- home

- Online business

Evgeniy Malyar

Updated: August 9, 2021

0

Article navigation

- Basic concepts in mining

- Types of expenses, or where to invest money to start mining?

- Types of mining and differences in profits

- Mining on a farm

- Cloud mining

- Mining in pools

- Calculation of mining profitability

- Profitability calculator

- Possible causes of unexpected losses

- What is the income from cloud sites

- Tips for beginners

- Conclusion

The word cryptocurrency (English, “cryptocurrency”) appeared in 2011 - it was coined by employees of Forbes magazine. It means one of the varieties of electronic monetary units. The phenomenon is unique. If cryptocurrency is assessed from the standpoint of classical economics, it is practically meaningless. According to all the laws of the market, something that seems to be of no use to anyone is being sold. This product is not materialized (does not exist in material form) and is not backed by anything. But they trade it and earn considerable profits from it.

Basic concepts in mining

First, about cryptocurrency and its nature. In its physical essence, it is a set of electronic impulses wandering in the worldwide information network. Each virtual currency unit has a unique number, which gives it a certain resemblance to a paper banknote. Moreover, it is this code that gives value to Bitcoin or another similar unit.

After the collapse of the Bretton Woods agreements, the world lives in conditions of floating exchange rates, determined by the demand for a particular monetary unit. There is no longer any provision of precious metals, that is, gold or silver content. Thus, the value of money issued by any state and its purchasing power are, in fact, not tied to anything. This property is also inherent in cryptocurrency, but it has undoubted advantages. Let's compare it with ordinary monetary units in circulation in different countries:

| Parameter | National and interstate currencies | Cryptocurrency |

| Emission | Issued for circulation by emission centers (mints) with conditional restrictions due to inflation risks | Decentralized, limited |

| Anonymity of transactions | Conditional: non-cash financial flows can be tracked | Full |

| Inflation | Definitely takes place | Deflation is most likely due to the initial limited size of the issue |

| Risk of counterfeiting | Low but not zero | Almost zero, thanks to cryptographic generation methods and decentralization of storage |

Cryptocurrency is a kind of analogue of ordinary money, differing from them mainly in the absence of a state guarantee, which, however, gives very illusory advantages.

A significant obstacle to expanding the circulation of new means of payment are legislative restrictions adopted in many countries. Uncontrolled financial circulation is contrary to state interests.

Cryptocurrency units are generated through mathematical algorithms. The essence of the process is to create a special computer code. The result of each successful transaction is the formation of a link in a chain of blocks (blockchain), each of which is connected to the previous one and the next one after it. Bitcoins and similar units can be purchased on an exchange or “mine,” that is, “fish” for another unique number from the Internet. This process is long and painstaking, requiring costs, but generating income. This is what the next story will be about. The ratio of profit to the costs of obtaining it determines the profitability of cryptocurrency mining.

Today there are about 5,000 cryptocurrencies. And not every one of them is profitable to mine. In addition, it should be taken into account that the profitability of mining may fall due to the increasing complexity of calculations in the absence of an increase in the price of the coin itself.

And, of course, the value of a cryptocurrency asset itself may fall for various reasons, which reduces the profitability of its production to nothing.

It should also be taken into account that mining requires a certain set of knowledge and skills in servicing the technical part of the process. Which makes it inaccessible to those new to the field.

Many, therefore, prefer to make money on cryptocurrency by directly purchasing it on exchanges and exchangers. Profit is obtained through subsequent sale at a higher rate.

For example, if you use the Matbi wallet exchanger, then after registering using your phone number or email, wallets are provided for a number of well-known cryptocurrencies. After purchase, they end up in these wallets, where they can be stored until better times.

The question of safety arises. For online storage, or “hot” wallet, Matbi provides quite serious protection. Three-factor user authentication will prevent fraudsters from withdrawing funds without knowing three codes: pin, from SMS, from email.

Simplicity, reliability and accessibility for everyone have allowed Matbi to successfully operate in the cryptocurrency market since 2014.

If the user has any questions, the Matbi team has prepared detailed video instructions.

Types of expenses, or where to invest money to start mining?

To begin with, about that. What is a cryptocurrency farm? This is a room in which special computing devices are mounted on racks. They heat up and are blown by numerous fans. All this is noisy and radiant with heat.

The profitability of a mining farm is determined by costs and possible profit in the form of mined cryptocurrency. To start activities, you need to purchase equipment. The second component of the cost will be payment for consumed electricity, the share of which will be approximately 85% of its total volume.

