Lazy Investor Blog > Investment Tools

Before moving on to the topic of today’s article, I would like to remind you that on November 1, a new stream of the Lazy Investor Course will start, the cost of which will be higher than the current one. Anyone who is currently taking, or has already completed, a free week of training should hurry up with their decision to avoid overpaying in November. If you want to pay for the marathon at the old price, write to me via any convenient communication channel.

Let's move on to today's topic. Investment markets are becoming global. Because of this, the demand for financial instruments that help overcome state borders is growing. Today we will look at one of these instruments – depositary receipts, or, as they are also called, “secondary shares”. I'll tell you what it is and how you can make money from it.

What are ADR and GDR

So you went to your favorite mobile application for trading on the stock exchange and decided to buy a couple of shares. For example, the EMC network of private clinics, or any other company. We opened the description of the financial asset and discovered that these were not shares at all, but some ADRs and GDRs. What are they and why are they traded INSTEAD of stocks? And in general, if you bought this GDR, are you a shareholder or not? Can you also get dividends on them?..

GDR, or Global Depositary Receipt , is a certificate that gives the right to own foreign shares. A certificate is not a share, but with its help you actually become the owner of shares, which means you get all the opportunities available to an ordinary shareholder.

“Well, then why do we need these GDRs at all, if you can just buy shares?” - the reader will ask.

ADR and GDR were invented by smart financiers to circumvent unnecessary bureaucracy and create loopholes in complex economic regulations.

Do without money and power? Economic theories through the eyes of anarchists

Release mechanism

A global receipt is based on shares, its issue is carried out by agreement of two parties - between the issuing company of the shares themselves and the custodian bank of the jurisdiction where the GDRs will be circulated.

The mentioned agreement includes traditional things for agreements - obligations, rights, relations with investors.

Additional points - timing of placement of assets in the depository, division of expenses, conditions of transfer.

A little history

In many countries there is a ban on the free sale of shares of foreign companies, as well as on the export of domestic securities. The question is, what should investors from abroad do then? If you live in New Zealand, do you have to go to the USA to buy shares there?! And then how to sell? Make a voyage across the whole world again?!?

People first encountered this problem at the beginning of the 20th century, when England banned the export of shares of British companies. At the same time, the United States decided to introduce restrictions on the import of foreign securities. But the invisible hand of the market resolved this situation, and American financiers came up with a workaround in the form of depositary receipts.

“Since it is impossible to trade foreign shares, we will speculate in domestic depositary receipts,” these financiers decided.

What is it? By and large, a depositary receipt is simply a piece of paper that gives its owner the right to a certain number of shares of a particular company.

The first receipts were issued by the American company Guaranty Trust Co. (the predecessor of modern JP Morgan) for shares of the British department store chain Selfridges. The company, by the way, recently celebrated 110 years since its founding. Who knows what would have happened to it if they had not attracted foreign capital in 1927.

Since the Americans were the first to produce depository receipts, they began to be called American Depositary Receipts , or ADR . Subsequently, the instrument gained popularity around the world. And the receipts began to be collectively called global depositary receipts (Global Depositary Receipt), or simply GDR.

There are no bans on the circulation of foreign shares in Russia yet. But still, many people prefer to sell receipts just in case.

Advantages and disadvantages of the GDR

The disadvantage of Global Receipts is related to economic factors within the country whose company is the issuer. These are the notorious currency risks due to the difference in exchange rates between the US dollar and the issuer’s national currency, which can both reduce profits and result in losses.

Benefits for the company

- They provide issuers with easy access to foreign financial markets and an increase in their client base of investors.

- They help increase the liquidity of shares on which depositary receipts are based.

- Help increase the popularity and recognition of the company abroad.

- They give such a total increase in the amount from external markets that it is impossible to obtain in a single market.

Benefits for the investor

- Investors can diversify their portfolio with securities of foreign companies.

- They use simplified procedures for concluding transactions and settlements in comparison with shares of the same companies.

- Own derivative securities whose liquidity is comparable to the original shares.

