Today we have a large and most relevant article about taxes on cryptocurrency in the Russian Federation 2022! Let’s take a very brief look at the new federal law, which should regulate crypto in the Russian Federation. Let's figure out when these taxes need to be paid and which declaration to submit - from a self-employed person or from an individual entrepreneur?

What amounts can be safely withdrawn to the card so that the tax office does not have questions for you? Are there such amounts at all? Can a bank block your account and take your money without giving any reason?

Is it possible to face criminal liability if you simply trade cryptocurrency in Russia? How to reduce taxes and pay less? Do you need to pay taxes if you recorded your profits in USDT?

And we will also look at MANY more frequently asked questions that concern ALL crypto investors today! At the end of the article, we’ll talk about security when working with cryptocurrency and how to prevent your coins from being stolen! Go…

Law 259-FZ “On Digital Financial Assets” - briefly

What is the Federal Digital Financial Assets Act? What is the status of cryptocurrencies in the Russian Federation today and what has changed with the adoption of this law? Who will be affected by the changes? What should you pay attention to first?

On January 1, 2022, Law 259-FZ “On Digital Financial Assets” came into force. This law is crude, not finalized, and includes references and hints that there will be other federal laws and legal acts that will complement it. From what we have today, the legislator has introduced 2 definitions: digital financial asset and digital currency.

We have not encountered such concepts in international practice. Russia has gone its own special way. This is an analogue of a company’s digital share, that is, in fact, these are tokens - security tokens that are issued by companies.

DFA (Digital Financial Asset) - in simple words, these are security or utility tokens issued by a company, which give the right to receive some services or dividends, etc. Accordingly, a token must have an issuer - the one who issues this token and, accordingly, provides services or pays dividends.

What is DV (Digital Currency)? — This is a classic cryptocurrency, decentralized, that is, Bitcoin, Litecoin, Ether, etc. In short, everyone affected by this law. And this law primarily affects companies that want to launch an ICO and become tokenized in order to attract investment in this way.

In connection with the new law, they will have to place all their tokens on the platforms of the DFA exchange operator and, accordingly, trade exclusively through it. It’s not possible to just open a company, launch a presale, then an ICO and raise money. Now you have to do everything through them. Special data registers will be introduced, where all this will be entered electronically and ownership of these tokens will be confirmed.

For ordinary citizens, this now allows these types of transactions to be carried out more or less clearly.

That is, the legislator told us that all transactions that are related to digital currency, please be guided as for real estate transactions. Now, as before, citizens can buy, sell, give, inherit digital currency and pay taxes on it. It is also worth adding that, according to this law, you have the right to judicial protection only if you have declared your assets. That is, in fact, if you do not declare your crypto-wallets and crypto-assets, then you cannot seek judicial protection in the territory of the Russian Federation, since this is directly established in this law!

Let's sum it up

At the moment, Binance is really in a difficult situation, and what is most alarming is that events around the site are unfolding at lightning speed. But many experts believe that there is no need to panic yet, since the company has all the prerequisites to solve the problems that have arisen and not lose the title of the No. 1 cryptocurrency exchange.

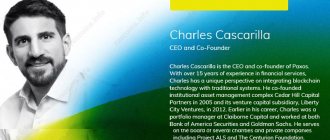

Author of the article: Nina Kolesnik

A professional journalist who knows how to find information where roads are closed to others. Thanks to 7 years of experience in financial and copywriting activities, she is able to analyze large amounts of data and prepare truly expert reviews.

Self-employed, simplified or personal income tax? How to declare income from cryptocurrency?

Let's start with the self-employed - this concept has nothing to do with the cryptocurrency market! The law on self-employed people has a closed list of activities that a self-employed person can engage in. Cryptocurrency and activities related to the turnover of cryptocurrencies and new types of property are NOT included in this list!

Accordingly, as a self-employed person, you will NOT be able to pay 4% on cryptocurrency turnover and report through the application!

By the way, registering for self-employment in the Russian Federation today is quite simple. You can submit your application directly from your bank’s mobile app. Many banks already provide this service. After this, ALL transfers received to your bank card will automatically be equated to income from your activities and a tax of 4% will be withheld from them.

