that deductions are made to pay for transfers.

Transactions have their own characteristics. Let's say you have one Bitcoin. To send 0.5 BTC, you will receive 0.5 BTC in change. Each translation is a program code. It is generated based on where the coins came from and where they are going. Thus, the length of the code will increase depending on the number of participants in the transaction.

You don’t even need to think too hard to indicate the amount of the fee during a transaction. A modern Bitcoin wallet is configured in such a way that when a user makes a transfer, the commission window already displays the amount that the system recommends paying in order for the transaction to be competitive.

Selecting the transaction fee using the example of the Electrum wallet

But the user has the right to indicate the amount that is convenient for him. If you change the commission, the speed of the transaction will also change. The lower the amount, the longer you will have to wait. Some crypto wallets indicate this value. If you pay a lot, the transfer will be included in the next block, and if you are greedy, it is not a fact that the transfer will be included in the 25th block. Also, the cost of cryptocurrency transactions depends on the price of Bitcoin. Because when coins become more expensive, activity on the network increases noticeably.

Bitcoin commission: what is it and what is it for?

The Bitcoin Network commission for a money transfer, like any other payment system, consists of 2 parts:

- One is funds to maintain the operation of the system.

- The second is an incentive reward for miners so that the transfer can be processed and confirmed as quickly as possible.

Transactions with a minimum commission are processed by the Network, but rather late rather than early due to low competitiveness.

Sometimes, under certain conditions, you can do without any commission for transfers on the Bitcoin Network. But there is no point in striving for this. The cryptocurrency system is configured in such a way that the minimum payment per transaction prevents spam attacks, in which bots issue a lot of free transactions and overload the Network. Such transfers will always have low priority and have a negligible chance of being blocked.

What affects Bitcoin commission

Satoshi Nakamoto, the developer of a decentralized cryptocurrency network, sought to create an inexpensive, accessible service. This was true at first, but as soon as Bitcoin gained popularity:

- the number of transactions, that is, transfers, has increased;

- the load on the BTC Network has increased;

- there was a scalability problem;

- the transaction confirmation time has increased to 10–15 minutes;

- Periods began to arise when the payment froze for hours and even days.

Along with the problem of slowdown, methods have emerged to speed up translation. The simplest one is to assign a higher transaction fee so that it is included in the calculated Bitcoin block. Because miners, first of all, add transactions to the current block for which users are willing to pay more money.

In general, the algorithm is as follows:

- The Bitcoin commission does not depend on the transfer amount, but on the volume of the transaction.

- For every 1 thousand bytes, you must pay the so-called optimal commission share of 10 thousand satoshi. This amount is conditional. If the demand for transactions on the Network increases sharply, as was the case at the end of 2017 when the BTC rate was about 20 thousand US dollars, such a share could be 50 thousand satoshi or more. If the transfer amount is less than 0.01 Bitcoin, the size of the recommended contribution increases additionally.

Therefore, the cost of a transaction does not depend on the amount, but on the number of addresses involved in the operation. For small and frequent transactions, the fee will be higher than for rare and large ones.

However, it is not necessary to pay the optimal commission, the size of which varies depending on the current load on the Network. It is enough to assign any one other than zero and the transfer, albeit not quickly, will be confirmed.

Retention by the Bitcoin Network should be distinguished from commissions of blockchain services - online wallets, exchanges, where intermediaries charge a premium and transactions are more expensive.

Including a transaction in a block

The user has the right to set the transaction fee independently. In turn, miners look at the proposals and include profitable transfers in the block first, since, after calculation, they receive a reward for the block itself and payments for transfers, and thrifty users have to wait patiently in line.

Reasons for the increase in bitcoin commission

Each transfer of funds on the Bitcoin Network is a computer code that includes 2 parameters - the address of the recipient and the sender. The weight of one address is approximately 150 bytes. The commission, on average, increases by 10 thousand satoshis per 1 thousand bytes. With large transaction codes, or with an increase in demand for transactions, or with the simultaneous action of these factors, the load on the cryptocurrency network becomes higher, and the increase in commission protects the system from overload.

Things are more usual with commissions in exchangers; let’s look at the example of Matby. You don’t need to delve into anything, since you just need to select the cryptocurrency to be sent, indicate its quantity, and the service itself will calculate and indicate the amount that will be debited from the wallet, taking into account the commission.

If the transaction needs to be completed quickly, then simply check the “Set high priority” checkbox. Then the commission will increase, but transaction processing will also be faster. That's all, all you have to do is click the “Send” button.

