MetaMask is one of the most popular crypto wallets where you can manage your ETH and ERC-20 tokens. Now that Binance has launched its own blockchain; Along with ERC-20, you can also store and manage BEP20 type tokens in the MetaMask wallet.

Once the MetaMask wallet installation is complete, only ETH (Ethereum) is displayed by default.

No other BEP20 tokens will appear in your account. READ:

BEP2, BEP20, ERC20, OMNI and TRC20 networks - what's the difference? How to send and receive coins?

Also, some new and little-known tokens may not even appear in search results. You will have to manually add such tokens to your wallet.

Adding a token is very simple and will only take you a few seconds.

In this guide, we will tell you how to add ERC20 (Ethereum Chain) and BEP20 (Binance Smart Chain) tokens to your MetaMask wallet.

How to add tokens to MetaMask wallet

Before adding tokens to your MetaMask account, make sure you select the correct network. That is; if you want to add an ERC20 token, select Ethereum Mainnet

"

If you want to add the BEP20 token, select " Binance Smart Chain

".

Now let's add tokens to the MetaMask account.

Try the search string:

Note. The search function only works on the Ethereum Mainnet. That is, MetaMask only displays standard ERC20 tokens in search results. To add BEP20 tokens, you need to use the custom token option which we have explained below.

- Open your MetaMask wallet. On the main account screen, scroll down and you will find the “Add Token” button.

- Click “Add Token” and find the token name or ticker. For example: USD, ETC, LINK, YFI, UNI, DAI, etc.

- Once you find a token in the list, select it, click “Next” and click “Add Token”. You will now be redirected to your account dashboard where you will find the token added to your MetaMask account.

As we already said, only the most common and popular tokens will be displayed in the search tab. If the token you are looking for is not displayed, use the custom token option.

Adding custom tokens to MetaMask

To add a token, we only need the contract address of the corresponding token.

What is the token address (contract address) and where can I find them?

The contract number is what the token represents on the blockchain. By simply entering the contract number, your MetaMask wallet will automatically receive the token data from the smart contract.

Visit Etherscan.io to find the ERC20 token contract number.

Use BscScan to find BEP20 token contract details.

Use the appropriate block explorers, find the token name and copy the contract number. You will see the contract address details under the profile summary.

Castle in the air. How not to lose money when buying tokens

The head of Playkey, Egor Guryev, tells how an investor can distinguish a promising blockchain project from a scam and not give his funds to scammers

Only 8% of tokens after the ICO go to the exchange and only one out of 10 is used for its intended purpose. The head of Playkey, Egor Guryev, explained how not to lose money when investing in cryptocurrencies in his author’s column on RBC-Crypto.

Because of scammers, participants in the crypto industry lose about $9 million every day. One of the most risky areas for an investor is the purchase of tokens, digital assets of companies developing blockchain-based projects. Criminals hack exchanges and wallets, copy the websites of promising token publishers, conduct fake ICOs, and use dozens of other ways to steal money from crypto enthusiasts. Some high-profile thefts reach millions of dollars in volume - for example, the fake ICO AriseBank raised $600 million (for that amount of money, for example, you can buy an airline). According to the latest data, 81% of ICOs turn out to be scams.

But it is difficult to scare and stop token buyers - despite the high risks, everyone wants to invest in a cryptocurrency that will grow rapidly. On average, investors who buy project tokens at the ICO stage can receive 82% profitability, provided that the cryptocurrency is on the exchange within two months. How to distinguish scammers from the creators of promising tokens? Instructions from the cloud gaming service Playkey, which completed its ICO last year.

Check the authenticity of the project

Regardless of at what stage you invest in a token - pre-ICO, during the ICO itself or after its completion - study whether the project whose tokens you are going to buy is real. It is not uncommon for scammers to create a beautiful page, describe an attractive idea, and then disappear with the collected money.

For example, this happened with the Benebit scam project, which promised to create a platform to increase customer loyalty. The pre-ICO was in full swing when one of the potential investors discovered that photographs from the website of one of the British schools were published in the section with the project team. By this time, the team had managed to raise at least $2.7 million. Sometimes scammers do not even hesitate to use photos of celebrities - for example, the authors of the Miroskii scam project passed off Ryan Gosling as their designer.

Therefore, verifying the founders, advisors and their intentions is the first step of a responsible investor. The project’s website itself can tell you whether it was created as a scam. Yes, there are also prudent scammers who have been maintaining fake project profiles on social networks for months and licking every little detail into the white paper. However, more often their less scrupulous colleagues can write a non-existent legal address and contact numbers, use illustrations without a license, or even steal the logo (this is what the scam project Razormind did, appropriating the logo of one of the Linux-based operating systems).

