Moreover, this fork is not the only one for Bitcoin. In general, 2022 has become very fruitful in this regard: two forks have appeared since the summer, each of which has its own unique features and advantages. In particular, at the end of summer the world saw a fork of Bitcoin Cash, and from October users can get acquainted with another currency equivalent of the world’s first coin - Bitcoin Gold.

But the emergence of a new cryptocurrency does not mean its success, as has been proven more than once. However, when it comes to Bitcoin forks, one thing is clear: this financial unit will not go unnoticed. All that remains is to find out which exchanges support bitcoin gold. This is important, because if there are no exchanges working with the cryptocurrency in question, then there is little point in working with it. After all, there will be no place to trade coins.

In addition, the coin is very young, so it is not surprising that many resources are wary of introducing it to other digital coins. But we must accept that this is a more accessible fork of Bitcoin, the most expensive and popular cryptocurrency in the world. Not taking advantage of it would be a huge miss. I am glad that most exchanges nevertheless took into account the last argument and added the newly-minted fork to their assets.

Now ordinary users and professional traders can take the chance to make money on a promising new product or get it for free. Moreover, considering that the developers initially came up with Bitcoin Gold as a way to take away part of their income from the monopolists who occupied the cryptocurrency market and return mining to a more accessible channel for ordinary people.

But all this may turn out to be just a beautiful fairy tale that they are trying to tell to naive and inexperienced users. This is evidenced by the high level of distrust in Bitcoin Gold among specialists and the rather dubious position of the cryptocurrency itself. Only time will help sort all this out.

Bitcoin Gold

Starting an article about the new Bitcoin Gold fork, I would like to paraphrase the well-known proverb “all that glitters is not gold” into “all that glitters is not gold.” To understand the essence of the situation, let’s go back in time for a moment and remember the Bitcoin Cash fork. Why did it arise? Not quite out of the woods, as some people think. At that moment, in the summer of 2017, a real crisis was brewing in the Bitcoin community. The cue ball blocks were overcrowded, they could not reach an agreement in the community, and they did not know what awaited the market next. Large miners and Bitcoin millionaires decided to take the initiative into their own hands and created an alternative coin. Let me emphasize that there was a problem and there was serious support. The situation around the next fork seems simply ridiculous.

Bitcoin Gold is not a unique coin that is designed to stop the approaching Apocalypse, make the poor rich, or ensure world peace. This is a complete copy of Bitcoin with the only difference that it will be mined in a different way.

So, what did the Bitcoin Gold developers come up with that was so brilliant? Absolutely nothing other than enriching ourselves. A certain friend from Hong Kong, Jack Liao, decided that Bitcoin is overly centralized in its mining and ASIC farms have become completely insolent, it’s time for him to make super profits. And since this same Jack Liao has a company producing video cards, he had a brilliant idea - to make Bitcoin mined exclusively on video processors. That’s the whole story - they took classic Bitcoin, changed the mining algorithm to Equihash - and voila! - here's a new coin for you.

And everything would be fine, the Bitcoin community would have swallowed a story with the noble goal of decentralizing the cryptocurrency for its sweet soul, but no, the developers decided to screw it up. The code was not shown to anyone, no one was convinced of the protection against double spending, and it also became known that since the previous fork of the Bitcoin cache, coins have been actively pre-mined (although mining will officially begin on November 1). Obviously, the developers decided to make money not only on video cards, but also on the coins themselves.

The fork did take place, the coin entered the exchange and within 2 days its price fell by 70%! And all because investors are not interested in such an asset - only freeloaders paid attention to Bitcoin gold, who successfully received free coins and drained them in the first days of trading, buying themselves a more reliable cryptocurrency. It should be noted that the situation with the fork played into the hands of Bitcoin, which, while cryptocurrency news was trumpeting on all corners about a future distribution, hit another historical high. And the reason for this is quite banal - in anticipation of free coins, a massive purchase of the main cryptocurrency began.

Why Bittrex and Coinbase won't work with Bitcoin Gold

Passions around the new crypt are heating up. When some resources support the march of a new Bitcoin fork with all their might, others disown the new product and say that they will not add this coin to the list of their assets. The latter include the large cryptocurrency exchanges Bittrex and Coinbase, which have officially stated that they do not trust this cryptocurrency and will not use it.

