Hello, dear readers of the KtoNaNovenkogo.ru blog. To navigate the events happening around us, we need to at least know what a particular term means.

Today we will analyze what stagnation is, in what areas this concept is applied, when it arises and what it can lead to.

Market stagnation

A stable, unchanged market situation without growth in sales volumes is market stagnation. That is, in order to reach a stagnation state, the market simply needs to stop growing. As soon as market growth stops, inflation, which was previously compensated by an increase in the number and turnover of sales, is no longer compensated. Everything is gradually falling into disrepair. Therefore, a stagnation period is always followed by a recession—that is, a fall. The financial crisis completes this chain. As a rule, only those states that refuse to artificially increase markets can recover from this crisis.

Period of stagnation

The most striking example of economic stagnation is the situation in the United States market in the late 1920s and early 30s, after the so-called Great Depression. It was then that this term appeared - it was introduced by an American economist named Hansen. The end of the Soviet era was also marked by the “freezing” of market processes and even the appearance of the expression “Brezhnev stagnation.” This time is associated with a lack of goods in stores and long queues of many kilometers. As for modern Russia, at a recent forum in Davos, where market prospects for 2016 were discussed, A. Kudrin said that the period of stagnation in our country could well be overcome.

Economic stagnation

What synonyms have not been invented for this term over the past 100 years - “freezing”, “swamping”, “timelessness”. But, in essence, all this is economic stagnation. Experts argue that no matter how hard the state leadership tries, this period still cannot be avoided: any economic model is cyclical and develops according to the following algorithm:

- Climb.

- Stagnation or stabilization.

- Recession.

- A crisis.

Thus, economic stagnation is just one inevitable stage of development of any country on our planet. It is impossible to prevent it and remain in the growth stage forever, but you can prepare for it in advance.

Stagnation in Russia

The first pronounced stagnation in Russia occurred immediately after the collapse of the Soviet Union. This was a transitional type of stagnation, when the country tried to integrate into a new free market model. The work of production stalled, agriculture went into decline, and a sharp outflow of intellectual resources abroad began. It took a long time for our country's economy to recover and competitive goods to appear on the market. As for the current situation, according to Alexei Kudrin, considered one of the best finance ministers in the entire history of the Russian Federation, “the moment for restructuring the country’s economy has not yet been missed.”

Consequences for the country's economy and business

As a result of a decline in the level of the country's economy, the population may become dissatisfied, even leading to rallies and riots. The discrepancy between real income and the constant rise in prices for essential goods and reductions in enterprises lead to poverty. People's purchasing power is decreasing and they are forced to give up many goods. As a result, sales volume decreases, trade turnover and production volume decrease.

The economy enters a closed cycle, which leads to an even greater decline and the recession stage. Investments are moving to other countries with more successful economies. Often there is an increase in taxes and tougher penalties. As additional control, the country's leadership may introduce food cards or a curfew.

Another consequence of stagnation (though not a necessary one) is inflation . When prices for goods and services increase, and money depreciates.

Social stagnation

There is not only economic stagnation, but also so-called social stagnation. The American Dictionary of Sociology defines it as follows: “A period when society is “marking time,” socio-political life stops, and no factors are foreseen to change people’s lives.” This is a rather difficult period, which is characterized by:

- Stopping the development of culture and art in the country.

- Mass humiliation of certain categories of the population or an entire people, deliberately organized by the authorities (the most tragic example is the genocide of the Jewish people during World War II).

How to run a business during stagnation

Overcoming a nationwide recession is the government's concern. What should a businessman do if his enterprise experiences stagnation, that is, stagnation?

The first step is to change the perception of the crisis as an insurmountable problem and focus on the opportunities that arise. Now is the time to make reforms and optimize activities by mobilizing available resources.

Activities recommended during periods of stagnation:

- Cost reduction based on functional cost analysis. In other words, it is necessary to balance the costs and the benefits they bring. Unprofitable assets should be disposed of.

- Suspension of long-term investments that produce financial results only after years.

- Attracting third party funding. Shareholders will invest only in the most profitable business ideas with quick returns.

- Reduce advertising costs. In times of crisis, commercials, billboards and other promotional means are more likely to cause irritation than to arouse consumer desires.

