Globalization affects all areas of everyday human life. Finances were not left out either. New types of currencies are appearing everywhere that do not belong to any state. They can safely be called folk, since they are provided and maintained by ordinary people who use them. However, they cannot be called a full-fledged replacement for traditional money, since they have not yet become so widespread. But there is no need to worry about the stability of the current system. During its existence, it managed to prove to others its vitality and resilience.

Therefore, everyone who has not yet encountered cryptocurrencies should find out what Bitcoin looks like, what it is in simple words, and how to make money using electronic money.

What are Bitcoins and how to earn them in 2022

Bitcoin is the first hard, reliable virtual money. They exist only in electronic form; they have no paper or metal equivalent. But this does not make them less valuable, since their quality is in no way inferior to their usual, generally accepted analogue.

A big plus of this currency is the absence of a state that issues them.

This makes them completely independent of politics, and therefore more resistant to external influences.

Bitcoin owners value not only their stability and independence, but also their high value, which continues to grow. Thus, they become not only a convenient payment instrument that can be used to pay online, but also an excellent source of income and saving existing savings.

The only way to acquire cryptocurrency is to buy it. This can be done both on special exchanges and from individuals. But the second is more dangerous, since among such sellers there may also be scammers who want to make money on the gullibility of others. Therefore, when choosing a place and method of purchasing crypto money, you should soberly assess the risk and not trust unverified sellers.

Review of popular Bitcoin mining software

You may think that mining Bitcoin is not very profitable, since its rate has dropped significantly recently. However, Bitcoin is currently quickly returning to normal, so now is the perfect time to start mining it again. And, obviously, this is best done using the appropriate software. There are so many operating systems available to manage your Bitcoin mining process that choosing one can be quite overwhelming. This article will help you by looking at the features, advantages, and disadvantages of the most popular software. Keep reading to find your ideal Bitcoin mining management software.

Hive OS: a solution for those looking for everything in one

Hive OS is a stable and secure mining platform based on the Linux Ubuntu distribution. It's easy to install, configure, and use—no technical knowledge required. There is an extensive knowledge base or contact support. 24/7 support.

Hive OS makes it easy to manage farms of any size. Autofan controls the temperature while commands can be executed automatically, according to your own schedule. Switching between pools, wallets or coins takes about a second. The list of miners is updated regularly, and the same applies to the list of features. And workers can be controlled remotely, from anywhere in the world.

Hive OS allows you to mine Bitcoin on both GPU rigs and ASICs, has its own pool (and also supports many other pools), and offers custom firmware for ASICs.

Cudo Miner: a suitable option for beginners

Cudo Miner is an easy-to-use cryptocurrency mining platform. Remote control, overclocking, monitoring and other traditional functions are available. In addition, Cudo Miner offers automatic mining and automatic switching between coins, which is quite convenient. If necessary, you can create your own templates to improve the performance of your equipment.

However, like Cudo Miner, it does not support ASICs. Additionally, the fee is based on the amount of cryptocurrency mined in the last 30 days and is quite high. For example, for less than 0.005 BTC the commission is as much as 6.5%.

SimpleMining: the choice of GPU rig owners

SimpleMining is a mining platform that supports all modern AMD and Nvidia GPUs. It offers a variety of miner programs and you can also add a custom miner if you have special requirements. In addition, with SimpleMining you can perform bulk actions on many rigs at once, which is important if you have many devices. Traditional features such as overclocking and downvolting are also available, so you can increase your profits while consuming less power. However, the platform does not allow combining AMD and Nvidia in one rig.

СGMiner: suitable for experienced AMD card owners

CGMiner is an open source miner focused specifically on Bitcoin mining (although some other coins, such as Monero, are also available). CGMiner allows you to mine on ASICs, GPU rigs and CPUs, and is compatible with several platforms: Windows, Linux and OS X. When using all the traditional functions such as overclocking and monitoring, you do not have to pay a developer fee (dev fee).

On the other hand, CGMiner does not work very well with Nvidia cards. Beyond that, it's unlikely to be suitable for inexperienced users - you should at least be familiar with GitHub.