There are five mining technologies in total:

| Type of mining | Description |

| CPU | Using an adapted processor. Currently not used due to low efficiency |

| GPU | The principle is the same as that of CPU mining, but the performance is higher - a video card is used |

| RAM | The computer's RAM is used. Profit is minimal |

| ASIC | Special integrated circuits are used, which are expensive and cannot be repaired if they fail. The ratio of financial results to energy consumed is high |

| FPGA | The use of gate arrays is the most productive, but they themselves are expensive and their price is rising |

The power consumed by a piece of mining equipment ranges from 0.88 kW (L3+) to 1.57 kW (S15). The main indicator of efficiency is the so-called hashrate, that is, the performance of the device, expressed by the number of mathematical operations performed per unit of time. The higher this indicator, the greater the likelihood of creating a new block. The mining speed depends on the total power consumption and the perfection of technical means.

The better the device works, the higher its price.

Mining on Nvidia GeForce RTX 3080 Ti: how many megahashes does the card produce using other algorithms

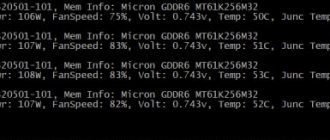

Users found out that Nvidia in the RTX 3080 Ti reduced the mining power (hashrate) not only for Ethereum, but also for other cryptocoins - Ethereum Classic (ETC), Ergo and Ravencoin (RVN). This is how the company is trying to discourage miners’ interest in its video cards.

It is noteworthy that the Octopus algorithm for mining Conflux (CFX) skips the new Nvidia restriction. And the version of the video driver, which removes all mining restrictions for the RTX 3060, does not work on the RTX 3080 Ti and produces a BSOD when using it.

Ethereum is moving to a Proof-of-Stake model, which should reduce energy consumption and could potentially reduce demand for GPUs in the mining sector. Therefore, Nvidia began to extend its hash rate limiter to other crypto coins, even those that are not particularly popular. However, on some algorithms the card produces a good hashrate.

| Ethash | 64 Mh/s | MTP | 7.3 Mh/s |

| KawPow | 58.9 Mh/s | CuckooCortex | 6.5 GPS |

| Cuckatoo31 | 3.15 GPS | Cuckatoo31 | 1.19 GPS |

| BeamHash | 56.4 Sol/s | Equihash 125_4 | 84.7 Sol/s |

| Etchash | 64 Mh/s | CuckooCycle | 15.24 GPS |

| Autolykos2 | 261 Mh/s | Equihash 144_5 | 144.1 Sol/s |

Types of mining and differences in profits

The division of mining into three types has finally been formed. Let's look at them separately.

Mining on a farm

The most profitable type of cryptocurrency mining. Requires the highest costs. Involves significant costs for the purchase of equipment and payment of significant amounts for electricity consumption (up to a third of the equivalent of the generated cryptocurrency). The modules operate in parallel mode. The equipment requires powerful cooling.

Cloud mining

Capacities are used that are leased by third parties who own the equipment. The participant acts as an investor, receiving a profit from the invested funds. The yield is low - about 1% per annum. It is more profitable to open a bank deposit account.

Mining in pools

The essence of the method is the cooperation of many miners with the goal of increasing the probability of creating the next block. The financial result is divided between the participants, but appears more often, which makes the income more stable. Pools charge a commission.

The profitability of mining in 2022 depends on one more factor, which, unlike the mining method and type of equipment, is external. This is the volatility of cryptocurrency rates, which have recently not shown the growth characteristic of past times. It is important to choose the right electronic currency (Bitcoin, ETH, ZCash) based on forecasts based on available dynamics.

How to calculate the hashrate of equipment?

So, we have a little understanding of what hashrate is, and now let’s move on to the question of how to calculate the hashrate of your miner? The easiest and most accurate way is to start your equipment and monitor its performance in the program console. This method fully takes into account the entire configuration, all settings and features of your particular miner.

If you don’t have the equipment yet and want to purchase it, then there is only one way to find out the hashrate - find the indicators for specific video cards or ASICs in special tables. These can be found online or on cryptocurrency forums. You can also ask about the performance of other miners by writing to them on social networks. The main thing to remember is that the same video card, the same processor or ASIC can produce different hashrates depending on the way it is included in the system.

Even a banal change of connection connectors can cause a drawdown or a jump. Therefore, the most accurate way to calculate the hashrate is to connect the equipment and start mining!