As for IPs (Individual Entrepreneurs), the story is almost the same. We do not have the appropriate OKVED codes and economic activity related to the turnover of cryptocurrencies and new types of property.

That is, you also cannot declare income from this type of activity as an individual entrepreneur in order to pay a tax of 6%!

Thus, we are left with only form 3-NDFL (personal income taxes) with a tax payment of 13% - 15%, depending on your annual income. 13% - up to 5 million rubles per year, and 15% - for EVERYTHING above this amount, according to the new amendments.

How do we calculate the tax base in these conditions? — You must declare it yourself by submitting the appropriate tax form 3-NDFL.

To do this, calculate the difference between your transaction costs and the income received. You must indicate this net profit (margin) in your declaration and confirm all transactions with screenshots.

You must submit the appropriate declaration after the expiration of the tax period, which for us by law is 12 months, after which you pay your taxes.

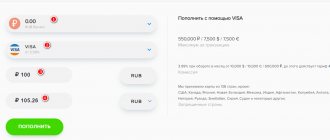

For example, you topped up your Binance balance with $1,000, traded for a whole year and withdrew a total of $2,000. This means that exactly $1,000 is your net income on which you need to pay tax. This is to put it briefly, but in reality it will be necessary to convert it into rubles at the Central Bank exchange rate and then calculate the tax amount from the resulting amount.

How to avoid double taxation for a crypto investor who is also self-employed? — It turns out that when withdrawing funds to a self-employed person’s card, 4% is withheld by default. But we cannot pay tax on crypto like that, so in the end we will still have to file 3-personal income tax and pay an additional 13% - 15% on the same income.

Yes, in this case you will first pay a tax of 4% as a self-employed person, then pay another 13% - 15% as an individual. BUT those 4% can be challenged and returned. To do this, you submit an appeal through the taxpayer’s personal account and demand a refund of the overpaid tax, since it does not fall under the activities of a self-employed person.

True, in this case you can spend a LOT of time and effort. Therefore, if you are already self-employed, then it is better to get yourself a separate account (bank card) to withdraw income from crypto and then submit a declaration from it as an individual.

P2P and online exchangers! How do banks know that the transfer is for crypto?

If you exchange your crypto through P2P, for example on the Binance exchange or through any online exchanger, then you receive funds from individuals and, as a rule, there are no marks that this is money for cryptocurrency.

Therefore, it all depends on the specific bank on whose card you accept such payments. Some banks track such receipts more meticulously, and some less so.

Much here depends on the regularity of transfers and their volumes. If you accept small payments on your card from time to time, then most likely neither the bank nor the tax office will have any questions for you.

But if you accept payments regularly, albeit in small amounts, or, on the contrary, do not receive very often, but quite large transfers of 200 - 300 thousand rubles, then the bank has the right to block such transactions as doubtful. Then you will need to prove where this money came from, whether it was received legally, etc.

It must be said that in general, the tax office does not have access to the banking secrets of individuals. But this does not exclude the possibility of blocking a transaction or account by the bank, because The bank will consider the transaction suspicious. And from the point of view of the position of the Central Bank of the Russian Federation, ALL transactions with digital currencies and cryptocurrencies are suspicious - this is their official position! Therefore, to summarize, there is no “safe” amount that would exempt you from taxation!

The Bank, in turn, is guided by 115-FZ - this is combating money laundering and the financing of terrorism. This law gives banks unlimited opportunities in this regard. They can block the account and find out the origin of the funds, as well as submit a request for an explanation of the economic meaning of the transactions performed.

Therefore, if they ask for the origin of funds, you will need to provide it. Write an explanation about the economic feasibility of these operations, and after that the bank will unblock the account. Or the bank will not unblock the account after this, but will allow you to withdraw funds to another account, and this account will most likely be closed at the bank.

Therefore, it is impossible NOT to show the origin of the funds, and to ignore the bank’s request! Otherwise, the bank will block the account in accordance with 115-FZ and will be right.