Awesome Miner: suitable for centralized mining management

Awesome Miner is a solution for managing and monitoring mining operations on GPU rigs and ASICs (CPU mining is also available). In addition, you can perform operations both for individual miners and for groups. You can create templates for easier customization and even use Awesome Miner for free. But at the same time you can have no more than 2 miners. The list of available features will also be limited.

Please note that Awesome Miner only runs on Windows (but it can still connect to mining software running on Linux). Also, its interface is not very user-friendly, and a new user may have some difficulty understanding exactly how everything works.

Hashr8: for users who know everything about mining

Hashr8 is an operating system suitable for both ASIC and GPU rigs. The system also supports many pools and miners. You can monitor devices not only in the web interface, but also through the mobile application. Support is provided around the clock. In addition, Hashr8 can be used for free - this option is available to miners using up to 3 devices inclusive. There are no other restrictions - free users can use all the functions of the system.

However, despite the above advantages, Hashr8 also has some disadvantages. Firstly, you can only contact the support service using a form on the website or by email - thus, you are unlikely to receive help instantly. The site also doesn't have an FAQ, so if you run into any problems, chances are you'll have to resolve it yourself. Secondly, Hashr8 is a fairly unstable system, which may affect your income.

Which software should you choose?

The final decision depends on your needs, but we recommend choosing a stable and versatile system that supports both ASIC and GPU rigs. This way, you will have freedom of action, which is especially important if you have many devices. The same goes for GPU rigs - it's better to choose a system that works great with both AMD and Nvidia cards.

Choose wisely, and happy Bitcoin mining!

How many Bitcoins are there in the world at the moment?

One of the most important secrets to the success of bitcoins is their limited supply. Their creator, Satoshi Nakamoto, prudently protected new finance from depreciation. And now their appearance is limited to a minimum amount of 3600 Btc per day. In this way, he increased the value of his invention and made it more reliable and in demand.

There are currently about 16 million bitcoins in the world. And it is almost pointless to expect a serious increase in their number in the near future. No one will change a proven and perfectly working system for the sake of increasing the total money supply. Moreover, no one is interested in the rapid growth of the supply available on the foreign exchange market.

In addition to limiting daily growth, the creators of the currency also took care of the maximum amount of crypto money.

The final number will not exceed 21 million, no matter what users and cryptocurrency holders do.

Bitcoin, generating coins in a common pool

The Bitcoin cryptocurrency continues to develop, the difficulty of generating a block increases every time. Trading on the exchanges is already taking place for very significant amounts. But generating alone becomes almost impossible. Today we will talk about generating coins collectively - in a common pool. In this case, the prize for generating a block is divided among all participants in the pool approximately in proportion to the contribution to the generation of the block. Due to the large total computing power of the pool, blocks are generated much more often than if you work alone, but the prize for each participant is smaller. On a long-term average, it turns out to be about the same amount (minus the percentage of the pool owner), but more evenly. There are already articles on Habré about what Bitcoin is and how it works. But information about generation in the general pool is very scattered even in its native wiki. This article describes how pools work, available pools, client programs, and some results.

First some terminology

A block

is a batch of Bitcoin exchange transactions signed with the SHA-256 cryptographic hash function. The block signature does not contain any key, anyone can generate and verify it, but the block signature must be less than some “target” (if we consider the signature and the target as 256-bit integers), roughly speaking, it must contain a certain number of zeros at the beginning bit. Thus, it is difficult to generate a correct signature - you need to select the block parameters for a long time so that the block hash is less than the target. Block example.

Difficulty

— the relative complexity of generating a block signature. Complexity = 1 corresponds to a target in which the first 32 bits are zeros. Accordingly, to generate a block signature you need on average '2^32 * complexity' of attempts (block hashes). The difficulty is recalculated by all Bitcoin clients approximately once every 2 weeks, so that the block generation rate is approximately 6 blocks per hour. The current complexity is approximately 157416 (the first 49 bits of the hash must be zeros and then the 23 bits of the hash must be less than 6A93B3)

Mining

– the process of selecting block signatures. It is the only source of increasing the “money supply” of bitcoins and at the same time serves to record all completed transactions.

Share

— candidate for block signature — a block and its hash containing the first 32 bits of zeros. The number of share pools is calculated by the contribution of each participant in the work of generating a block signature. With a complexity of one, each ball becomes a signature, with the current one - only every 157,416th on average.