A dubious circumstance received on the yobit exchange provoked a wary attitude towards bitcoin gold - trading began when the coin in fact did not even exist yet. Having such a condition, it is logical to assume that all this is really one big deception that was done for the purpose of profit or for some other selfish reasons. Perhaps this was a fraud by the Yobit exchange itself, as has happened to it more than once. But we must take into account that despite all the circumstances, the developers did nothing to stop dubious transactions, but, on the contrary, incited it in every possible way. The honesty of such persons is questionable, isn’t it?

So, despite the fact that you can get bitcoin gold on such large exchanges as HitBTC, Bitexchange, Yobit, Bitstar, Bitfinex, etc., such market giants as the Coinbase and Bittrex exchanges refused to accept Bitcoin Gold.

Let's figure it out in order, what didn't suit the Bittrex exchange in particular. This is an American resource that released the following statement before the fork:

“If you have Bitcoin (BTC) in your Bittrex account at the time of block 491.407, approximately October 24 at 3am PT (10am UTC), in addition your account will be credited with an equivalent amount of Bitcoin Gold (BTG) at a 1:1 ratio. Receiving BTG is only possible with BTC in your accounts.”

But a little later, warnings about the new coin were published. The exchange refused to work with Bitcoin Gold, arguing its position with the following facts:

- As of today, Bitcoin Gold does not have a fully formed consensus code. This is unacceptable for cryptocurrency, since it does not allow full mining, and this coin exists very conditionally;

- The second huge disadvantage of the coin is that it does not have fully implemented protection against replay attacks. This is a disaster for cryptocurrency, since each coin is unique in its essence. If more than one identical unit appears on the network, it means it loses value. What's the point of having money like that if it has no value?

- Bitcoin Gold code developers remain dark horses for many. Who they are and where they come from is unknown to many. Of course, something similar has already happened with Bitcoin. The identity of its developer is still being speculated upon. But Bitcoin achieved popularity over many years, and did not emerge and immediately become a leader not only in the cryptocurrency field, but also in fiat money, as Bitcoin Gold is trying to do;

- Last but not least is the code. Has it been sufficiently tested and successfully audited? Nobody knows this. And conducting experiments with real money from real users is, at a minimum, irresponsible.

The Bitcoin Gold codebase has a private premine of 8,000 blocks (100,000 BTG). This means that the developers could make the currency in advance and sell it when it was in price. In general, to carry out a very large financial fraud. So Bittrex refused to include Bitcoin Gold in its listing platform.

In addition, it is very strange that in order to connect to the network, trading on the exchange must be stopped for 24 hours. These are colossal losses that the resource is not ready to accept.

So, it is unknown whether bitrix will issue Bitcoin Gold in the future, but for now the exchange’s position is cautious. In principle, like another “rebel” - the cryptocurrency brokerage center Coinbase. On October 21, 2022, an exchange representative stated that the Bitcoin Gold protocol is not compatible with the current version of Bitcoin, so they will not support the fork. The statements read verbatim as follows:

- “Currently, Coinbase will not be able to support Bitcoin Gold because its developers have not released the code for public viewing. This is a serious security risk";

- “The fork has already occurred at a point that is known exclusively to the Bitcoin Gold development team. The Bitcoin Gold blockchain will become available to the public when the Bitcoin blockchain reaches block number 491.407, which is currently estimated to happen on October 25, 2017.”

But at the same time, Coinbase left itself a small loophole by indicating that it and subsidiary GDAX could release new tokens later when they have proven their stability and security.

In the meantime, users can use other exchanges that have demonstrated their positive attitude towards Bitcoin Gold. There are quite a lot of such resources, as already mentioned. But we still advise you to hold off and not provide your access codes, because all this may turn out to be a big scam with the aim of enriching specific individuals, and not a beautiful theory about accessible mining.