- Active search for solvent clients, especially corporate ones. The task is not an easy one - competition intensifies during a crisis.

- Improving the quality of a commercial product combined with price optimization.

- Searching for new partners to jointly confront crisis challenges.

- Identification of bottlenecks in production and sales.

- Reduction of staff or transfer to part-time work.

- Debt settlement.

- Creation of a reserve fund.

Other unpopular measures are also possible. To reduce the tension in industrial relations, it is necessary to explain to the team that without these cuts and austerity, the enterprise will go bankrupt and everyone will become unemployed.

Is it possible to earn money during this period?

Economic growth in a state of stagnation is slowing down. Sometimes it is zero, and sometimes it is negative. This does not mean that you cannot earn money during this period. For some entrepreneurs, a crisis means disaster, while for others it is a time of opportunity.

Enterprises are forced to respond to changing market conditions. This tendency was especially evident during the transitional stagnation that prevailed in the economy after the collapse of the USSR. Factories that were part of the military-industrial complex were undergoing transformation. Conversion often consisted of producing low-quality products.

Stagnation causes many assets to depreciate. This stage of cyclical economic development is the best for acquiring real estate, intellectual property, securities and other undervalued sources of profit. Of course, speculative earnings are available only to owners of large capital.

The profit of brokerage houses is formed from the margin that arises when stock exchange quotes change. Their income affects the size of the gross domestic product. This process is not entirely correctly called economic development (real values are not created), but the result helps to overcome stagnation, thanks to the circulation of funds.

The stagnation stage is characterized by selectivity of investment attractiveness. Enterprising people invest in businesses that meet the needs of the population.

What to pay attention to when running a business during stagnation

As mentioned above, stagnation can be predicted with a high degree of certainty. To do this, it is necessary to evaluate not only the current state of the economy, but also the dynamics of changes in the main indices characterizing economic development.

The harbingers of the stagnation stage are:

- progress in prices for consumer goods;

- employment regression.

These indicators in modern economic science are combined into the concept of stagflation, which describes the phenomenon of a simultaneous increase in inflation, unemployment and low production rates.

Some countries have adopted their own markers of economic development, called stock indices:

| Index name | A country | Informative Content |

| Dow Jones | USA | Describes the degree of success of the activities of three dozen largest American corporations |

| S&P | USA | Approximately the same as Dow Jones, but calculated taking into account the 500 most capitalized firms, and therefore reflects the state of the US economy in more detail |

| Nikkei | Japan | Summarizes data from 225 Japanese zaibatsu |

| DAX | Germany | Indicators of the 30 largest German corporations |

| FTSE | Europe | One hundred EU companies listed on the London Stock Exchange |

| CAC | France | 40 members of the Paris Stock Exchange |

| MICEX | Russia | Shares of the 50 most liquid companies in the Russian Federation are traded. Calculated based on indicators in rubles |

| RTS | Russia | 50 most liquid companies in the Russian Federation. Calculated based on indicators in US dollars |

The significance of macroeconomic indices for an individual company is that if they sharply decline, the company is recommended to prepare for stagnation. The nature of the activities is described above.

Examples

Currently, the ruble is not stagnating, but this does not mean that the banking sector of the Russian economy does not have problems. Stagnum was experiencing Binbank, in whose activities the Central Bank of the Russian Federation identified signs of impending bankruptcy, and therefore a reorganization procedure was initiated in the fall of 2017. The measures taken can be considered only partially successful.

Somewhat earlier, in the summer of the same year, similar problems arose at Otkritie Bank. Rumors about its stagnation caused a panic reaction from depositors, who withdrew 151 billion rubles from their accounts.

Binbank's deposits were estimated at that time at 533 billion rubles.

When analyzing the possible consequences of the insolvency of financial institutions, the scale of their activities should be taken into account. Payments by the Deposit Insurance Agency to affected depositors (in the event of bankruptcy of B&N Bank and Otkritie) should have amounted to a huge amount.

Their collapse could lead to a chain reaction and undermine confidence in the country's financial and credit system. There was a danger of a large-scale crisis, during which devaluation of the ruble, a sharp rise in inflation and other troubles would be inevitable.

This has already happened in recent history. In 1998, the Russian Federation even carried out a denomination in order to remove three zeros from banknotes.

As a result of the actions of the Central Bank, which decided to merge B&N Bank and Otkritie, and assisted in the rehabilitation of institutions, they emerged from stagnation.

Organizational stagnation

Production may “stalle” not only on the scale of the entire state, but also on the scale of an individual enterprise. In this case, the following processes occur:

- The quality of manufactured products is decreasing

- Sales volumes are falling

- Technical resources are idle and not used to their full potential

- The product ceases to be competitive in the market and loses to analogues: it becomes not modern, not fashionable, etc.

The stagnation of an organization can only be overcome from within. It is necessary to restructure production models, revise business plans, improve the ideological component and re-motivate the team.

Stagnant period within production

Stagnation can be observed not only on a national scale, but also within a specific organization. During a stagnant period, the following processes are observed at the enterprise:

- the volume of products sold falls;

- production capacities are not fully utilized;

- the quality of manufactured goods is deteriorating;

- products become uncompetitive in comparison with analogues.

To overcome the stagnation period, intra-organizational measures are used. For example, business processes are revised, new equipment is purchased, and new specialists are attracted.

Reasons for stagnation

It is impossible to quickly prepare for economic stagnation after seeing its forecast in the news - its preconditions are too complex and varied. In April 2016, the “Own Business” portal published a study on this topic, highlighting the following reasons for stagnation:

- Bureaucratization of government agencies. There is a growing number of employees whose work is essentially useless. Maintenance is becoming more complicated, and the administrative apparatus is disconnected from the needs of the population.

- Corruption as a state apparatus and business areas.

- Lack of investment in research and development.

- Gradual failure of production equipment.

- Breakdown of foreign trade relations.

Breaking out of stagnation

The fight against stagnation should be aimed at the following activities:

- introduction of new technologies, investments in efficient production projects. This approach will reduce production costs, increase labor productivity and the competitiveness of the product. Increase sales volumes;

- encouragement of entrepreneurial activity, development of market conditions;

- provision of financial and legal assistance from the state to enterprises to create competition for monopolies;

- increasing the role of the household in the economy;

- development of the country's microeconomics - increasing the standard of living of the population and its purchasing power;

- reduction of tariffs for services of natural monopolies;

- attracting foreign investment.

Types of stagnation

Economists identify the following types of stagnation:

- Monopolistic

- Transition

In the first case, monopolies, reigning in the market, “pressure” small businesses. Production stands idle, unemployment occurs on a massive scale. History shows that the way out of this situation is the accumulation of achievements of science and technology and the export of capital outside the state. Another stagnation of the economy - transitional - is caused by a change from the command-administrative market model to a free one. The country is no longer of interest to investors, the national economy is suffering, and huge fields remain unsown. In this case, experts say, the economy will face an inevitable recession, depression, and only then gradual growth.

The difference between recession and stagnation

There is a significant difference between the considered states of economic development. Stagnation and recession, the differences of which emerge from their definitions, should be understood somewhat more deeply. The recession, although characterized by more negative manifestations, indicates the beginning of the search for a new economic system. It adapts to currently existing conditions. This process begins with a reduction in production.

Stagnation does not imply any development. The economy is mired in closed, unpromising production. Therefore, although both processes are considered negative, a recession is still better. It precedes development.

Stagnation does not imply any improvement. In this case, no development is observed. Manufacturing simply unwisely consumes existing resources to the point of exhaustion. That is why this state of the economy is dangerous and irrational.

Consequences of stagnation

As a rule, the consequences of stagnation are disastrous. Almost always observed:

- Declining production rates and, as a consequence, falling prices for natural resources

- Employees losing their jobs

- Extremely low purchasing power of the population

- Stopping intellectual work and research activities

- The brewing crisis of enterprises in virtually all business sectors

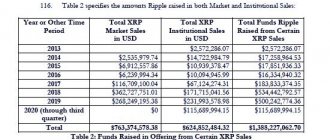

The most predictable consequence of stagnation is a recession, which, at best, will keep production at zero, and at worst, lead to a negative GDP value.