Pool

— a server engaged in distributed mining — using the computing power of the participants. The pool distributes the current block to the participants and waits for the ball to be received. As soon as one of the participants sends a share that turns out to be smaller than the current goal, the pool announces the generation of a block signature. The prize for generating a block (currently 50 BTC + voluntary taxes on transactions) is distributed among the participants, the owner of the pool takes a certain share. Distribution rules vary from pool to pool, which will be discussed below.

Stale share

— a share that came from the participant too late, after the corresponding block had already been signed by someone. The client program searches for the block signature until it finds it or until it gets rejected. If the pool does not send a callback or the client program does not understand these calls, then some part of the share (as they say, 0.5% -1.5%) will be out of date. Support for “hang up” in pools is implemented through long polling.

Miner

— client program for mining. To participate in the pool, you need a separate client program, because... a regular Bitcoin client does not support mining in a pool. A miner is also an account for one participant’s client program on a pool. One participant can create several miners without additional registration on the pool in order to use several client programs (of different types and/or on different computers) and receive income from them in one wallet.

Accounting by points (score based system)

— a system for evaluating the balls, depending on the time they were received by the pool. The cost of balls in points increases over time of work on one block, i.e. the very last balls will pay the most. This system is designed to counteract cheating - the strategy of disconnecting from the pool after working on a block for some time. If the balls are equal, then it turns out to be more profitable to switch off after the pool receives a total number of shares equal to 0.435 * complexity, and switch to single generation (or to PPS, see below). But this is considered cheating.

Now about the pools

1) deepbit.net

The largest of the pools. The total computing power is 854 Ghash/s (gigahashes per second). According to bitcoinwatch.com, this pool generates almost half of the block signatures (see chart), which is already starting to cause concern.

There are two models for receiving your share: 1) Proportional. In this case, the participant receives a share proportional to the number of shares found, and all shares are counted (except for the stale share), and not just for the successfully signed block. Owner's share - 3%. 2) Fixed per share (Pay per share, PPS). The participant receives 0.00028584821460503 BTC for each (non-stale) share, regardless of the share in signing the block, etc. It is not difficult to calculate that this price of the shares is almost exactly equal to 50 BTC * 0.9 / Difficulty. Those. on the long-term average, the participant will receive 90% of his share of the work of generating the signature. The owner's share is thus 10%. The model is set for each participant's miner account, so you can use both models at once if you have several CPUs/GPUs. You can get your share immediately, without waiting for block confirmation. In addition, the share is not taken away even if the block is invalid (a block will be invalid if a longer chain of blocks is generated somewhere that does not include this one).

2) mining.bitcoin.cz

(also known as slush's pool)

The second pool in terms of power. The total computing power is 312 Ghash/s. Now this pool generates about a sixth of the block signatures (although in April it had a third of the total capacity). The pool owner's share is 2% (1 BTC for a 50 BTC prize). Only those participants who sent balls for a successfully signed block receive a share of the prize. Accordingly, if a block was not signed by this pool, all shares sent to this pool for this block are useless. The share of the prize is calculated by points (score based system), the author of the scoring system is slush, the owner of the pool. Payment of the share is possible only after confirmation of the block - after 120 blocks signed after it (which is about 20 hours).

3) btcmine.com

Power - 146 Ghash/s Registration is open. Owner's share - 2%. Only those participants who sent shares for this block receive a share of the block. The share of the prize is calculated by points. Payment of the share is possible only after the block is confirmed by 120 blocks.

4) bitcoinpool.com

Power - 34.3 Ghash/s Owner's share - only voluntary taxes (no percentage of 50 BTC is taken). All participants who sent shares since the pool signed the previous block receive a share of the block. The share of the prize is calculated in proportion to the number of balls. Payment of the share is possible only after the block is confirmed by 120 blocks.

5) Eligius

Power - 31.8 Ghash/s Pool without the need for registration - just indicate your Bitcoin address and your share is transferred there, and immediately - right in the generated block (using Generated transaction). The owner's share is voluntary taxes on transactions plus 0.00000001 BTC per second (about 0.0003%). The miner's share is proportional to the number of shares from the previous block created by the pool. If a block becomes invalid, the number of balls found is counted into the next block. Interestingly, this pool was apparently the first to introduce additional rules for transactions that the pool includes in blocks - 0.00004096 BTC per 512 bytes of transaction.

