“Ethereum deflation will make the cryptocurrency more valuable than Bitcoin” - similar headlines can be seen in various media. But how is this possible with unlimited emissions? It's all about the London hard fork. The algorithm should become the next stage in the evolution of the network and cause a shortage of Ether.

ETH creator Vitalik Buterin said that in 2022 the project will completely abandon mining. After switching to PoS, transactions will be confirmed by proof of stake. In particular, owners will lock their coins and receive rewards.

Ether Evolution

There are currently 118 million Ethereum coins in circulation. Although the second largest cryptocurrency by capitalization has no restrictions, the issue is kept within strict limits.

In August of this year, the London hard fork was launched. He brought the network closer to the PoS algorithm. Once the transition is complete, the supply of ETH will decrease by 2% every year. It is this goal that the developers strive to achieve first.

When owners lock coins using staking, they will receive rewards for confirming transactions. While some of the coins will be burned, the rest will go to the user’s balance. In addition, the mechanism increases the size of the next block. This will eliminate network congestion and make transactions even faster.

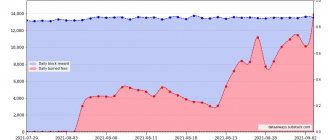

Such measures were taken to put deflationary pressure on Ethereum. So far everything is going well. During the last reporting period, miners mined about 1 million coins. But at the same time, 630 thousand ETH were burned, which reduced the supply by 57%. Once the new algorithm is enabled, the cryptocurrency should go into outright deflation, constantly reducing supply.

How has the complexity and size of the Ethereum network changed the income of miners?

Ethereum network difficulty indicators (block difficulty) are fundamentally important for calculating mining profitability. The concept is used as a characteristic of the time required to validate a block. This value is determined by the Nonce parameter, a hash, the only method of finding which is to enumerate all possible values. The expected amount of time to find it serves as an indicator of the difficulty of mining. The hashing algorithm for the Ethereum platform is called Ethash (an improved DaggerHashimoto mechanism). It specifies the metadata of the last block in the blockchain using a Nonce code.

It is almost impossible to guess it randomly, so the use of computing power is absolutely necessary to decrypt the block and receive a reward. Correction of indicators occurs automatically - they must be in full agreement with each other. The time required to validate a block is set when determining its complexity, and if it is less than expected, the system lowers the Block difficulty parameter.

The main reason for switching to ETH 2.0

Transfers on Ethereum cost users a pretty penny. One transaction takes about 0.013 ETH ($54.64). The values are almost astronomical compared to June-July of this year, when the transfer cost $0.4-0.7.

The prohibitive cost of transactions is associated with a huge load on the network. Recently, the field of decentralized finance has been developing rapidly. Most popular platforms operate on the Ethereum blockchain, for example, Uniswap. Now a transaction on this service is 3–5 times more expensive than a regular transfer.

The network's inability to handle such load should be resolved after a full transition to ETH 2.0. However, according to Vitalik Buterin, the process is fraught with much greater difficulties than expected.

Local victories of the new algorithm: Ethereum deflation is near

On October 26, observers recorded that more ether was burned than produced. In an hour, mining brought 562.7500 ETH, and 697.0828 were destroyed. The issue lost 134.3328 coins.

At this point, it looks like a record of sorts. However, in the foreseeable future this will become commonplace. And this is undoubtedly good news for asset holders. Limiting supply always benefits cost. In particular, gold, jewelry and works of art are prime examples of this.

When will the transition end?

The implementation of the ETH 2.0 algorithm will not be completed until 2022. It will most likely take at least 10 months. But already now owners can block coins. However, they can be returned along with the reward only after switching to PoS.

News

The second cryptocurrency by capitalization

First, let us remind you of the news that was already on the channel, but it is important because it can lead to a direct acceleration of the growth of the price of Ethereum, maybe it will be possible to reach $5,000 dollars on it. We are talking about the launch of microfutures on Ethereum on the CME exchange. Let us remember that this is a regulated American exchange and only futures for Bitcoin and Ethereum are traded there. And it was their futures that Bitcoin ETFs were recently launched in the United States.

Continuing the topic of ETFs, Bloomberg analysts believe that a similar ETF for Ethereum futures could appear as early as early 2022. An important point is that the Ethereum ETF will appear earlier than the Bitcoin spot ETF. And if Bloomberg analysts were correct this year with permission for a Bitcoin futures ETF, then we can also rely on this forecast.