How to explain to the bank where the funds came from, and how to prove that it is your money? — You need to start from what request the bank is asking you! That is, the bank clearly formulates the requirements that need to be provided to it. For example, a bank asks what is the meaning of transactions between party A and party B.

Next, the bank client who received this request begins to describe the entire structure of the transaction and attaches documentation of his justification. Without documentation, the bank most likely will not accept an explanation.

If the money comes from the platform where you trade, then you will have to show screenshots. If the bank asks you to certify them, then you will have to certify them and explain that this money comes from trading your crypto assets. But I repeat - at the moment the central bank considers all transactions with cryptocurrencies questionable. In this connection, banks block such receipts.

In practice, if the justification comes from the point of view that this is a purchase or sale of cryptocurrency, then banks try not to get involved with this, disown the client and simply give him the money. If you do not want to lose this account and card, then the only way to go is pre-trial and judicial. That is, first respond to the bank’s request, provide all the necessary documentation, if no movement is received, make a pre-trial claim, then go to court and restore your violated rights.

As for judicial practice, it is generally positive. The only point is that this is not a panacea and each case is separate and exceptional. It is better to consult with lawyers here.

How does the tax office know that the transfer was for crypto? Money from another person’s card just arrived on the card! Maybe the debt was returned to me, but it wasn’t necessarily a sale of crypto?

As a rule, banks report to the tax authorities and Rosfinmonitoring about large transactions. If these transactions are systematic, then they attract attention. When additional attention is called, we are blocked under Article 115-FZ, that is, it is a question of the volume and systematic nature of these transactions.

Accordingly, the data that you will transfer to the bank as an economic justification for activities may, within the framework of 115-FZ, be obtained by the tax authorities.

Binance denies the authenticity of the documents

On August 7, Binance released an official statement regarding the false KYC data leak. The exchange said that an unknown hacker (the pseudonym Bnatov Platon was not named) is demanding 300 BTC from the platform for 10,000 photos “similar to the KYC data of Binance clients.” After the exchange refused to cooperate, the hacker began distributing data on social networks and the media, posing as a benefactor. According to him, he has KYC data from several other exchanges.

Binance claims that the hacker's KYC data does not match the data in their system - the photo does not contain the digital watermark that the exchange puts on all KYC images. The photos published by the hacker date back to February 2022, when Binance entered into a contract with a third party to verify KYC and process the increased number of requests. It is noteworthy that this data has already appeared on the darknet.

As Binance notes, when asked by the exchange to confirm the source of the information, the hacker demanded 300 BTC and refused to provide evidence. Binance is currently working with its contractor and the police to try to determine the source of the KYC data. For help in identifying the hacker, the exchange promises a reward of 25 BTC ($284,000 at the time of publication of the article).

Screenshot of correspondence between a hacker (John Amat) and a Binance representative. Here he talks for the first time about 300 BTC in exchange for KYC data and reports that the exchange code is still vulnerable to attackers. Source.

According to Binance, Bnatov Platon can be considered a scammer extortionist. This is indirectly confirmed by the hacker himself. Medium user Steven Jim published an interview with Bnatov Platon, in which the hacker said that he allegedly cooperates with other exchanges, and hinted that, unlike Binance, they are willing to pay “commissions” to protect the personal data of their users. Twitter also suggested that the hacker could have created a fake Binance website and thus collected data from users who did not notice the substitution.

Taxes on cryptocurrency before withdrawal to fiat?

If transactions were carried out on the stock exchange and profits were not taken, that is, you did not withdraw funds into fiat, but invested in other assets, then how to declare assets and pay taxes in this case?

If you conduct transactions on the stock exchange and do not record them in fiat, that is, do not withdraw funds, then now these are exchange transactions between different types of property according to the tax code of the Russian Federation. That is, you DO NOT make a profit until you transfer funds to fiat and withdraw real money.

You just have a trading wallet, these are your financial risks. And until you fix your profit, you don’t have to account for it, it doesn’t exist yet. Anything can happen in the crypto market and your profit can grow very quickly, and then just as quickly level out or turn into a loss.

Therefore, you must pay tax after you enter fiat and calculate 2 main indicators - the funds you invested and the funds you received upon exit. The difference between them is your profit, on which you must pay tax.