6) sweatpool.net

Power - 1.8 Ghash/s A fresh addition to the list of pools, positioned as a competitor to the PPS mode on deepbit. The share for mining is fixed per share (Pay per share). The current value of the shares is 0.00029220039715181 BTC, i.e. the commission is 8%. In addition, the payment of the cost is promised immediately, without even waiting for the block to be generated.

(Pool capacities and rules are given at the time of writing)

Client programs (miners)

1) Ufasoft's SSE2 CPU miner – bitcoin-miner

Uses CPU, optimized for SSE. According to the author, one hash requires about 1000 processor cycles. I get about 1100 clock cycles - on my Q9550 quad, the miner produces 12.5 Mhash/s if you give it all 4 cores (running it in 4 threads) and 9.5 Mhash/s if in 3 cores. The processor heats up to 60 degrees when 4 cores are loaded, which bothered me a little (at idle the temperature is about 40), but it’s quite possible to work. When loading 3 cores, it heats up to 53 and you can even watch HD movies. Most of the time I generated balls this way. For comparison, the official Bitcoin client (bitcoin-0.3.20.2) mines at a speed of 4.9 Mash/s if you give it all 4 Q9550 cores.

2) m0mchil's python miner – poclbm

Uses OpenCL. It didn’t want to work on my CPU, but on the 8600GT video card it produces 6.8 Mhash/s. Alas, the miner loads the GPU core by 95%-99% and the video heats up to 75 degrees. And it’s extremely difficult to do anything on a computer while the miner is running - windows are even dragged jerkily. Playing with the -f parameter did not yield anything. Perhaps owners of more powerful video cards will be able to get better results and less lag. Judging by the wiki, you can get 802 Mhash/s on the ATI Radeon HD 5970.

There are also miners, but I haven’t tried them:

3) jgarzik's CPU miner 4) Diablo's java GPU/CPU miner

My results

The first time I mined was in April (when the difficulty was 82347) - about 26 hours.

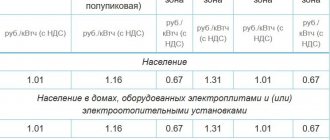

I mined 198 shares, 1 of which turned out to be outdated. It was calculated about 930 Ghash. The first 17 shares were generated on the btcmine pool (in 1 hour 40 minutes), I did not receive anything for this, because... disconnected long before the end of block generation. The remaining balls are on deepbit, 28 in PPS mode and 153 in proportional mode. I earned as much as 0.13430786 BTC from this. If I generated everything in PPS, I would only earn 0.09891044 BTC, and if everything was in proportional, then 0.14083968 BTC. The rate of ball generation (1 ball for 4.7 Ghash) coincides well with the theoretical one (1 ball for 4.295 Ghash). If we take the then rates on the mtgox (1.04 USD/BTC) and MICEX (28.19 RUB/USD) exchanges, then my income was 3 rubles 81 kopecks. Now let’s calculate the speed of receiving income from mining 1) Each Mhash/s of mining speed gives about 20 shares per day, 2) Taking into account the current block prize, pool tax, and April difficulty, the income per Mhash/s will be 0.0119 BTC 3) In terms of according to exchange rates, it will be 35 kopecks per day. After this, you need to estimate how much energy is required for generation (very much depends on the equipment and its operating mode during the day) and how much this energy will cost. I got it like this: 4) 3.3 rubles per day in income from mining (9.5 Mhash/s), 5) Processor consumption - 71.25 watts (we only count the addition for using 3 cores, I mine only when the computer is already running - 3/4 from 95 watt processor), i.e. 1.17 kWh per day, 6) Which cost 4.55 rubles (tariff 2.66 rubles/kWh). That is, there was no point in generating coins for me, because... energy costs are higher. Which is where I stopped then.

The second time I started mining was on May 15th, when the price of BTC on the mtgox exchange almost reached 9 US dollars. Taking into account the current difficulty, income has dropped to 0.059 BTC per day, but now it costs 12.25 rubles (mtgox 7.4 USD/BTC, MICEX 28.1 RUR/USD). Those. mining gives 7.70 rubles per day or 32 kopecks per hour.

conclusions

In the long term, there is no difference in which mode it is more profitable to participate in mining, proportional or PPS, by points or by shares, only for a signed block or for all blocks.