And two more important news about the adoption of TOP-2 cryptocurrencies. Firstly, the regulated American platform Bakkt is also adding Ethereum. Bakkt offers trading in cryptocurrencies and crypto derivatives, and they also have a payment app that supports Google Pay. And previously, like the CME exchange, they worked only with Bitcoin, but now they also add ether.

And good news for gamers, and everyone else who actively uses Discord. Soon the messenger will add support for NFTs and other tokens through the connection of the MetaMask crypto wallet, and all this will work through the Ethereum blockchain. In the community of Discord users, by the way, there are different opinions about this news; many consider cryptocurrencies to be a pyramid and do not want them to appear on the platform. What can I say, we will open their eyes.

Subscribe to the CoinPost channel to quickly receive the latest cryptocurrency news

Miners bet on Ethereum update delay

ETH mining farm producers such as Bitmain are hoping that Ethereum deflation will be delayed. They continue to create specialized mining machines despite Buterin's plans. Recently, the company's management announced that a new model of equipment will be released at the end of the year.

Major BTC mining companies have increased their investments in ETH mining. Public organizations Hut 8 and Hive have also begun to increase their Ethereum transaction processing capacity.

Such investments may seem strange against the backdrop of news about the cessation of traditional transaction processing. According to experts, this is due to the fact that delays in the development of crypto projects are commonplace.

Mark D'Aria, director of Bitpro and a specialist in creating mining farms, said in this regard: “4 years ago they already said that mining would end, but it is still going on.” Many analysts supported him, because “everything takes longer than planned.”

Ethereum Price Prediction: Will the Crypto Bounce to New Highs?

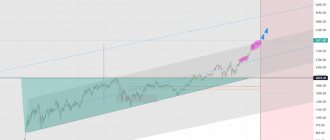

According to CoinCodex, technical analysis indicators were neutral at the time of writing, with 14 indicators giving bullish signals and 14 giving bearish signals. At around $2,450, the coin was trading above the 100- and 200-day simple and exponential moving averages, although it remained below the 5-, 10-, 21-, and 50-day moving averages. The short-term support level is around 2481 USD, resistance – 2682 USD. The next support levels are at 2,350 USD and 2,281 USD. Resistance is at 2,752 USD and 2,883 USD.

Digitalcoin's Ethereum forecast remains bullish, predicting the price to average $3,562 in 2022 and rise to $4,451 in 2022. In the longer term, prices are projected to increase to an average of 7,701 USD in 2025 and to 11,170 USD in 2028.

ETH price forecast for 2021-2028

Wallet Investor has lowered its ETH forecast from 3,200 USD in early June to 2,826 USD. At the end of the year, the forecast was raised to 3,709 USD. The price is forecast to exceed USD 5,000 in 2022, end the year at USD 5,540 and then reach USD 11,038 by the end of 2025.

Forecast for the year

The Economic Forecast Agency believes that the price of ether by the end of the month will be 2,644 USD. It predicts that by the end of June the price will fall to 2,639 USD, and by the end of 2022 it will rise to 6,247 USD. The agency estimates that the price will peak at $10,997 in October 2022 and then fall to $7,863 by the end of December 2022. Then it will decrease to 6,624 USD by the end of 2023 and finally to 4,118 USD by the end of 2024.

Destruction of tokens worth $2.4 billion

Now the burning rate is 5 ETH every minute ($19.5 thousand). The process started on August 5 this year. Currently, the total value of the destroyed coins is about 2.4 billion tokens. As a result, the total emission decreased by 619,200 ETH. The bulk of the tokens were destroyed as a result of:

- transactions on the NFT marketplace Opensea;

- transfers in the Ethereum network;

- transactions with the stablecoin Tether;

- transactions on the decentralized exchange Uniswap.

Ethereum Price Bounces to Find Support After Selloff

The price of Ether started at $2.14 against the US dollar in 2015, rising to $1,283.42 during the cryptocurrency's rally in January 2022. By December of that year, the price had fallen to $86.17, remaining below the $300 level until the market began to rise again in 2022.

The coin rose in price from 125.63 USD to 729.65 USD last year, an increase of 480.8%. ETH price briefly touched $2,000 during the cryptocurrency's rally in February and returned above that level in April. On May 12, 2022, Ethereum soared to a record high of $4,380, up 500% from the start of the year.

The following week, on May 19, the price fell to 1,952 USD after Tesla (TSLA) CEO Elon Musk's tweets and reports of a cryptocurrency ban in China shook the markets. Ether rose in price to 2993 USD on May 20, and on May 23 fell to 1737 USD. At the time of writing, June 11, the price of ETH is about 2490 USD.