And if you, for example, have several hundred different cryptocurrencies, then you must declare all your wallets. Each cryptocurrency has its own wallet number and you submit a declaration for each such wallet - you report on its balance.

It is important to note that USDT is NOT fiat and is not, in fact, money yet. This is the same property that is simply provided by our company. And we pay tax only on income, that is, on the profit actually received when we withdraw cryptocurrency or stablecoins into traditional dollars, rubles, euros, etc. - to Fiat!

Advice: try to record in detail all your transactions with cryptocurrency, so that at the end of the tax year you can add them all to your declaration. It will be bad if you do not indicate some transaction, and the bank, within the framework of 115-FZ, requires you to justify it! Many cryptocurrency exchanges today will provide you with a complete statement of all your transactions and deals upon request. Also, do not forget that NOT all of your transactions can be profitable.

Sometimes it is worth summing up the results for a certain long period and it may turn out that you did not earn any profit. In this case, there will be nothing to pay tax on. What questions might you have then? ッ

Actions of exchanges

In addition to banks and regulators from different countries, some cryptocurrency exchanges have also begun to speak out against Binance, although they do not officially advertise this. For example, most recently the company FTX bought back its shares from Binance, arguing that such an action was part of its business plan. I was also surprised by the statement of the Gemini crypto exchange that in the near future it will take a leadership position, and Binance will fade into the background. It is not surprising that “colleagues” of the Binance company strongly support her persecution. They expect to benefit from this.

Is owning crypto illegal in the Russian Federation? How to NOT run into criminal liability?

In what cases can a criminal case be opened against owners of digital money? Is there a need to declare their assets and how to get legal protection?

In accordance with Part 6 of Article 14 of the Federal Law on CFA, the right to judicial protection extends only if the person has informed the state about the facts of owning digital currency, carrying out civil transactions with it or transactions with digital currency in the manner prescribed by law Russian Federation on taxes and fees.

Accordingly, if you notified the state properly, then only in this case do you receive the right to judicial protection. Here we are talking specifically about those cases when some coins are stolen from you and you want to report this to law enforcement agencies. By the way, at the end of this article there will be a small section about security when working with crypto, be sure to read it!

Regarding criminal cases that may affect users. — The very possession of digital currency is not a crime; accordingly, crimes will arise if you directly do something with this digital currency.

That is, if you derive income from transactions with digital currency and evade taxes, and at some point you have a particularly large amount, then you will fall under Article 198 of the Criminal Code of the Russian Federation - this is tax evasion. If you take possession of a CV fraudulently, you will be subject to Article 159 of the Criminal Code of the Russian Federation - fraud.

If someone’s cold wallet is stolen or a digital currency disk is stolen, people will then fall under 158 of the Criminal Code of the Russian Federation - theft. The same with the use of force, robbery - 162 of the Criminal Code of the Russian Federation. If you launder money obtained by criminal means, or criminally legalize it through the Central Bank, you will fall under 174 of the Criminal Code of the Russian Federation. Etc.

That is, the very fact of owning and making transactions is NOT a crime. But nearby there are many related articles of the Criminal Code of the Russian Federation, which you can fall under one way or another.

Other frequently asked questions about crypto taxes

Question: Will the tax office force you to pay 13% on all amounts that come to the card? If a user trades, for example, on Binance P2P, then large amounts come to the card, but the net profit from this amount can be 0.5% or 0.25%.

Answer: Indeed, the tax office can automatically take and charge tax on all amounts that fell on your card and simulate the situation when you will understand and provide reports on your transactions, attach screenshots and fill out form 3-NDFL. Therefore, in fact, you will most likely be charged for all transactions if you do not voluntarily submit a declaration and you will have to justify your income in response to this resolution.

Question: There is an opinion that when transferring more than 200,000 rubles, we fall under the gaze of financial monitoring. Is it better to transfer less frequently, but in large amounts, or often, but in small amounts? And how not to get caught by financial monitoring?