Everything is determined by the “tax” of the pool owner (and the cheating of pool participants). In the short term, it can be a shame to mine for several hours and get nothing. Actually, the same uniformity is needed, for the sake of which it is worth mining in a pool, and not alone. My favorite mode on deepbit.net right now is proportional mode. PS The total computing power spent on generation is now about 2023 GHash/s, which is approximately equal to 25.7 TeraFLOP/s, i.e. is already 4.5 times greater than the total capacity of the BOINC project.

Virtual currency bitcoin Btc: what is it and how does it work

Having found out how many bitcoins there are in the world, you should understand the basic principles of their creation and stability.

To understand this issue, you should take another look at the appearance of this currency. At its core, it is an electronic file that moves between the computers of owners of electronic funds via the Internet. The weight of one unit of currency is not very large, but together they occupy a huge amount of information, the storage and processing of which requires thousands of computers.

It is these computers that are responsible for the stability of the system.

Each bitcoin owner provides his own equipment to maintain the system's functionality.

All involved laptops, computers and processors are united into a single extensive network, capable of painlessly enduring the disappearance of individual elements and easily adding new ones. Since every owner of crypto money is interested in its growth, this network is almost impossible to destroy.

At the same time, this same network is responsible for issuing currency – mining. It is this process that is currently the main source of income for cryptocurrency holders. It brings a solid profit, similar in profitability to earnings on exchange rate changes.

Bitcoin mining process

The essence of Bitcoin mining is as follows : devices located in different parts of the world solve computational problems, the result of which is virtual Bitcoin coins.

The security of the process is ensured by distribution; there is no single center that controls mining. All operations taking place on the network are entered into a kind of log and one by one are transferred to miners, whose task is to find, among millions of possible combinations, a certain “hash” that will match all transactions made recently and a special secret key. Finding such a hash provides the miner with a reward (currently it is 12.5 BTC, and after the halving in 2022 the reward will decrease to 6.25 BTC). Getting a reward is not so easy, because thousands of people are competing for it at the same time. When the hash is guessed, the transaction block is closed and the queue moves on to the next one.

The block hash includes:

- hash of the previous block;

- the total hash of operations performed by users over the last 10 minutes;

- a random number that is changed to ensure that the result matches the conditions set by the system.

Changing conditions are a key factor in determining mining difficulty; they are adjusted every 2016 blocks found (approximately once every 14 days).

How does Bitcoin differ from electronic and paper money?

Much has been said about the main differences from real money. But in order to find out exactly what bitcoins are and why they are needed, we should consider this issue again.

Comparing virtual currencies with other types of finance, we can highlight the following distinctive features:

- independence from individual countries, banks and states;

- no paper or metal media;

- limited quantity;

- dependence of cost on demand;

- lack of real security;

- existence in a virtual environment;

- dependence of release on users.

There are other features that make cryptocurrency so popular. But besides the differences, there are also similarities that should be remembered. Most of them are related to the purpose of electronic finance. Being such a specific payment instrument, they remain money and retain all the corresponding features and functions. They can be used to pay for purchases and services, although not all sellers are ready to accept such payments yet.

How many zeros are there in Bitcoin?

The limited number of Bitcoins would make them extremely inconvenient if they were not divided into smaller particles. These particles are named after the founder of the currency and are called satoshi.

There are 100 million satoshis in one bitcoin. Such fragmentation is associated with the demand and cost of electronic money. Few people can afford to buy a whole bitcoin, but it is much easier to buy a small part, much less in cost.

This approach to the formation of currency makes it much more accessible and attractive.

Since anyone can buy several satoshis, the demand for virtual finance does not fall, and the interest in acquiring such a profitable financial instrument does not fade.

As a result, everything is gradually growing: the exchange rate, the number of owners, the number of computers involved, and the total supply of bitcoins. And this is precisely what is required for their stable existence.