- They practice long-term and short-term trading strategies with GDRs as financial instruments.

How it works

The process of issuing depositary receipts involves a lot of paperwork and elaboration of legal subtleties. This is due to the fact that the company cannot arrange everything itself without intermediaries. To do this, you need to resort to the help of two banks: the depository and the custodian.

The depository bank is a credit institution from the country where the receipts are intended to be sold. The issuer (the one who issues the receipt) enters into an agreement with him. It is the depository that issues ADRs or GDRs. The agreement between the bank and the company specifies the following parameters: the type of securities, their denomination, the location of both parties, postal addresses, and so on.

A custodian bank is a credit institution that is located in the same country as the company that issued the shares and that has an agreement with the depositary bank. This custodian holds the shares that are guaranteed by the receipts. A lot of words and nothing is clear? Let's explain with an example:

Company A operates in Italy. Its shares have long been traded on the local stock exchange. The company is doing well, and management wanted to attract foreign investors. For this purpose, they place their securities in London. They do this through the issuance of GDR. To do this, company A enters into a depository agreement with bank B, located in London. In turn, Bank B signs an agreement with Bank C, located in Rome. Shares of company A were transferred to it, which will act as a guarantee for the receipts.

From the example it is clear that company A is a business that wants large infusions, bank B is an intermediary that facilitates the presence of company A in a foreign country and issues depositary receipts (depository) on its behalf, bank C is essentially a repository that provides receipts (custodian).

After all procedures with the depository bank and custodian bank are completed, the receipts are released for trading. GDR and ADR have variations. Let's look at the main ones.

Margo Pazhinskaya, financial analyst at the DotBig investment platform:

— Large depository banks issue GDRs and ADRs. The key difference is that an ADR is an American Depositary Receipt, while a GDR is a global one, usually issued in Europe. With the help of both certificates, a company can enter the international market: in the case of ADR, this could be, for example, the New York Stock Exchange, and through GDR, organizations often enter the London and Frankfurt stock exchanges. As for Russian companies, they are more willing to place shares on European exchanges, where the requirements are lower than in the United States. This path was chosen by such large companies as Mail.ru, Sberbank and others.

Deadline for collection of funds according to receipt

A general limitation period of three years applies to loan repayments. How to calculate it?

If the receipt indicates the loan repayment period, the statute of limitations begins to run the next day after the expiration of the repayment period. If the period is not specified, then the statute of limitations is counted after 30 days from the date of sending the lender’s request to repay the loan.

But the court will apply the statute of limitations only if the defendant declares so. Therefore, if you are the defendant, claim the statute of limitations before the court makes a decision.

Types of receipts

All ADRs are divided into two types: unsponsored and sponsored. Non-sponsored shares are issued on shares that are already traded on the stock exchange, without necessarily having an agreement between the depository bank and the company. The main advantage of unsponsored ADRs is that the US SEC does not require almost any documentation on them. You just need to notify the regulator that the company’s activities are legal. However, unsponsored receipts are not sold on exchanges. They can only be found in the over-the-counter markets.

Sponsored are available on the stock market . They can be issued only by decision of the company, both for already issued shares and for new ones. There are 4 types of receipts in total: I, II, III and, according to the rule, 144A. They all have different levels of interaction with the SEC. ADR I is the least demanding in this regard, and ADR III is the most demanding. ADRs placed under Rule 144A do not require registration with the SEC at all. They are issued through the PORTAL system and are intended for a narrow circle of qualified investors.

GDRs are typically distinguished by the countries or banks that issued them. For example, there are European receipts (EDR), Japanese (JDR), Russian (RDR) and others.

Pass to high profitability. How to become a qualified investor

What are the benefits of depositary receipts for a simple private investor? Or, on the contrary, are there continuous pitfalls?

What's the difference between them?

So, let's draw conclusions - how do the types of depository receipts differ?

- American - papers for listing exclusively in the USA. They appeared first in their class, the rules for issuing and placing ADRs have been worked out to the smallest detail.