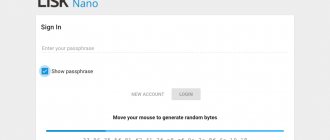

How to get Bitcoin Gold

Someone has already managed to lose new coins, while others have not yet managed to take possession of them. There is only one extremely popular question on the Internet about Bitcoin gold - how to get a new cryptocurrency? It’s never too late to treat yourself to a freebie, and if at the time of the fork you were a holder of classic Bitcoin, then you can become the proud owner of an alternative Bitcoin. In fact, the principle is no different from how we received Bitcoin Cash not so long ago. The main condition is to have coins in wallets that allow you to own your private keys. That is, it could be any software wallet that supports Bitcoin; there is information that you can also get such permission through a hardware wallet (but this is not certain).

Bitcoin Core

Although the official developers of Bitcoin Core do not support forks that cling to the glory of Bitcoin, a client produced by Satoshi Nakamoto will easily give you alternative Bitcoin Gold coins. As with all other wallets, you must have a mnemonic phrase and classic bitcoins in your account.

Copay

The wallet from Bitpay is a “thin” client, that is, one that does not take up much space on your hard drive and does not download the entire blockchain - it is a hybrid option. However, only you have the access keys, their export/import is provided, which means that it is possible to receive coins of the new Bitcoin Gold fork on Copay.

Electrum

One of the most popular wallets, a hybrid called Electrum, also stores keys on the client side. To gain access to these same keys:

- Go to the “Wallet” tab;

- Select the “Private Keys” section;

- And then click on the “Export” function.

Bitcoin Classic

The classic cryptocurrency client is on the list of wallets that give us the opportunity to get free coins. Don’t forget that before mining Bitcoin Gold in any wallet, the main Bitcoins must be transferred to another wallet - otherwise you will simply lose expensive coins and receive this strange fork in return.

Which wallets will support BTG?

Considering how many exchanges support Bitcoin Gold, having a wallet is a necessity, because this cryptocurrency must be stored somewhere, and without a wallet it is difficult to do this. Of course, you can try to get by with regular exchanges with built-in accounts. But this can be dangerous, since few people understand what will happen to the coin next and what to do with it.

Bitcoin owners need the private keys of their wallets to receive btg coins. To make your work more convenient, it is advisable to use wallets that provide private keys directly, without various workarounds, etc. That is why it is important to choose the right and affordable wallets. In principle, almost all wallets that offer simple management of private keys will do. Of course, it depends only on the user which resource to choose, because the choice is really large.

Let's figure out which wallets to use to get a private key for charging the Bitcoin fork - Bitcoin Gold. Let's look at several wallet options and ways to work with them to get a new cryptocurrency. Here are the wallets where you can take private keys and wait for the new fork to be credited:

- EXODUS. We will look at this wallet first, as it is one of the most popular for bitcoins and other popular cryptocurrencies. To start working on it and gain private access to the keys, you need to follow a few simple steps. First you have to call up the main menu. It's simple, just use the following key combination: Ctrl+Shift+D. When the window opens, you can go to the menu and select the following sequence there: Exodus > Developer > Acets > Bitcoin > Export Private keys.

If everything is correct, the program will show a message stating that the private keys are saved on the desktop. After that, click on the icon to open the saved file. Better use a text editor. When it opens, there will be two codes: the first is a short one, indicating the user’s wallet address; and the second is a long code that denotes the private key. - Jaxx. This is the second most popular wallet that works with bitcoins and is ready to give access to bitcoin gold. In this case, to obtain private keys for the user, you need to perform even fewer manipulations. In particular, it will be enough to enter the menu. Next find the Tools item. When you click on it, you will go to Display Private Keys. By the way, Jaxx has an automatic change of wallet addresses after each transaction. It turns out that each wallet has its own separate private key and they are all visible on one page. So this bitcoin wallet copes well with its mission of working with bitcoin gold.

- Electrum. Another wallet for users, and to use it you will need to go through the following path. First go to your wallet. Next you need to go to the “Private Keys” tab, and then click on “Export”.

But these wallets are used to store coins of the new fork:

- Trezor. So far, this wallet only shows interest in the Bitcoin Gold fork. But the manufacturers of the Trezor hardware wallet, Satoshi Labs, indicate that they cannot consider this cryptocurrency completely safe, which means they cannot offer their clients a risky option for storing funds. The fact is that they fear for security, because Bitcoin Gold has not yet implemented full protection of the coin from repeated copying (the main problem of the coin so far). Naturally, this causes concern among cryptocurrency services, and Trezor is no exception.