Main parameters: mining difficulty, network hashrate, block reward, algorithm

The requirement for block hashes is determined by a special parameter - complexity . Since the computing power of the network is not constant, this parameter is recalculated every 2016 blocks so that the average speed of blockchain formation is 2016 blocks within 14 days. Thus, 1 block in the Blockchain network should be created approximately once every 10 minutes.

When the computing power of the network increases, the time to create a block decreases, and when it decreases, it increases.

In 2009, the reward for miners was 50 BTC, in 2012 it decreased to 25 BTC, and in 2016 - to 12.5 BTC. On May 11, 2022, as a result of the next division of the network, the reward to miners was halved and is now 6.25 BTC .

Every 4 years, the Bitcoin network halves the block reward

The probability of a miner receiving a reward is equal to the ratio of his computing power to the computing power of the entire network.

If this ratio is small, then the probability of receiving the reward will also be low.

Bitcoin mining operates on the PoW (Proof of Work) algorithm: miners with the greatest computing power have the greatest chance of finding a block first. A miner with low power can also find a signature for a block, but in modern mining conditions this is more of a happy one-time accident.

Due to the constant complication of mining, in order to increase the chances of receiving a reward, miners combine their computing power into pools (from the English pool - common fund).

The pool's probability of receiving a reward is equal to the sum of the probabilities of each of its participants receiving a reward.

The pool acts as a powerful solo miner , which receives rewards and distributes them among all participants in accordance with the rules established by the pool owner.

Pools differ in interfaces, information content, power, types of currency, reward distribution system and commissions. The miner’s earnings directly depend on how well the pool is selected. An important factor in choosing a pool is the commission - a percentage of the block amount that will be divided between miners. The service should also have a user-friendly interface and a minimum withdrawal fee.

Bitcoin: what is it backed by and who is its owner?

Bitcoins have virtually no collateral or owner. Their main asset and guarantor of stable existence is their numerous owners. It is with their help that the continuous distribution of crypto money is possible.

Despite the impossibility of saying what Bitcoin is backed by, it has been showing stable growth in its value for almost 10 years.

This is due to constantly increasing demand and slowly growing supply.

In this case, the work of the classical laws of economics is visible, in which high demand for a scarce product leads to an increase in its cost until the price is balanced with the number of buyers.

But, given that crypto money has become an excellent source of profit and shows high profitability, the growth in demand for it does not stop, and, accordingly, the consistent increase in price does not stop.

At the same time, bitcoins are reliably protected from sudden drops. This protection is their total number. Given that there are only 21 million bitcoins available to the user, the total money supply will always be lower than demand.

How to start mining bitcoins at home

Step-by-step instructions on how a beginner can start mining bitcoins :

- Select equipment. For Bitcoin mining (SHA-256 algorithm), ASIC miners are now relevant. The cost depends on the model. It is very likely that to achieve the desired income you will have to purchase not one, but several devices.

- Connect and configure the ASIC according to the instructions. Provide fast and uninterrupted Internet. Be sure to check the wiring in the room; not all of them can withstand such power.

- Select a suitable mining pool, download the miner program from its website, and configure it properly.

- Create a wallet for cryptocurrency or an account on an exchange where earned bitcoins will be credited.

- Choose reliable services (bitcoin exchangers or cryptocurrency exchanges), through which you can subsequently exchange crypto for fiat if you do not plan to store it as an investment.

Read more about preparing ASIC for home Bitcoin mining, since this is what a beginner most often faces difficulties with:

- Place the purchased device on a flat surface, connect the PSU (power supply). Some ASICs are sold already with a power supply; for others you will have to buy this element separately. It is important to correctly determine the required power - if this parameter is chosen incorrectly, there is a risk of breaking an expensive device. If you plan to overclock the ASIC in the future, you need to consider connecting an additional unit.

- Plug the power supply into a power outlet. Connect the ASIC to the Internet via an Ethernet cable. When you first turn on the device, it gains power slowly, this is due to the need to eliminate dust that has accumulated during transportation.

- When choosing a pool, you need to focus on the total hashrate, payment methods, ease of setup and general reputation in knowledgeable circles. Some pools also allow you to work in solo mode. The main thing is to go to the site, register and create a so-called worker.

- Before starting mining, determine the IP address of the device. There is special software for this, for example Advanced IP Scanner.

- Go to the ASIC settings interface, enter the login and password for the pool there. In many models, you can simply enter “root” the first time you log in.