- Global - analogue American securities for circulation in non-American markets, mainly Europe. Therefore, GDRs are sometimes called European Depositary Receipts. The costs of issuing GDRs are slightly higher than ADRs. There are no obvious advantages, so GDRs are issued less frequently than ADRs.

- Russian - issued on securities of a foreign issuer, the custodian bank is located in the Russian Federation. Traded on foreign exchanges, the least popular within the class of depository receipts.

Pros and cons for investors

Depository receipts are similar in their properties to the same shares of companies. Main advantages:

- diversification of portfolios by investing in shares of different countries;

- the possibility of receiving higher dividends compared to domestic ones;

- reduction in commission compared to purchasing shares from a foreign broker;

- you can trade under the jurisdiction of your country, which is very beneficial for law enforcement agencies and government officials who are prohibited from buying foreign assets.

ADRs and GDRs do not have their own disadvantages; rather, they have the same disadvantages as shares. Among the main disadvantages of depositary receipts are:

- risk of a sharp depreciation;

- problems with taxation if you often buy/sell receipts and receive dividends from them;

- Often it is not possible to purchase depository receipts with a small amount. For example, shares in Russia are traded at almost 2,000 rubles. And Novatek’s GDRs sold on the London Stock Exchange cost almost $270, or almost 20,000 rubles. Because 1 GDR contains 10 shares of this company.

Grigory Pakhomov, strategic development consultant at Capital of Regions:

— Should a beginner invest in GDR or ADR? Depends on the risk profile. An important feature of investing is strict adherence to the strategy. If an investor understands that he is ready for risks and is not afraid of drawdowns, then he may well use these instruments to diversify his portfolio. Moreover, it is not always possible to gain access to the exchanges of the countries where the shares are issued.

Features of buying and selling GDRs

The main feature of GDRs as an investment goal is that both private and institutional investors (that is, national banks) have the right to use this type of securities in cases where they themselves are subject to legal restrictions in their own country.

The second feature is the release of the investor from a number of commissions, reaching 30-35 points of the share basis per year.

Depository receipts on Moscow Exchange

Since Russian legislation does not prohibit the circulation of foreign shares, the total share of depositary receipts on the Moscow Exchange is small. However, there are fairly well-known companies that prefer to sell these particular securities. Among them: the provider of payment and financial services QIWI, the largest owner of supermarkets X5 Retail Group, Tinkoff Bank, and the EMC network of private clinics. A complete list of depositary receipts sold on the Moscow Exchange can be found here.

Conclusion: depositary receipts help companies attract foreign capital and legally sell around the world, and private investors increase income while remaining in their home country and paying taxes in accordance with domestic legislation.

Have you ever bought ADR or GDR? Or are you bypassing these cuts? Write about it in the comments.

We don't want to lose you, let's be friends! Subscribe to our Telegram channel, here are financial life hacks every day!

Payment of income

To ensure the receipt of income from depository receipts accounted for in NSD accounts in BONY, the depositor must register bank details according to which funds will be transferred by submitting a custody order in form AF005 with a notice of bank details attached in form GF088 (operation code - 07, code assignment of bank details - 06). Payment of income on securities on NSD accounts in BONY is carried out by crediting funds to the NSD account in BONY with subsequent transfer through NSD to the accounts of depositors.

**********

Receiving ADR [edit]

You can either obtain new ADRs by depositing the company's corresponding domestic shares with the custodian bank that administers the ADR program, or you can instead obtain existing ADRs from the secondary market. The latter can be achieved either by purchasing ADRs on a US stock exchange, or by purchasing the relevant domestic shares of the company on their primary exchange and then exchanging them for ADRs; these swaps are called "crossover swaps" and in many cases form the bulk of secondary trading in ADRs. This is particularly true in the case of trading ADRs of UK companies, where the creation of new ADRs involves a 1.5% Stamp Duty Reserve Tax (SDRT) levy by the UK Government; instead, the search for existing ADRs on the secondary market (either through cross-swaps or on an exchange) is not regulated by the SDRT.