- Ledger. Another popular wallet that adds support to Bitcoin Gold. It is clear that the wallet is also interested in ensuring that the coin is protected from re-copying.

- Coinomi. This wallet will also support the new Bitcoin fork. In addition, the service in question offers to provide not only the opportunity to use the cryptocurrency itself, but also high-quality technical support while users master new cryptocurrency assets. Obviously this feature will be useful. Especially considering that there are not many people who support bitcoin gold.

- Freewallet

. A very convenient multi-currency wallet that copes well with many cryptocurrencies. Moreover, this wallet has many interesting features. In particular, there are so-called “hot” sections; they show currencies that are currently growing rapidly. In addition, there is a “Preferences” function that allows you to see which wallets on the resource are the most active and which are rarely used. - Guarda. One of the most reliable resources for the Bitcoin Gold cryptocurrency. It’s just that the test version for the cryptocurrency in question is currently working, but the developers are actively working to fix it.

So, we see that there are a lot of wallets. The official Bitcoin Gold website is located at bitcoingold.org. By the way, mobile applications can be obtained on Google Play or the App Store, depending on what phone model you have.

And to get a full-fledged Bitcoin Gold cold wallet, you can download it from the link. In addition, users have access to such a convenient web wallet as Btgwallet.

Bitcoin Gold official website

As expected, Bitcoin Gold has its own official website, where you can read about the coin from the developers’ perspective. It is exclusively in English and is a one-page page, so if you are familiar with an overseas language, you can gain knowledge about the new coin from this resource. By the way, the site was being updated on the fly, so it is not at all surprising that it became the victim of a lengthy and massive DDOS attack at the beginning of its existence.

Bitcoin Gold mining

The fundamental difference between Bitcoin Gold and Bitcoin is that mining the former on ASICs is impossible. It follows from this that mining the coin is much easier than the main cryptocurrency, because this can only be done on video cards. Thus, everyone can join the mining process.

What has changed at the technical level is that Bitcoin Gold will be mined not using the SHA256 algorithm, which is used in Bitcoin and Bitcoin Cash, but using Equihash technology, thanks to which cryptocurrencies such as Monero are mined. This very algorithm gives gold mining immunity from ASICs, but otherwise there are no differences from the principles of generating the main coin. As in the case of the cue ball, no more than 21 million coins will be mined, a block is created at intervals of 10 minutes, and its size, like Bitcoin, is 1M (2-4M).

Forecasts for the future

Despite the fact that the project is quite young, it already has both its fans and opponents.

Nevertheless, the emergence of Bitcoin gold affects the forecast for the price of classic Bitcoins. The fact is that it is very similar to classic Bitcoin and can be something like a storage facility for the coin. More precisely, to play the role of a backup copy of already collected coins, if something happens to the blockchain and you have to restore it. Thus, it turns out that Bitcoin Gold is something of a fallback version of the Bitcoin network. There is even a theory that the gold code can be attached to Bitcoin, thereby solving the problems of its network. Although making predictions for the future is not easy, because the coin simply has not had time to show itself. However, having found out which exchanges charge btc gold, we can conclude that the coin is here to stay.

- Price forecast . It was predicted that this coin would start at a high level. In principle, this is what happened. So at the beginning of 2022, on the wave of interest aimed at a new fork of Bitcoin, the value of the coin will gradually but strongly increase. Some experts even argue that Bitcoin Gold will be able to repeat the success of Bitcash, which is only three months older than the coin in question. When the hype around Bitcoin gold dies down a bit, the price will fall (although it is doubtful that it will fall by much). In 2022, coins will be valued based on their real value, rather than the credibility gained from Bitcoin. Then a critical period will come for the people who will have these coins. But if the coin succeeds, it will take its rightful place in the list of popular cryptocurrencies.

- Technical component . Since the project was done in a great hurry, it is logical that there are many deficiencies in it. And they prevent the coin from being taken seriously by large exchanges and multi-currency wallets. Therefore, whether the coin will be accepted or whether it will gradually fade away depends on what actions to improve the technical component will be carried out and whether the developers will carry them out at all. Now the network has not been properly tested, so the risk of critical vulnerabilities appearing is very high.