Depositing Bitcoins into a Matbi wallet is even easier. Just go to the “Accept cryptocurrency” tab, select the one you need (BTC-Bitcoin) and your wallet address on Matby and a QR code for quick scanning will be shown there. The minimum deposit amount is 0.0003 BTC, the commission is fixed, that is, does not depend on the amount - 0.0001 BTC.

Rules for calculating Bitcoin transaction fees

You can find out what the commission for Bitcoin transactions is using a special service - Bitaps processing. This is done as follows:

- Go to the website via the link bitaps.com;

- In the “Bitcoin network” block on the main page of the site, see the line “Recommended commission”;

- You will see a line with three different colored numbers. They are blue, green and black in color;

- Blue - high priority, that is, if you specify the value indicated in blue as a commission, there will be a very high probability of your transaction being included in the next block. Green - medium priority. Black is low priority.

- Select a number and divide it by 10 thousand to get the Bitcoin value. This will be the size of the commission.

Bitaps.com home page

We calculate the commission as follows:

In the screenshot above, the value of 40 satoshi per byte is indicated in blue. To determine how much a high priority transaction will cost in bitcoins, you need to divide 40 by 10 thousand. We get 0.004 BTC. That is, in order for your transaction to have high priority, the commission must be 0.004 BTC. The calculation is similar for transactions with low and medium priority.

The values on bitaps.com are constantly changing. Therefore, make the calculation before sending each transaction.

What factors does the Bitcoin commission depend on?

Bitcoin commission depends on several factors.

- First of all, these are transactions. The more participants, the larger the transaction code. Each new point adds a certain number of bytes to the transaction (mempool size 15 MB). Please note that the minimum translation price increases depending on the size of the code. Every 1000 bytes = 0.0001 Bitcoin.

- How many addresses are involved in the transaction.

- Network loading. The more trades are carried out at the same time, the higher the commission will be. It prevents the Bitcoin network from becoming overloaded, since not everyone will agree to pay more.

Transaction operations are performed by miners, and commissions are their reward. Thus, the amount you transfer has virtually no effect on the fee. But there is still some pattern, although it concerns the frequency of the transaction:

- A large number of small amounts is a high price;

- Rare but large Bitcoin transactions – the price drops noticeably.

Ways to reduce Bitcoin network fees: Segregated Witness (SegWit) and Lightning Network

Segregated Witness is an update to the network protocol proposed by the developers of the Bitcoin Core wallet. Its main goal is to solve scalability difficulties by optimizing the volume of blocks. This will entail solving several problems at once - high commissions, overcrowding of blocks, speed of payments. Blockchain with SegWit works more efficiently.

The solution optimizes the structure of blocks - it separates the transmission of transactions from their signatures. This way, operations take up less space and more transactions fit into a block. Commissions also naturally decrease because the queue in the mempool is shortened.

Segregated Witness is used in conjunction with another technology – Lightning Network.

This solution is deployed on top of a blockchain network to support increased throughput without violating peer-to-peer principles. As a result, the network works noticeably faster, making microtransactions easier with lower commissions.

What could be the commission?

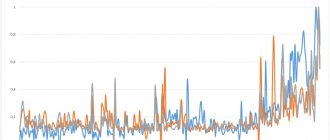

Bitcoin fees are volatile, but sometimes users experience too much volatility. For example, consider the fluctuations for 2022, when the price for a Bitcoin transaction could fluctuate from 1 satoshi to 500 satoshi at the time of the highest Bitcoin rate. As a result, it was unprofitable for users to make transactions, as they could not navigate.

Due to the fact that the price often changes, people are in constant competition. They try, like at an auction, to outbid each other. The speed of the transaction will depend on what commission to set when transferring bitcoins. The one who bids the highest price will complete the transaction the fastest and receive his Bitcoins to his account.

On average, a block is formed in 8 minutes, but the price of inclusion in this block is set before it is formed. If you set low prices, a queue forms that can go on for days. In this case, your transaction will hang, waiting for its turn. That is why, before sending a transaction, pay attention to the recommended commission. The recommended commission is the average at which a user can expect a quick completion of his Bitcoin transaction. If you indicate a higher price than the recommended one, there is reason to believe that such an operation will go faster.

Let's look at the example of a deposit in an ICO:

- We make an ICO deposit of 0.01 Bitcoin (about $82).

- When transferring, the commission is 0.004 Bitcoin (almost $33). This is the amount that needs to be paid in addition to the money that is sent.