But what do analysts’ forecasts say regarding the further price movement of Ethereum? Let's figure it out.

What will happen to the exchange rate after deflation?

The full implementation of the ETH 2.0 algorithm is still a long way off. In particular, large companies do not believe at all that this will happen in the foreseeable future. But the probability of a successful transition is nevertheless high.

When destruction begins to dominate coin generation, a shortage will be created. Experts predict the rate will rise to $10–15 thousand over the next year. This trend will continue until the ETH threshold of $100,000, with a BTC price of $175,000. Thus, Ethereum has every chance of becoming the number one cryptocurrency in terms of capitalization.

How has the Ethereum rate changed over the past 2 years?

The Ethereum blockchain was launched on July 30, 2015, a month later reaching a difficulty of 8 TH (terahashes), with the first drop of 25% when the t + 1 bug was discovered; the block mining time was then 26 seconds.

The next important moment in the history of the platform’s development was the release on March 14, 2016 of the first stable version of Ethereum software - Homestead. The Homestead release reduced the block mining time from 17 to 14.3 seconds, thereby reducing the calculation complexity from 20 TH to 17.5 TH.

Conclusion

Holders are advised not to get rid of coins and continue to increase the volumes on their balance sheet. There are two options: additional investments and staking.

Potential investors need to open an order to buy ETH as soon as possible before the train leaves. Experts agree that the Proof-of-Stake algorithm promises a high price for the asset and further prospects.

In what corridor will the Ethereum price fluctuate in 2019?

Now we see the emergence of a large number of new projects based on the Ethereum platform, all actions of this kind are widely covered on news resources of the relevant profile. The more news, the more people learn about this currency and become interested in it, and this, of course, leads to an increase in the rate itself. In essence, we see all the signs of an ordinary bubble. But you should be aware: the prospects for Ethereum are significant, although they will only be realized in the long term. It is important to understand where the line of expectations of participants in a given market goes, and how different it is from real indicators.

Trying to make an objective assessment of the value of currencies similar to Ethereum is pointing your finger at the sky. No one can have an exact answer to this query. Investors, traders, developers, as well as speculators are now betting on the prospects of the cryptocurrency system itself. But it is unrealistic to determine the limits of real exchange rate indicators. How good is an increase in the exchange rate value of the currency for the Ethereum infrastructure itself? The answer cannot be unambiguous: the rise in the exchange rate attracts new participants, increasing the number of users, and this has a positive effect on the state of the system, on the other hand, transaction costs are increasingly significant. Therefore, a balance must be maintained.

The popularity of Ethereum is also evidenced by the fact that at this time approximately 90% of all trades are carried out in the ETHXBT pair (Bitcoin to Ethereum). Cloud currency mining has also become available from most of the leaders in this market. The transition of users from one cryptocurrency to another will have a wave-like appearance. The most important thing for speculators is to quickly earn money; for investors, the most important thing is to see the prospects of the technology itself. Now Ethereum is at its peak and in demand, which may have a short-term impact on the decrease in Bitcoin’s capitalization, and it is difficult to predict what to expect in the future. Speculative operations do not last long, and as a result, many traders will be left as losers with a lot of negative emotions.

Forecast from N. Green

The founder of deVere CEO N. Green recently expressed his opinion regarding the prospects for Ethereum coins in 2022. He stated that by the end of 2022 the price of the digital tokens in question will be able to overcome the important level of $2,500 thousand. Among the factors that will contribute to the growth of Ethereum quotes, N. Green highlights the following:

- The growing popularity of digital tokens as means of payment.

- Wider adoption of smart contracts.

- Decentralization of the cloud computing process.

These factors, according to Green, will lead to an increase in the value of the digital tokens in question, but also to an increase in the level of capitalization of the entire cryptocurrency market in 2022.

Forecast from D. Rachinski

D. Rachinski, who is the director of the company Joe-Technologist, has formed his own forecast for Ethereum quotes for 2022. He claims that Ethereum will be able to overcome the important level of $1,200 by the end of this year. The expert explains his rather optimistic forecast by the fact that the platform will expect a serious influx of institutional investments.

According to D. Rachinski, over the years of its existence, the Ethereum platform has managed to prove its performance, thanks to which many large organizations are beginning to use it for their own purposes. It is the growth of interest in the platform in question on the part of large companies that, according to D. Rachinski, should cause a serious influx of institutional investment.