- Mining . Since mining this coin is simple, at least comparatively, you don’t need to be a millionaire to do it. It is difficult to make a forecast on the topic of mining. The outcome depends on the miners and the presence/absence of more interesting and profitable projects. But it is quite possible that the greater vulnerability of the system will make mining ineffective and it will simply cease to be interesting. Then cryptocurrency will come to an end.

A more accurate forecast can only be made in the second half of 2022. If by that time the coin remains at a high rate, then over time it can repeat the path of Bitcoin and make a tenfold rise. In the meantime, we advise you to monitor the situation on the market. Perhaps the rapid rise in the price of a coin is a simple speculation, which can also sharply lower the rate, thereby allowing interested people to profit.

Bitcoin Gold what exchanges

Due to scandalousness and technical misunderstandings, many cryptocurrency exchanges were skeptical about Bitcoin Gold. And if it became profitable for someone to support the new cryptocurrency, then most sites openly opposed the coin, hinting at its incomprehensible code and fraud in the form of pre-mining. By and large, this position was taken by many large trading platforms that value their reputation, but those who are interested in the emergence of Bitcoin Gold accepted the fork with open arms.

A fork appeared on the exchange on October 23 at a price of $479 per Bitcoin Gold coin. The rate fell by 70% in the first two days, which not only indicates that there was no interest in the coin, but also that it was massively dumped as best they could.

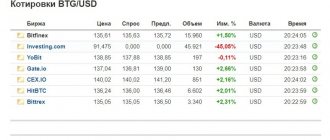

HitBTC

The exchange has the highest trading turnover in the direction of Bitcoin Gold - $2.5 million per day. Bitcoin itself, cryptodollar and ether are traded in pairs with the new fork. The price of the coin at the time of writing on this exchange fluctuated around $127, and the total trade turnover is 30% of the entire market.

BitStar

The new exchange also announced support for Bitcoin Gold, but this service is not listed on the list of exchanges trading the fork, according to Coinmarketcap.

Yobit

A cryptocurrency trash bin called Yobit began trading the Bitcoin Gold coin in the forefront, when in fact it did not yet exist. Many users accused the site of trading in candy wrappers and not real coins and, apparently, they were completely right. The most interesting thing is that on October 23, all Bitcoin owners on the exchange received an alternative coin in a 1:1 ratio, and the rate on this exchange reached $900, while on other sites it was around $130. It is unclear what the exchange administration does, but it is highly undesirable to trust your money to such schemers.

Which exchanges will support the new coin?

Despite the fact that the Bitcoin Gold coin appeared not so long ago, cryptocurrency exchanges managed to pay attention to it. Users are also interested in the new product and are actively finding out which exchanges will distribute Bitcoin Gold. So, in this regard, we have something to please you with, since quite a few popular, well-known and reliable resources have become interested in the project. So, here are detailed lists of bitcoin gold exchanges:

- HitBTC. This is one of the first exchanges to agree that it will support bitcoin gold. Since the resource in question is quite large, let’s consider how to work on it, having the desire to exchange your mined cryptocurrency. So, the user first needs to send his savings to an exchanger in order to exchange them for any other assets - it doesn’t matter whether they are digital, like Bitcoin, or fiat, like dollars. But in order to do this, you need to register on the exchange. Registration on HitBTC is the same as on other exchanges, so follow the simple instructions and fill out all the required fields. When registration is completed, go to the Accounts tab, where you can fund your newly created account. The transaction can be tracked in the Bitcoin Gold block explorer section. When the transfer receives three confirmations, the transaction will appear in your HitBTC account. When the money is transferred to the trading account, you can carry out any transactions - exchange, trade, etc.

- Binance

. Recently it became known that another one has joined the list of exchanges that will provide bitcoin gold. This is Binance. The resource is quite well-known in its field, so many miners trust it. The exchange has opened additional trading pairs involving the cryptocurrency in question: first, pairs for trading BTG/BTC, BTG/ETH. And after that, very recently, representatives of the resource updated the information, indicating that the exchange is starting to trade with the following trading pairs: OAX/BTC and ICN/BTC. - YoBit. In general, this cryptocurrency exchange has had some kind of murky history, since Bitcoin gold trading here began earlier than it became possible according to all common sense. In essence, air was traded on this resource. Nevertheless, those users who were looking for how to get Bitcoin Gold and on which exchange it would be most profitable to do so, while there were no other offers, went to Yobit. And no one was surprised that trading began much earlier than November 1, the moment when the coins were supposed to appear at official auctions. Of course, the coin rate skyrocketed: for one position they paid from 400 to 900 dollars. And no one was embarrassed that the fork was not finished yet, there was no wallet, as well as miners and a pool, and the official website of the cryptocurrency was silent. This raises serious concerns for the project, since it has all the signs of a scam project. If this were not so, the exchange would be punished for such manipulations. But so far there have been no decisive actions.