Calculation of mining profitability

The following parameters will be required for the calculation:

- mining period, measured in seconds (86 thousand 400 seconds in a day);

- reward for finding a block, expressed in cryptocurrency units;

- equipment hashrate (number of operations per second);

- the difficulty of mining a specific cryptocurrency.

The last indicator deserves separate consideration. The fact is that the difficulty of mining is constantly increasing due to the limited emission (for bitcoins the limit is 21 million units). In other words, the longer mining continues, the lower the probability of calculating a block in a certain time.

Much the same thing happens when developing a coal mine. The thickest and richest seams are mined first. Then the useful layer becomes thinner, and more effort is required to extract it.

The frequency of difficulty changes is 14.3 days (Bitcoin).

Forecasting income from mining is done by introducing the specified initial parameters into the formula:

Where:

- P – income (in cryptocurrency units);

- TS – planned mining duration in seconds;

- RT – reward for calculating a block (in cryptocurrency units);

- HR – hardware hashrate (performance in operations per second);

- DF – mining difficulty.

The calculation of estimated income is simplified by the use of a special calculator, available here.

Mining profitability on Nvidia GeForce RTX 3080 Ti

We figured out how many megahashes the RTX 3080 Ti produces, but what about the profitability? In the table below you can see how much profit one card will bring per day. Data is presented as of August 2021. Current information can be calculated at whattomine.com.

| Cryptocurrency | Income in dollars per 24 hours | Cryptocurrency | Income in dollars per 24 hours |

| Ravencoin(RVN) KawPow | 5.94$ | Ethereum(ETH) Ethash | 4.25$ |

| Ergo(ERG) Autolykos | 6.23$ | Conflux(CFX) Octopus | 5.71$ |

| Nicehash-Autolykos Autolykos | 5.91$ | Ryo(RYO) CryptoNightGPU | 5.17$ |

| Firo(FIRO) MTP | 4.91$ | Equilibria(XEQ) CryptoNightGPU | 4.63$ |

| Beam(BEAM) BeamHashIII | 4.36$ | Conceal(CCX) CryptoNightGPU | 3.72$ |

Profitability calculator

Typically, a calculator is developed to calculate the profitability of each type of cryptocurrency. It is quite simple to use, but there are some subtleties.

Initial data for calculating profitability:

- Hashrate (hardware performance), CH/sec.

- Equipment power consumption, Watt.

- Electricity tariff (monetary units per kilowatt-hour).

- Commission charged by the pool.

When choosing the type of cryptocurrency, the miner automatically sets the basic information parameters of the electronic coin:

- calculation algorithm;

- reward amount for finding a block;

- confirmation time;

- the amount of the issue at the current moment (the number of coins already mined);

- complexity;

- network performance;

- trading volume;

- capitalization amount.

The result of the calculation is the predicted profit for the day. When mining, you have to use a calculator often, since the data is constantly updated. The value of assets changes within 15–30 minutes, difficulty changes daily.

Calculate

A natural question from readers is what is the profitability of mining in 2022? This article will not provide an exact answer in numbers. Why? Read on and you will understand.

Possible causes of unexpected losses

Cryptocurrency quotes depend on demand for them. The profitability of this business also depends on the activity of miners. There are also other risks in the electronic money market:

- Possibility of adoption of restrictive and prohibitive legislative acts by the state.

- Price dumps (sharp declines in quotes due to massive intervention).

- Obsolescence of existing computer technology and the emergence of new, more productive equipment.

- Technical problems related to power supply.

- Failure of technical means of mining.

Market risks can be mitigated by mining different types of cryptocurrencies. It is recommended to pay special attention to new electronic “coins”, the danger of a sharp reduction in price is relatively low.

What is the difference between KH/s, MH/s, and GH/s?

Hash speed

- 1 kN/s 1000 hashes per second

- 1 MN/s 1,000,000 hashes per second.

- 1 GH/s 1,000,000,000 hashes per second.

- 1 TH/s 1,000,000,000,000 hashes per second.

- 1 PH/s 1,000,000,000,000,000 hashes per second.

- 1 EH/with 1,000,000,000,000,000,000 (one quintillion) hashes per second.