- Enter basic information - ports, pool URL, worker settings.

- Go to the pool and enter the user ID there. As soon as the data is saved, mining begins directly. After approximately 10 minutes, the ASIC power should reach its maximum.

To check that Bitcoin mining is really going on, just go to the statistics (section “Miner status”). There is no point in carrying out such a check earlier than an hour after the start of the process. It is important to remember to monitor the temperature of the device to avoid overheating.

Bitcoin cryptocurrency: how to use it

Owners of virtual finance can use them for three main purposes:

- as a unit of payment;

- as a source of saving funds;

- as a profitable financial instrument.

In the first case, you should count on paying for services on the Internet. Moreover, most transactions occur between residents of different countries. Additionally, it is possible to pay for purchases in those states where cryptocurrencies are legally permitted at the highest level.

The second option is based on the constant growth of the exchange rate. Considering how many zeros there are in Bitcoin, anyone can invest in them. Then you just have to wait for the price to increase. This method is also good because electronic finance is not affected by political upheavals and conflicts.

In difficult times, when economic stability is under threat, the demand for alternative financial instruments only increases.

Cryptocurrency mining equipment

A little theory. In general, the following types of mining equipment are or have been used in the cryptocurrency world:

- CPU. Nowadays, it is no longer profitable to mine popular cryptocurrencies - a lot of energy is spent, and the profit is minimal, and therefore, going into the negative is inevitable.

- Video card. Over time, mining on processors was replaced by GPUs - the video card is designed in such a way that it can calculate many times more numbers per unit of time than any CPU. It has also become possible to create mining farms by combining several graphics cards into one design.

- FPGA mining is now practically not used, although it played a significant role in its time. FPGA chips were powerful, energy-efficient, but very expensive to manufacture - so gradually all manufacturers abandoned their production.

- ASIC mining. We have already talked quite a lot about it and let us remind you once again that in 2022 this is the only cost-effective way to mine BTC.

However, when it comes to other cryptocurrencies, users more often opt for video card farms. Not everyone believes in the bright future of Bitcoin; many consider altcoins, of which there are now a great many, to be a more promising direction.

Earnings

The third point deserves special attention. In the modern world, everyone should be able to explain what Bitcoin is in simple words and how to make money with it. Moreover, earning income is not at all difficult. To do this, you can use the following options:

- mining;

- currency speculation;

- trading in foreign exchange markets.

The first approach requires good equipment. To make money you need powerful computers with large amounts of memory. Those who want to make a profit are required to install a special program and simply receive passive income.

It is important to remember that the equipment you are using cannot be used for other needs, so you should make sure in advance that nothing significant is stored on it that may be needed in the near future.

The second option involves the constant resale of crypto money. To receive revenue, you need to purchase a currency when it has fallen in price and sell it when it has reached its maximum price. A decent profit is possible only with serious investments, so this method is not available to everyone.

But Forex trading does not require huge investments. The main thing here is to correctly assess risks and calculate existing trends. In this case, you should carefully choose the rocker. It is advisable that it be registered in Russia (the rest may become unavailable at any time). And it is especially important to ask in advance whether there are cryptocurrency pairs in the trading terminal.

The main feature of the latter method is that you don’t need to buy them to make money on virtual finance. They act as a financial instrument that can bring stable, serious profits, and the trading account can be in dollars or rubles.

Legality of mining

States have always had a wary attitude towards cryptocurrencies. In May 2022, within the framework of the new law “On Digital Financial Assets,” State Duma deputies proposed to impose administrative and criminal liability for illegal circulation of cryptocurrency : a fine of up to 2 million rubles and criminal liability of up to 7 years.

Two documents (on amendments to the Code of Administrative Offenses and the Criminal Code) were published in the financial Telegram channel “OrderCom” and sent to the Ministry of Economic Development.

If the bill comes into force, digital currencies will be considered property, and their issue and circulation in the country will be officially prohibited. A complete ban on cryptocurrency in Russia, including mining and ICOs, applies only to unregistered activities.

The purpose of the new bill is to translate crypto activities into the legal field. ✅

For the state, such a transition will reduce cases of illegal actions in the industry and allow it to control the entire digital financial flow.