- Let's do some simple calculations. If you get back the invested 0.01 Bitcoin + 20% profit, then you get 0.012 Bitcoin ($98).

- Everything seems to be fine, we are in profit. But remember the 0.004 Bitcoin commission. That is, we spent $115 and only received $98. Loss 18 dollars.

As a result, making a deposit with such prices is completely unprofitable. If you reduce them, the fee will return back to the Bitcoin wallet, and will not go to the wallet of those addresses that are involved in the transaction. But with large amounts of transfers everything is not so sad.

Dirty deal

Today, the legal status of virtual money is not defined. But cryptocurrencies exist and are often used by criminals. For example, the police have identified cases where drug dealers accepted payments in bitcoins (one of the cryptocurrencies). As Judge of the Supreme Court of the Russian Federation Alexander Chervotkin said during the plenum meeting, a number of similar cases have already reached the court.

“We have specific convictions that establish that criminal proceeds in cryptocurrency, including from the sale of narcotic drugs, were subsequently converted into cash through a series of financial transactions and withdrawn from bank accounts,” the judge noted. .

Cryptocurrencies are a type of digital money and are created using cryptographic methods.

And someone uses cryptocurrency and believes that it is the future. Legal scholars in general have not yet decided how to treat it and how to regulate it. However, criminals must not be allowed to exploit legal loopholes for their own purposes.

As the plenum of the Supreme Court specifically explained: “The subject of crimes provided for in Articles 174 and 174.1 of the Criminal Code (Criminal Code) of the Russian Federation may include funds converted from virtual assets (cryptocurrency) acquired as a result of the commission of a crime.”

These articles punish financial transactions and transactions made solely to launder criminal money. Let's say someone sold drugs for bitcoins and then cashed out the money. This turns out to be pure money laundering. The person will be convicted of both drug trafficking and illegal financial transactions. As the Supreme Court emphasized, with its clarification the plenum is not trying to define the concept of virtual assets, which does not exist in Russian laws. In addition, the adopted clarifications do not equate simply cashing out cryptocurrency to a crime. If legal money is used, then no claims will be made against the person. The investigation must prove that through such operations they tried to clean up dirty currency.

Lawyer Vyacheslav Golenev explained how the transfer of received cryptocurrencies into regular money occurs, pointing out that such a transition is the same for everyone - both for those who legally use virtual assets and those who can carry out illegal transactions with them. According to him, cryptocurrencies are only a code (sequence of symbols) in the distribution system; exchanges and exchangers cannot freely convert them directly into non-cash funds in a bank or cash. To cash out bitcoins, cryptocurrency exchanges or intermediaries are used, which have both regular money and accounts in cryptocurrency systems. Through such intermediaries you can get to the person who laundered the criminal money.

It is impossible to convert cryptocurrency into regular money without special intermediaries. There are cryptocurrency exchanges and special exchange offices. It is impossible to exchange bitcoins for rubles in a regular bank.

“Criminals are constantly improving schemes for laundering illegal proceeds, and legislation and law enforcement practice must correspond to modern realities,” Vladimir Gruzdev, Chairman of the Board of the Russian Lawyers Association, told RG. — The emergence of cryptocurrencies has created one of the opportunities for legalizing proceeds from crime. Any attempts to legalize illegally obtained funds through the purchase and sale of cryptocurrencies must be punished by law.”

Minimum transaction fee

The minimum commission for transferring Bitcoins can be 0%. But, unfortunately, such a “theory” has long since become obsolete. Today it is impossible to transfer Bitcoins for free. Such transfers are non-competitive and are delayed on the network indefinitely. As a result, Bitcoins are returned to the person’s wallet with advice to increase the commission.

But once upon a time such transactions were carried out, albeit under certain conditions. Here they are:

- The transaction size must be less than 1000 bytes.

- Each output was supposed to contain 0.01 Bitcoin.

- High priority level.

Today, commissions when transferring Bitcoins make up a decent percentage of the amount transferred, especially if the amount is small. At the moment, the minimum commission requested for transactions is 0.0001 Bitcoin (at the current rate, this is 82 cents). But by setting this price, there is no point in hoping that your transaction will be included in the next block. It is not a fact that with such a rate it will be possible to make a transfer at least on the same day.

Bitcoin commission calculator

Today, few people calculate the price of transferring cryptocurrency manually. There are convenient services for this, and we will look at some of them today:

- estimatefee.com. A fairly simple platform where you can calculate the transaction price based on how quickly you need to complete the transaction. The service allocates a range of commissions that can meet the client's needs.