ADR: how to start trading?

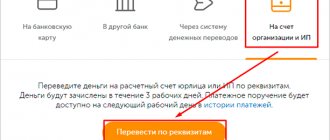

Now that you already know what American Depositary Receipts are, what types they are, and why you should start investing in ADRs, it’s time to get down to practice – start trading!

You can do this in just three steps:

1️⃣ Open an account to trade ADR.

2️⃣ Download the ADR trading platform.

3️⃣ Open the New Order window and make your first deal with ADR!

Here's an example of how to purchase a US depositary receipt using Alibaba Group ADR. Similarly, you can open a short position on ADR.

How to buy ADR?

1️⃣ Log in to your Admiral Markets account (MT4/MT5 /WebTrader/Mobile application).

2️⃣ Go to market status.

3️⃣ Find Alibaba Group shares (#BABA).

4️⃣ Use the one-click trading feature on the chart or right-click and select Trade -> New Order.

5️⃣ Select entry level, stop loss, target levels and position size (volume) and then confirm the trade.

6️⃣ Click the blue “Buy on the market” button.

When you buy Alibaba Group ADRs, you expect the value of the asset to increase so that you can profit from the transaction.

How to sell ADR?

1️⃣ Log in to your Admiral Markets account (MT4/MT5 /WebTrader/Mobile application).

2️⃣ Go to market status.

3️⃣ Find Alibaba Group shares (#BABA)

4️⃣ Use the one-click trading feature on the chart or right-click and select Trade -> New Order.

5️⃣ Select entry level, stop loss, target levels and position size (volume) and then confirm the trade.

6️⃣ Click the red “Sell” button.

When you sell Alibaba Group ADRs, you expect the value of the asset to fall so that you can profit from the transaction.

If you're ready to get started, click on the banner below, open a live account with Admiral Markets and get started! And the MetaTrader 5 Supreme Edition trading platform will help you with this:

How to collect a debt on a receipt in court

The statement of claim is filed with the district court at the defendant’s place of residence.

If the loan amount together with interest does not exceed 50,000 rubles, then contact the magistrate.

After the court decision comes into force (one month after the decision is made, unless an appeal is filed), you can receive a writ of execution to present it to the bailiff service.

Magistrates also have jurisdiction over cases of issuing a court order. A court order is issued for monetary claims of no more than 500,000 rubles, based on a written transaction. A court order is an executive document. But not all courts recognize the receipt as an indisputable requirement.

If the amount of the claim is no more than 100,000 rubles, then the case can be considered through simplified proceedings without calling the parties.

To correctly determine the jurisdiction of the dispute and draw up a statement, contact a lawyer.

How to properly file a claim for debt collection using a receipt

When filing both a claim and an application for a court order, you must pay a state fee. Its size depends on the amount of the claim.

In the statement of claim, please indicate:

- name of the court,

- information about the plaintiff and defendant,

- circumstances of the loan,

- demand for loan repayment.

Attention! If the loan amount is indicated in the receipt in a foreign currency (currency of the debt), then you have the right to collect it only in Russian rubles (currency of payment) in an amount equivalent to the currency of the debt at the exchange rate of the Central Bank of the Russian Federation on the date of execution of the court decision. (Resolution of the Plenum of the Armed Forces of the Russian Federation No. 54 of November 22, 2016).

- requirement to pay interest for using a loan (if the loan is interest-bearing), interest on the basis of Art. 395 of the Civil Code of the Russian Federation for late loan repayment,

Attention! The obligation to pay interest on the loan amount (penalty) in the amount provided for in clause 1 of Art. 395 of the Civil Code from the day when it should have been returned until the day it is returned to the lender, arises in case of delay in obligations, regardless of the payment of interest provided for in paragraph 1 of Art. 809 of the Civil Code, for the use of a loan (Definition of the Armed Forces of the Russian Federation dated September 5, 2016 No. 4-KG15-75).

- signature.

What documents should be attached to the claim?

Attach to the application a copy of the receipt, a receipt for payment of the state fee (request for deferment), as well as evidence of sending the claim to the defendant.