Answer: From the point of view of Rosfinmonitoring, we fall under it from amounts over 600,000 rubles. Accordingly, if you receive 200,000, it’s not scary. From 600,000 questions begin, because... the transaction is automatically marked. Rosfinmonitoring can conduct an audit of such transactions and may ask for information about the parties to the transfer and the content of the transfer.

We proceed from the fact that a deal or transaction over 600,000 rubles automatically comes under the microscope, then it turns out better more often, but smaller. But in this case, we have systematization and the bank may consider transactions suspicious.

Question: What should I do if the bank has blocked an incoming transfer, for example, from Binance P2P for an amount less than 600,000 rubles?

Answer: It doesn't matter if the amount is higher or lower than 600,000! The bottom line is that when blocking a transaction, the bank is guided by 115-FZ. Accordingly, if the bank perceives dubiousness in this operation, then it blocks this conclusion. After blocking, he makes demands on the client about what kind of transaction it is and for what purposes it is happening. Then we return to the diagram in which we explain the entire chain of actions to the bank.

Question: When filing a tax return, do you need to indicate crypto as financial transactions with currency, or as transactions with real estate?

Answer: These are not transactions with currency or real estate. Since cryptocurrency is a different type of property, so is a transaction with property. That is, it is simply the purchase and sale of such property. And accordingly, you also report on the income received from the sale of property that you purchased earlier.

Question: How to officially declare income from crypto trading so that the tax authorities do not suddenly issue a fine for non-payment of taxes, because... At the request of banks, we report the financial benefits of frequent money transfers and do banks report this information to the tax authorities?

Answer: Banks do not directly transmit this information without a specific request. But if the tax office requests it, then naturally this data will be transmitted through internal monitoring channels. Also, the tax services of the Russian Federation already have access to your transactions and can view them without asking the bank.

Question: Only qualified investors can trade crypto? There is a bill providing for the ownership of cryptocurrency over 600,000 rubles only for qualified investors. What to do if you don’t have qualifications, but your investments currently exceed this limit?

Answer: The bill, which provides for the ownership of cryptocurrency over 600,000 rubles for qualified investors, is unlikely to be adopted in the version in which it currently exists. And if it is adopted, then general rules for qualified investment will be introduced, as is done in the stock markets. That is, the qualification will be related to special education or turnover. At the moment, there are no restrictions on cryptocurrency ownership in this regard!

Question: How to properly report to the tax office if the tax office itself has not yet clearly stated how to report for crypto? Should I only declare what I made a profit on? And if you put the crypto on a long-term basis, then you don’t need to declare it?

Answer: You simply fill out the standard 3-NDFL form, according to mathematical calculations, fill it out at your discretion and attach documentation that confirms your transactions. You need to declare all crypto, and pay taxes only when you have entered into fiat and received real income.

Question: Are there any options to legally avoid paying taxes at the moment while everything is settled? Or how to protect yourself if the bill is not ready, but taxes are required.

Answer: For example, you can change your tax residence to a residence, for example, the UAE, where the tax burden is 0%. Then, in principle, you will not have to report your income from cryptocurrencies in the Russian Federation. Or you can change your tax residence to a residence in any country so as not to report in Russia. But then you will report in the country where you are a tax resident. But tax residency and citizenship are two different things. Study this issue thoroughly.

Another legal scheme for mining-related income is when an LLC located in a special economic zone subject to 1% taxation acquires mining equipment under the customs declaration, places it and leases its production facilities to a company that can legally be in the mining pool . Thus, the scheme will be completely working, taxation is transparent, the rate is 1%.

Question: If a Russian citizen does NOT live in Russia, should he pay tax in Russia?

Answer: If you live for more than 183 days in the territory of another state, then you lose tax residency in the Russian Federation and acquire it in the state in which you permanently and legally reside.

Then you must already pay taxes and report on your income received on the territory of this state, in this state. For taxes received on the territory of the Russian Federation, you report at the non-resident rates, that is, 30%.

If you are engaged in crypto and simply use Russian banks to withdraw profits, then in this case you do not earn income on the territory of the Russian Federation, so you will not have a 30% rate.

Question: Is continuous profit-making from P2P crypto trading considered illegal business activity?