- Bitcoinfees.info. This platform helps to allocate commissions for several types of transactions at once: slow/medium/fast. All that remains for a person is to choose the method that suits him.

- Bitcoinfees.earn.com. This tool shows the transfer fee in Satoshi.

Commission deductions for transfers are a very variable value. While you are forming a deal, its price may change significantly up or down, so the information quickly becomes outdated. Therefore, online calculators are real helpers for beginners in this field.

Let professionals use byte calculators. For example, people involved in mining (the commission is used to pay for their work). By the way, despite the fact that, theoretically, anyone with electricity and processors can engage in mining, in reality you need powerful equipment, which is not cheap. Therefore, mining is the work of professionals, and professionals want decent payment for their work.

Displaying the recommended commission for fast/medium/slow transactions from the Bitcoinfees.info service

Commission for withdrawing Bitcoins into rubles

You can find the most favorable exchange rate for Bitcoins to rubles by monitoring BestChange exchangers. Exchange rate fluctuations largely depend on how active the demand for this cryptocurrency is in the market. The pattern of operation of exchangers is obvious:

- If the Bitcoin rate falls, then the exchanger will deliberately lower the rate or raise commissions in order to earn more.

- When the rate rises, exchangers will inflate the purchase rate.

There are other ways to withdraw Bitcoins into rubles:

- Cryptocurrency exchanger. As a reliable exchanger, we recommend paying attention to the Russian-language multicurrency service Matbi, which has been operating on the crypto market for the 6th year. You can exchange Bitcoin, Dash, Litecoin and Zcash there. The service is equipped with built-in crypto wallets for convenient and secure storage of digital assets. To exchange Bitcoin for rubles, you need to go through a few easy steps, namely:

- go through a simple registration on the site;

- send bitcoins to your bitcoin address in Matby;

- exchange cryptocurrency for rubles;

- send rubles to your bank card (Sberbank, VTB, Alfa Bank, etc.) or electronic wallet (QIWI, Yandex.Money). The entire procedure takes on average no more than 15 minutes.

- Cryptocurrency exchanges. Only a few platforms work with BTC and rubles. On exchange platforms the exchange rate is more favorable, but the exchange is more difficult. Verification is required and the exchange procedure itself is not the easiest, especially for beginners. At the same time, exchange trading commissions are slightly lower than in exchangers, and commissions must also be paid when withdrawing from the exchange.

- To the payment system account. For example, the most profitable option is WebMoney. That is, actually exchange Bitcoin for Webmoney. If you have a formal certificate, you can create a WMX wallet (1 BTC = 1000 WMX). From a WebMoney wallet, money can be withdrawn to a bank card (2%), Yandex.Money (3.7%), QIWI (2.2%), cash (from 1%).

It is not possible to exchange Bitcoins for rubles for free. In addition, you need to follow security rules, since if a transaction is carried out without intermediaries, there is a high risk of encountering scammers.

Scheme for withdrawing Bitcoin into rubles, dollars, euros through the cex.io exchange

Bitcoin commission for withdrawal from the exchange

Withdrawal fees vary quite widely between exchanges. Sometimes, the minimum payment for withdrawing cryptocurrency varies by 10 times between different services. An alternative is transfers not in Bitcoin, but in other cryptocurrencies or fiat.

There are platforms with a floating commission for withdrawals in regular money. The exchange market of such exchanges includes the market for dollars, euros, and rubles. A couple of platforms with favorable conditions - YoBit (review), EXMO (review).

Some crypto exchanges, in particular Binance (review), are introducing bank cards that support the ruble and other major currencies.

How to save on Bitcoin transfer fees

Although you will have to pay for the transfer in any case, if you need to transfer a small amount of Bitcoins, and the commission component is too high, you can save money.

In particular:

- Just enter commissions that are less than the recommended amount. This can be done if the speed of transaction execution is not critical to you;

- Make Bitcoin transfers when there are fewer transactions on the blockchain network than usual. For example, the flow is much less at night and in the early morning;

- Check the time for the transaction on the official website blockchain.info.ru. In particular, if the value is less than 10 thousand, then you can reduce the commission, and if it is more, it is better not to risk it.

But given that online transactions with a small reward for miners may not be confirmed, there is a big risk of wasting time without sending money. At the moment, the number of unconfirmed transactions is more than 162 thousand, and I would not like yours to join this list.