In addition, evidence of the issuance of the loan and its terms may include:

- audio or video recording,

- recording of a telephone conversation.

Submit your application to the court by mail or via the Internet by filling out a special form on the website.

claim for debt collection

2022 sample

View document

CONTENT

- 1 Depository receipts

- 2 programs (objects) ADR 2.1 Unsponsored ADR

- 2.2 Sponsored Tier I ADRs (“over-the-counter” credit)

- 2.3 Sponsored Tier II ADRs (Listing Opportunity)

- 2.4 Tier III Sponsored ADRs (“Offering”)

- 2.5 Prohibited Programs 2.5.1 Private Placed (SEC Rule 144A) ADRs

- 2.5.2 Offshore (SEC Regulation) ADRs

How to challenge a receipt for lack of money

The presence of a receipt from the lender is confirmation of the borrower’s failure to fulfill the obligations of the borrower to repay the loan, unless otherwise proven (Decision of the Supreme Court of the Russian Federation dated February 13, 2018 No. 41-KG17-39; Appeal determination of the Moscow City Court dated November 28, 2019 No. 33-51586/2019) .

The loan agreement is considered concluded from the moment the money is transferred. The debtor can challenge the loan by proving that in reality the funds were not provided to him.

Evidence may include:

- information about the financial situation of the creditor, which does not allow him to provide the loan amount indicated in the receipt,

- witness's testimonies,

- information about the lack of funds from the debtor after the issuance of the receipt.

Attention! In itself, the argument that the lender does not have a sufficient amount of money is not a basis for recognizing the loan agreement as non-monetary (Appeal ruling of the Moscow Court dated July 22, 2019 in case No. 33-12511/2019).

But in case of bankruptcy of the debtor, the reality of issuing funds to close relatives and other affiliated persons, on the basis of a receipt, can be challenged by the financial manager or bankruptcy creditor as an imaginary transaction precisely on the basis of the above signs.

The courts also take into account such signs as the issuance of further loans in the conditions of non-repayment of previously issued amounts, the failure of the creditor to take measures to claim the loan amount. If the court determines that the note is fictitious, it will refuse to include the creditor’s claims in the register (resolution of the Moscow District Court of April 30, 2019 in case No. A40-243525/17).

People often turn to their friends, relatives, and colleagues for cash in order to avoid taking out a bank loan. As a rule, borrowers in such situations try to repay their debt on time and in full in order to maintain normal human relationships and not burden themselves with unnecessary legal and personal problems. However, not everyone succeeds and not always.

Then lenders have to one way or another return their money on a claim, through the court, the bailiff service, or even using the services of collection agencies.

In fact, there are a large number of options for civil transactions, the failure of which may result in receivables. But in practice, disputes about the collection of the loan amount against a receipt are especially common, since this is the most popular type of civil dispute about the collection of funds between individuals. People often borrow money from their loved ones and, unfortunately, are not always able to repay it on time or in full.

Links[edit]

- Staff, Investopedia (November 18, 2003). "American Depositary Receipt - ADR". Retrieved June 17, 2022.

- Sikonathi Mantshantsha (22 March 2013). "American Depositary Receipts: Facilitating Foreign Investment." Financial mail

. - "How ADR works and the value for companies and investors". OTC Markets Group. Retrieved March 18, 2015.

- "JPMorgan Celebrates 80 Years of ADR". JPMorgan Chase &

Co. April 27, 2007. Archived from the original on April 2, 2015. Retrieved March 18, 2015. - See Dutta, Pratik, Intermediaries as Arbitrageurs: Revisiting the Motives for Foreign Listing, Jindal Global Law Review (2015) 6(2): 193-205.

- See Dutta, Pratik, Intermediaries as Arbitrageurs: Revisiting the Motives for Foreign Listing, Jindal Global Law Review (2015) 6(2): 193-205.

- "NASDAQ - SEC Filing". secfilings.nasdaq.com

. Retrieved June 17, 2022.