- Bleutrade

. Another large exchange that decided to take a risk and pay attention to the new product so that users have the opportunity to pay for Bitcoin gold. So this is where users will pay for the coins in question, exchange them, or conduct other financial transactions available. So far, there are not many people who have taken advantage of the offered opportunity, since the coin, despite the fact that it is on everyone’s lips, is considered a dark horse. People are waiting for her to show herself. And to get full access to the resource, you need to pass verification. Moreover, indicate not only the data that is standardly requested, namely full name and address, but also provide scans of documents and your photo where the user holds these documents. Only after this will his identity be confirmed. - Coinnest. This is a Korean exchange that quickly added a new cryptocurrency. In principle, the platform is very popular, although it is little used in our country. But it has already worked with new coins more than once and even became the first exchange to include the NEO cryptocurrency in its listing. So the use of Bitcoin Gold on it was not such a big surprise. In addition, the exchange works with fiat money, so it is very convenient for those who want to exchange Bitcoin gold for real currency.

- Bitfinex

. The Bitcoin Gold hard fork was carried out a little earlier than planned, but the Hong Kong exchange still supported the project, only through Chain Split tokens, which are designated on the resource as BG1, and Bitcoin Gold can be found under the abbreviation BG2. The price of these financial units began to rise almost immediately. And users can conduct transactions to convert BG1 and BG2 to BTC. So among those exchanges that will charge bitcoin gold, this one seems to be the most reliable. To begin with, it is one of the largest in the world, so users trust it completely, even though the ability to use Bitcoin Gold on it seems like a complicated process. - Gate.io. This cryptocurrency exchange is little known among us, as it is American. But it is often used in America and sometimes in Europe. However, there are 20 pairs of coins being traded here, and recently one of these coins is Bitcoin Gold.

But this is not all the exchanges on which Bitcoin gold will be traded. There is a whole list of resources that are ready to include this coin in their list and have even done so. In particular, we can highlight the following small and large resources: BitBay, BitFlyer, Beatcoin, Change Now, Paribu, Abucoins, BitStar. Each of the exchanges presented has its own distinctive features, but before working with this cryptocurrency, you need to be careful to save your money. And the reliability of many exchanges on this list is questionable. Despite the fact that they are not very popular, working with the sensational cryptocurrency is a way to become a leader in a new market.

Opinion about the Bitcoin Gold hard fork

My opinion on the Bitcoin Gold coin is clear - this is another attempt by a group of people to profit from the cryptocurrency market, and with thinly veiled motives. There was no obvious need for such a coin, it does not offer anything fundamentally new, its appearance was poorly planned and worked out. The developers promise more than they deliver, and at the same time they are actively mining the coin. Therefore, it is definitely a scam cryptocurrency that cannot be of any interest to investors.

I wouldn’t invest in it and I really don’t advise you to do so, because even if Bitcoin Cash, which many were skeptical about, seems much more promising, then there’s nothing to think about. The fate of the coin will clearly be uncertain; if the developers do not show the code and solve the problem of double spending, then not a single reputable exchange will list gold and it will have to be traded for the rest of its days in a crypto-graveyard called Yobit.

I don’t recommend investing in the Bitcoin Gold cryptocurrency, but it’s worth getting free coins, although it is unknown whether the coin’s rate will rise to the heights that it had when starting on the exchange. In any case, I do not recommend holding coins in anticipation of their rise in price, as this may not happen. The only investment idea that I have regarding the fork is to quickly merge it and buy more promising altcoins.

Author Ganesa K.

A professional investor with 5 years of experience working with various financial instruments, runs his own blog and advises investors. Own effective methods and information support for investments.