Conversions

- 1 MH/s = 1,000 kH/s

- 1 GH/s = 1,000 MH/s

- 1 TH/s = 1,000 GH/s

- and so on

And about the coins themselves \ Predefined Values

- 1 Satoshi = 0.00000001 ฿

- 10 Satoshi = 0.00000010 ฿

- 100 Satoshi = 0.00000100 ฿ = 1 Bit / μBTC (you-bit)

- 1,000 Satoshi = 0.00001000 ฿

- 10,000 Satoshi = 0.00010000 ฿

- 100,000 Satoshi = 0.00100000 ฿ = 1 mBTC (em-bit)

- 1,000,000 Satoshi = 0.01000000 ฿ = 1 cBTC (bitcent)

- 10,000,000 Satoshi = 0.10000000 ฿

- 100,000,000 Satoshi = 1.00000000 ฿

If you would like to know more about Hash please visit other pages of our site.

Look at the summary table of profitability of video cards in mining, divided by model, price, income and payback.

What is the income from cloud sites

The main problem of mining is the constant increase in mining difficulty parameters (by about 10% monthly), which entails the need for more productive equipment. The cost of technical equipment and the special conditions required for its installation and operation make it difficult for ordinary citizens to access the cryptocurrency market.

Cloud mining, which involves the use of someone else's computing power, does not involve significant initial costs. But its profitability is also decreasing. Return on investment is achieved in up to 9 months. Entry occurs after signing a contract for at least a year.

You can evaluate the feasibility of an investment by using the calculator offered by the service.

Tips for beginners

It makes no sense to start mining with zero knowledge in the field of cryptocurrency mining. If a future participant in this specific market has a minimum initial qualification, he will have to do the following:

Step one. First, you should delve into the theory of the process and understand its economic meaning. The novice market participant is then advised to evaluate his chances of success. As in any other type of business, those who have the opportunity to invest large amounts of money have the advantage. The times when big money was mined in garages and private apartments are long gone.

Factors influencing the profitability of investing in cryptocurrency mining:

- electricity tariffs;

- the capabilities of the computer, in particular its video card;

- availability of special equipment;

- available system settings for an effective algorithm;

- the right pool.

It is currently not advisable to start mining in solo mode. Creating your own productive farm requires huge investments.

Step two. It is necessary to select the type of cryptocurrency, that is, the specific coin to be mined. Options: Bitcoin, Ethereum, Litecoin, NEM, IOTA, Monero and a few more items. The criterion is the dynamics of changes in complexity and, of course, price. It should be remembered that the newer the currency, the easier it is to mine, and the less power is usually needed for this.

The complexity of the work increases over time, and it is good if the choice is made before it reaches a critical level.

Step three – creating a wallet. It can be desktop, mobile or online. The choice of wallet type is most often determined by the terms of the service on which mining is performed.

Step four is determining the optimal pool. If you don’t have enough money to create your own farm, then the easiest way is to join the community of miners. The share of income depends on the contribution expressed by the productivity of the equipment. The determining factors are the following:

- commissions charged for a new block and withdrawal of funds;

- pool service capabilities (process control and obtaining additional information);

- multi- or single-currency;

- simplicity of organizational issues of entry;

- clarity of instructions.

It is not always possible to determine the best pool the first time, so you have to use trial and error.

Step five – purchasing a miner. This word refers not only to the person who mines cryptocurrency, but also to the software tool. There are several of them (Antmainer, Cgminer, Cudaminer, etc.), and each of them has a functional specialization.

Step six – software setup. After downloading and installing the mining program, it requires adjustment. The procedure is simple - you need to follow the instructions.

That's it, you can mine.

Nvidia GeForce RTX 3080Ti: Ethereum hashrate and main characteristics of the card in mining

What about the performance of the 3080TI? How much does a megahash card give on ether?

Mining efficiency is usually assessed by three indicators:

- Hashrate;

- Energy consumption;

- Energy efficiency.

The first indicator shows how many mathematical operations the model performs per second, the second shows how many watts of energy it requires, and the third shows the amount of energy spent on obtaining one megahash.

In the GeForce RTX 3080 Ti video cards, Nvidia has implemented a hardware limitation aimed at reducing their popularity among miners. Because of this, the hashrate of the model when working with Ethereum or other currencies using the popular Ethash algorithm is noticeably reduced, and even after overclocking it is about 70 Mh/s.

Power consumption of 240 watts gives an energy efficiency of 3.4 watts per megahash, which is the worst indicator in the 30 line. At the same time, the RTX 3080 Ti model is potentially capable of producing up to 118 megahash. If a method to bypass the blocking is found, the model will become extremely popular among mining farm owners.

Tests showed that Ethash and, to a lesser extent, several other cryptocurrencies were affected by the restriction. At the same time, on the card you can profitably mine CFX, other coins on Octopus, and the Firo altcoin. Now we can recommend buying a 3080 Ti video card if the user is interested in these particular cryptocurrencies.