Answer: This is not, in principle, a business activity, because the P2P platform involves direct transactions between individuals. It’s as if Avito was exchanged for soap - what kind of business is this?! ッ

Question: If digital assets are a type of property, then after owning them for more than 3 years, when sold, will this be considered income on which to pay tax? For stocks or real estate, for example, it is not necessary.

Answer: You will always pay tax on this income. Yes, we have taxable objects that have special tax rules, a special tax regime, which is why the terms are set at 3-5 years for certain types of property. For crypto, like another type of property, there are no such deadlines, so there will be no tax exemption.

Security when working with cryptocurrency What to do if your cryptocurrency is stolen? Where to run?

How should a person whose cryptocurrency was stolen act? And is it worth doing anything at all? — In this case, the theft can be divided into 2 types of incidents: 1 is physical - when a computer, phone, hard drive is stolen, physical abduction of the owner and 2 - cyber crimes.

In the first case, the probability of detecting intruders is quite high. Police officers will have a good chance of solving the crime, but you should immediately contact law enforcement agencies and service providers who can provide information support on how to proceed with your account in such a situation.

You should diversify your security, that is, a good quality modern device is good, but do not forget to duplicate important information in a safe place. Two-factor identification should become the norm. Don’t forget also about master keys and QR codes and two-factor authentication not only via e-mail, but also using Google 2FA, which is supported by almost all exchanges and wallets today.

If we consider 2 - cyber incidents, then today a whole galaxy of criminals operating exclusively in cyberspace is being cultivated. According to forecasts, by 2023, up to 30% of all crimes will move to cyberspace.

In Russia, the statistical detection rate for such crimes is ~20%. These statistics also take into account low-profile crimes involving the transfer of funds via security calls to banks. So, in principle, the question that interests us regarding the detection rate of cryptocurrency theft is at the level of ~5%.

Most often, the theft of cryptocurrencies occurs due to carelessness! For example, going to a phishing site, entering seed phrases on it, infecting the device by spreading malware, etc. A good paid antivirus will help with the latter; it’s better not to skimp on this, although such an expense item is unlikely to ruin you. We are talking about 2-3 thousand rubles PER YEAR for 3-5 devices!

Larger events occur less frequently: hacking of exchanges, wallets or smart contracts, etc. In the first case, simple care, checking links, timely updating of working devices, and using official websites almost completely neutralizes these risks. In the second case, service providers must think about protecting placement mechanisms.

Use only official platforms that have a layer of trust, have proven themselves, are officially registered, etc. Well, even when working with such, DO NOT store ALL your tokens in one place, diversify! In cases with cryptocurrency projects, it is worth paying attention to the security audit performed, although this is not a panacea.

In general, if an incident occurs on the Internet, you need to thoroughly collect all the evidence that you have, and contact the Ministry of Internal Affairs, Department “K”, which specializes in cybercrime, and hope for the best. If the amount is large, then there are great private agencies and cyber detectives who can help unravel even the most difficult cases.

Is Binance still under threat?

The market was not frightened by the news about possible leaks from Binance. In contrast, Binance Coin (BNB) rose 10% overnight, trading at $30 per coin. This is not surprising, since Binance is the largest and leading crypto exchange in the world.

#Binance said it's investigating the alleged leak of its customers' verification information. The leak affected up to 60,000 individual users who sent #KYC information to the company in 2018 and 2022. The market's reaction? A big yawn.

— Weiss Crypto Ratings (@WeissCrypto) August 7, 2022

“Binance said it is investigating the alleged leak of its customers' KYC data.

The leak affected up to 60,000 individual users who submitted #KYC information to the company in 2022 and 2022. Market reaction? Big yawn,” noted Weiss Crypto Ratings. However, questions regarding the security of KYC data and user funds remain. If the leak is a third party vendor's fault, are they still being dealt with? If this is a hacker hack or an attacker among its own employees, then why is the exchange silent about this? Has the vulnerability in the code been fixed, allegedly thanks to which hackers were able to steal 7,000 BTC?

Users are used to Binance always being open about its own mistakes, but this time the exchange is tight-lipped.