If you want to work with cryptocurrencies, officially register your activities, get a license and participate in the country’s taxation.

For users, this means that in order to become the owner of cryptocurrency, they will be required to declare it to the tax authority and obtain a license.

As a result, the crypto market will be “whitened”: it will be cleared of all kinds of scammers, scammers, and other lovers of quick and dishonest profit.

Many experts believe that limiting the circulation of cryptocurrency, on the contrary, will harm the development of the Russian Federation.

“Banning mining and cryptocurrencies will lead to the complete decline of the blockchain industry. For this reason, all developed countries, although they understand the risks associated with money laundering and tax evasion, do not impose a ban on cryptocurrencies and mining; to ban it today means to limit the potential for economic growth and technological development of your country.”

— Yuri Brisov, member of the Commission on Legal Support of the Digital Economy of the Moscow Branch of the Russian Bar Association

Legality of cryptocurrencies

The issue of legality and permission of virtual currency in Russia is of great importance for users. Considering that no one knows who the owner of electronic money is (he simply does not exist), payments using bitcoins in the country are impossible. But this applies to any financial instruments except rubles. In the Russian Federation, transactions are allowed only in the national currency; everything else is prohibited.

However, no one prohibits the use of crypto money as financial instruments. This is confirmed by the fact that even reputable, large companies use them. Legislative regulation of the circulation of cryptocurrencies is identical to that used to regulate standard monetary transactions. That is, cases of fraud and money laundering are being pursued.

To summarize, it must be emphasized that although the use of virtual funds is not encouraged, there is no legal ban on them and owners should not fear criminal prosecution.

Mining farm

Basically, the concept of mining rigs is associated with video cards, but the components can be different - for example, ASIC rigs are gaining momentum. In any case, there is a design of several devices aimed at solving computing problems.

GPU farms became popular with the advent of the Ethereum cryptocurrency, which has less complexity than Bitcoin, but is quite profitable when selling. When mining ether on processors became irrelevant, the question arose of how to mine it. Then they remembered that in 2012–2013 they successfully mined Bitcoin on video cards, and applied this method to ether.

Similar cryptocurrencies and electronic money

In addition to the familiar and well-known Bitcoins, there are many other cryptocurrencies. Knowing how the system works and how virtual money functions, users can use any option that currently exists. Those who wish have the opportunity to purchase Ethereum, litcoins and other financial instruments.

The main differences between the existing options are the prevalence and demand for cybermoney. Everything else, including the identity of the creator, the country of origin, the current exchange rate and other nuances are not decisive. The rate and viability of cybercurrencies is related to demand and popularity. If there are no people willing to buy money, virtual finance will not be able to exist.

Therefore, when purchasing electronic finance, you should consider 2 nuances:

- the lower the popularity of a financial instrument, the greater the risk of losing money or being left without earnings;

- At the same time, lesser-known cryptocurrencies are more promising because they have more opportunities for price growth.

Where to sell mined bitcoins

Mined Bitcoins can be disposed of in different ways:

- Store in a reliable Bitcoin wallet (preferably in a “cold” wallet) and wait for the rate to rise;

- Immediately sell and withdraw money to fiat, fixing income from mining; Several options are available for sale: Cryptocurrency exchanges; Exchangers; OTC transactions on p2p platforms.

- Increase your digital capital by trading bitcoins on crypto exchanges.

To make money from trading, you need to find a reliable trading platform with favorable conditions and high security. These include the following crypto exchanges:

| # | Exchange | Address | Trading volume, 24 hours |

| 1 | Binance | www.binance.com | 381,696 |

| 2 | OKEx | www.okex.com | 124,994 |

| 3 | Huobi Global | www.huobi.com | 49,276.28 |

| 4 | Bitfinex | www.bitfinex.com | 20,372.63 |

| 5 | Bitforex | www.bitforex.com | 10,829.14 |

| 6 | BitGlobal | www.bitglobal.com/en-us | 5,719.96 |

| 7 | Bittrex | bittrex.com | 2,206.42 |

| 8 | Poloniex | poloniex.com | 1,890.18 |

| 9 | EXMO | exmo.com | 1,640.84 |

| 10 | CEX.IO | cex.io | 531.47 |

Data update 01/13/2022, 14:52

Related article: