Some general information

LTC/USD and BTC/USD are electronic currencies that exist only on the Internet, but this does not make them cheaper than the real currencies of many countries. On the contrary, Bitcoin (this is the name of the currency abbreviated as BTC) at the time of writing this article costs $1270 (!!!), and Litecoin (LTC) is almost $30. Such a high price for these “unreal” currencies is due to the fact that there is a finite number - a limit on the number of units of these currencies throughout the world. Both Bitcoin and Litecoin are “electronic keys” calculated using special algorithms. The calculation algorithm is becoming more complicated all the time (to obtain new keys), and the price of the currency increases accordingly. As you probably guessed, obtaining new keys requires serious computing power - there are entire computing farms adapted for these needs:

In addition, electronic currencies are increasingly used as payment - there are a huge number of services that accept Bitcoin and Litecoin on an equal basis with currencies such as USD or EUR. Unlike the latter, Bitcoin and Litecoin are easily tracked - any user can see all transactions (sender and recipient addresses, as well as the transfer amount), but will never know personal information about the sender and recipient, which also makes this currency very attractive.

Reasons to trade Bitcoin against the dollar on Currency.com

- Detailed Bitcoin to dollar chart and clear tools

Access over 70 technical indicators and analysis tools, detailed charts, real-time price alerts and notifications.

- The ability to trade cryptocurrencies for cash.

You can conveniently fund your account and withdraw funds using a credit card, bank transfer or cryptocurrency wallet.

- Large volumes at lower costs

There is no need to overpay to trade Bitcoin against the dollar. Start with just 0.002 BTC and leverage the power of 100x leverage.

- Taking care of the user

Instantly buy tokenized securities with Bitcoin at competitive prices. Keep your assets safe and move them easily and conveniently.

- Negative balance protection

Manage your risks with stop loss and take profit orders. Never lose more than you invested.

Features of trading LTC/USD and BTC/USD

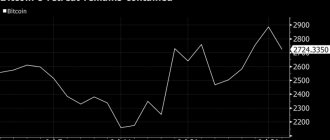

First of all, LTC/USD and BTC/USD are trending assets. Moreover, most of the time there is a bullish direction on these assets, and a very strong one. LTC/USD and BTC/USD are growing actively! As an example, I suggest taking a look at the weekly BTC/USD chart:

The main advantage of LTC/USD and BTC/USD is that these assets have full price charts on which technical analysis can be carried out. LTC/USD chart:

BTC/USD chart:

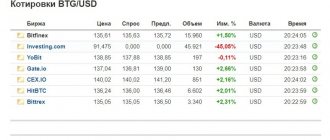

LTC/USD and BTC/USD obey the basic rules of the market - they react to support and resistance levels, “react” to indicator readings, in addition, since the pair “half” consists of USD, that is, they also react to news on the American dollar. LTC/USD and BTC/USD are traded on weekends with the Binomo broker - one of the best types of weekend trading. At least everything is honest - quotes can always be compared with third-party sources!

Bitcoin Review

Bitcoin appeared in 2009 and became a fundamentally new type of digital currency, which gradually gained popularity throughout the world. Transactions with bitcoins are carried out without intermediaries, that is, without the participation of banks or other authorities. Not only is Bitcoin an alternative payment network and a profitable asset to invest in, but it also offers great opportunities to traders.

Basic facts about Bitcoin

- The first decentralized cryptocurrency

- On August 8, 2008, the domain name bitcoin.org was registered

- January 3, 2009 the first block and the first 50 bitcoins were generated

- Developed by a person or group of people under the pseudonym Satoshi Nakamoto

- Maximum Bitcoin turnover is 21 million

- 80% of all Bitcoins have already been mined

- Bitcoin is considered both a commodity and a currency.

- The first notable transaction is the purchase of two pizzas for 10,000 BTC at the rate of 1 BTC = 0.0025 USD

After Bitcoin was launched on the first cryptocurrency exchange BitcoinMarket.com in April 2010, its price was $0.003. Later, the Bitcoin rate increased sharply, which brought more than a thousand percent profit to the original owners of the coin.

In 2022, the price of Bitcoin increased by more than 220% and reached almost 20 thousand dollars. In 2022, the value of the asset fell sharply during the 2022 cryptocurrency winter, when Bitcoin lost more than 60% and dropped to the $3,000 level.

The price chart shows the BTC/USD ratio in real time. Analysts believe that 2022 will be an important milestone in the history of Bitcoin, despite the coronavirus and the financial crisis.

Trade LTC/USD and BTC/USD without intermediaries

Have you ever been interested in real trading? I mean trading where you make a profit that is not limited by anything other than the time spent waiting for favorable conditions. What about the basic principle of trading: buy low, sell high? In this case, the entire difference from the sale is the income from the transaction. Is it interesting for you? Several years ago I came across a very interesting service that allows you to trade electronic currencies, but I remembered about it only recently when I was asked to talk in more detail about LTC/USD and BTC/USD. The service is called EXMO. This service is a platform for carrying out transactions between buyers and sellers: sellers believe that the asset will not become more expensive (or simply need to sell the currency) and place sell orders; Buyers, on the contrary, tend to buy cheaper and later sell at higher prices. The difference from the purchase/sale goes directly into the trader’s pocket. This kind of trading has a huge advantage - there is no “All or Nothing” binary options rule. And the probability that the price of an asset will fall to zero is negligible. In any case, the trader will receive at least part of the money from the completed transaction, even if his forecast does not come true. Another important advantage of such trading is the complete absence of expiration time - no one forbids you to buy a currency now and sell it in a year or two (or after 5 minutes). It is interesting that the LTC/USD and BTC/USD pairs have very high volatility: in a few hours of my observations, the BTC/USD pair changed its price from $2180 per 1 BTC to $2290, and this was repeated several times! It is on these movements that you can make very good money by buying a currency at the lowest points, and selling practically (or actually, if you’re lucky) $100 more expensive. Many may ask: “Where can I get this $2,300?” Such amounts are completely unnecessary. Like any other currency, LTC/USD and BTC/USD have their own “pennies” called Satoshi. Moreover, the number of these satoshis in one BTC or one LTC can be very large, but at the moment, the minimum unit of calculation (satoshi) = 0.00000001. It follows that it is not necessary to have significant amounts of money for such trading.

Trading BTC/USD is the best way to invest in Bitcoin

The volatile nature of the BTC/USD pair presents an interesting alternative to traditional Forex markets. Traders who work with Bitcoin can always profit from the price fluctuations of the cryptocurrency. You can go long or short, depending on how the Bitcoin/USD exchange rate moves, and benefit from the difference in price.

Bitcoin has proven itself to be a profitable investment, strengthening its position as the largest cryptocurrency in the world every year. Investors tend to give optimistic forecasts for the further growth of Bitcoin against the dollar. On you can trade BTC with 100x leverage and a tight spread.

EXMO trading platform

The EXMO trading platform supports several types of account replenishment: both conventional currencies (EUR, USD, RUB, UAH) and electronic currency transfers (BTC, LTC, DOGE (dogecoin), DASH, ETH). In addition, currencies can be exchanged among themselves at the current market rate.

Trading is carried out on pairs:

- BTC/USD

- BTC/EUR

- BTC/RUB

- BTC/UAH

- DASH/BTC

- DASH/USD

- ETH/BTC

- ETH/USD

- ETH/RUB

- DOGE/BTC

- LTC/BTC

- LTC/RUB

- USD/RUB

You can open and close orders “By market”:

Or “According to the limit”:

To withdraw funds from the platform, you can use one of the many popular methods of transfers and payment for services. For example, the following withdrawal methods are available for a ruble account:

Millions of rubles pass through the EXMO platform every day, and it has existed since 2013, so there is no doubt about its reliability. By the way, the platform itself makes money from transactions (in some places there is a commission for withdrawing funds), and not from the loss of its clients (like Binary Options brokers). There is one more little trick - many Internet resources are ready to give out most of the electronic currencies for free. A free way to start your own business, if you can call it that. True, as you guessed, the currency will not be distributed in the largest quantities, but it’s still a freebie.

US Dollar Review

In the Bitcoin to Dollar pair, BTC is the base currency and USD is the counter currency. The graph shows how much Bitcoin is worth against the US dollar.

The US dollar is the most powerful currency in the world, holding up to 61% of all foreign reserves of the world's central banks. The dollar also dominates the Forex market, where it participates in almost 90% of all transactions. Together with the euro, the US dollar accounts for more than 80% of the world's foreign exchange reserves.

The value of the dollar is directly affected by the policies of the US Federal Reserve. Major political events can also cause the value of the dollar to decline.

Those interested in trading the BTC/USD pair should closely monitor cryptocurrency market news, as well as the US Federal Reserve's publications regarding interest rates and changes in monetary policy.

What determines the price of Bitcoin today?

The fundamental difference between cryptocurrencies and simple means of payment is that they are not backed by any real material resources. Therefore, the cost of electronic money in relation to national currencies is determined by several factors:

- the level of supply and demand on the stock exchange today;

- volume of cryptocurrency on the market: the more there is, the cheaper it is;

- the number of transactions carried out on the Internet.

Thus, the exchange rate of Bitcoin to the dollar and ruble depends primarily on how much they are willing to offer for it at auction. Although cryptocurrency is considered to be independent of political factors, its relationship with real money can also be influenced by international events and economic conditions.

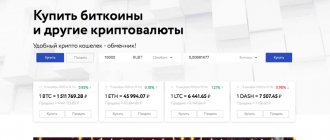

How to buy Bitcoin?

You can buy Bitcoin on specialized “exchanges” - however, such sites do not yet have licenses. Perhaps a more literate name for bitcoin exchanges is digital currency exchange services. On such platforms, transactions of exchange of bitcoins and other cryptocurrencies for national currencies of countries or other assets are carried out electronically. The sites make money from commissions. While the position of Bitcoin exchanges remains vulnerable - multiple hacks show that clients are not protected from the loss of Bitcoins. The most popular bitcoin exchanges: Mt.Gox (located in Japan, went bankrupt in 2014); Bitstamp (Luxembourg); Cryptsy (USA); Kraken (San Francisco); Bitfinex; BTC-e; Chinese OKCoin, BTC China and Huobi.

In addition, the purchase and sale of bitcoins is possible through specialized ATMs, as well as directly from hand to hand. Many Forex brokers today offer trading with settlement CFD contracts for the Bitcoin-US Dollar (BTC/USD) pair.