If the project has already successfully raised money, this is not a reason to relax. Fraudsters in the crypto market know how to play for the long haul and do not necessarily disappear immediately after the completion of the ICO. While the project is supposedly being developed, they can continue to sell tokens and even list them on the exchange. Fake news can be a signal of fraud - for example, if a collaboration with a certain company is announced, it is not at all a fact that the company knows about it. Thus, the World of Battles project announced its partnership with Twitch, until the ICO organizers disappeared along with the collected funds.

Pay attention to token purchase tools

You have checked everything and are sure that the project is worth investing in its tokens. However, this is where scammers of a different kind come into play, intercepting funds on the way to the creators of the project.

Their favorite method is to engage in dialogue with users on behalf of the company and provide false payment information. During the ICO of the Aragon distributed network, scammers created a fake Twitter account. Since there was a lot of excitement around the project (it raised $25 million in 15 minutes), people tried to buy tokens as quickly as possible and transferred about $10,000 to scammers from Twitter.

A more complex scheme is to create a fake ICO website. Users are not always ready to understand and go beyond the first tab in a search engine or a link on a forum. In the run-up to the Telegram ICO, fake sites earned millions of dollars - the largest of them, Gramtoken.io, collected about $5 million, although neither Pavel Durov nor the Telegram channels were in any way affiliated with the resource. Always check what addresses are published by the project founders on their official channels and websites if the team has other projects or its own company.

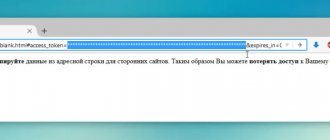

The hardest thing is not to get caught when you end up on a phishing clone site. It is not always obvious to recognize it: scammers simply copy the website of the official ICO project, changing the address by one letter (for example, p1aykey.io), and make only one difference - the wallet number for collecting money. Typically, companies monitor the appearance of clone sites and block their domains, but if there are too many of them, then this cannot be done quickly - providers and hosting providers also need time to understand the situation.

So even when the site has been studied inside and out, before depositing money it would be a good idea to look at the address bar again. Otherwise, the money can be sent by an attacker, as the owners of $700,000 did during the Bankor ICO.

Clarify the technical features of collecting and storing money

Another common method of fraud is hacking a smart contract (a computer algorithm designed to conclude a digital transaction), which is used to collect money. Nowadays, many projects launch ICOs based on a ready-made platform or constructor. In this case, it is worth studying the experience of other ICOs conducted using these tools. How safe are they? Have there been any cases of hacking or leaks? Typically, sites with critical vulnerabilities are not popular, but it wouldn’t hurt to check.

More risks arise when the team itself writes a smart contract to collect money - if there are errors in the code, fraudsters can easily gain access to the money. This happened with the DAO project, whose investors lost almost $44 million due to vulnerabilities in the algorithm. It is important that the project team conducts an audit of the smart contract in several stages - both internal, when the review is carried out by project employees, and external, when the security of the code is assessed by professionals. Typically, this service is offered by ICO ratings, and it is good if the project is ready to provide a report from a reputable auditor - or at least confirmed news that the audit has been completed.

After the money is safely with the project developers, their safety is also not guaranteed. Last year, scammers stole about $34 million from three startups that stored funds in a special wallet for Ethereum called Parity. It is almost impossible to return this money, even if you find the thieves - the sphere of cryptocurrencies and ICOs remains poorly regulated.

Be careful with exchanges

It is the most difficult thing to protect yourself from the theft of money when trading on the stock exchange - real professionals are involved in their hacking, and not a single large exchange is immune from attacks. Moreover, the more authoritative it is, the more actively scammers will try to find vulnerabilities. A hack on such exchanges can affect the entire market and you will suffer even if your investments remain safe. For example, a recent attack on the South Korean exchange Coinrail, during which up to $40 million was stolen, led to a drop in the Bitcoin rate by 10%.

In this case, you can only diversify the risks: trade on different exchanges, store funds not only on them, but also in separate wallets, and monitor the security of your account - create unique passwords, do not log into it from third-party devices, inform the administration about suspicious activity and use two-factor authentication.

Don't expect a miracle

Only 8% of projects list their tokens on the exchange and only 1 out of 10 created tokens is used for its intended purpose. Even if the project is not run by scammers and is not subject to hacker attacks, no one is immune from a bad investment. Do not forget that when the cryptocurrency market falls, not a single project, no matter how promising it may be, will be able to achieve an increase in the price of its token. Therefore, follow the market as a whole, communicate with the community and study the token holders of the projects you like - the more institutional investors and bakers who are committed to playing for the long haul, the greater the chance of making a profit from the purchased tokens.

Steps to Add a Custom ERC20 Token to MetaMask

- Go to Etherscan. Find the contract number for the specific token you want to add to your MetaMask wallet.

Example of an RSR token contract address: 0x8762db106b2c2a0bccb3a80d1ed41273552616e8

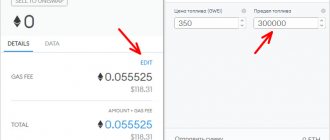

- Now in your MetaMask wallet, go to the add tokens page and select custom tokens.

- Enter the token contract address you just copied from the Etherscan.io block explorer. Now the token details such as: name, symbol and value (quantity) will be automatically retrieved from the smart contract.

Once the information is received; Click Next and add the token. The custom ERC20 token has now been added to your wallet.

Giveaways and sweepstakes through gleam.io

I am publishing several interesting airdrops at once through the Gleam platform. Everyone has the same principle: go to the page and complete the tasks in order. All tasks are standard, subscribing to Twitter, Telegram, retweets and the like. The execution time is from 2 minutes for each, but you can make good money.

Cryowar is a real-time multiplayer PVP arena NFT game developed on Unreal Engine and running on the Solana blockchain, so we can expect NFTs, DAO voting, DeFi and cash games.

In each airdrop, 100 winners among launchpad token holders will receive $50 in Cryowar tokens. To do this, you need to deposit the amount indicated below. Also, 10 winners will be chosen from those who simply score more points in the tasks. So you don't have to register to participate.

Valid until November 10-22

- Anypad (Participate) – 10k $APAD

- Cyberfi (Participate) – $100 CFI

- Multipad (Participate) – $100 CFI

- MoonEdge (Participate) – $1000 $ MOONED

- Synapse Network (Participate) – $2500 SNP or SNP LP

- Trustpad (Participate) – $2500 TPAD

YARLOO competition for $20,000 in NFTs. Valid until November 11

- YARLOO (Participate) – playable NFT cards worth $20,000

Airdrop for the Wasted Lands community for $20,000. Effective November 15

Wasted Lands (Participate) is a hybrid match-3 puzzle game, role-playing game and strategy game. The developers decided to reward participants who join the project from day one.

A prize fund of $15,000 in WAL tokens will be distributed among 3,000 winners. The top 100 referrals will share a $5,000 prize.

Airdrop for $100,000 from ZoidPay with a guaranteed reward. Valid until December 1st

ZoidPay (Participate) is a convenient cryptocurrency wallet, marketplace, and now also an extension for the Chrome browser that allows you to make purchases in cryptocurrency on popular trading platforms such as Amazon, AliExpress, eBay and others.

To celebrate the launch of the browser extension, ZoidPay is giving away $100,000 in ZPAY tokens. All participants who complete the following tasks will receive a reward:

- 10 ZPAY for all completed tasks

- 3 ZPAY for each referral

Let's move on and complete simple tasks: subscriptions, likes, tweets, retweets, watch videos, invite friends. Answer to the question: Moon lamp

Steps to add a custom BEP20 token to MetaMask

The procedure for adding BEP20 tokens is the same as above. Except you will need to use BscScan to find the BEP20 contract address.

- Go to BscScan. Find the token name and copy the contract address. Block Explorer looks and works the same as Etherscan. So there shouldn't be any confusion.

- Once you have copied, enter the token contract address into the custom token address bar in the MetaMask wallet.

For this to work, make sure you select the Binance Smart Chain and connect to it. Only then can the wallet receive information about the BEP20 token.

That's all. You have successfully added your favorite ERC20 and BEP20 token. Your newly added token will appear on the main screen in the list of tokens.

Types of tokens

Unlike regulators, members of the crypto community conventionally classify tokens into so many different types:

- Utility - utility tokens . Designed for access to services or project functions. They do not promise financial benefits to users, so they are not of interest to regulators. Despite their non-investment nature, they are speculated on on exchanges along with other cryptocurrencies, but the project team is not responsible for this.

- Security - security tokens (or shares). They promise buyers and holders to distribute profits from activities or return on investments. By doing this, they attract the attention of regulators, which sometimes leads to fines, court injunctions, and the liquidation of tokens and the project. FINMA classifies them as an asset type.

- Equity - (or investment) tokens They promise buyers and holders the right to partial ownership of the project and participation in its management. Due to their investment attractiveness, they also come to the attention of regulators. The FCA and SEC consider them to be the same as tokenized securities that must be registered.

- Asset - asset tokens . Backed by real assets, such as precious metals and stones, commodities, real estate; sometimes manufactured products or property on the balance sheet of the project. FCA and SEC classify them as security.

Stablecoins

Stablecoins can be considered the fifth type of token. They are also issued on third-party blockchains, so despite the name, they are not technically coins. When there were half a dozen stablecoins on the market with a rate pegged to the US dollar, they were classified as asset tokens. Since 2022, their variety has expanded, many new items began to be backed by reserves of other hard currencies in addition to the dollar.

Because fiat currencies and their baskets are a separate financial instrument that is more resistant to market shocks, they appear more stable than other assets (e.g., securities, commodities). In addition, traditional traders, brokers and investment funds prefer to take profits in fiat. It is more convenient for them to convert cryptocurrency into regular money. Stablecoins are precisely suited to the role of digital cash, so they have become crowded among assets.