Ways to fight

To lift the country out of a long-term crisis, officials at the highest levels must develop a common plan and take concerted action to restructure the economy. Since the period of stagnation is still not a frequent phenomenon, there are no clear tools that will help overcome stagnation. The first theory of E. Hansen, who saw no way out for the American economy in the 30s of the 20th century, burst like a soap bubble, and the United States continued to develop and is one of the largest economic powers in the world.

Theoretically, methods of combating the condition should be aimed at eradicating the causes of its occurrence. Then efforts need to be made in these areas:

- fight against corruption in the echelons of power;

- disaggregation of management structures and their simplification to eliminate unnecessary bureaucracy;

- investments in scientific and technological progress and the latest developments related in our time to nanotechnology, space and medicine;

- updating enterprise equipment;

- establishing foreign economic relations.

Practitioners of economic theory offer slightly different solutions, which are not always clear how to implement. The following exit routes are called:

- implementation of scientific and technical developments in all spheres of the economy, business and production; There is an implication here that such developments already exist, however, how could they arise against the backdrop of reduced funding?

- increasing the purchasing power of the population; The question immediately arises: how to increase the solvency of citizens?

- reduction in production costs; And here again the objection: after all, the equipment base is outdated, where else can we reduce costs?

- maximizing profits from monopolies;

- export of locally produced products to foreign markets. But how can you export your goods if trade relations with other states are disrupted?

In a word, the ways out of stagnation that practitioners offer are not always clear how to implement. They sound like useful recommendations, divorced from reality.

The conclusion that suggests itself is that the government of a single country in a state of stagnation must analyze the situation and find the only correct solutions, based on the totality of all economic components.

What is real estate market stagnation?

Stagnant processes can affect both the market as a whole and its largest industries - for example, such a colossal area as the purchase and sale of housing. So, what is real estate market stagnation? This is a situation in which the intensity of purchase and sale of apartments and houses decreases compared to similar periods in previous years. There is a demand for housing, but the supply cannot keep up with it, since construction is not taking place. The latest example is the Russian situation in 2015: due to the external political “blockade” of our country, there was a long-term stagnation in the market of both new buildings and secondary housing.

What is ruble stagnation?

Ordinary citizens without an economic education are often interested in what is ruble stagnation? First of all, let's say that the state of the currency is a mirror of the country's economy. If the national currency does not develop, this means stagnation in the economy of the state itself. And vice versa: economic growth significantly strengthens the domestic currency and its competitiveness on the world stage.

In recent years, the Russian currency has been declining and inflation has been rising. A typical example: in the first 3 quarters of 2014, the ruble depreciated by an average of 35%. Recently, E. Nabiullina stated that the Central Bank expects that by the end of 2016 the national currency will strengthen, and the inflation rate should not exceed 6%.

The history of the term stagnation

This economic term originated in the early twentieth century and meant stagnation or decay. Translated from English, stagnation can also mean swamp or standing water. The term arose thanks to the American analyst and economist Dvin Hansen, who called the thirtieth year of the twentieth century the century-long stagnation of the economy of the United States of America.

In those years, it was decided to significantly increase government spending in order to create a deficit in the US budget. This economic procedure was surprisingly successful, and the economic condition of the United States of America stabilized.

The process of economic stagnation also affected the Soviet Union, when Leonid Brezhnev held the reins of power. At that time, inflation fluctuated between two and three percent.

Thanks to the examples from history described above, it becomes obvious that stagnation can be called an exclusively long-term situation that arises due to a lack of cheap resources or those varieties of them that could be obtained in easier ways. It is these resources that are primarily associated with the stable growth of the economy of any state.

Some economic analysts argue that stagnation could occur in all countries at the same time. In this case, the entire globe will be plunged into the abyss of the Great Stagnation, a detailed description of which was proposed by Tyler Cowen. If this happens, then the collapse of all states without exception will occur.

And therefore, it is necessary to take certain measures today to ensure that such a situation never occurs. To achieve this, all economic indicators are maintained at a sufficient level to keep the economy of an individual state within acceptable limits. In this situation, both people who are citizens of the state and the country’s leadership itself, who do not have to look for solutions to incredibly complex and tricky economic problems, remain in the black.